A statement that is causing fierce debate in the trader community:

“Layer-1 (ETH, SOL and underlying blockchains) is no longer worth investing in long term. Blockspace will always be redundant – like buying Cisco in 2000.”

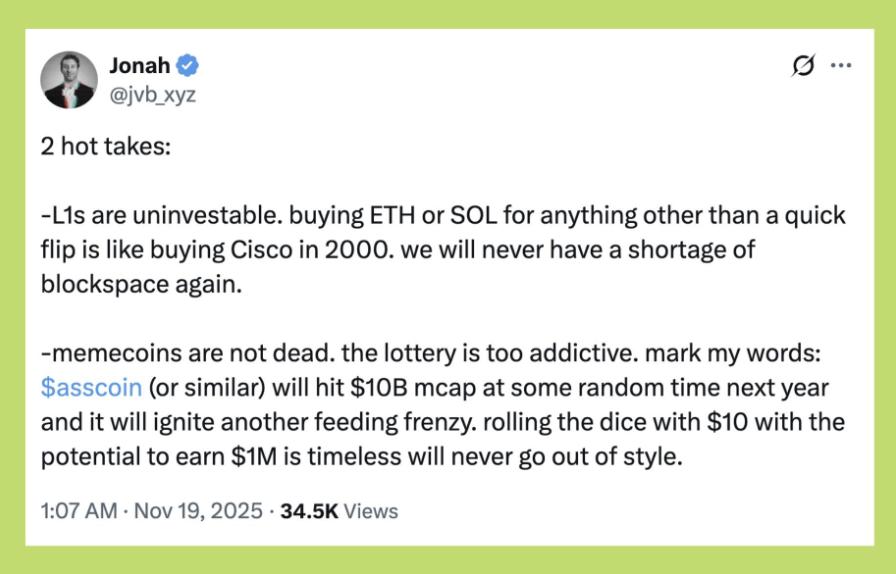

This point was made by Jonah – host of the Blockworks podcast – and it created a huge debate.

But is this true? Or is it just too extreme a view?

Analyze with data, not emotions.

1. Is L1 No Longer Worth a Long-Term Investment? Here's Why This View Comes

1.1 Blockspace is really redundant

Hundreds of blockchains compete for speed & fees.

Most have the ability to expand beyond actual needs.

The number of chains is growing much faster than the number of real users.

Data:

According to Coin98 Analytics, more than 120+ EVM & non-EVM blockchains are active.

Many chains have theoretical TPS 10–100x higher than Solana.

→ Supply increases, demand does not increase accordingly → blockspace becomes cheaper, L1 Token value is diluted.

1.2 Comparison with Cisco in 2000

Cisco was once the king of Internet infrastructure, but:

Infrastructure capacity increases too quickly → supply exceeds demand.

Cisco stock has not returned to its 2000 ATH for 20 years.

Jonah's argument:

L1 today is like Cisco: strong initial growth → saturation → price difficult to increase in long term.

2. But Are ETH & SOL Really Like Cisco? Data Shows Otherwise

The view that “L1 is worthless because of redundant blockspace” is only half true .

❌ Blockspace may be redundant

✔️ But high value blockspace is extremely rare

Classic example:

“There is soil everywhere. But the soil of central New York is completely different from the soil of the Sahara.”

Blockchain is the same:

2.1 Ethereum – the most expensive blockspace on the market

Data:

1 day fee: highest in the crypto world

70% of DeFi TVL is on ETH & L2

Developer active: ~16,500 dev/year (Electric Capital 2024)

→ Developer chooses Ethereum → Dapp chooses Ethereum → Users flock to Ethereum → ETH blockspace has high value.

2.2 Solana – fastest user growth

Highlights from the last 12 months:

Solana active addresses increased by more than 300%

Solana DEX Volume Exceeds Ethereum for Several Consecutive Weeks

Meme + DeFi + SocialFi blooms → self-sustaining ecosystem

→ Solana has a flywheel that develops similarly to ETH in the 2020–2021 period.

2.3 Sui – the new challenger worth XEM

Dev growth rate is top.

Game & infrastructure projects are growing rapidly.

Cheap fees but real user/game activity is increasing.

3. The view that “Memecoin will reach 10B market cap” – Sounds absurd but completely grounded

Jonah also gave a second idea:

“Memecoin is not dead. A coin like $asscoin will hit $10 billion next year.”

Sounds crazy. But history doesn't lie.

Historical data:

Doge ATH: 88B USD

SHIB ATH: 40B USD

PEPE from 2023–2025: increase >1200 times

Each cycle, memecoin:

Leading the number of new users

Create huge Volume

Attract high-speed liquidation

Usually outperform L1 in the short term

→ In terms of market behavior: memecoin never dies.

4. So in the end: Are ETH & SOL worth investing in long term?

✔️ Worth it if you believe:

Value comes from network effect and developers.

Ethereum & Solana Flywheel Hasn't Topped Yet.

The market will favor quality over quantity of chains.

“Premium” Blockspace will still be highly valued.

❌ Not worth it , if you believe that:

Blockspace will become a commodity (like water, electricity).

Users will choose the cheapest, fastest chain (regardless of brand).

L1 has peaked in growth and is unlikely to return to high profitability.

5. Conclusion — The market may be diluting, but value is not evenly distributed

Both views have merit:

Memecoin: will continue to grow strongly , because the "lottery" mentality is human instinct.

L1: not dead , but only a few chains can hold real position.

The most important thing:

**Not “is there any blockspace left”,

but rather “who owns the most valuable blockspace”.**

Ethereum, Solana and a few other chains are proving it with real data.

Instead of choosing sides, traders and investors should ask themselves:

👉 Am I holding blockspace in the New York segment… or the Sahara desert?