This month saw Bitcoin end at a loss for the first time in seven years. Meanwhile, BNB soared thanks to memecoin.

Bitcoin is at $107,049 (updated according to BingX exchange ) leaving investors disappointed as October, a historically good month, is about to end in the red. Meanwhile, BNB Chain has seen record trading activity as the Token price skyrocketed in early October.

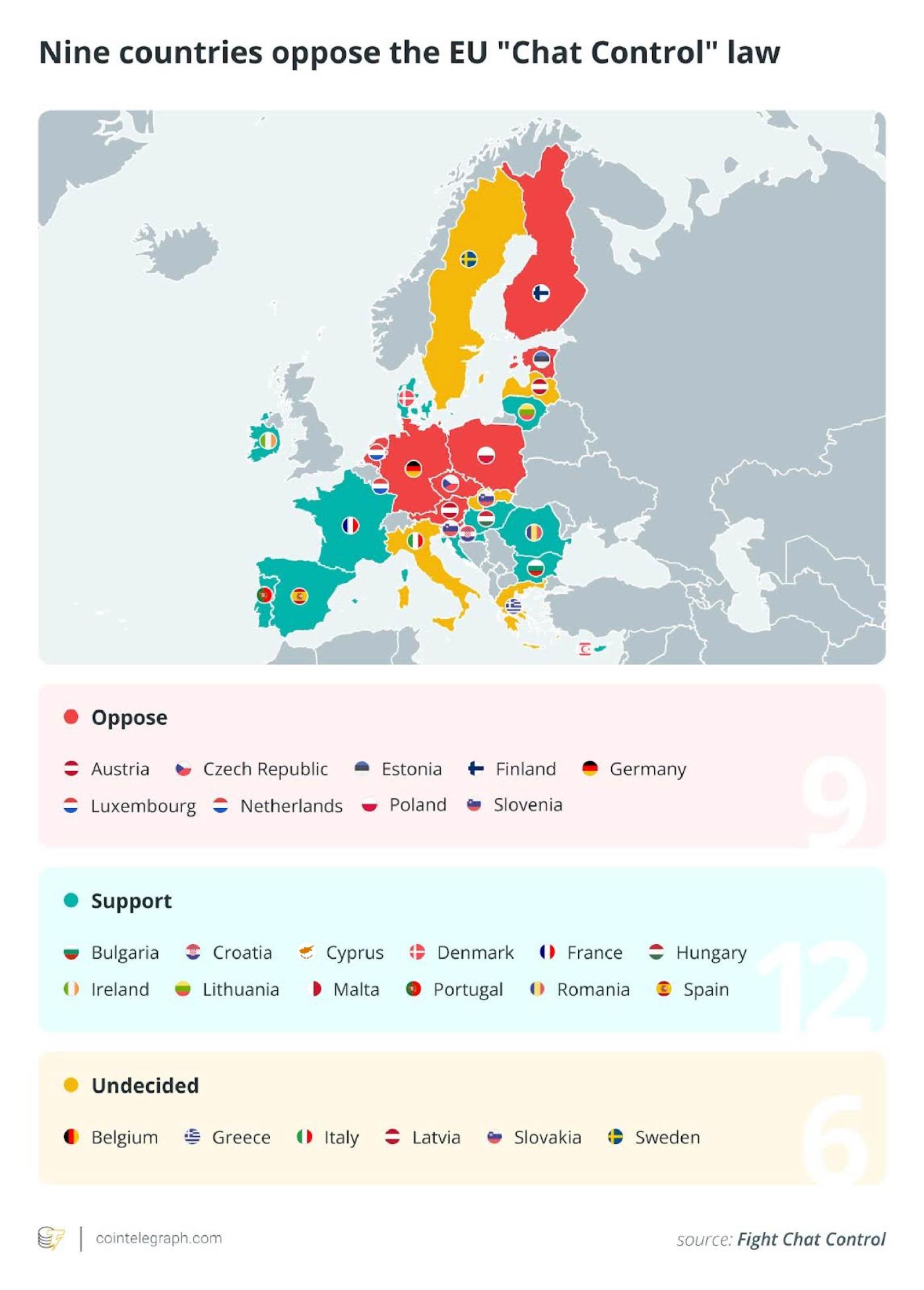

In the EU, the situation is still fluid as countries decide whether to back the “Chat Control” proposal, with nine countries outright opposing it. Concerns about the lack of support have led lawmakers in Brussels to delay a decision on the controversial regulation until December.

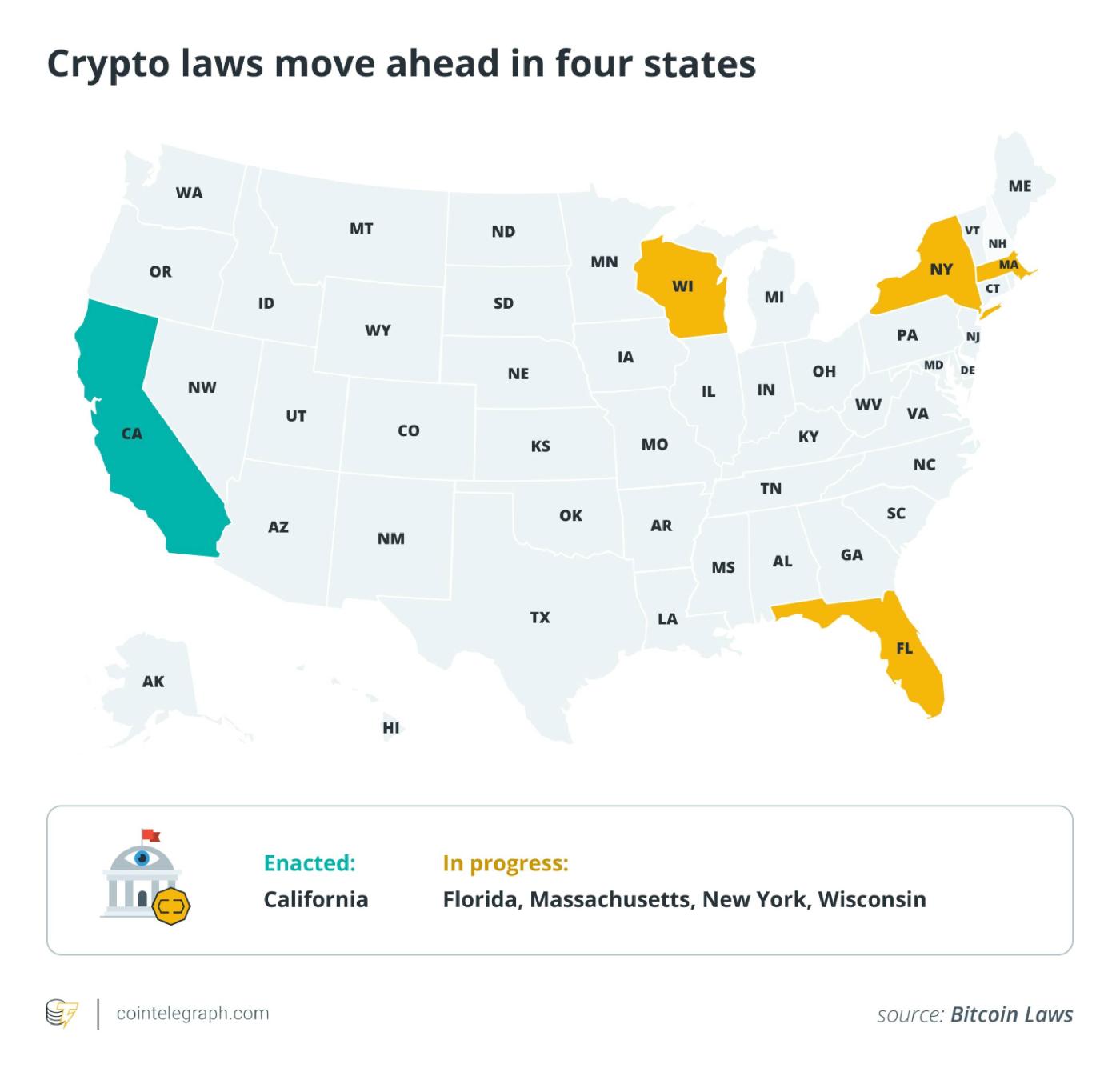

While the US government shutdown has stalled most federal activities, including decisions on cryptocurrency trading projects, crypto bills were passed in four states this month.

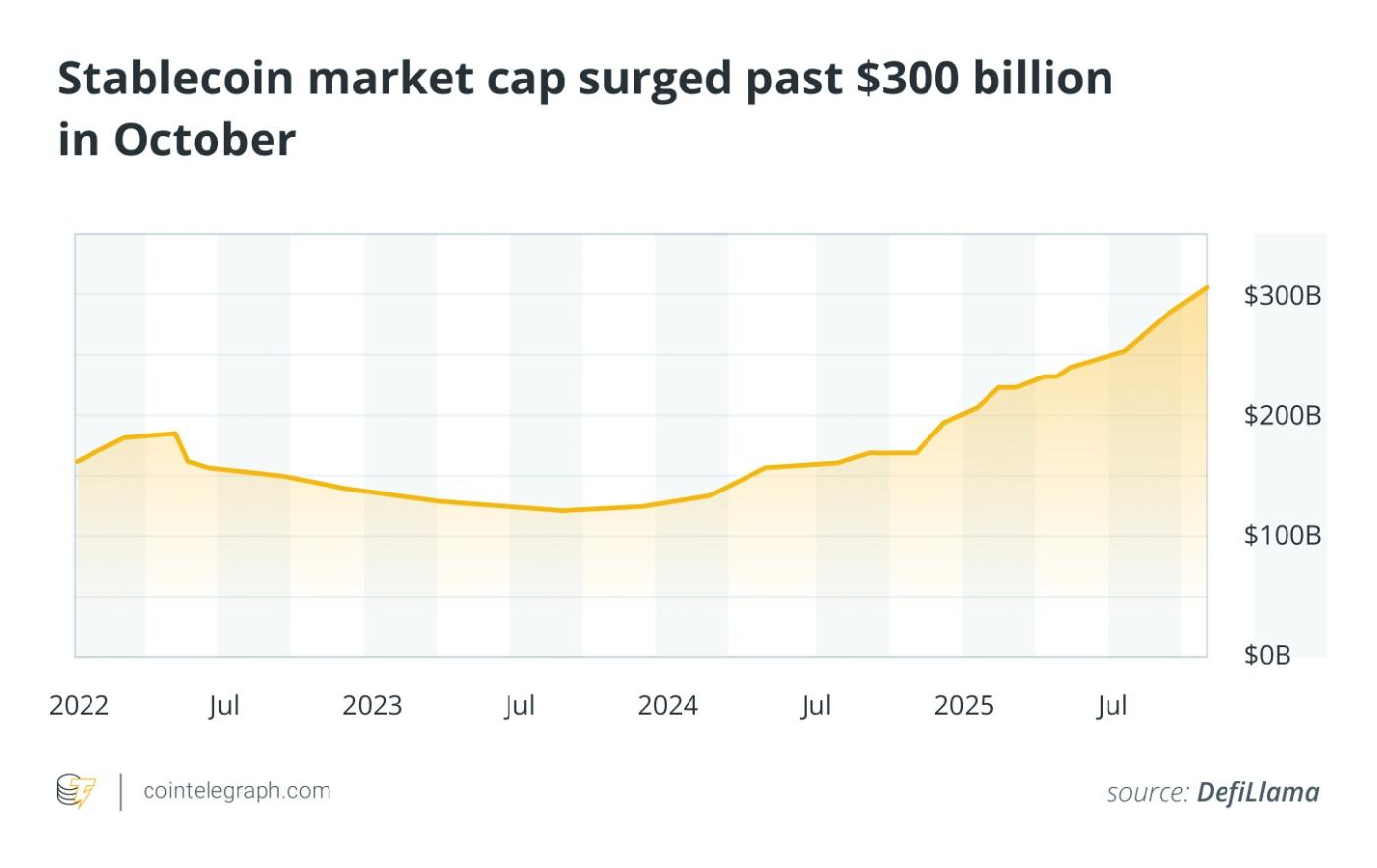

Meanwhile, stablecoin adoption continues to grow. The total stablecoin market Capital surpassed $300 billion for the first time in October.

Here is the chart for October:

Bitcoin Drops 10% in First Month in Red “Uptober” in Seven Years

For the past six years, Bitcoin traders have been expecting growth in October. The trend has been so reliable that the crypto community has dubbed the month “Uptober.” However, this year, Bitcoin has fallen more than 10% month-to-month, undercutting that trend.

Several factors in particular have put downward pressure on Bitcoin prices this month, including a liquidation event of nearly $20 billion due to US President Donald Trump's trade war with China and interest rate cuts at the US Federal Reserve.

Some traders believe that a disappointing October could mean a further rally in November. Others are less convinced. “The last time Bitcoin closed in the red in October, November saw a 36.57% drop,” said analyst Crypto Rover.

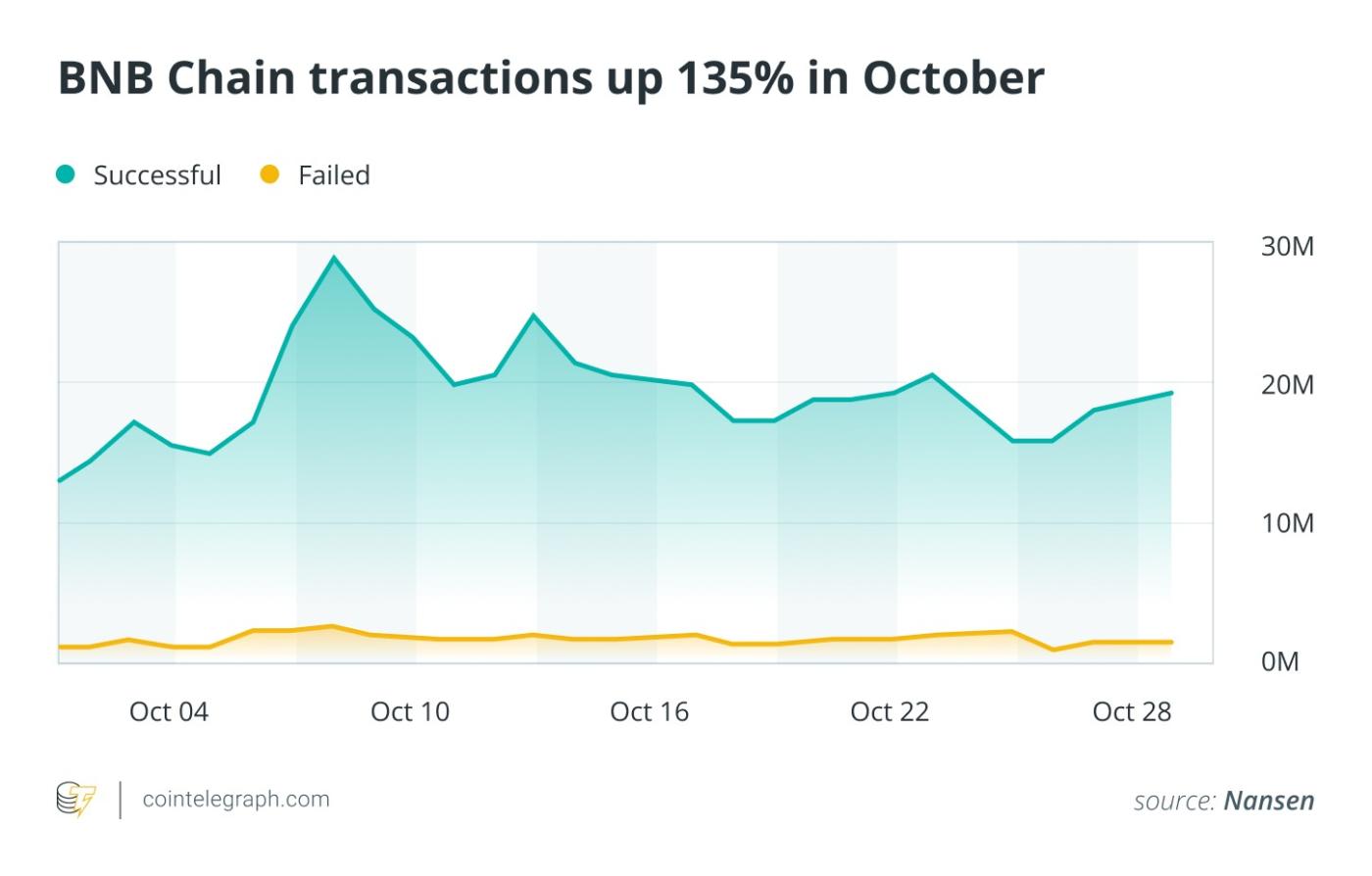

BNB Chain Transactions Soar 135% in October

According to Nansen Analytics, October saw a 135% increase in transaction volume on BNB Chain as memecoin issuance skyrocketed. Bubblemaps says “memecoin szn is real” on BNB Chain.

According to the analytics platform, more than 100,000 new traders bought memecoin on October 7, and 70% of them were profitable. About 40 of them made more than $1 million, while 6,000 made at least $10,000.

Anonymous cryptocurrency trader Star Platinum claims that most memecoins crashed on October 8 and 9.

“Retail investors bought at the peak. Large holders sold. If we XEM at the onchain data, we see: centralized supply, low liquidation , repetitive bot trading [and] peak DEX/CEX exits,” they said.

The memecoin craze has made BNB Chain's Meme platform the dominant format for memecoin launches. On October 1, Pump.fun accounted for over 90% of all new issuances, but by October 8, Meme had flipped the balance, accounting for over 80% of all new Token launches.

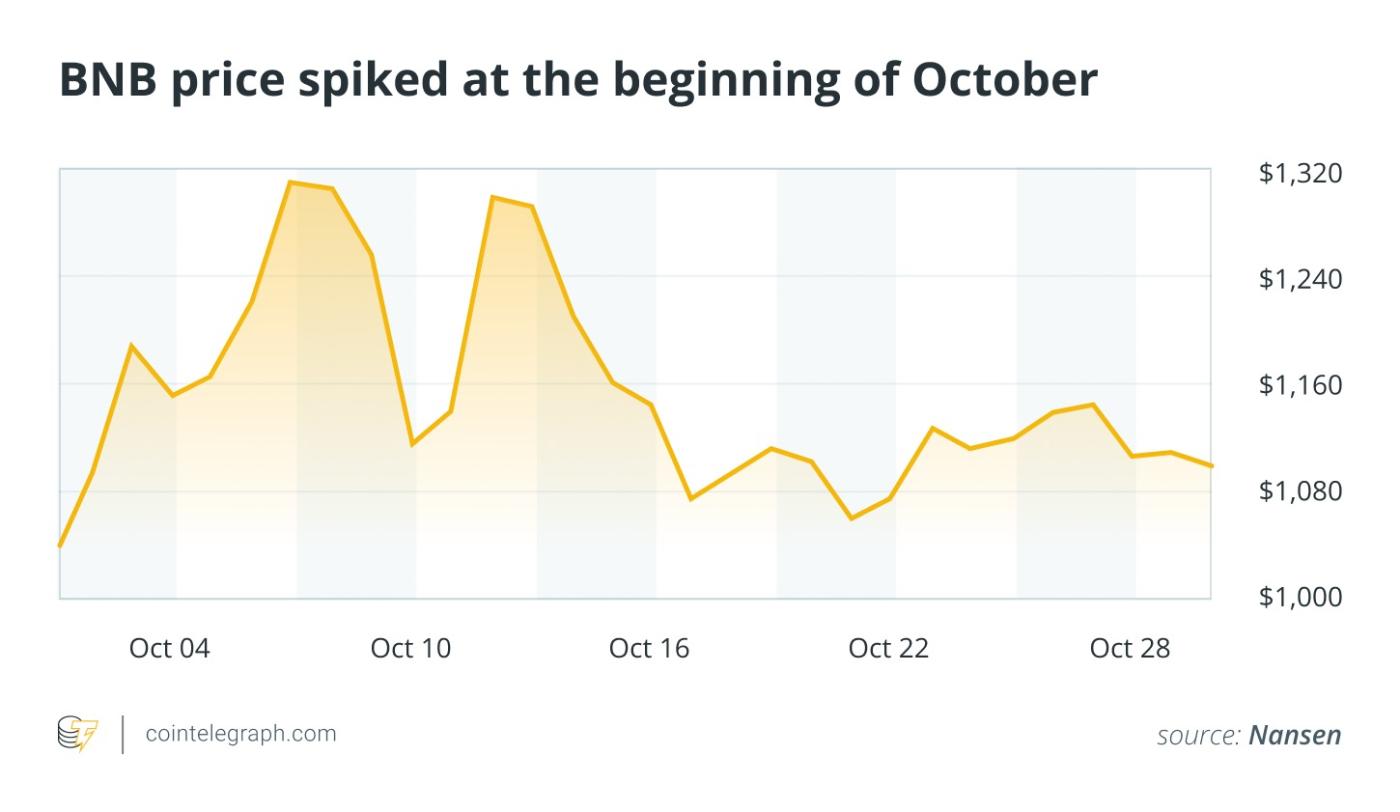

The memecoin craze saw a simultaneous surge in BNB which surpassed the $1,300 mark on October 13. The Token has since retreated but is still up 6.6% on the month.

Nine countries oppose Chat Control, postpone until December

The number of EU member states that support “Chat Control” continues to fluctuate. As of late October, 12 countries supported it, while nine countries had publicly opposed it. Six countries remained undecided.

Ahead of the vote scheduled for October 14, observers and privacy activists were watching closely to XEM which way Germany would vote. At the time, a majority of member states supported “Conversation Control,” but the bloc did not have the 65% of the EU population needed to pass.

Germany, the EU’s most populous country, is Vai if the European Council is to secure the support needed to pass the bill. However, as of publication, public records obtained by Fight Chat Control, a privacy advocacy group monitoring the law, show that Germany opposes the bill.

The proposed Chat Control Act has been in the works since 2022 but has yet to gain the support needed to pass. The current version, proposed by Denmark, which holds the European Council presidency, would introduce mandatory screening of encrypted messages to detect traffickers of child sexual abuse material. The vote has been postponed until December.

Four US states are drafting cryptocurrency laws

While partisan gridlock has slowed progress on the US Senate’s Responsible Finance Innovation Act, US states continue to enact their own legislation for the cryptocurrency industry. In October, four US states made progress on passing cryptocurrency legislation.

In Florida, the legislature introduced a bill that “authorizes the Florida CFO and certain public entities to invest a portion of state and local funds in digital assets, including Bitcoin and exchange-traded products.” The bill also sets requirements for cryptocurrency kiosks and guidelines for stablecoin issuers operating in the state.

Wisconsin is updating its tax laws. Current law allows cryptocurrency mining data centers to be exempt from income tax. A new bill would close that loophole. The state Senate is also drafting a bill “to ensure that individuals and businesses can accept digital assets as payment, use self-hosted or hardware wallets, operate blockchain nodes, develop blockchain software, transfer digital assets, and participate in Staking.”

New York is drafting a new excise tax on electricity used in proof-of-work cryptocurrency mining. Massachusetts is updating its crypto-related trusts.

California has passed a law that says abandoned Bitcoin cannot be sold by the state immediately and must be kept in its original form, which observers say will help speed recovery and reduce the burden on exchanges.

Stablecoins Hit $300 Billion

As stablecoin adoption grows globally, their total market Capital surpassed $300 billion in October.

This new high comes amid positive stablecoin news in October. EURAU, AllUnity's euro-backed stablecoin, a joint project between Deutsche Bank and asset management firm DWS, is expanding to several blockchains.

Neobank Revolut has introduced 1:1 conversion between dollars and stablecoins for customers. Indonesia's central bank is reportedly planning to issue a “national stablecoin” — a digital currency backed by government bonds.

On October 29, Visa CEO Ryan McInerney announced: “Adding support for four stablecoins running on four unique blockchains, representing two currencies that we can accept and convert into more than 25 traditional fiat currencies.”

Source: Cointelegraph