Kalshi Capital another $1 billion, pushing its valuation to $11 billion. Photo: CoinDesk

Kalshi Capital another $1 billion, pushing its valuation to $11 billion. Photo: CoinDesk

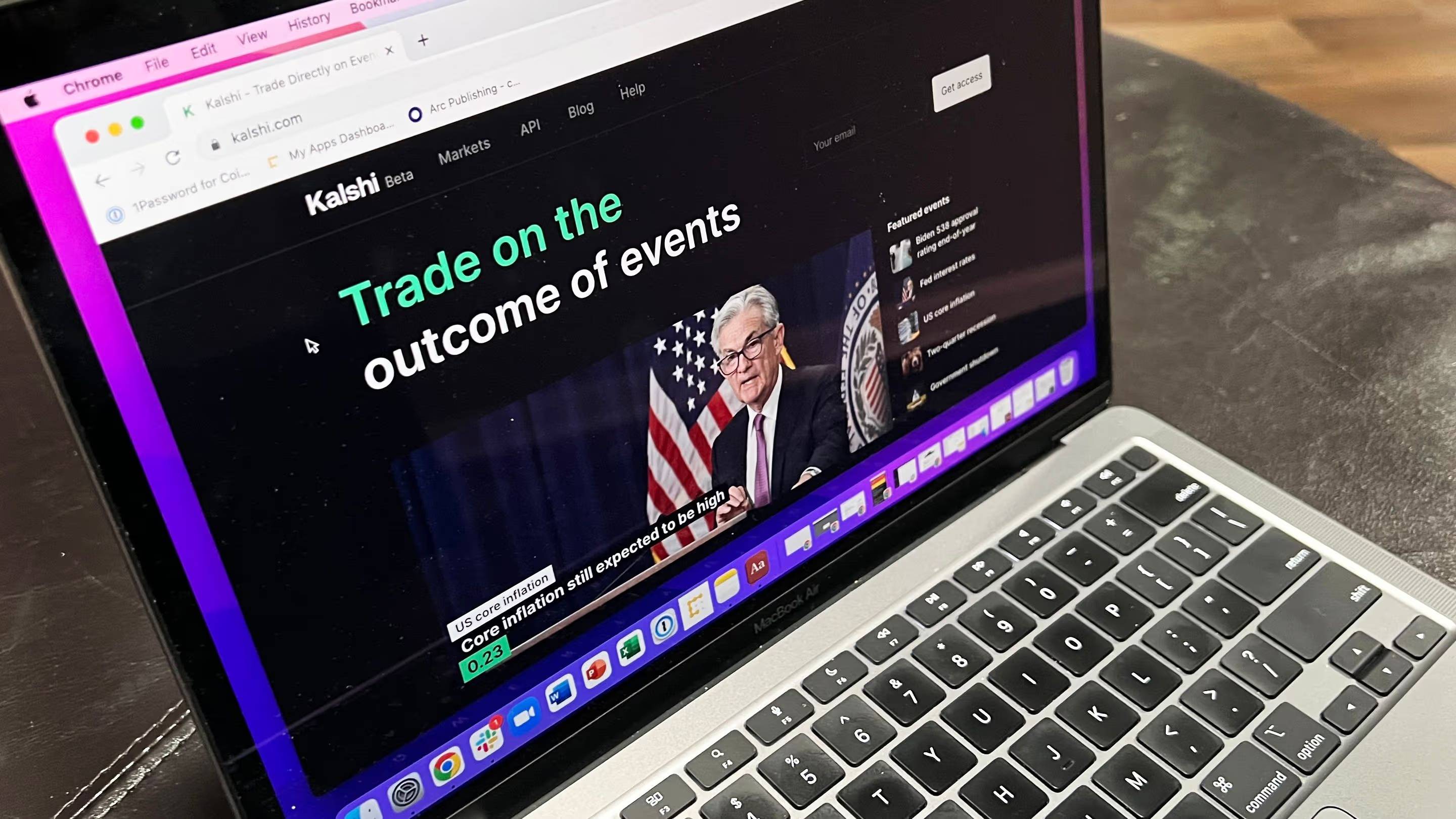

Kalshi , the only CFTC-licensed prediction market in the US, has just closed a $1 billion Capital round, raising the company's valuation to $11 billion.

According to TechCrunch, the Capital round was led by Sequoia and CapitalG, with participation from several leading funds including Andreessen Horowitz, Paradigm, Anthos Capital and Peg.

It is worth noting that just a few weeks ago, Kalshi raised $300 million at a $5 billion valuation and just four months after its $185 million Capital at a $2 billion valuation. The valuation has more than doubled in a short period of time, showing that the market has high expectations for Kalshi’s legally compliant prediction market model.

Kalshi has overtaken rival Polymarket in monthly volume , surpassing the $1 billion mark in Volume in the first half of September alone, capturing 62.2% of the global prediction market share. In October alone, Kalshi recorded $4.4 billion while Polymarket reached $3.02 billion.

Kalshi’s unique advantage lies in its robust regulatory framework in the US, which few other prediction market platforms have. This is believed to be the reason why large-scale Capital flows continue to flow into Kalshi, although the company declined to comment on new developments.

Polymarket, however, is not out of the race. Last month, Bloomberg reported that the platform was negotiating a new Capital round with a valuation ranging from $12 billion to $15 billion . Polymarket’s appeal was further bolstered when ICE , the group that owns the New York Stock Exchange (NYSE), agreed to invest up to $2 billion in the company.

The prediction market’s reach has accelerated further since Google Finance announced it would integrate data from Polymarket and Kalshi directly into search results. Predictive data will be placed in the same position as stock prices or financial indices, giving hundreds of millions of users access to real-time market information without having to access each platform. By expanding its user base, the prediction market will now be more recognizable to ordinary users.

Bernstein analysts also noted a significant expansion of the industry. Prediction markets are no longer confined to single events but are becoming information hubs across sectors – from sports, politics, business to economics and culture. Because the data is shaped by real money flows, prediction markets are XEM as more accurate and responsive indicators of social expectations than traditional survey models.

Amid growing competition, Kalshi has made no secret of its ambitions to expand into Web3. John Wang, Kalshi’s Chief Crypto Officer, said they aim to have Kalshi’s prediction market available on all major crypto exchange and applications within the next 12 months.

Coin68 synthesis