No matter how many assets you have on the blockchain, if you can't consume them in the real world, you're still a "proletarian" without the means of production.

Written by: Kean

I've always found it difficult to explain my identity to friends outside the crypto industry.

Most of the time I would joke that I was in the "fraud industry" because the essence of a cryptocurrency project is issuing tokens and finding someone to take over the investment, while "crypto" is a stigmatized term in both legal and social sense.

Therefore, the phrase I say most often is: "I am a true proletarian."

The reason is simple—

While it's possible to earn money, make transactions, and receive a salary using cryptocurrencies on the blockchain, once these cryptocurrencies leave the wallet and enter the real world, they become useless and have nowhere to be spent. Moreover, crypto companies often don't pay social security for their employees.

I remember the first card I linked was OneKey Card. I believe many people are like me: when you link an encrypted payment card to WeChat/Alipay and successfully make your first payment, you feel a pang of anxiety, followed by a sigh of relief. At that moment, all you want to say is, "Finally, I can live legally!"

Before this, every monthly living expense was a psychological battle: USDT OTC → worrying about risk control → worrying about card freezing → worrying about the bank calling to inquire about the source of the funds. Even though it was a small expense, it felt like a shady operation.

However, the shutdown of OneKey Card kept me out of the U Card market for a long time, making me a "proletarian" in the real world again. After all, Crypto users are not only active on the blockchain, but also need to live in the real world as subjects with daily capabilities.

Until Token2049, based on my friend's aggressive brainwashing, I tried Bitget Wallet's newly launched card and experienced the smooth payment effect from USDT to fiat currency, which also sparked my new thinking on "crypto payments".

U-Card Payment: The Breakthrough of the "Crypto Proletariat"

As is well known, U-card is not a profitable business. It is not a purely decentralized payment system, but rather a component of the traditional card industry's profit chain.

Its upstream and downstream links are long, including card organizations (Visa/Mastercard/UnionPay, etc.), BIN providers (licensed banks/card issuers), card issuers (providing underlying accounts and risk control systems), card program managers (Bitget Wallet and other U card project providers), OTC merchants (handling exchanges between Crypto-Fiat) and card manufacturers.

Throughout this long chain, the U-card project team only has a say with Crypto users, and lacks the ability to change the complete business model of the traditional card industry's profit chain. The profit sources of traditional card businesses include foreign exchange fees, exchange rate differences, merchant fees, annual fees/card activation fees/management fees, lending services, etc. To date, the U-card business has become extremely competitive: 0 activation fees, 0 annual fees, 0 top-up/exchange fees... even with real-time exchange rates, and still having to bear compliance costs.

However, the U-card remains the most user-friendly solution for connecting cryptocurrencies to the real world, and also boasts the strongest real-world use case. In other words, whoever controls the user's payment gateway can achieve user retention. Who wouldn't want such a massive influx of traffic?

This is why the U-Card project team, knowing this business isn't profitable, continues to invest in it relentlessly. Why? From Maslow's hierarchy of needs, you'll find that Crypto payment isn't a function, but a right to survival .

A very real problem faces all Crypto users: how does money on the blockchain enter real life? The best solution, of course, is for sovereign states to accept cryptocurrency as a payment tool. But if that doesn't happen, what happens to your daily life if you're essentially penniless?

No matter how much asset you have on the blockchain, if you can't use it in real life, can't be recognized by banks, and can't participate in the financial order of the real world, then you are still a "proletarian" without means of production.

In Marx's theoretical framework, the "proletariat" refers to the class that does not own the means of production and must rely on selling its labor power for a living. In short, the "nothingness" of the proletariat does not mean a lack of money, but rather a lack of resources that belong to them and enable them to function autonomously.

In today's financial system, the means of production include bank accounts, credit systems, payment instruments, the right to use currency, and global capital flow channels. Cryptocurrency holders' assets exist on the blockchain, but they cannot be recognized by the mainstream banking system, cannot be freely used for payments, are excluded from the mainstream financial system, and are fundamentally deprived of their means of production.

Therefore, I proposed this new concept: the crypto proletariat.

The crypto proletariat is not poor because they lack money, but because they lack the right to make payments in the real world. Whether an on-chain asset can make payments is often not determined by the asset itself, but by whether the real world allows it to be considered "money."

The successful KYC process for Bitget Wallet Card made me, as a Crypto user, feel for the first time that I was truly "accepted" by the compliant financial system.

Payment Equality: Saying Goodbye to the Era of High Wear and Tear

Objectively speaking, the current U-card market has entered a stage of "homogenized competition"—after years of elimination, the few remaining U-card products on the market today actually build their underlying bank account architecture and card issuance channels in cooperation with licensed financial institutions.

For example, Fiat24 is one of the earliest technology and compliance service providers to enter this field and is widely adopted in the industry. It can even be said that Fiat24 now dominates half of the U card business: in addition to a series of old projects that have been phased out, such as OneKey Card, Dupuy, and Infini, the few remaining ones, such as SafePal, imToken, and Bitget Wallet, are all based on Fiat24's compliant Swiss banking services.

This also means that the underlying account architecture and card issuance channels of each product are highly similar, and the differences are more focused on stability, specific service experience and fee wear.

During Token2049, a video circulated on social media showing Xie Jiayin using Bitget Wallet to make a direct offline QR code payment in Vietnam. This really struck me. Perhaps this is the ultimate form of Web3 payments, where the wallet directly takes over the acquiring end. Although this feature currently only covers parts of Southeast Asia, it is an important signal.

Of course, U cards are still the mainstream at present, and whether a U card is good or not ultimately depends on two things: stability and price.

When it comes to stability, it's an open secret in the industry that U-card business is often subject to banks and is at risk of having its channels cut off at any time. That's why there were rumors last year that Bitget strategically acquired DCS, a licensed institution in Singapore. This explains from a business perspective why this product has recently become more aggressive and stable in terms of risk control and funding channels— it's not just about having "money," but about achieving vertical integration from wallet to card issuer.

Only with autonomy over the underlying channels can cost advantages become possible.

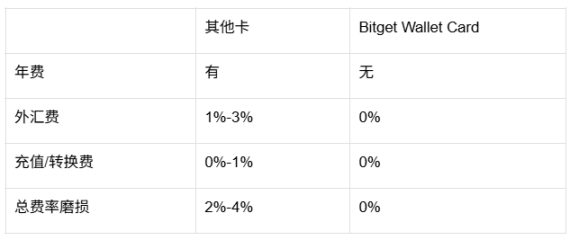

After all, the biggest pain point of U-cards in the past was "wear and tear": a fee was charged for each top-up, a fee for each redemption, and another fee for each purchase, with the total loss often reaching 2%-4%. The current trend is that in order to compete for users as "main accounts," all companies are trying their best to lower the fees.

Bitget Wallet Card's current strategy of waiving transaction fees, foreign exchange fees, and aligning with Google's real-time exchange rates is essentially pulling Crypto payments back from "luxury services" to "common consumer spending."

For example, in the past, when using a U-card to pay for coffee, book airline tickets, or pay for hotels, there was an extra 2%–4% transaction fee. However, these U-cards offer users a lifetime exemption from transaction fees for the first 400 U transactions per month. Foreign exchange fees, top-up fees, and conversion fees are all 0. They also guarantee that the settlement exchange rate is consistent with Google's real-time exchange rate, truly achieving 0 hidden costs and 0 wear and tear. It's more than enough for daily consumption payments!

If the previous U card solved the problem of "whether on-chain assets can be used for payment", then now that everyone is based on the Fiat24 underlying architecture, the Bitget Wallet Card is solving the problem of "whether on-chain assets can enter real life with the lowest cost, the highest stability, and the widest range of scenarios".

When a U-card can operate without being selective about users or regions, without relying on transaction fees or currency exchange rate differences, and still guarantee long-term operation, it will truly have the significance of widespread adoption. Moreover, its significance will no longer be just a card, but a signal of an industry turning point, a historical juncture about how "encrypted living" is shaped, practiced, and recognized by society.

In short: For the first time, Crypto users are not just living on the blockchain, but living in the world as subjects with everyday capabilities.