(Note: This was originally written for my new personal site - knwr.site - so make sure to check that out going forward. I did not proofread this, so don’t take it too seriously).

Stablecoins are routinely cited as the definitive example (outside of BTC price chart) of what crypto has done right or succeeded at, and for good reason.

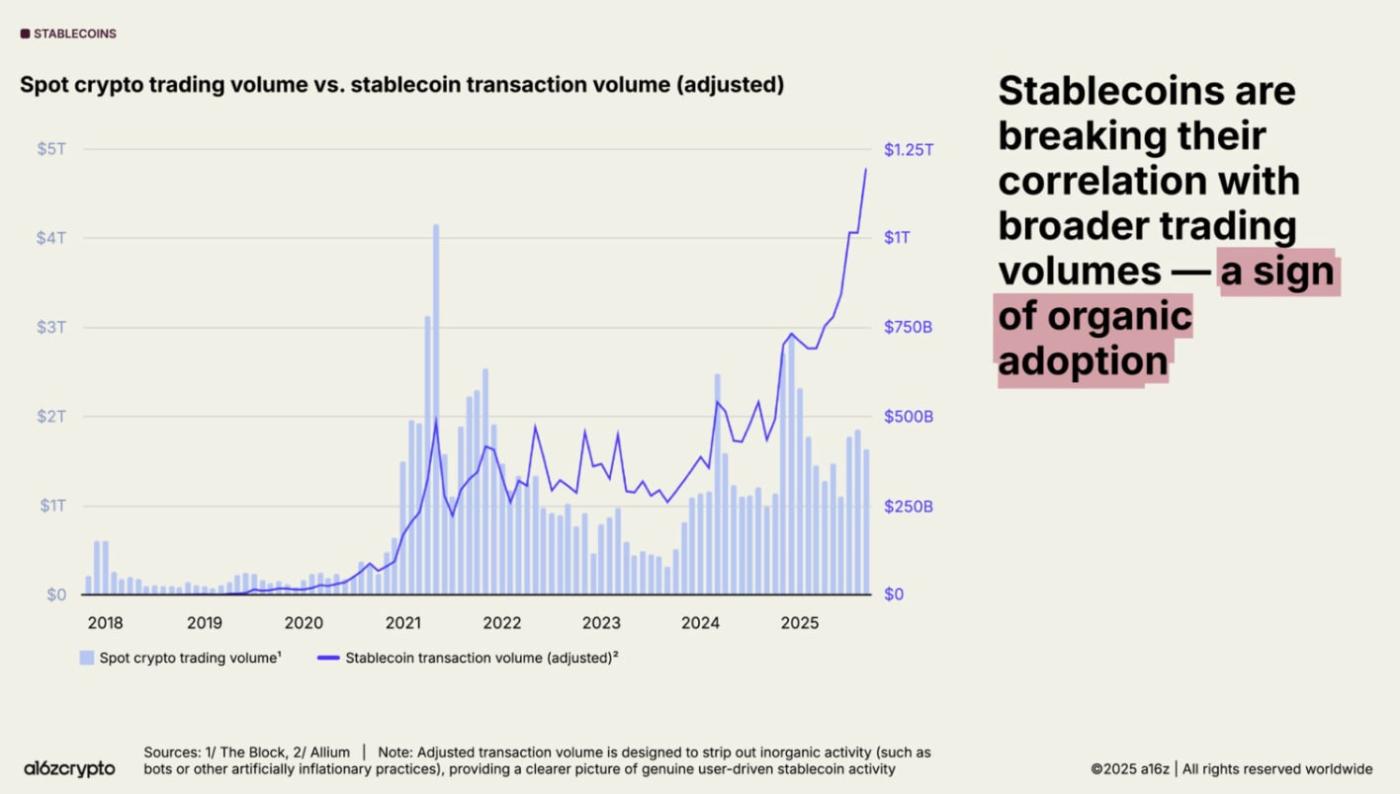

Total stablecoin supply - now sitting at roughly 303 billion (according to defi llama) - has experienced rapid growth in the past year, but this only tells you one side of the story. Referencing a chart from a16z crypto’s state of crypto report, we see that stablecoin-specific transaction volume has eclipsed spot crypto trading volume, showing us that not only do people value stablecoins as a store of wealth, but as an efficient and useful means of transacting.

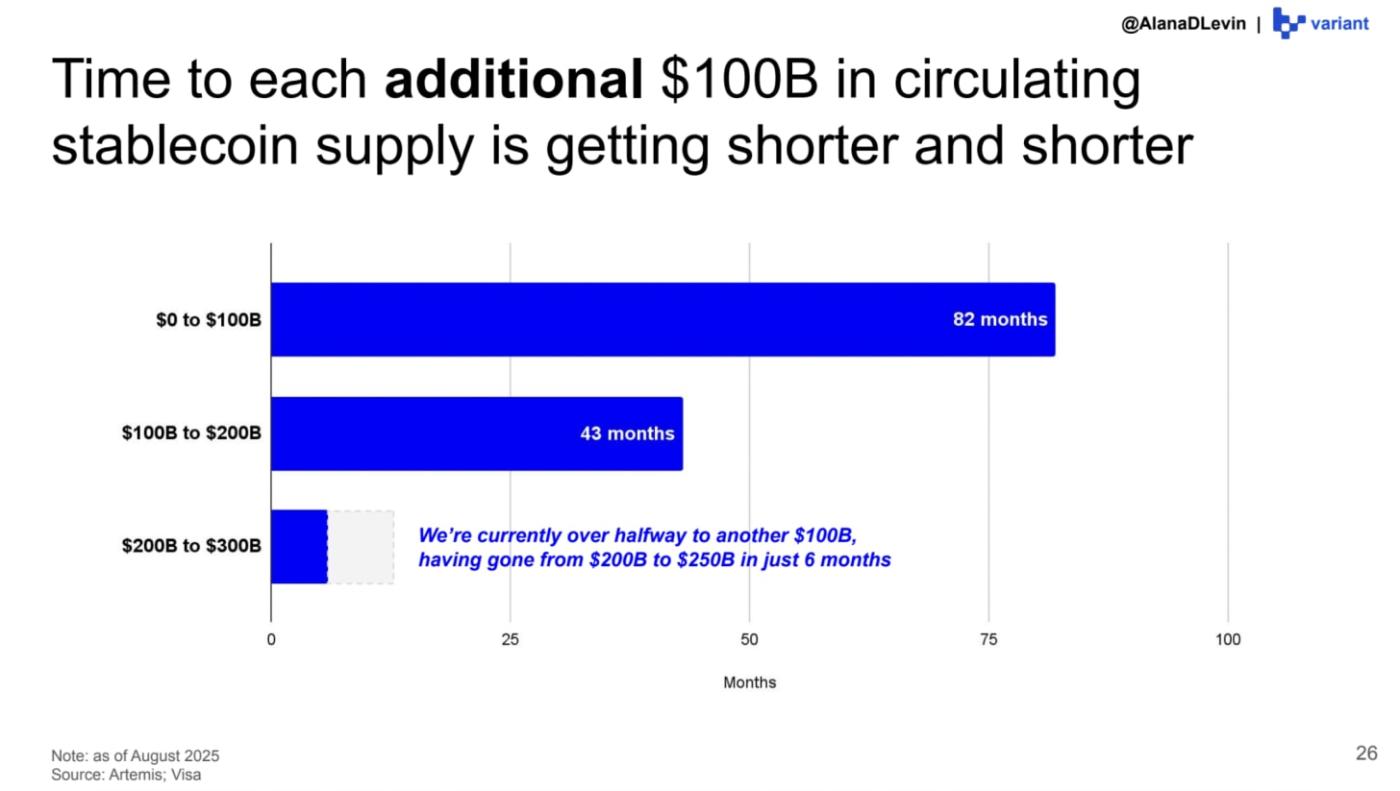

In this post I’ll try to avoid all of the basic or mundane stablecoin facts you more than likely already know, and present a case for what the future of stablecoins looks like beyond just extrapolating total supply growth - because that’s boring! I say that it’s boring because anyone can point to the supply chart and come to the conclusion that clearly these digital representations of US dollars are quite a hit, and reasonably assume the chart will continue rapidly trending up and to the right. Alana Levin of Variant also did the work for us with this chart from her recent 2025 crypto trends report, which I highly recommend checking out:

Dissecting stablecoin transaction volume is a bit of a chore, so instead of going through asset-based flows by chain, and digging through what protocols or addresses these assets are being sent to, I’ll provide the following short list of functions in the stablecoin stack and generalize. The most important takeaway is that stablecoins are being used for many different things, and that’s because stablecoins are money, and if money is good at one thing, it’s moving around and changing hands:

THE PRODUCT: You have your major stablecoins like USDT, USDC, USDe, DAI, PYUSD, BUIDL - for simplicity, we’ll just group stablecoins together and use the definition that they are digital representations or tokens designed to maintain a stable value, most commonly pegged to the US dollar

THE WAREHOUSE: Stablecoins can be bought and sold on a centralized exchange (Binance, Coinbase) or decentralized exchange (Hyperliquid, Uniswap), but are born from issuers (like Tether or Circle, but also Agora or M0) who store assets in reserves and send out stablecoins onto many different blockchains

THE INVISIBLE HANDS: It would be useless to hold stablecoins if you couldn’t actually use them, and that’s why it’s important to know what chains a stablecoin lives on, but for all intents and purposes the largest stablecoins are very quickly being utilized across every major blockchain, though for a more concrete breakdown consult Artemis’ data

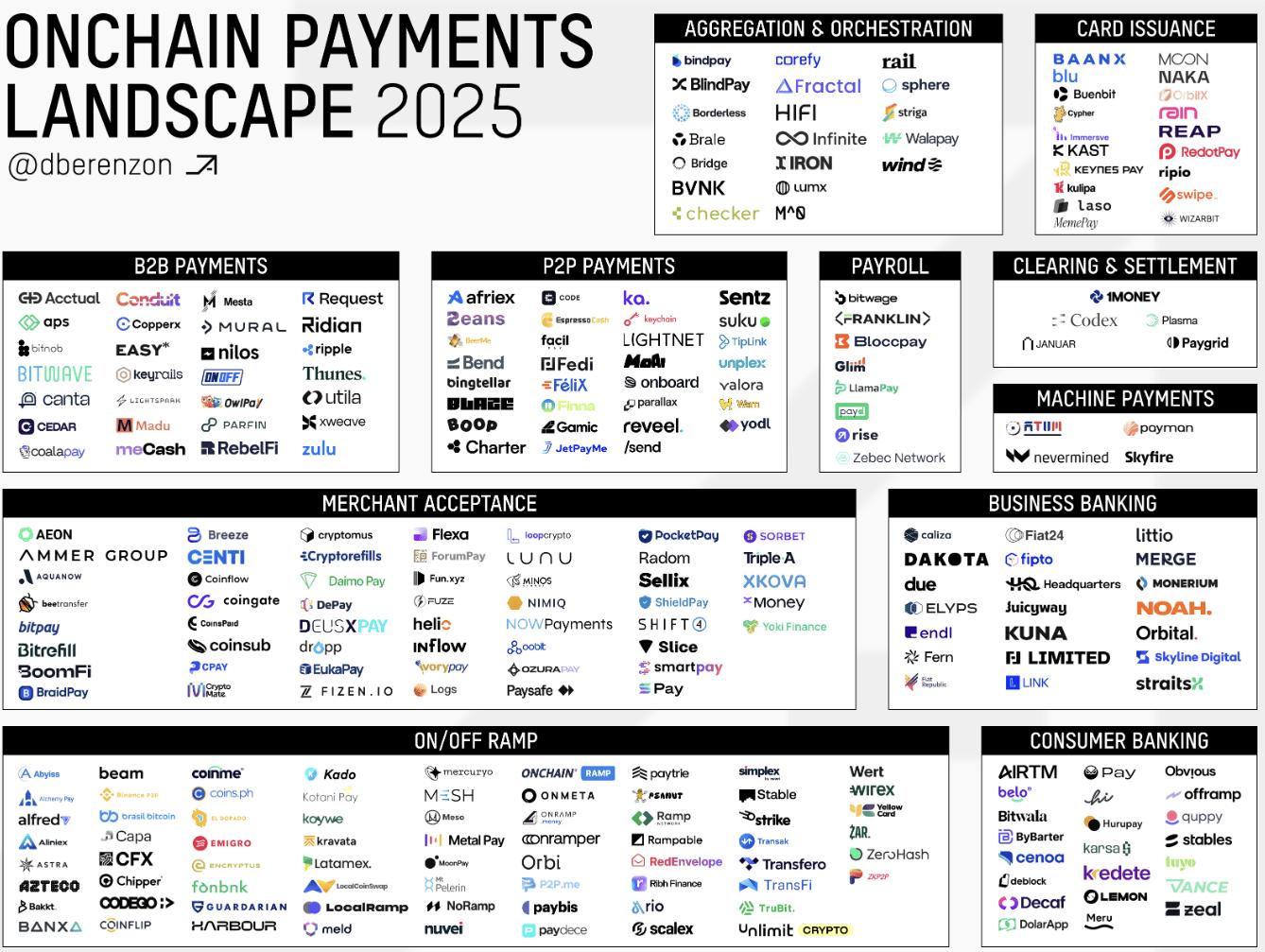

THE MOVERS AND SHAKERS: Money is used for many different things, and digital dollars are no different; whether you are holding stablecoins as a hedge against your local currency, selling out of an alt and into stablecoins onchain, or purchasing an item with your stablecoin supply, nearly every crypto app “supports” stablecoins; other categories like cross border payments, remittances, b2b payments, and merchant acceptance are quickly adopting stablecoins, though it would be impossible to analyze these categories in their entirety while still respecting your time (please consult dmitriy berenzon’s market map)

That’s a very simplistic framing of the stablecoin stack, but there’s no need explaining things you probably already know. Before getting into the fun stuff, there are also a few other interesting dynamics playing out in stablecoin land that are worth highlighting:

FIGHT FOR USDH/BESPOKE ISSUANCE: Maybe a month or month and a half ago, several leading companies and protocols lined up to try and earn the rights to USDH (USD Hyperliquid) issuance, with Native Markets ultimately winning out. This came after acknowledgement that the roughly 5-5.5b of USDC on Hyperliquid, earning 3.5-4% yield for Circle (and HL competitor, Coinbase), was simply not going to fly. This entire saga was widely discussed but the most important takeaway is tied to Nic Carter’s post on the end of the stablecoin duopoly, mainly that Circle and Tether’s market share may have peaked in % terms given the now growing demand for bespoke stablecoins. Quote: “And intermediaries – whether they are exchanges, fintechs, wallets, or DeFi protocols – have a very strong incentive to strip out the major stablecoins and direct user flows into their own.” This phenomenon will not be a one-off event and is a reasonably bearish indicator not only for Circle, but for Tether, assuming some of these bespoke stablecoins pop up and see demand.

ISSUANCE DYNAMICS: Once again referencing DeFi Llama, in the past thirty days Tether and Circle have made $700m and $236m respectively. Issuance is a great business, but there are some nuances here. Simon from Delphi has a good post on this, but for one, Circle has to give up 50% of its earned yield on reserves to Coinbase - Tether does not. Issuance revenue is also uniquely affected by interest rate fluctuations, though if supply continues growing rapidly, smaller fluctuations would technically have less of an effect on revenues in the short term. Simon discussed how distribution is the key to success from here on out, anchored to the idea that app-specific stablecoins and L1 native (or enshrined) stablecoins are the future (both of which will be discussed in the next section). Issuance is a layered topic, as there could be potential for bespoke issuance deals via M0, Paxos, Agora, or one-off deals with established stablecoins, like MegaETH’s USDm created in collaboration with Ethena and Blackrock’s USDtb.

AGENTIC PAYMENTS & x402: This will be briefly discussed in the next section, but the rise of agentic payments is a trend that you should follow closely. I’ve previously been critical of existing agentic infra, mainly because there really aren’t many definitional AI agents that actually operate today, but there is a long list of tech giants actively developing agentic payment protocols, most notably Google, Stripe, and OpenAI, each with their own specifications and vision of what the agentic payment ecosystem will look like. Simply put, agentic payments are payments initiated and executed autonomously by AI agents. These frameworks are different and have varying degrees of partnership, along with entirely unique alliances, but at the end of the day there is room for more than one. This phenomenon was kind of discussed by Dylan Patel in this post, with a focus on ChatGPT as a super app and a growing trend of LLM-enabled ads and monetization routes. Additionally, Coinbase’s x402 development is showing promise as a potential financial layer for the internet of blockchains, though this is still a long shot. While we don’t have agents yet, most of this is preparation for a future where humans direct computers in more natural human language to do work for them. Humans used to have to go to a bank and deposit a physical check, but now most of our financial needs can be met on the internet. In a similar way, our relationship with finance will change once everyone has a helpful agent (or multiple) tailored for their specific financial needs. The reason I bring up these two things is because if stablecoins become an even more dominant form of transaction, or a preferred unit of account for humans, it makes all the more sense that agents - existing entirely in the cloud - would only associate with digital dollars. x402 was discussed in great detail, written by Jay Yu, and sums it up better than I can in a short post, but it’s worth checking out. The ability for native or embedded payments on the internet coming to fruition would be a) extremely convenient but also b) a huge signal for blockchains and digital money overall. Some of the use cases and capabilities of x402 are discussed by Privy in this blog.

It’s a bit of a misnomer to say that you’re bullish on stablecoins, considering their value should in theory remain stable, but it isn’t actually ridiculous for someone to claim they’re bullish stablecoins - it’s just the world we live in. However, there’s a ridiculously large amount of content out there related to stablecoins, and it can be overwhelming to swim through a sea of podcasts, news articles, institutional reports, earnings calls, and tweets to actually develop a coherent view of what stablecoin growth will look like over these next few years.

I’ve thought long and hard today about what this might look like, and it seems to me there are a few different futures stablecoins might stumble into, though none of these are absolute and it’s entirely likely many of these ideas could materialize simultaneously, but that’s the fun part about writing: you can just extrapolate the future based on prior trends and sometimes you’re correct.

Digital ID worldcoin-coded hellscape

There’s always been conspiracy about some future digital ID system, where the government can track your every move and basically instantiate a sci-fi dystopia. In some ways, this is already in progress - companies like Palantir are supposedly capable of tracking US citizens, US passports are now accessible directly from your iPhone wallet, and entities like Worldcoin are working to tokenize identity. Stablecoins fit into this, and I’ve heard some very schizo theories surrounding planned rollout of government-backed, tokenized US dollars. In my opinion, it’s less likely that occurs than it is the government gets in bed with a large issuer like Tether or Circle, eventually bending the knee and showing support for USDT/USDC with open arms.

It’s undeniable the government loves control, and you’d be a fool to bet against the government wiggling its way into every crevice of our lives. Blockchains are often criticized by people on social media for their lack of privacy, though most who use blockchains are fully aware of this and there are obviously methods of obfuscating your activity - a topic for another day. Because of this, it’s actually extremely likely the government would endorse blockchains, even though they definitely already have the capabilities of monitoring everyone’s financial activity and transactions.

The fear is that at the cost of finance becoming more global, seamless, and connected, we’d lose our freedom of privacy. I know there are many advocates for different privacy coins, the tradeoffs between these, and accompanying charts (mainly zcash) that support a type of counter movement - this trend will continue to accelerate. The key takeaway here is that everyone should be aware of what’s occurring. Yes, we’re seeing massive levels of adoption. Yes, the government is now suddenly pro-crypto after years of industry terrorization led by Gensler. However, this is more of a sign for caution and preparation. This may not be an entirely good thing and just because the scoreboard says we’re up 40 with another half to play, it could be wise to keep your starters in.Tool for reconstruction of modern financial rails:

I discussed this in yesterday’s post, but instead of viewing stablecoins purely as money, it could be useful looking at them as a means of brute forcing massive technological shifts in our modern financial rails. It can be difficult to gain an understanding of financial plumbing, but it’s really just a handful of large entities/players that handle the changing of money between businesses, individuals, and governments (kind of). These include CHIPS, ACH, Fedwire Funds Service, RTP, FedNow, card networks, and SWIFT. There are others, but these make up much of the financial plumbing that blockchains and stablecoins could theoretically encroach on.

Most interesting is SWIFT, as it’s a type of messaging or networking layer that manages instructions of payments globally - it’s really deserving of an entire report, but I’ll get to that. I’ve seen so much discussion around stablecoins and where they are today, but very little about just how many opportunities might present themselves in the years to come.

This new type of financial system could have issuers like Tether and Circle acting in pseudo government roles (assuming activity of the Federal Reserve) or acting directly with the Federal Reserve on issuance; something like Tempo and its claimed 100,000 transactions per second would be a SWIFT/ACH system managing every stablecoin-related transaction passing through the on-chain internet; wallet providers like MetaMask and Jupiter would act like banks, or existing L1s/L2s would act like banks - it’s unclear. Market infrastructure could be overseen by oracles and risk committees, managing the boring stuff and ensuring money doesn’t go missing (a very, very important and crucial role).

Obviously we can already transact with stablecoins on blockchains, and today’s L1s and L2s are very fast, secure, and most are reasonably cheap to use, but that isn’t to say we can’t benefit from more bespoke infra. I hate to be the guy that talks about infra again, but I think most here only have a bad taste in their mouth because previous infrastructure projects (mainly those in the realm of modular blockchains) were released too soon for their time. Even something like a Phantom or MetaMask enshrined stablecoin, which fits squarely into the definition of infrastructure, makes a lot more sense today than it did two or three years ago. The UX of wallets is not only a whole lot better, but much more robust - just scroll through Phantom’s tweets to get a look at everything you can do in it now.

More than anything, these projects need to make some money, which could be the deciding factor on whether or not these become good investments, privately or publicly. Blockchains are significantly cheaper and faster than existing rails, meaning unless you gain a sizable share of activity, revenue generation won’t be as significant as it would be in a business like perps exchange, wallet transaction fees, etc.Bessent-led stablecoin speed run takeover:

This one is a bit more out there, and to start, I’ll quote Alexander Good because this paragraph introduces the scenario succinctly:

“US stables are needed to finance the deficit. Scott Bessent in his June 18 tweet and subsequent interviews targeted $3.7 trillion of stable supply by 2030 to support demand for US treasuries. Paolo Ardoino of Tether - who previously had not set foot in the US for years, was subsequently invited to the White House and honored by Donald Trump. Donald Trump’s family launched a $20+B FDV stablecoin project (as of Sept 2025), “World Liberty Financial”. The Stable cycle is well under way with transparent motives.”

It’s abundantly clear that key figures in the United States government are very keen on stablecoins and want them to remain and continue to be a major part of the United States’ economic future - but the $3.7 trillion demanded by 2030 is a bit ridiculous. Bessent is a smart guy, and it’s unlikely he’s throwing out some insane number just to draw headlines.

I understand the appeal of using stablecoins as a means of drumming up demand for US treasuries, but really any other number could have been used. If Bessent even wants half of that $3.7 trillion by 2030, we would have to add one existing 2025 stablecoin supply ($300b) each year for the next five years, which would be truly incredible growth. This isn’t to say that it’s impossible, especially considering US M2 money supply is 22 trillion - but it implies a very sudden shift in not only US monetary policy, but global economic order.

Should Bessent’s wish get granted, in five years we are really in a completely different world. These demands could maybe be related to the threat of non-USD denominated stablecoin growth, but this would be a pretty massive overreaction considering the dominance of USD amongst existing circulating stablecoins and the existence (and assumed persistence) of USD hegemony. This is a deeper rabbit hole and less of a potential future than it is a massively bullish catalyst, so maybe place this higher up amongst your list of potential outcomes.More modest “slow” adoption and integration over long time frame:

Theia Research has a good writeup that models out stablecoin growth, with a tangible estimate for 480b circulating supply by EOY 2026. This was achieved via breaking down TAM, SAM, utilizing s-curve analysis, and taking a closer look at M2 money supply. The post has many different model outputs, so I highly recommend taking a look at it and coming to your own conclusion. Regardless of who adopts stablecoins and who throws their hat into the issuance ring, the stablecoin market today is quite stable (haha) and clearly functioning smoothly, and even without assuming any new entrants, they can continue to do quite well for themselves.

If crypto were to enter a bear market, you could make a case for more limited growth (peak to trough supply 2022-2023 was something like 190b circ to 130b) but a counter argument is that stablecoin supply growth has been accelerating in dollar terms and this growth has propelled the sector into entirely uncharted territory. Additionally, public support and acknowledgement of stablecoins continues breaching ATHs - it would truly take forever to list off every major government official, corporation, or significant financial entity who has expressed positive opinions regarding stablecoins.

It’s my belief that stablecoin growth will continue at a fairly reasonable pace based on the reality that everything has quickly become more digital or digitized over the past 10-15 years, and money is no different. The floodgates have been opened and it’s clear that a) individuals in many, many countries value stablecoins, b) that China may or may not wish to wage war against stablecoins and the USD, and c) that should we assume blockchains will grow in popularity, stablecoins - being a major factor/contributor towards blockchain success - will propel/follow this.

Hopefully some of that was valuable to you guys, but even if it wasn’t, I still had a lot of fun writing it.

There really isn’t enough entertaining stablecoin content out there, mainly considering the fact that you can enjoy price appreciation with any other asset, but stablecoins are more practical. Regardless, they’re here to stay and it’s important to have an opinion on what their continued growth might look like and how you can maybe take advantage of it.

Before closing, there are a few other developments in the stablecoin world that I wanted to discuss, mainly some of the protocols I am supportive of and certain aspects of them that have stood out to me:

Seismic Systems: Privacy-focused, crypto native fintech isn’t inherently a stablecoin product but at the end of the day, much of the activity routed through Seismic will probably be stablecoins. This one came on my radar last week after their fundraise, and can be defined as a “privacy enabled blockchain” with additional capabilities for on/off ramps that would be used by other fintech companies. In one of the stablecoin futures I described, something like Seismic would fit in as an intermediary or key infrastructure partner handling much of the traffic in a stablecoin-denominated world.

M0: With a focus on letting anyone build app-specific stablecoins, M0 is one of those “bespoke issuers” I hinted at earlier. I first discovered M0 after seeing Luca’s announcement about its fundraise way back, as I’d always really enjoyed his writing. M0 has done quite well so far, and you can track their growth here. Part of what makes M0 unique is its shared liquidity layer, meaning that any project who utilizes M0 for issuance becomes part of a network, giving M0 a really special ability to horizontally scale across both DeFi and the stablecoin space broadly.

Sphere: Describing itself as the operating system for the digital economy, Sphere’s primary focus is cross border payments. I’ve been lucky enough to know the Sphere team, having met in summer 2023, and they’re one of the most underrated organizations in crypto. This is primarily a project that real businesses and individuals can use to move money in ways they’ve never been able to before, and is a true example of a crypto native fintech company.

Thanks for reading!