Despite huge Capital , aPriori is facing a serious crisis of confidence.

aPriori was exposed for creating 14,000 Airdrop farming wallets for itself. Photo: aPriori

aPriori was exposed for creating 14,000 Airdrop farming wallets for itself. Photo: aPriori

How to manipulate Airdrop

aPriori , a native project on the Monad ecosystem that successfully Capital $30 million from leading VC funds such as Binance Labs (new name YZi Labs ), is expected to be one of the platform's day 1 "bright stars".

aPriori launched its APR Token on October 23 on BNB Chain and quickly reached a market Capital of $300 million, creating a lot of attention in the crypto community. Before the Monad mainnet went live, aPriori distributed 12% of the total Token supply through an Airdrop , promising an opportunity for the community and early users.

However, right before the mainnet, the project was caught in a serious scandal. More than 60% of the Airdrop Token fell into the hands of a single entity through thousands of linked wallets.

According to Bubblemaps ' investigation, the details of the incident are as follows:

14,000 shady wallets claimed more than 60% of the Airdrop, while the total Airdrop distribution only accounted for 12% of the total supply.

These wallets received 0.001 BNB from Binance exchange.

Once claimed, the APR is transferred to other wallets, creating a “second-layer” network, turning what was Capital a community Airdrop into a private party for a sophisticated group.

This entity continues to create new wallets to continue claiming, the identity and validity of the wallets remain a mystery.

This project raised $30M from tier-1 VCs

— Bubblemaps (@bubblemaps) November 11, 2025

But 60% of its Airdrop was claimed by one entity via 14,000 addresses

What's going on with @aPriori ? 🧵 pic.twitter.com/QIaLSUgHY5

This way of working is a true Sybil Attack, a trick of creating a series of fake identities to exploit incentives, distort Token distribution and destroy the fairness of the Airdrop.

Direct impact on Monad ecosystem

The Airdrop incident is not only a story of Token distribution, but also heavily affects the market and project reputation:

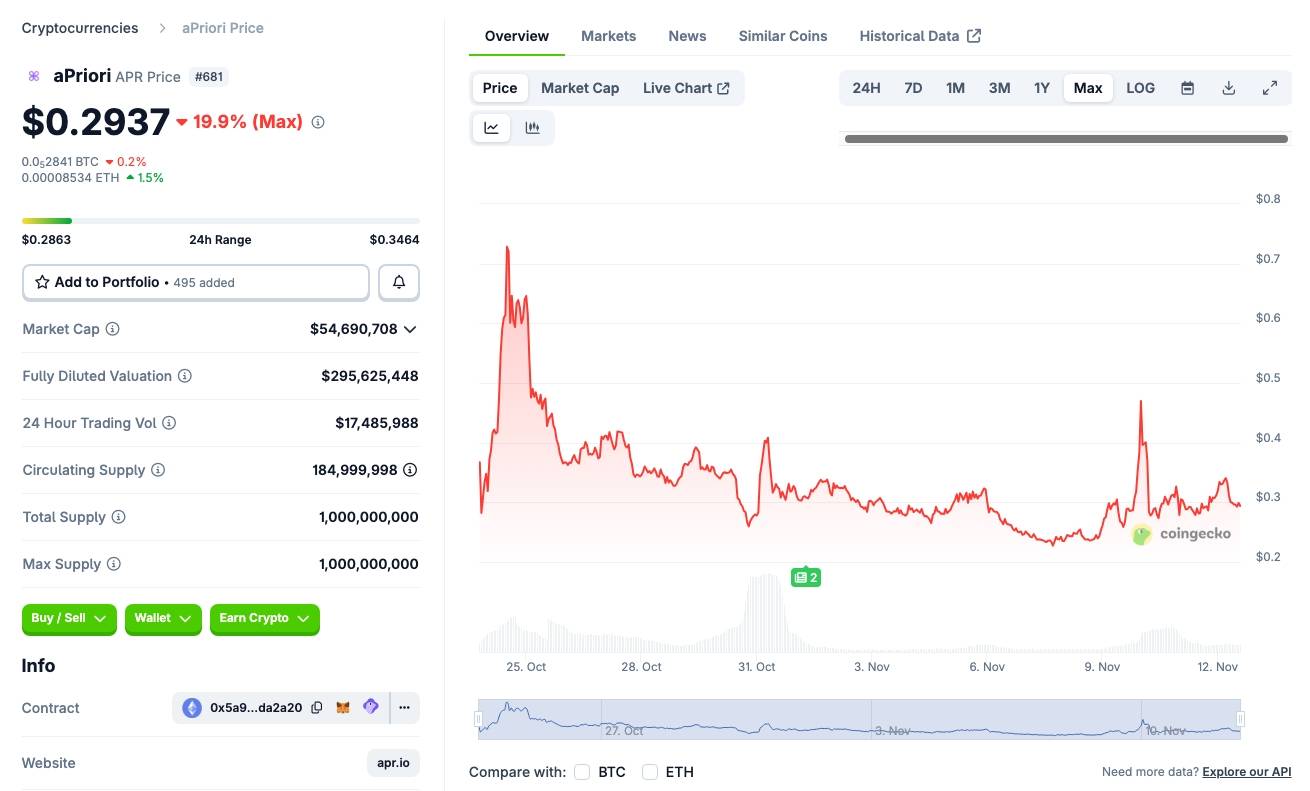

In the last 24 hours, APR price decreased by 1.8% and is trading around 029 USD per coin. APR once reached a Capital of 300 million USD, now it has dropped to about 55 million USD.

APR price movement since listing, screenshot on CoinGecko at 02:20 PM on 12/11/2025

APR price movement since listing, screenshot on CoinGecko at 02:20 PM on 12/11/2025

Since aPriori is one of the top applications in the ecosystem, this scandal threatens the mainnet event, and at the same time poses risks to the entire ecosystem.

The wallets were created before the Airdrop criteria were announced, suggesting there may have been insider trading or community leverage, rather than simple manipulation.

To date, the aPriori team has yet to issue an official response, leaving the information gap and FUD to spread.

Coin68 synthesis