Threshold Network, a cross‑chain bridge infrastructure hub that lets Bitcoin move between different blockchains, has upgraded its tBTC bridge to make it easier for large investors to use BTC in decentralized finance (DeFi).

The update means that institutions such as ETFs, hedge funds, and custodians can now deploy their Bitcoin in DeFi to earn yield or provide liquidity without removing it from regulated storage, according to a press release shared with The Defiant.

Until now, most institutional Bitcoin has been locked in vaults due to strict compliance and insurance rules, Threshold Network claims.

The upgrade is expected to give tBTC a new architecture that would link directly to regulated custodians, allowing institutions to mint tokenized Bitcoin without physically moving it out of insured storage.

$400B In Locked Liquidity

Speaking with The Defiant, MacLane Wilkison, co-founder and CEO of Threshold Labs, the firm behind Threshold Network, noted that since U.S. spot ETF approvals, institutional participation in Bitcoin “has accelerated at an unprecedented rate.”

Speaking with The Defiant, MacLane Wilkison, co-founder and CEO of Threshold Labs, the firm behind Threshold Network, noted that since U.S. spot ETF approvals, institutional participation in Bitcoin “has accelerated at an unprecedented rate.”

“Institutions now hold more than $400 billion in BTC, corporate reserves increased 40% in Q3 to $117 billion, and ETFs represent nearly 7% of the asset’s market cap. Bitcoin is becoming a core holding for balance sheets and professional portfolios,” Wilkison said.

With the upgrade, institutions can now mint tBTC in a single transaction without paying gas fees, and redeem it instantly back into Bitcoin. The bridge supports multiple blockchains, including Ethereum, Arbitrum, Base, Polygon, Sui, Starknet, BOB, and Optimism.

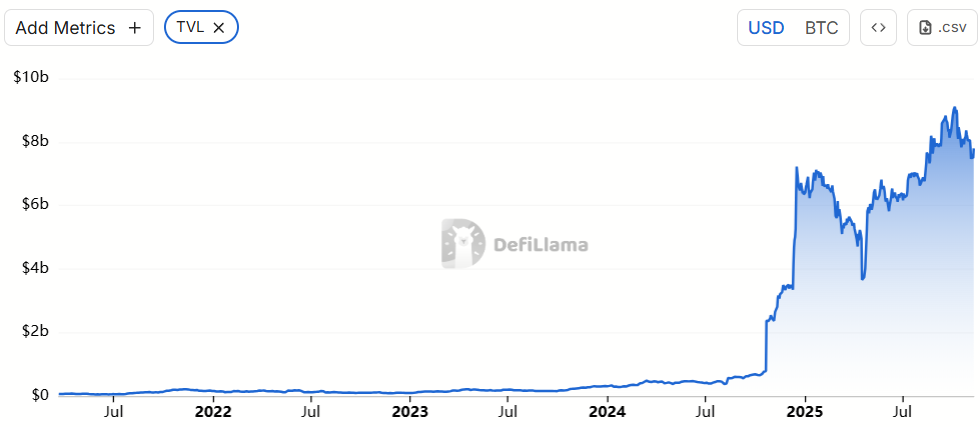

Data from DefiLlama shows Bitcoin has accumulated over $7.7 billion in its DeFi ecosystem. While the figure might seem significant, it still represents only 6.7% of the market, behind BNB Chain, Solana and Ethereum, which have over $7.8 billion, $10.4 billion and $77.2 billion locked in DeFi, respectively.

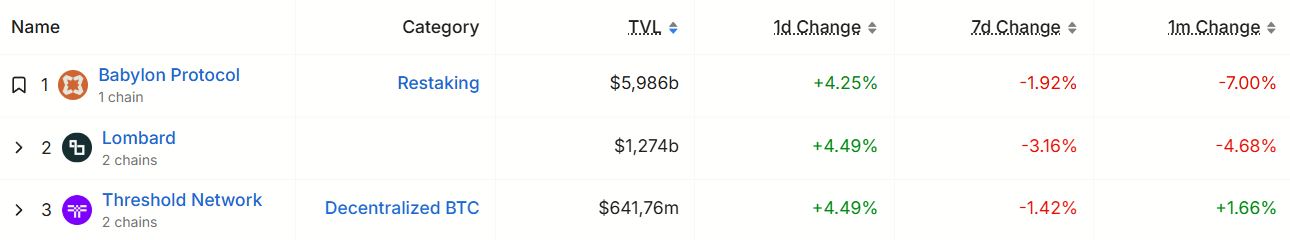

Threshold Network, which has processed over $4.2 billion in Bitcoin bridge volume, has over $640 million in total value locked, per DefiLlama. This makes it the third-largest DeFi project in the Bitcoin DeFi space, trailing only Lombard, with over $1.2 billion in TVL, and Babylon Protocol, with over $5.9 billion.