On November 20th, Beijing time, the hybrid public blockchain project BOB (Build on Bitcoin) released an official blog announcing its token economic model and issued the token (TGE) on November 20th, Eastern Time.

BOB is the most representative project in the Bitcoin DeFi ecosystem and a gateway to Bitcoin DeFi, providing users with the simplest and safest way to earn yield with Bitcoin. BOB's unique hybrid public chain model combines the security of Bitcoin with the innovation of Ethereum, making it the preferred platform for building Bitcoin liquidity, applications, and institutional services.

Safety

• The combination of zero-knowledge proofs and billions of dollars worth of staked Bitcoin provides security for all applications, assets, and transactions;

• Use native BTC on BOB with BitVM technology, without the need for encapsulated tokens or custodians.

Convenient

• Bitcoin staking, Bitcoin DeFi, and Bitcoin vaults can be easily accessed with a single click and a completed BTC transaction through BOB Earn;

• Supports one-click native BTC deposits and withdrawals on 11+ mainstream blockchains, including Ethereum, Unichain, Base, and BNB Chain.

• Top-tier DeFi ecosystem, integrating the most well-known projects, including Uniswap, Solv, Chainlink, LayerZero, Anchorage, and Fireblocks.

$BOB Token Details Overview

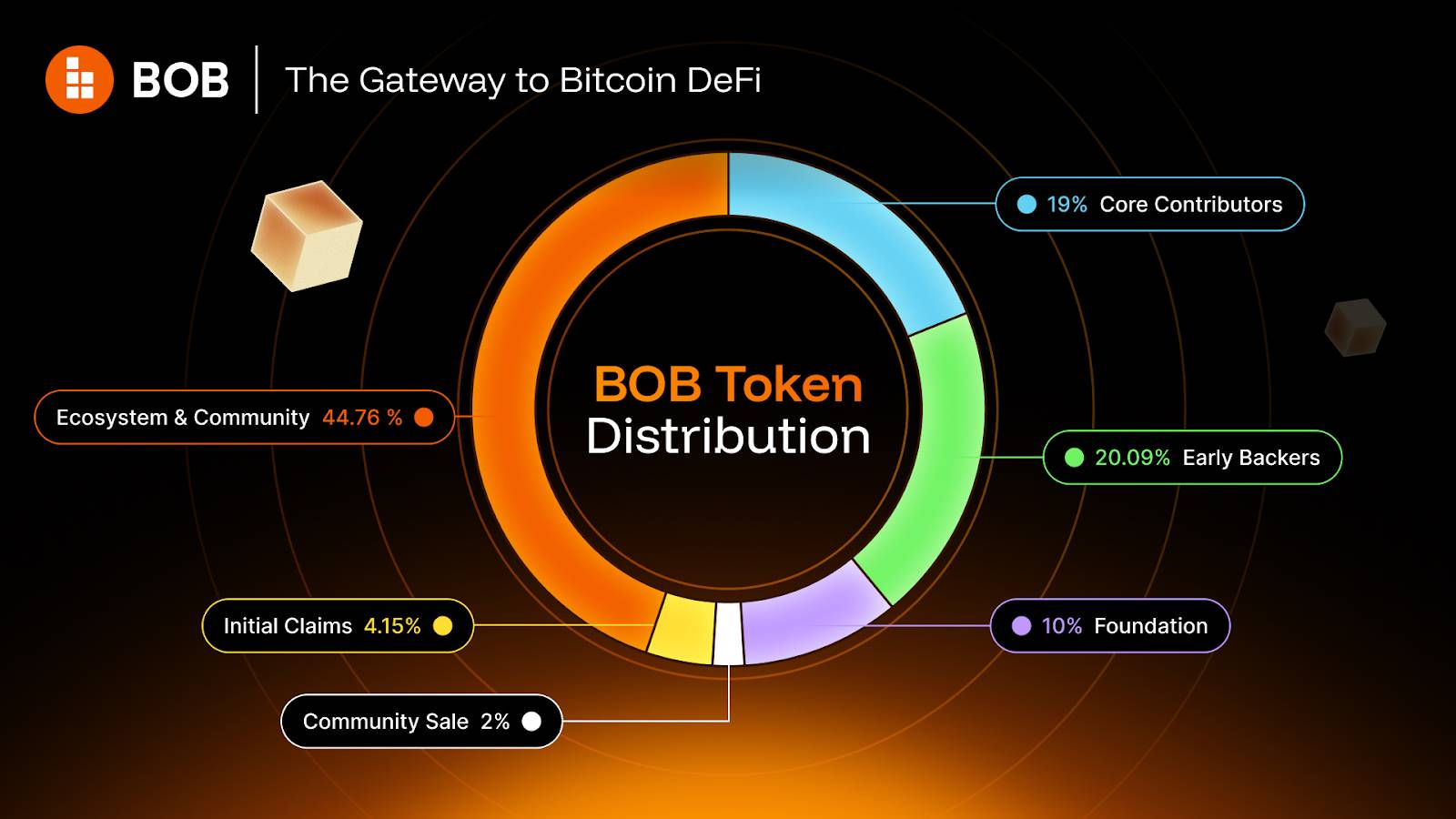

Token distribution

The total supply of $BOB tokens is 10 billion , which will be minted on the BOB hybrid chain and presented as ERC20 tokens.

The majority of the tokens (50.91%) are allocated to the BOB community and ecosystem, with the following specific allocation rules: initial subscription (4.15%) , community public sale (2.00%) , and ongoing ecosystem and community incentive programs ( 44.76%) .

$BOB Token Allocation

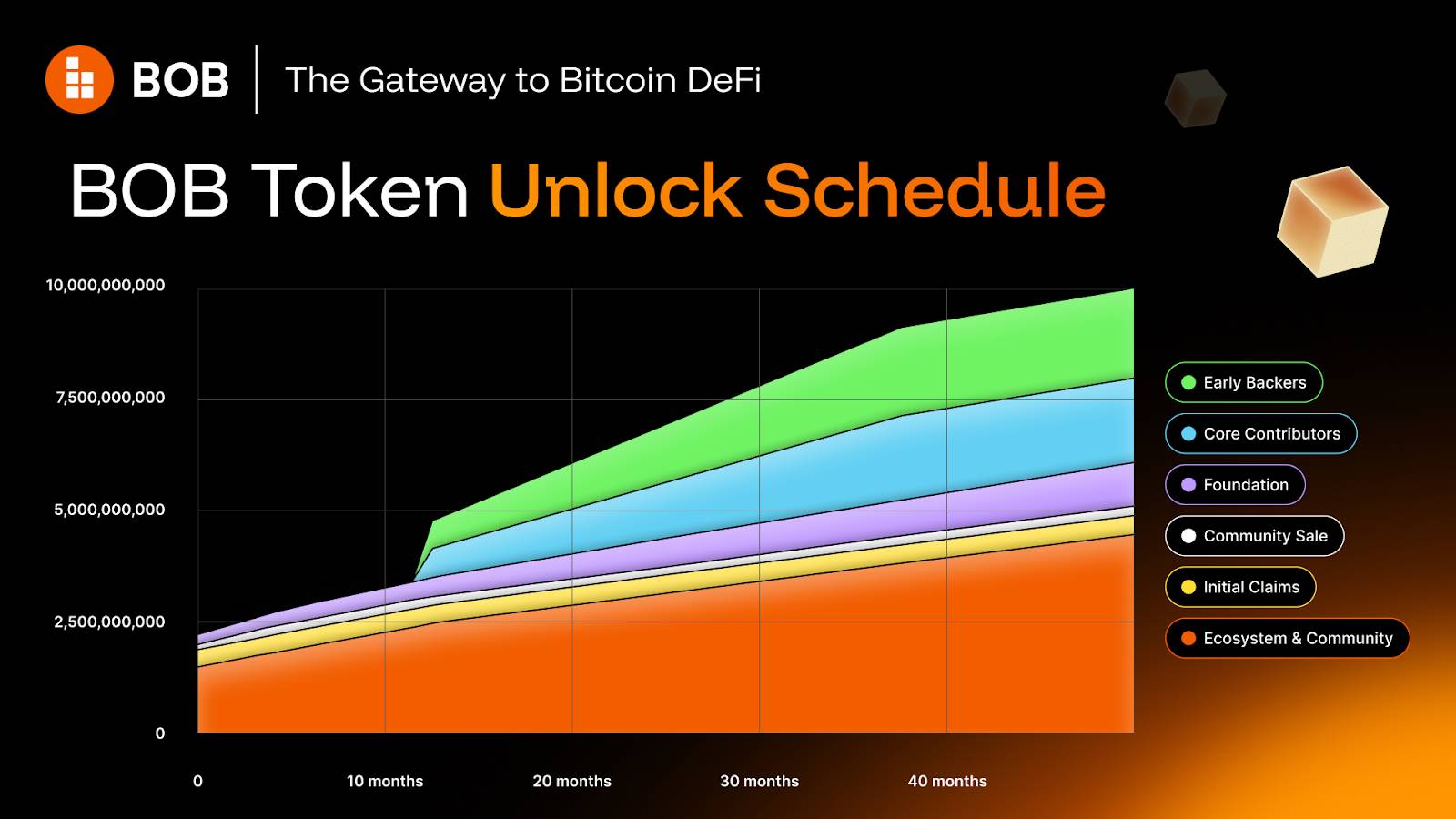

Token unlocking and release rules

At the time of the $BOB token issuance, 22.20% of the initial circulating supply will be unlocked tokens. Approximately 510 million tokens ( 5.1% ) will enter the community through initial subscription and community sale. In addition, approximately 1.46 billion tokens ( 14.6% ) will be allocated to the ecosystem and community, and 250 million tokens ( 2.5% ) will be allocated to the BOB Foundation; these tokens will also be unlocked at the time of issuance.

Tokens allocated to core contributors and early supporters will be locked at launch and unlocked according to a pre-set 2-3 year release plan to ensure their long-term returns are aligned with BOB's success. A total of 77.8% of the BOB token supply will be locked on the first day of launch . Tokens allocated to the Foundation, ecosystem, and community will also be unlocked gradually over 48 months. All 10 billion tokens will be unlocked 48 months after the BOB token launch .

Locked tokens cannot be staked to ensure that staking rewards are distributed to the community and active BOB ecosystem participants, avoiding the initial concentration of rewards in the hands of individuals directly involved in the project (team members and investors).

$BOB Token Release Cycle

Ecosystems and Communities (44.76%)

Approximately 44.76% of the tokens are reserved for ecosystem and community development. About one-third of this ( 14.6% of the total supply) will be unlocked at token issuance (TGE), with the remainder unlocking linearly over 48 months. This move aims to ensure that BOB DAO can utilize the funds to support its growth plans as early as possible, while also ensuring long-term planning. These resources will be managed by the BOB Foundation and BOB DAO through on-chain governance.

This funding will support the development of the BOB ecosystem and community, including ongoing community, developer, and DeFi projects, as well as staking rewards. A small portion (5%) has already been pre-allocated to early-stage DeFi, liquidity, and ecosystem growth strategies. The remaining 39.76% will be jointly managed by the BOB Foundation and BOB DAO over the next few years.

Initial claim and staking incentives (4.15%)

Approximately 4.15% of the tokens were distributed to the BOB community through initial claiming and staking incentives.

Of this, 2.15% will be allocated to BOB Fusion users, content creators, and event participants as initial subscription rewards. Some strategic liquidity providers who significantly support liquidity pools, seed lending, and other DeFi activities on BOB will be excluded from the BOB Spice system to avoid dilution and will be subject to a 12-month lock-up period. A portion of the event allocation will also be subject to a pre-agreed lock-up period.

The remaining 2.00% will be used for staking rewards. You can claim your rewards immediately after staking tokens and locking them for a certain period of time.

To receive the maximum initial reward, eligible recipients need to stake tokens and lock them for 18 months to receive a 250% token reward. Staking with shorter lock periods will yield smaller rewards.

All $BOB token holders (including airdrop recipients, public sale participants, and users who purchased on the open market) will receive this one-time lock-up and staking rewards within 60 days after the TGE date, on a first-come, first-served basis, until the pre-allocated budget is exhausted.

Only fully unlocked tokens can be staked and locked. Therefore, team and investor tokens subject to lock-up restrictions are not eligible for this activity.

The token allocation is intended to reward those who have made the greatest contributions to the launch and development of the BOB ecosystem. Detailed guidelines for claiming and staking will be provided prior to the token issuance.

Community public sales (2%)

The $BOB token community sale, held from November 10th to 16th, concluded successfully, selling 2% of the tokens and raising $4.2 million . BOB community verified members (the users with the highest Spice holdings in the BOB Fusion program and the top 2000 BOB Cookie Snaps users) could participate in the sale at a discounted price. 50% of the tokens purchased during the community sale will be unlocked at TGE, with the remaining 50% unlocking linearly over three months .

Foundation (10.00%)

As the guardian of the BOB ecosystem, the BOB Foundation's mission is to promote BOB's commercial interests and user well-being, thereby fostering the growth of the BOB ecosystem. To this end, 10% of the $BOB has been allocated to the BOB Foundation to fund research and development, as well as initiatives aimed at expanding and improving BOB's products, distribution, and technological design. Of this, 2.5% will be unlocked at TGE, while the remaining 7.5% will be unlocked linearly over four years.

Core contributors (19.00%)

To build the future of the Bitcoin DeFi ecosystem, attracting top talent and ensuring alignment on long-term goals is crucial. To this end, 19% of the $BOB tokens will be reserved for early and future contributors. These tokens will be locked based on service contributions for a 36-month lock-up period, with a 12-month clamp period in between.

Early supporters (20.09%)

Approximately 20.09% of the tokens were allocated to early backers who provided significant financial, advisory, and strategic support. The terms varied slightly among different backer groups.

• Strategic and seed round backers (18.71%) have a 36-month linear unlocking period, including a 12-month clamp period;

• Angel supporters (0.62%) have a 36-month linear unlocking period, starting from the TGE date;

• Some strategic partners (0.77%) have a 12-month lock-up period, followed by a 12-month linear unlocking period.

Token Utility

$BOB is the token of the BOB hybrid chain ecosystem, used to achieve the long-term goals of the BOB network. It will allow all users, builders, and other stakeholders to actively contribute to the network through staking and decentralized governance.

Pledge to safeguard economic security

As part of the $BOB token issuance, we are building economic security by introducing a $BOB token staking mechanism. Users can stake $BOB tokens and delegate them to "hybrid nodes". When BOB Phase 2 officially launches with the introduction of Bitcoin's finality mechanism, these hybrid nodes will have two main functions:

- Provide finality to BOB by staking Bitcoin. Users can become finality providers (FPs) by staking Bitcoin tokens. FPs receive a higher share of transaction fees.

- BitVM is the native Bitcoin bridge that operates BOB. Users can stake BitVM tokens to gain BitVM operator status, and operators can receive a higher share of transaction fees.

Decentralized governance

We hope that through the $BOB token, the community can play a vital role in the decentralization process of BOB governance over time. Both staked and unstaken tokens can be used to participate in BOB governance.

BOB governance oversees upgrades to core BOB components, including the underlying network, BitVM, and Gateway. Participants in the BOB DAO can also vote on treasury allocation. The BOB DAO will be operational from day one and will consist of all BOB holders.

Participants can vote directly or delegate their voting rights to a governance representative who will vote on their behalf.

Protocol Utility

&BOB token holders will have priority access to new BOB features and benefits, such as when BOB Earn increases the number of connected vaults and DeFi strategies, or when BOB Gateway launches instant Bitcoin exchange functionality.

Future BOB Fee Model and Buyback Plan

BOB aims to be a gateway to Bitcoin DeFi, attracting millions of users and generating billions of dollars in TVL and trading volume. As an independent DeFi platform and a crucial distribution channel for other large DeFi ecosystems, the BOB network boasts multiple revenue streams:

- Sequencer fees and premium MEV. BOB earns revenue through sequencer fees and premium MEV (such as DEX pool rebalancing and liquidation). Fees grow linearly with usage, while premium MEV from DEX pool rebalancing, liquidation, etc., grows exponentially. This can generate significant revenue as trading volume increases.

- BOB Gateway exchange fees. BOB Gateway is the first BTC intent protocol that supports exchanging native BTC for any asset on any chain. Higher exchange volumes directly increase revenue. Compared to slower, more expensive alternatives, BOB focuses on BTC up/down channels and integration with major bridges, enabling rapid scaling and network expansion with minimal operating costs. BOB Gateway has already partnered with LayerZero to support 11 chains, with more to be added in the future.

- Hybrid Vault. BOB's upcoming BTC yield vault combines on-chain and off-chain strategies and partners with institutional entities to generate performance fees for the vault as TVL grows.

- Native BTC Lending and Liquidation. BOB is developing a native Bitcoin lending system that allows users to borrow stablecoins on the Bitcoin network while the Bitcoin remains securely stored on the network. Powered by BitVM Vault and BOB's innovative liquidation engine, the system fully leverages one of Bitcoin's most powerful use cases—collateral—enabling the protocol to generate substantial revenue from lending demand and liquidation.

As network activity expands and protocol rewards grow, BOB DAO may introduce a structured buyback framework to strengthen long-term partnerships with builders, contributors, and users, thereby better driving ecosystem growth. Such mechanisms will become a core pillar of BOB's value stream, directly linking network growth to users who stake and maintain system security. This will create a sustainable virtuous cycle: increased user numbers will reinforce rewards, deepen engagement, and cultivate a resilient and cohesive community over time.