October, which just ended, saw the cryptocurrency market experience two major storms, leaving investors still shaken. First, the massive flash crash on October 11th saw a staggering $19 billion in open interest liquidated within 24 hours, setting a new record for single-day liquidation in recent years and igniting immediate market panic. Second, while the Federal Reserve cut interest rates by 25 basis points as expected at the end of the month and announced the end of quantitative easing (QT) on December 1st, Chairman Powell's hawkish remarks at a press conference, emphasizing that "rate cuts are not inevitable," severely dampened market expectations for a December rate cut.

Is Bitcoin still poised to reach $150,000 this year?

However, despite the significant blow to investor confidence in October, market bulls believe that Bitcoin is still on track to reach the year-end target predicted by several institutions and analysts, and surge to the $150,000 level before the year ends.

First, there's the seasonal factor. Looking back at Bitcoin's historical data from 2013 to 2024, November has consistently been Bitcoin's strongest performing month of the year, with an average increase of 42.5%. If this historical pattern repeats itself, based on the current price of approximately $110,000, Bitcoin still has the potential to challenge $150,000 or even higher.

In addition to seasonal advantages, bullish sentiment also stems from positive macroeconomic factors. Firstly, there are signs of easing trade tensions between the US and China. Following their meeting in South Korea, Trump and Xi Jinping reached a preliminary agreement, with the US agreeing to reduce some tariffs on Chinese goods in exchange for China cracking down on fentanyl, resuming soybean purchases, and suspending rare earth export restrictions for one year. This move is seen as a key step in defusing the flash crash in October.

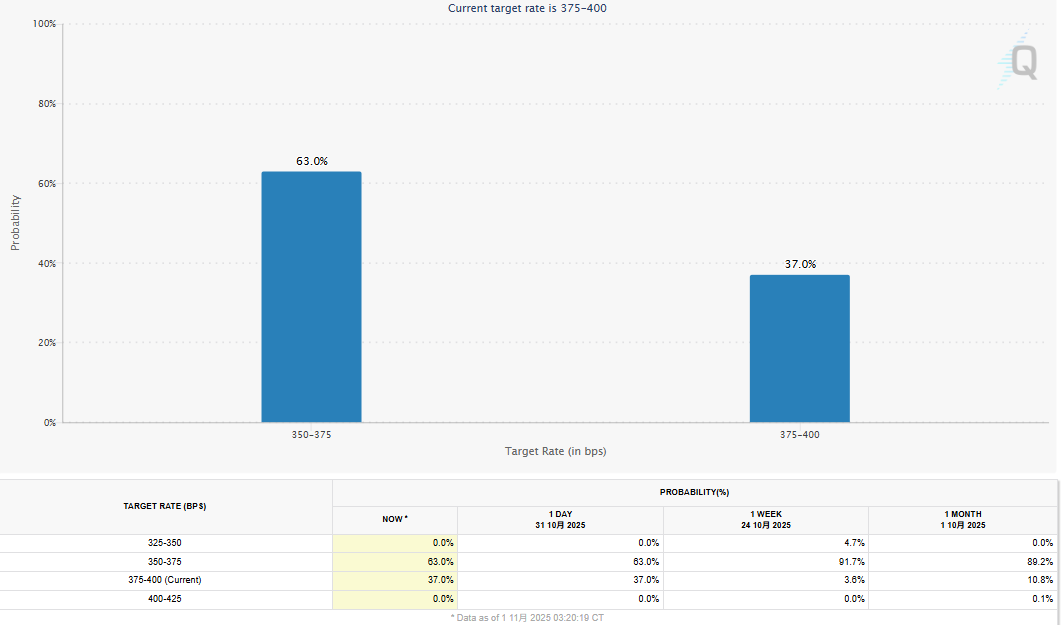

Secondly, the Federal Reserve has officially announced that it will end its balance sheet reduction in early December, and although the market believes that Powell's speech lowered expectations for a rate cut in December, the market still believes that there is a 63% chance of a rate cut in December.

Image source: CME Group FedWatch Tool

However, the market is not without its concerns. The US government shutdown has entered its fifth week, with Republicans and Democrats deadlocked on the budget bill. If the shutdown continues, it will further deepen market uncertainty.

Analysts: Sharp volatility is coming

In addition, cryptocurrency analyst Murphy also posted on the X platform today (1st) that the concentration of Bitcoin's holdings within 5% of the current spot price has surged to 17.6%, a new high in nearly two years. This means that a large number of holdings are rapidly being squeezed into a narrow range, and once the price fluctuates slightly, it will trigger a chain reaction and amplify market volatility. However, it is still uncertain whether the price will rise or fall.