Written by: KarenZ, Foresight News

Over the past few years, the crypto industry has made rapid progress at the infrastructure level. However, truly consumer-grade crypto applications for the general public have consistently failed to break into the mainstream. Issues such as fragmentation between different blockchain ecosystems, complex wallet operations, and gas fees remain significant obstacles for ordinary users, becoming the final hurdle preventing widespread adoption.

FOMO, a social crypto trading app that emerged in 2025, is attempting to rewrite the game with an extremely simple user experience by "breaking down the technical barriers of crypto trading." It has not only attracted more than 140 top angel investors in the industry, but also secured a $17 million Series A funding round led by Benchmark , a top VC firm that has always been cautious about the crypto field, making it one of the most watched dark horse apps in the crypto sector that year.

Team Background: A Crypto Veteran's "Reduced-Dimensional Attack"

fomo's core positioning is "a social encrypted trading mobile application built for everyone." Its product design revolves around two core principles: "eliminating technical friction" and "enhancing user connection," attempting to break the current status quo of lagging user experience in the encrypted industry.

FOMO co-founders Paul Erlanger and Se Yong Park previously worked together at the crypto derivatives trading platform dYdX. Team members come from companies such as dYdX, Uniswap, OpenSea, Square, and Two Sigma, covering multiple fields including DeFi, NFT ecosystems, and traditional fintech. This "cross-domain + strong collaboration" team DNA has become key to FOMO's rapid breakthroughs.

Financing channels

fomo's fundraising path was unconventional, yet it precisely hit the core of capital and resources. Instead of following the traditional "seed round → Series A" rhythm, fomo first built the most luxurious early supporter network in the crypto industry through an "angel investor list" strategy, and then attracted a "rare bet" from Benchmark, a top institution.

In February 2025, fomo completed a $2 million Pre-Seed angel round of financing, supported by more than 140 angel investors, covering the three core groups of builders, operators and traders in the crypto ecosystem: including Solara co-founder Raj Gokal, Polygon CEO Marc Boiron, Balaji Srinivasan, LayerZero CEO Bryan Pellegrino, Berachain CEO Smokey Bera, Sei co-founder Jeffrey Feng, Wintermute CEO Evgeny Gaevoy, Privy CEO Henri Stern, Kaito CEO Yu Hu, Pantera Managing Partner Paul Veradittakit, Dragonfly General Partner Rob Hadick, and others.

Among these angel investors are core members of the multi-chain ecosystem, who can provide key support for fomo's cross-chain technology integration; there are also top traders who are not only early users of the product, but also helped fomo optimize the design of its trading experience and social features.

The founder of fomo revealed to TechCrunch that the team initially compiled a "dream investor list" of 200 people. Through personal connections and direct communication, only a very small number of people ultimately declined. Behind this "high conversion rate" is the investors' recognition of the direction of "simplifying crypto transactions".

In November 2025, fomo secured another $17 million in Series A funding led by Benchmark. Benchmark is a legendary venture capital firm whose portfolio includes world-changing consumer products such as Uber, Snapchat, Instagram, and X. Benchmark has historically been cautious in its investments in consumer crypto applications—since 2018, the company has invested very little in crypto startups, with only a handful of projects in the Web3 space, including Chainalysis, Toncoin, and the Web3 social protocol Towns.

In an interview with TechCrunch, Benchmark General Partner Chetan Puttagunta stated that he was attracted to fomo by its "clear vision" and "truly outstanding growth." He noted that three people proactively introduced him to fomo. After learning about fomo's growth and clear vision, Chetan Puttagunta also joined fomo's board of directors.

Besides Benchmark, other angel investors in this Series A round include Luca Netz, CEO of Pudgy Penguins; Ivan Soto-Wright, CEO of Moonpay; and Jacob Horne, CEO of Zora.

Product Highlights: A crypto super app combining "cross-chain + social" technology.

FOMO's operation process is designed to be extremely simple. It allows cross-chain use of the same balance, one-click purchase of any asset, no need for a new wallet, no need for cross-chain transactions, and no gas fees. Even users with no crypto experience can complete transactions quickly.

Multi-chain asset coverage: Currently supports mainstream blockchains such as Bitcoin, Ethereum, Solana, Base, and BNB Chain, providing trading for millions of assets from mainstream cryptocurrencies (such as BTC and ETH) to meme coins and altcoins; the founder promises to achieve "coverage of almost all blockchain assets" within the next 6 months, so that users do not need to switch between multiple wallets and exchanges;

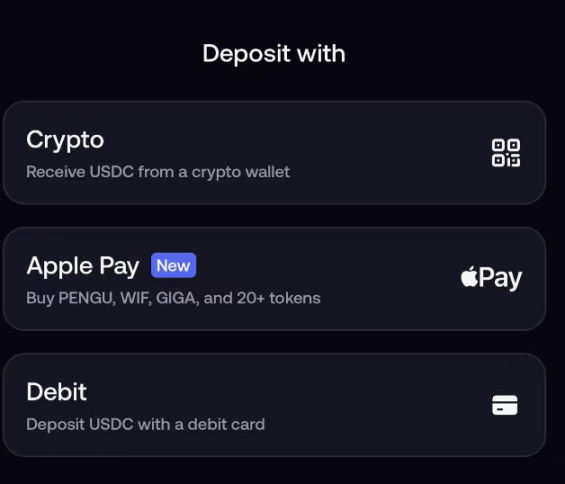

Supports direct cryptocurrency purchases via Apple Pay: After downloading the app, users can register using their Google or Apple ID without creating a complex seed phrase. Top-ups support direct cryptocurrency transfers, Apple Pay, or Debit Card payments.

No Gas: 0 Gas cost for the user.

Transaction fees: The transaction fee is uniformly 0.50%, with a minimum fee of $0.95 only set for the Solana network. Low-cost chains such as Base and BNB Chain have no minimum fee.

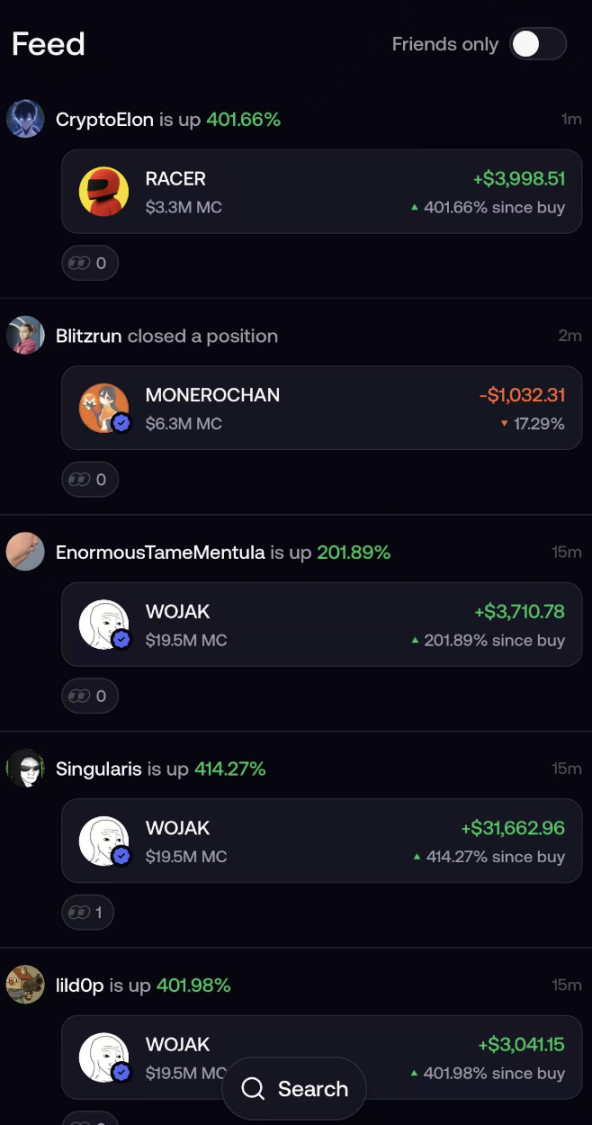

Social Discovery: fomo also has built-in social features, allowing users to follow KOLs, traders, or friends and view their trading records in real time (such as buying/selling a certain asset, changes in holdings). Users can also explore "Hot Assets," "Trend Trading," and "Top Trader Rankings" to quickly capture market opportunities.

FOMO's ultimate goal is not limited to cryptocurrencies. FOMO founder Paul Erlanger told TechCrunch that the company will gradually expand its asset classes to include prediction markets, bonds, and other traditional securities.

How is the FOMO data performing?

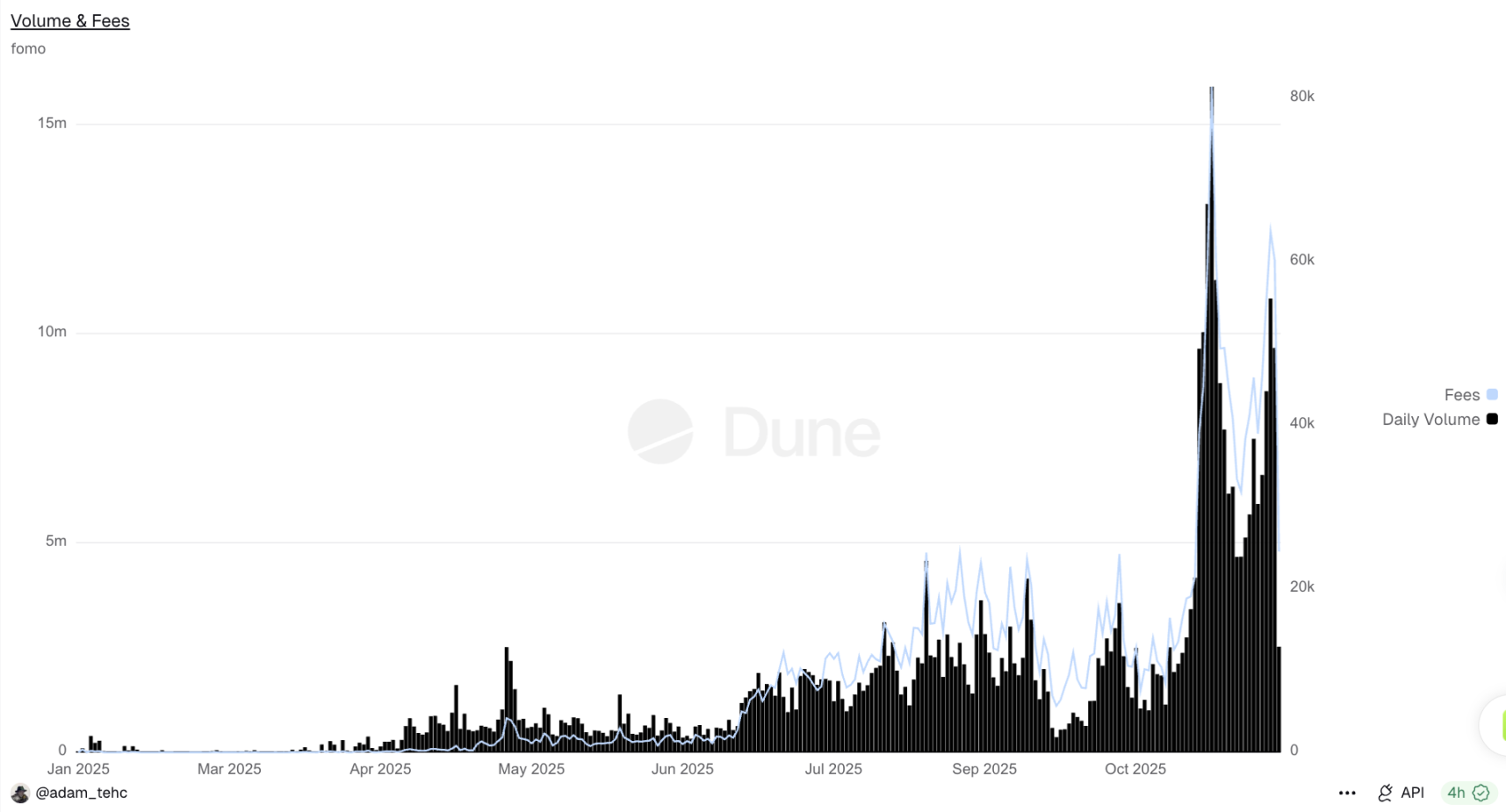

Since its beta launch in May 2025, FOMO's user and transaction data have shown "exponential growth," validating the viability of its product model.

Source: Dune

Transaction volume: According to Dune data, as of the time of writing, fomo's cumulative transaction volume is close to $850 million, generating $2.47 million in fees.

User Base: When disclosing its Series A funding, fomo stated that its user base has been growing at a rate of nearly 10% per week. fomo has attracted over 120,000 users and 35,000 traders, of whom nearly 15,000 are first-time cryptocurrency users (depositing funds via Apple Pay). Dune data shows that over 30,000 users on the fomo platform have made more than one trade.

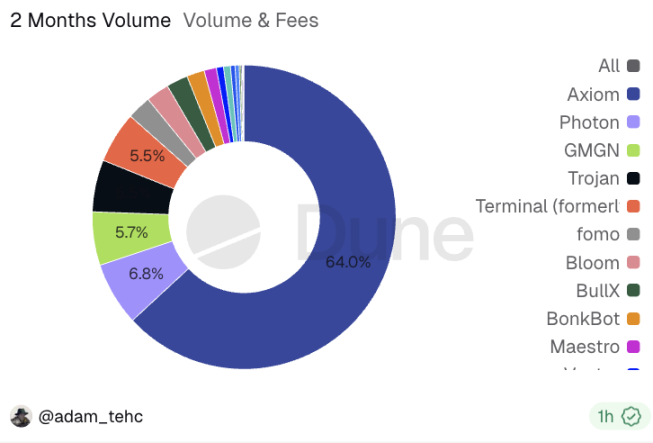

In terms of industry comparison, in the Solana Bot sector, fomo's transaction volume accounted for 5.5% of the market share in the past two months, ranking sixth.

Source: Dune

What are the interaction methods?

The core of the FOMO (Fulfillment by Investment) interaction strategy is trading. It's unclear whether referrals will be included in the rankings, but referring someone will earn you a 25% commission from the referred user's earnings.

FOMO has now launched a leaderboard feature in its mobile app. After trying to trade two small amounts of assets, I was ranked over 12,000th.

summary

Once the crypto infrastructure is mature enough, whoever can lower the barrier to entry for users will be able to seize the next wave of growth.

The core value of fomo is to solve the "last mile" problem in the crypto industry—focusing on user experience optimization, which perfectly matches the core need for the large-scale popularization of consumer-grade crypto applications.

Meanwhile, the presence of hundreds of angel investors and the addition of Benchmark signifies that industry consensus and institutional capital are beginning to re-evaluate the long-term value of consumer-grade crypto applications.

From a product perspective, FOMO is redefining the standard of a "good trading application": it's not about piling up features, but about achieving ultimate simplicity; it's not an isolated trading tool, but a socialized financial network.

According to the official plan, fomo aims to support almost all assets on nearly all mainstream blockchains within six months, and eventually expand to prediction markets and traditional securities. Whether fomo has the potential to become a bridge connecting the crypto world and traditional finance remains to be seen.