Hedera (HBAR) has gained more than 14% this week, recovering from its recent slide. However, despite the short-term bounce, HBAR is still down nearly 9% for the month, showing a clear downtrend.

Indicators are sending mixed signals, raising the bigger question: are whales hinting at a hidden crash that smart money and retail traders are ignoring?

Smart money and retail investors remain optimistic despite warning signs

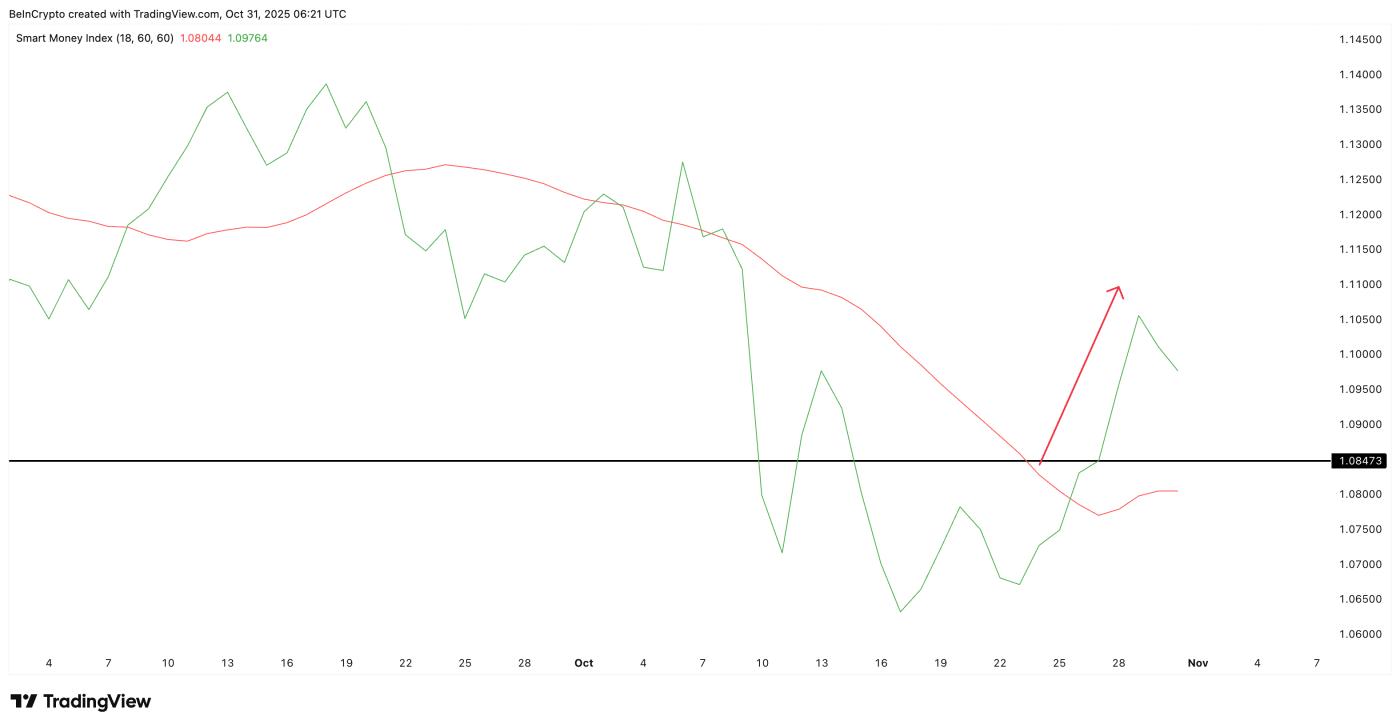

The Smart Money Index (SMI), which tracks the actions of seasoned HBAR traders , has been on an upward trend since October 26, 2024, consistently making higher highs and breaking above the signal line. This typically indicates that knowledgeable traders expect a price recovery or believe the worst is over. Despite the brief correction, the SMI remains around 1.08, maintaining a cautiously optimistic outlook in the short term.

Want more perspectives on Token like this? Subscribe to Editor Harsh Notariya's daily Crypto Newsletter here .

Smart money still favors the buyers: TradingView

Smart money still favors the buyers: TradingViewIf the index stays above that level, the bias remains positive. Conversely, falling below 1.08 could see sentiment reverse quickly.

Retail traders are also bullish, even more so than Smart Money. The Money Flow Index (MFI) — a measure of buying and selling pressure based on both price and volume — has surged from nearly 35 to 69.4 in two weeks. This surge represents new money and increased retail interest, often a signal that they are “buying the dip” to catch the rally.

HBAR Retail Trader Continues to Move Money: TradingView

HBAR Retail Trader Continues to Move Money: TradingViewIn short, Smart Money and the retail group still see room for HBAR price to increase. But this belief may not last, as whales are quietly withdrawing.

Whales are retreating while smart money bets on a recovery

While signals from smaller HBAR traders and institutions appear positive, large wallets tell a different story. Data shows that accounts holding over 100 million HBAR have reduced their share of the supply from 41.75% to 40.65% since October 21, 2024 — roughly 1.1% of this whale group’s holdings have exited in less than two weeks.

Hedera Whale Sell-Off: Hedera Watch

Hedera Whale Sell-Off: Hedera WatchThat’s a minimum of 110 million HBAR leaving large wallets. At current prices, that’s at least $20.9 million leaving whales. This is a notable change given the return of retail traders to the buying side.

It’s a classic divergence: smart money and retail think the Dip is in, while whales seem to be preparing for another pullback. If whales were indeed leading a correction, the charts would have shown early signs of it — and they are already there.

HBAR price chart shows “hidden” bearish divergence or catalyst for sharp drop

On the daily chart, HBAR price has been moving sideways in a narrow range from $0.219 to $0.154 since October 11, 2024, reflecting indecision between buyers and sellers — likely both traders and whales.

From October 6, 2024 to October 29, 2024, the price made a lower high, while the Relative Strength Index (RSI) — which tracks price momentum — made a higher high. This pattern is called a hidden bearish divergence, and it often signals that the existing downtrend will continue. With HBAR, this can lead to a correction if key levels are broken.

HBAR is currently above $0.189, but if this support is lost, the price could slide to $0.168. If the selling pressure continues, the next important support is around $0.154, and below that, the Token could retreat to $0.119.

HBAR Price Analysis : TradingView

HBAR Price Analysis : TradingViewA drop below $0.168 would confirm a continuation of the downtrend. Holding above this level could see a short-term consolidation. In the interim, the likelihood of a deeper correction in HBAR is tilted. This could happen unless there is enough new buying pressure to offset the whale Capital .