XRP price is trading near $2.15 today after falling more than 18% since November 10, 2024. The Token has spent the past month in a bearish channel. And the latest structure now shows weak volume, increased long-term selling, and the price sitting near a key support.

If buyers fail to defend a level, XRP price could slide into a deeper bearish phase.

The falling price channel and the decline in volume reinforce the bearish scenario.

XRP continues to move within a descending channel that has guided every bounce and rejection for over a month. This pattern is a bearish continuation structure, and recent candles show that each recovery has been weak.

This weakness is most evident in the On-Balance Volume (OBV) indicator. OBV adds volume on green days and subtracts it on red days to indicate whether buying or selling pressure is dominant. Between November 4, 2024 and November 9, 2024, OBV briefly crossed above the downtrend line connecting its lower highs. XRP price responded with a short-term bounce.

Weak Buying Affects XRP Price : TradingView

Weak Buying Affects XRP Price : TradingViewWant more Token news like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

But once OBV fell below the trendline on November 12, 2024, the tone changed. The indicator has remained below that line ever since, suggesting that overall buying pressure has continued to weaken. This aligns perfectly with the price action: XRP began to decline 18.6% on November 10, 2024, around the same time that OBV began to decline again.

The lack of volume strength means buyers are not coming in strongly. This prepares for the next index.

Long-term investors are increasing their selling.

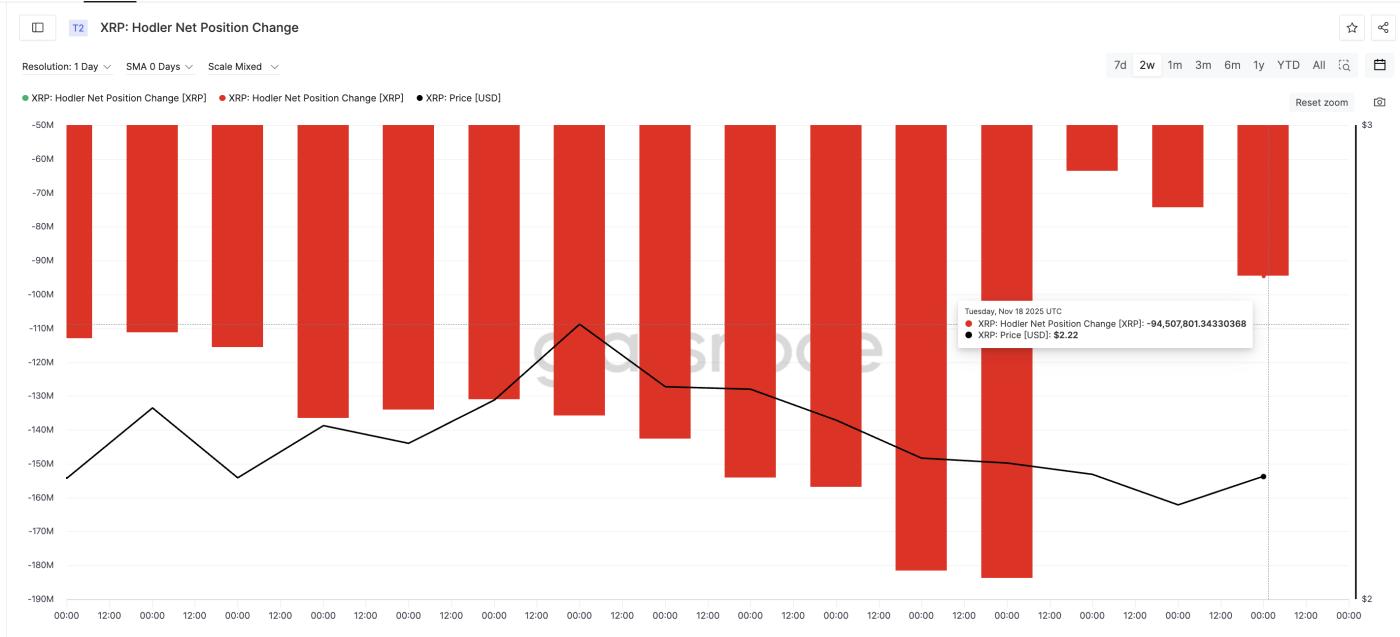

Glassnode's Hodler Net Position Change tracks the amount of supply long-term holders are moving into or out of exchanges and wallets. This is one of the clearest measures of long-term resilience.

Over the past few days, long-term holders have increased selling again after falling to a half-month low on November 16, 2024:

- 11/16/2024: –63.57 million XRP

- 11/18/2024: –94.50 million XRP

This is a 48.6% increase in long-term outflow in just two days.

Holders Continue to Sell: Glassnode

Holders Continue to Sell: GlassnodeThis confirms that the pressure shown on OBV is not random noise. It comes at the same time that long-term holders are reducing their positions more aggressively. When long-term selling activity increases while volume weakens, it usually signals a market that has not yet found its Dip . And that perspective keeps each nearby support level at risk.

Together, OBV and Hodler Net Position Change point to the same idea: buyers are not absorbing enough of the increased selling pressure.

The Most Important XRP Price Levels

XRP price is currently near the most important support level on the chart: $2.10. This level has been a reaction zone in the downtrend channel many times. If the daily candle closes below $2.10, XRP could continue moving towards $1.77, the long-term channel floor.

Conversely, the level that needs to be retraced to invalidate this bearish structure is $2.41. A break above $2.41 would indicate that buyers have regained strength and would open the way to $2.58. Only a daily close above $2.58 could turn the short-term trend back to bullish.

XRP Price Analysis : TradingView

XRP Price Analysis : TradingViewThe structure remains bearish at the moment. Volume is weakening. Long-term holders are selling faster. And XRP remains in a downtrend channel. Unless XRP reclaims $2.41, all eyes are on $2.10. This fragile floor will determine whether XRP stabilizes or falls further.