Assets like stocks generate meaningful income beyond dividends and price appreciation, but most investors don’t see the full upside. They suffer from “yield leakage” - the hidden income their assets generate, but isn’t fully realized.

In traditional finance, yield leakage is

Jon Schwartz | GLIF

@j_schwartzz

11-19

Not trying to minimize the exploitation of creators in any way, but this is also not true

tradfi intermediaries extract more value from typical retail clients (in banks, brokerages, money market accounts) than the entire creator economy as a whole

Here’s one example

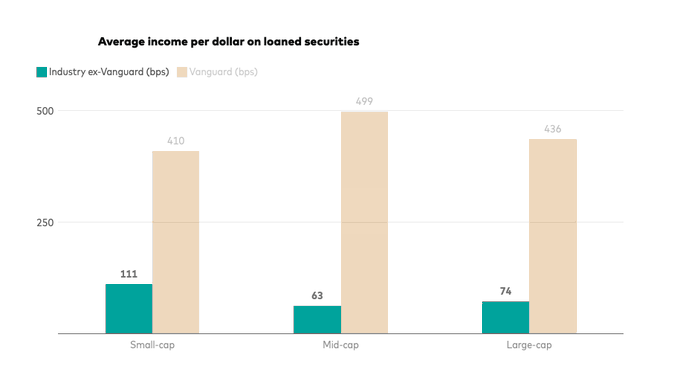

Vanguard reports their average income per dollar on loaned securities to be in the 4% per year range (even on large-cap securities), which is pretty nuts corporate.vanguard.com/content...…

*Vanguard does pay 100% of stock lending revenue back into their ETFs like VOO. This is good for investors. But this level of transparency and flow-through isn't the norm.

3/4

In some cases, paying fees to intermediaries makes sense, especially for investors that wish to be more passive, and in highly regulated markets.

But it goes to show that disintermediation through smart contracts can and will significantly reduce this burden. Ultimately this benefits the average investor, who will capture these on-chain efficiency gains in higher yield. It's a multi-trillion dollar opportunity

/fin

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content