Welcome to the US Crypto News Morning Briefing — a concise, essential summary of the most important crypto market developments for today.

Sipping coffee as the crypto market suddenly quiets down. ETF inflows have dried up, digital asset trusts are unwinding positions, and traders appear to have lost their fire. As sentiment stalls and altcoins retreat, analysts say the lull may mask deeper structural and psychological fatigue.

Crypto News of the Day: DAT Position Closing and ETF Capital Leave Market Lagging Stocks

The crypto market's rally is stalling , as analysts blame structural and psychological factors.

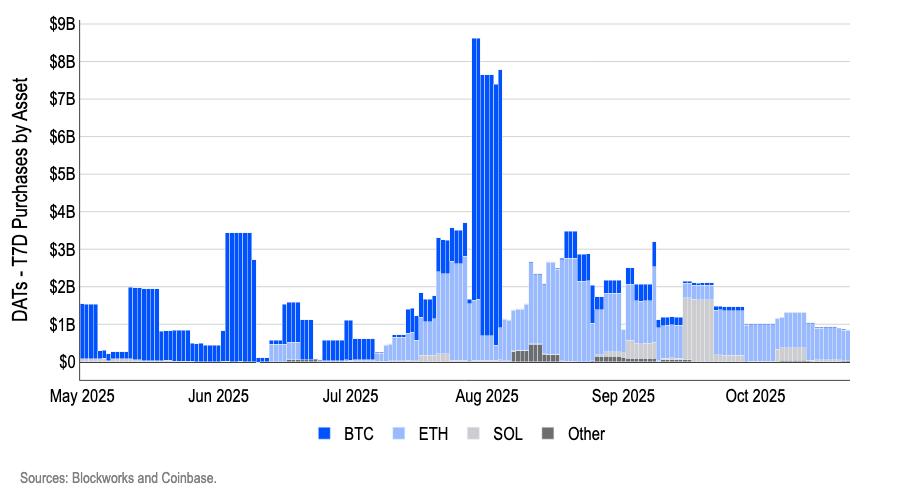

Demand for ETFs has dried up, digital asset trusts (DATs) aresharply reducing their exposure , and traders are finding it hard to find confidence as crypto continues to underperform the stock market . Market analyst Miles Deutscher said multiple forces are converging, putting pressure on Bitcoin and Ethereum.

While most large funds remain stable, smaller funds are taking action to protect net asset value, according to Deutscher.

“ETF demand has dried up (net outflows over the past few weeks) …There is a partial DAT unwind for $BTC and $ETH,” he explained .

Deutscher also mentioned the market shock of October 10, a day of widespread liquidation in crypto, as a “cloud” still hanging over.

“October 10 was damaging on multiple fronts… Psychologically, it was a bad look for crypto and a crushing blow after weeks of underperformance against stocks. Physically, market makers are still unwinding positions. I don’t think we’ve fully grasped the full extent of the damage,” he said.

The result is widespread fatigue among retail investors, as the prolonged sideways trading wears down the morale of even seasoned traders.

As the unwinding continues and spot ETF flows turn negative , Deutscher said it’s not surprising that prices are falling. However, he believes sentiment could reverse quickly if Bitcoin breaks out.

“There is one thing that can completely change the situation: a real pump $BTC. Even in August, we saw BTC/ ETH rise enough to completely reverse sentiment… It doesn’t need any special reason. It’s Bitcoin,” he wrote.

Altcoin Stagnation Worsens as Analysts Call for Patience and Research

Meanwhile, altcoins remain sluggish, reflecting a broader risk-off sentiment. Analyst Daan Crypto Trades said only 29% of the top 50 altcoins have outperformed BTC this year.

The index has not exceeded 39% over the past six months, a stark contrast to the 2020–2021 cycle, when altcoins consistently outperformed over long periods.

“After that, there are only short periods of dominance, not lasting more than two to three months,” Daan commented .

Therefore, the most reasonable move for investors at this time is to focus on research instead of short-term surfing, identifying emerging themes such as AI agents, RWA andprediction markets .

As Bitcoin consolidates below key resistance and traditional stocks hit new highs , crypto's next move may depend less on fundamentals, and more on whether the market regains confidence.

Intraday chart

DATs are running out. Source: Coinbase Head of Global Research

DATs are running out. Source: Coinbase Head of Global ResearchAlpha in brief

Here is a recap of more US crypto news to watch today: