- Technical analysis indicates short-term weakness, but it is approaching a key support level.

- Institutional funds continue to flow in to hedge against the impact of whale short.

- With strong long-term fundamentals, it is suitable for phased investment.

BTC Price Prediction

Bitcoin Technical Analysis

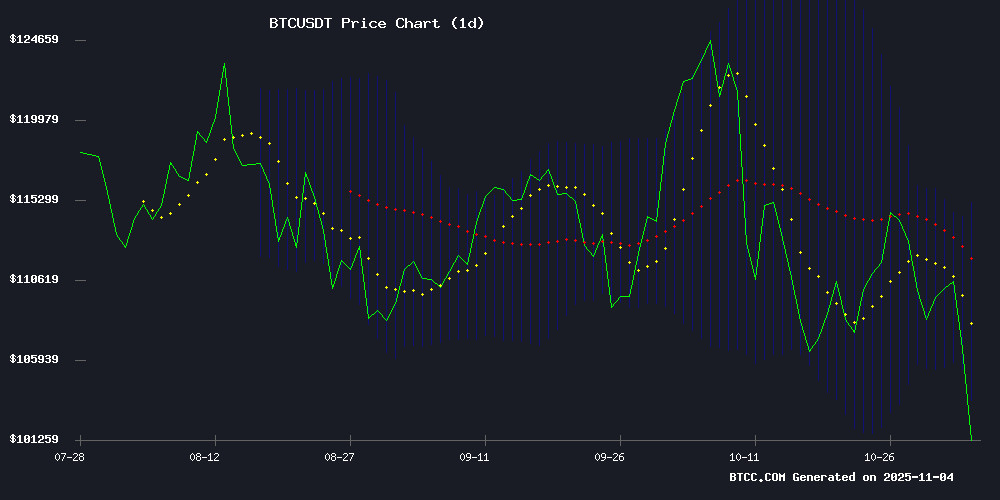

According to Michael, a financial analyst at BTCC, the current BTC price of $103,843.17 is below the 20-day moving average of $109,508.15, indicating a weak short-term trend. The MACD indicator shows the fast line (240.65) is significantly lower than the slow line (1,479.36), and the histogram is negative (-1,238.71), indicating continued bearish momentum. The price is currently approaching the lower Bollinger Band at $104,357.25; a break below this level could lead to further declines towards support.

Market sentiment and fundamental factors

BTCC financial analyst Michael points out that despite concerns raised by a whale establishing a $108 million short position, continued institutional inflows are providing support. Japanese fashion brand ANAP plans to accumulate over 1,000 Bitcoins by 2025, and a strategy firm has raised nearly $1 billion for Bitcoin acquisitions; this institutional demand will provide long-term support to the market.

Factors affecting the price of BTC

The spectacular fall of crypto whale James Wynn: from a billion-dollar holding to tiny, insignificant transactions.

James Wynn , once hailed as a legend in on-chain trading and a crypto whale, recently suffered a dramatic collapse. In just two weeks, this trader, known for opening positions worth $1 billion, was reduced to trading "ant positions" worth only a few hundred dollars. His rapid decline ended with a confessional, analyzing how he went from a $100 million profit to financial ruin—a cautionary tale about the dangers of uncontrolled greed.

On June 6th, Wynn suffered another devastating liquidation, losing 155.38 BTC (worth $16.14 million at the time), primarily due to the BTC-USDT contract price plummeting to a liquidation price close to $103,981. Market volatility completely shattered his leveraged bet. This event became a turning point: Wynn admitted that he had never been a serious trader, instead being enthusiastic about trading meme coins like Pepe—which had brought him eight-figure profits in his early days when his portfolio was worth only $600,000.

Today, his publicly available on-chain data, scrutinized by hundreds of thousands of people, has turned his transactions into a spectacle for the masses. The market is further questioning whether Wynn is acting as a "front man" for Hyperliquid. This story starkly exposes the risks of institutional overstepping boundaries and the fatal allure of high- leverage cryptocurrency trading .

Whales are accumulating large-scale, highly leveraged short positions in Bitcoin.

Two prominent whales have recently made a strong foray into the Bitcoin market with highly leveraged short positions. On-chain data shows that one entity established a $65 million short position with 40x leverage, briefly realizing a profit of $7.58 million; the other whale deployed a $43 million short position with 35x leverage.

This move indicates increased institutional activity in the derivatives market; however, the extremely high leverage suggests it is more likely a tactical maneuver than a structural bearish move. Market participants are closely watching whether these positions will trigger a chain reaction of liquidations or represent a complex hedging strategy for a broader portfolio.

Whales established a $108 million short position in Bitcoin amid market volatility.

Two highly leveraged Bitcoin short positions totaling $108 million indicate a growing bearish sentiment among large traders. Onchain analyst Onchain Lens reported a $65 million BTC short position with 40x leverage, currently showing $7.58 million in unrealized profit. Another $43 million position used 35x leverage.

This aggressive positioning occurred as Bitcoin continued to test key support levels. Such whale activity typically foreshadows increased market volatility, although the ultimate directional impact remains uncertain. Market participants are closely watching whether these positions will trigger a cascading liquidation or face short squeeze pressure.

Nearly $200 million worth of Bitcoin was transferred out of Kraken during a slight pullback in BTC prices.

Blockchain tracking platform Whale Alert detected two Bitcoin transfers totaling $197 million from the US cryptocurrency exchange Kraken. The two transactions, involving 875 BTC ($92.35 million) and 997 BTC ($105.08 million) respectively, were completed within an hour, suggesting that institutional investors or high-net-worth individuals are engaging in strategic accumulation.

Bitcoin's recent price volatility, influenced by ETF fund flows and macroeconomic uncertainties, has created opportunities for large investors to buy on dips. The anonymous wallet movement patterns align with typical cold storage or long-term holding strategies employed by institutional investors.

Large-scale withdrawals from centralized exchanges typically indicate reduced short-term selling pressure, as assets transferred to private wallets are often held for the long term. This activity coincides with a market readjustment, and experienced investors are taking advantage of temporary price discrepancies to position themselves.

Japanese fashion brand ANAP plans to accumulate more than 1,000 Bitcoins by 2025.

Japanese fashion brand ANAP announced plans to hold over 1,000 bitcoins long-term until August 2025. This move reflects growing institutional interest in cryptocurrencies as a store of value.

This decision highlights the trend of Bitcoin evolving from a speculative asset into a corporate treasury reserve. ANAP's commitment is similar to the strategies adopted by Microsoft Strategy and Tesla, but with a distinctly retail-oriented character.

Strategy firm expands fundraising to nearly $1 billion for Bitcoin acquisitions

Strategy has significantly expanded its latest fundraising round, now aiming to raise $979.7 million—almost four times its initial $250 million target—by selling SRD shares to institutional investors. The funds will be dedicated to purchasing Bitcoin , reinforcing the company's aggressive accumulation strategy.

The company currently holds 580,955 BTC , worth over $61.3 billion, solidifying its position as one of the largest institutional holders. This move demonstrates growing institutional confidence in Bitcoin as a long-term store of value, especially under inflationary pressures.

By opting for perpetual preferred stock instead of traditional equity, the strategy firm provides investors with exposure to rising Bitcoin prices while maintaining its treasury's BTC reserves. This oversubscribed fundraising round demonstrates strong demand from traditional financial players for cryptocurrency exposure.

Is BTC a good investment?

According to BTCC financial analyst Michael, Bitcoin is currently in a critical technical position. From an investment perspective:

| index | Current value | Investment Analysis |

|---|---|---|

| Price position | $103,843 | Below the moving average, near the lower Bollinger Band |

| MACD | -1,238.71 | Momentum is weak, but may be approaching oversold levels. |

| Institutional Trends | Continue buying | ANAP, strategy companies and other institutions continue to accumulate |

Overall assessment: Short-term adjustment pressure exists, but long-term institutional buying provides support. It is recommended to adopt a phased investment strategy and gradually build positions near key support levels.