The first day of the month has revealed where crypto “whales” are betting on profits in November. In many Token, big players are increasing their positions despite market volatility.

What’s notable is how the “whales” move differently across sectors, from privacy Token to decentralized exchanges and even the SocialFi project — hinting at where early strength could emerge this month.

Railgun (RAIL)

Crypto whales appear to be lining up behind Railgun (RAIL), one of the few Token that has seen strong accumulation, heading for gains in November.

The privacy-focused Ethereum Token , known for its ability to enable anonymous transactions, has attracted heavy activity from “whales” since October 31, just before the new month.

In the past 24 hours alone, the whale’s holdings have increased by 30%, from approximately 185,000 RAIL to 242,500 RAIL. That means the whale has added approximately 56,000 RAIL, worth nearly $220,000 at current prices. At the same time, the price of RAIL has increased by more than 40%.

Want more Token insights like this? Subscribe to Editor Harsh Notariya's Daily Crypto newsletter here .

At the same time, “smart money” wallets — addresses associated with consistently profitable traders — increased their balances by 8.17%. Exchange reserves fell by 15.67%, indicating fewer Token were being put on exchanges for sale.

Railgun Whale: Nansen

Railgun Whale: NansenTaken together, these changes suggest that both “whales” and seasoned traders are positioning early for a potential continuation of the rally in November.

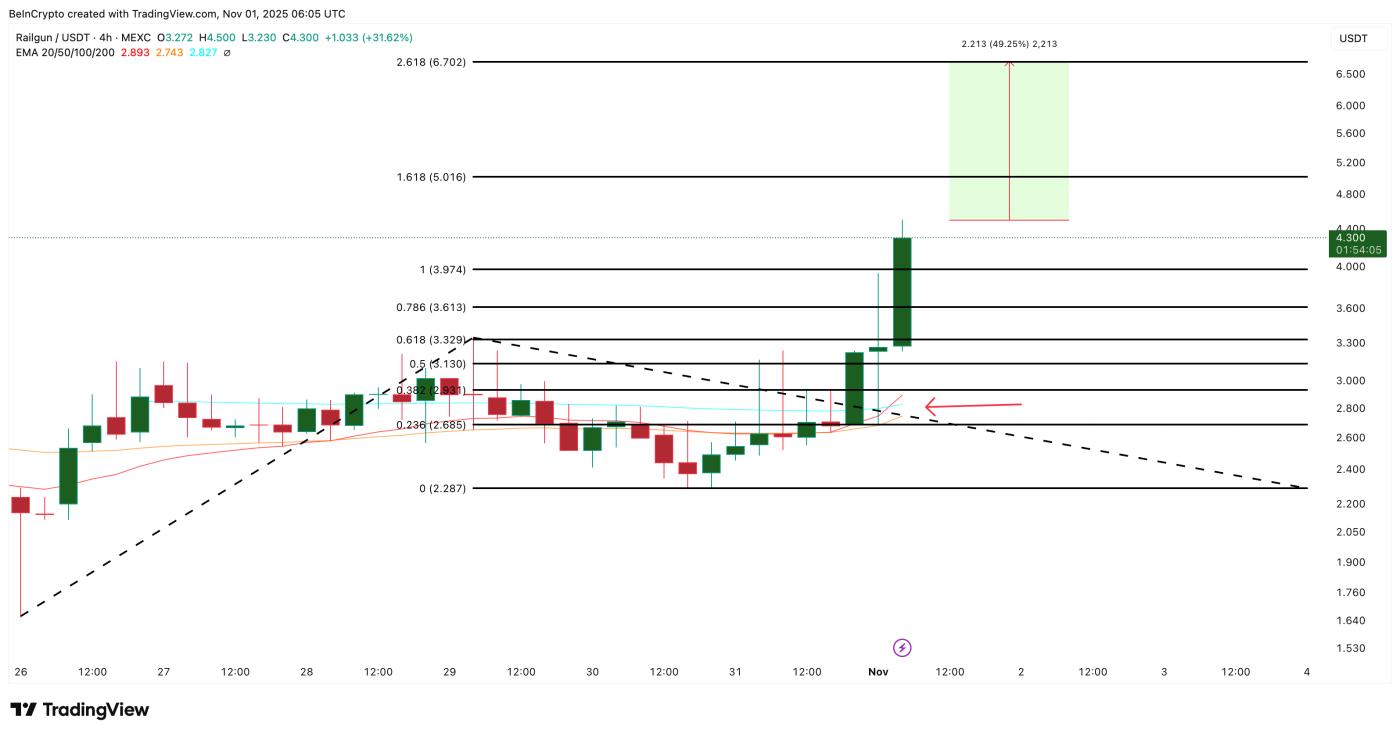

Railgun’s recent price structure supports the whale and smart money thesis. On the 4-hour chart, the 20-period EMA (which tracks short-term price direction) has crossed above the 50-period EMA, confirming a bullish shift. The 50-period EMA is now approaching the 100-period EMA, suggesting another crossover could trigger the next leg up.

If that “Golden” cross completes, Railgun could head toward $5.01 — an important psychological level — and then $6.79. However, $3.97 and $3.32 are key support zones and are often where prices bounce after rallies.

RAIL Price Analysis: TradingView

RAIL Price Analysis: TradingViewA sustained decline below $2.28 would invalidate this bullish structure and imply that the whales’ accumulation may be on hold. For now, crypto whales seem to believe that Railgun could be one of the prominent bets for profit in November.

Aster (ASTER)

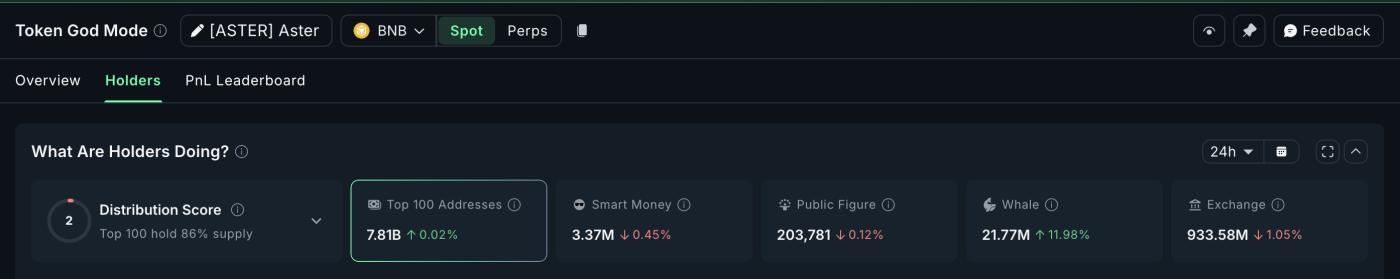

The second Token that crypto whales seem to be targeting for November profits is Aster (ASTER). This is a new generation decentralized exchange (DEX) built on BNB Chain, supporting both spot and multi- chain perpetual Spot Trading . After a quiet week in October, Aster whales were active again at the beginning of November.

Over the past 24 hours, the whale’s holdings increased by 11.98%, bringing the total to 21.77 million ASTER. That means they added nearly 2.33 million Token, worth about $2.3 million.

Even the top 100 addresses — the larger “mega whales” — saw small but steady increases, confirming accumulation across both large and Medium wallets.

Aster Whale: Nansen

Aster Whale: NansenASTER is up 7% in the past 24 hours, though it is still down around 10% on the week — suggesting “whales” may be getting into position for an early pullback.

The price action supports that view. ASTER is trading in a pennant pattern, which often precedes strong trend breakouts. A 4-hour candle close above $1.06 would confirm the breakout and could push the price to $1.09, or even $1.22 if the bullish momentum consolidates.

However, a fall below $0.94 or $0.92 could invalidate the pattern, opening up room for a drop to $0.85. Since the flag pattern’s lower trendline has only two touches, this remains a weak support zone.

ASTER Price Analysis: TradingView

ASTER Price Analysis: TradingViewHowever, it appears that whales are betting on the upside as ASTER trades near the breakout zone. With the increasing accumulation momentum and increasingly tight technical setup, Aster could be one of the stronger crypto whale bets for gains in November if the breakout is confirmed.

Pump.fun (PUMP)

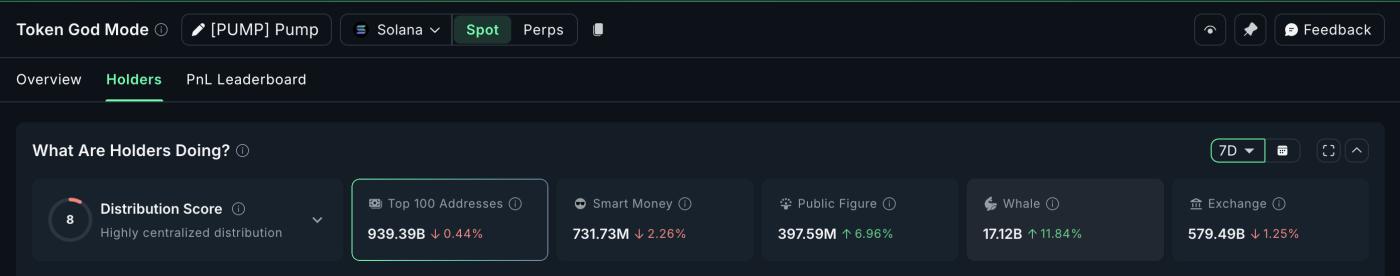

While crypto whales have been scooping up Railgun and Aster in the past 24 hours, their accumulation of Pump.fun (PUMP) — a SocialFi project on Solana — has been quietly going on for a week. Pump.fun allows users to easily create and issue meme coins on the Solana network, a trend that has generated a lot of buzz on social media and rapid rotation among small- Capital traders.

Over the past seven days, whale balances have increased by 11.84%, bringing total holdings to 17.13 billion PUMP. This means whales have added approximately 1.81 billion Token, worth nearly $8.1 million.

This increase coincides with a steady decline in the balance on the exchange, suggesting that the majority of purchases are being moved off the exchange — a classic sign of high-conviction buying.

The Pump Whale in Action: Nansen

The Pump Whale in Action: NansenPUMP is up 10% over the past week and nearly 5% over the past 24 hours, indicating whales are buying on strong momentum rather than selling against the rally.

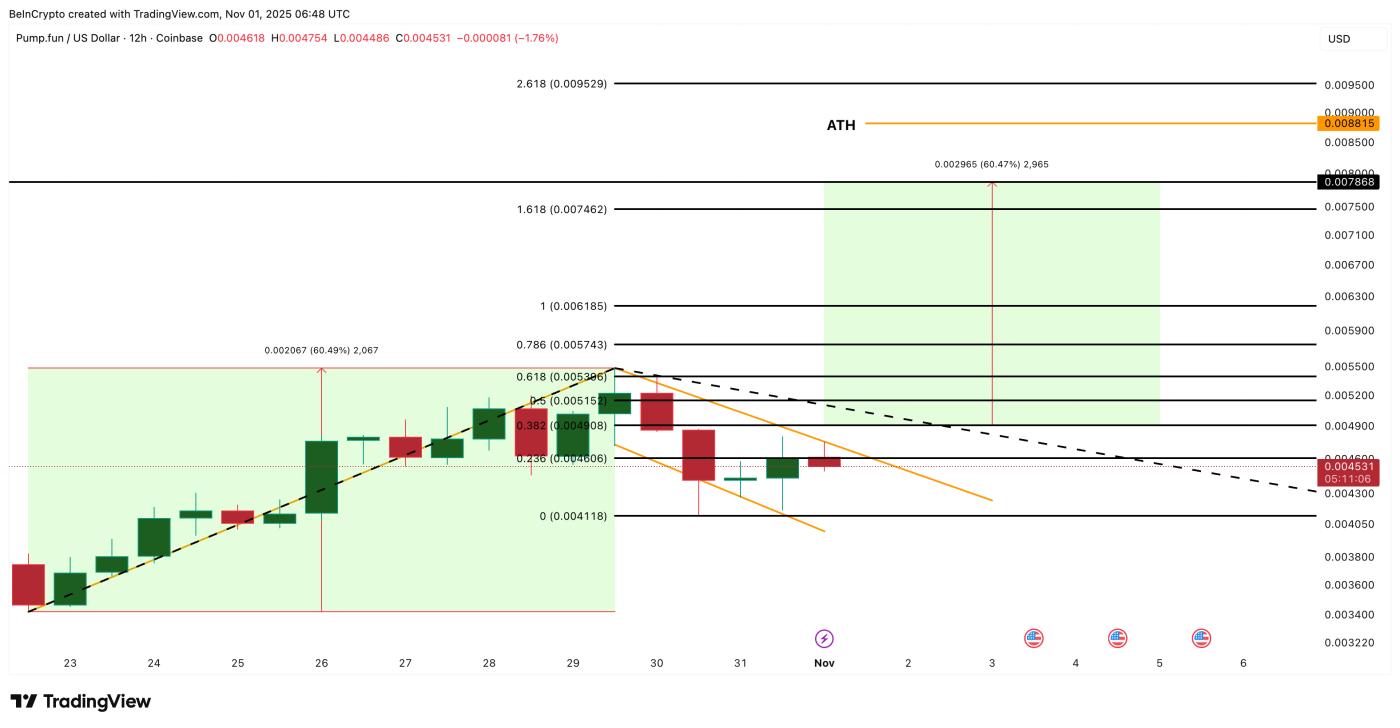

On the 12-hour chart, the price of PUMP is forming a flag and pole pattern, which usually signals a pause before continuing to break out in the same direction. The Token has tested both the upper and lower trendlines of the flag multiple times, which is typical of a volatile new asset consolidating after a rally.

PUMP Price Analysis: TradingView

PUMP Price Analysis: TradingViewA break above $0.0049 would confirm the uptrend, with short-term targets at $0.0053 and $0.0061. Based on the projection from the column, a complete breakout could push PUMP to around $0.0078, representing a potential upside of 60%.

If momentum remains strong, the previous all-time high of $0.0088 could also come into play. A break above $0.0095 would then mark a new record.

Currently, it appears that whales are pre-empting the breakout, gradually increasing their exposure while the market waits for confirmation. The bullish trend will be invalidated if the 12-hour PUMP candle closes below $0.0041.