Uniswap wants a comprehensive overhaul, proposes to retroactively burn 100 million UNI. Photo: DL News

Uniswap wants a comprehensive overhaul, proposes to retroactively burn 100 million UNI. Photo: DL News

Proposal to activate toll collection mechanism

- Uniswap Labs and Uniswap Foundation suddenly launched the “UNIfication” proposal to comprehensively reform the ecosystem, activate a fee collection mechanism, burn large-scale Token , and merge two core organizations into a unified block.

A proposal for the next chapter of 🦄

— Uniswap Labs 🦄 (@ Uniswap)November 10, 2025

UNIfication is a joint proposal from Uniswap Labs and the Uniswap Foundation that turns on protocol fees and aligns incentives across the Uniswap ecosystem

Positioning the Uniswap protocol to win as the default decentralized exchange https://t.co/ra0Y7TKpYk

- On the Uniswap forum , “UNIfication” marks the first time the development team has officially enabled the fee mechanism, a feature that the community has been waiting for for many years.

- Currently, all transaction fees on Uniswap are distributed to LP. If the “fee switch” is triggered, a portion of these fees will be transferred back to the protocol, i.e. to the Uniswap treasury or UNI Token holder .

- According to other sources, the fee rate transferred to the protocol fund can range from 16.7% to 25% of the total revenue of the pools, and a portion of it will be used to burn UNI. This is Uniswap's first truly deflationary mechanism, transforming UNI from a pure Governance Token into an asset with clear cash flows and economic value.

Reduce UNI supply, increase value for the ecosystem

- According to the proposal co-authored by founder Hayden Adams, Uniswap Foundation Director Devin Walsh, and researcher Kenneth Ng, UNIfication aims to reduce the supply of UNI through a variety of coordinated measures.

- Specifically, the plan includes:

Activate fee switch to use part of protocol fees and revenue from Unichain sequencer for UNI burning.

Retroactively burn 100 million UNI currently in the Uniswap treasury, representing approximately 16% of the total circulating supply, reflecting the amount of Token that would have been burned if the fee mechanism had been activated at UNI launch.

Uniswap Labs is ending its practice of charging fees from its interface, wallet, and API, which has generated $137 million in cumulative revenue for the company.

- If Uniswap activates the fee mechanism and deducts 0.05% for UNI, the protocol could buy back or burn over $38 million in UNI per month , putting UNI at the top of the Token with the strongest buyback model, above PUMP and just below HYPE.

Using historical numbers, this is how $ UNI would stack up against current buyback tokens.

— BREAD | ∑: (@bread_) November 10, 2025

→ 0.3% LP fee becomes 0.25% (LP)/0.05% (UNI)

→ 0.05% over ~$2.8B annualized fees and you get ~$38m in buybacks every 30d

Would put it ahead of $PUMP ($35M) and behind $HYPE ($95M) https://t.co/bXd35QDV6h pic.twitter.com/2KR0abGKm2

Uniswap Labs and Foundation Merge

- The proposal also proposes an important structural change: merging the Uniswap Foundation (the non-profit organization responsible for governance and community funding) into Uniswap Labs, the unit directly developing core products and infrastructure such as Unichain L2.

- After the merger, Uniswap will be run by a 5-member leadership team focused on product strategy, tokenomics governance, and global expansion. The goal is to create a unified organization focused on protocol development and driving the growth of the Uniswap ecosystem.

- Chia to Hayden Adams, the development team has delayed enabling the toll mechanism for many years mainly due to the unfavorable legal environment in the US.

- He said: “UNI launched in 2020, but for the past 5 years, Uniswap Labs has had little to no meaningful governance involvement and has been severely limited in creating value for the community. That ends today.”

- Uniswap was once one of many DeFi protocols targeted in investigations by the US Securities and Exchange Commission (SEC), under former Chairman Gary Gensler . However, the recent regulatory landscape is said to have become more open, especially as the US is discussing a federal crypto regulatory framework bill, paving the way for Uniswap to implement tokenomics reforms in a more legal and sustainable manner.

- Uniswap is currently among the most profitable DeFi groups, with an estimated annual revenue of more than $2 billion across multi- chain deployments. Analysts say that if the proposal is passed, this will be a turning point not only for Uniswap, but also reshape the entire DeFi market, where actual usage value begins to be more closely linked to the value of Token.

Uniswap is currently among the most profitable DeFi groups today. Source: The Block (November 11, 2025)

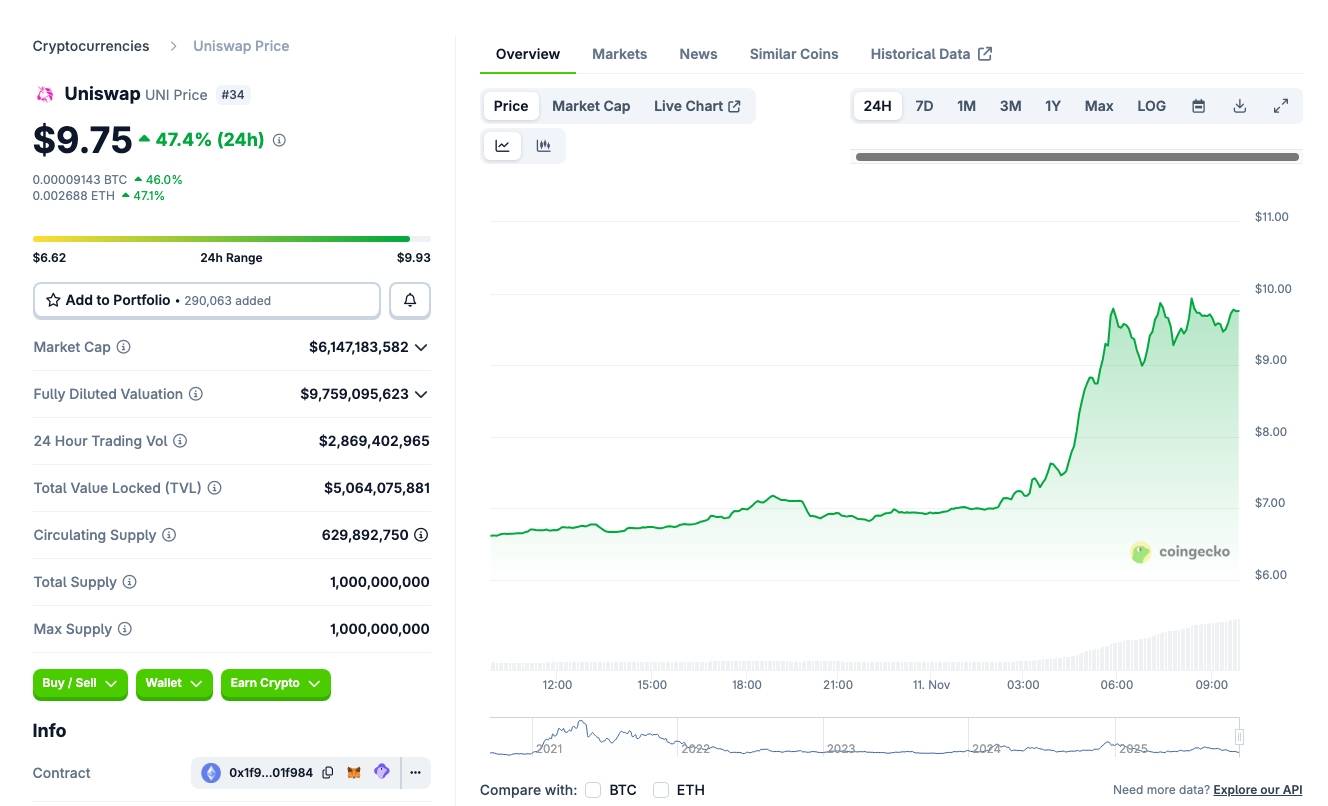

- UNI price increased by nearly 50% in the last 24 hours, as a response to the newly introduced restructuring proposal.

UNI price movement in the last 24 hours, screenshot on CoinGecko at 10:00 AM on 11/11/2025

UNI price movement in the last 24 hours, screenshot on CoinGecko at 10:00 AM on 11/11/2025

Coin68 synthesis