- The ERC-8004 and x402 standards are like issuing "passports" and "bank accounts" to AI, serving as the infrastructure for a trillion-dollar machine economy.

- Stop making shovels, go dig for gold.

- Currently, many agents are actually "LARPing" (role-playing/self-deception) – they do not have real reasoning and decision-making abilities, but are just executing pre-set scripts and lack training on real-world distributed data.

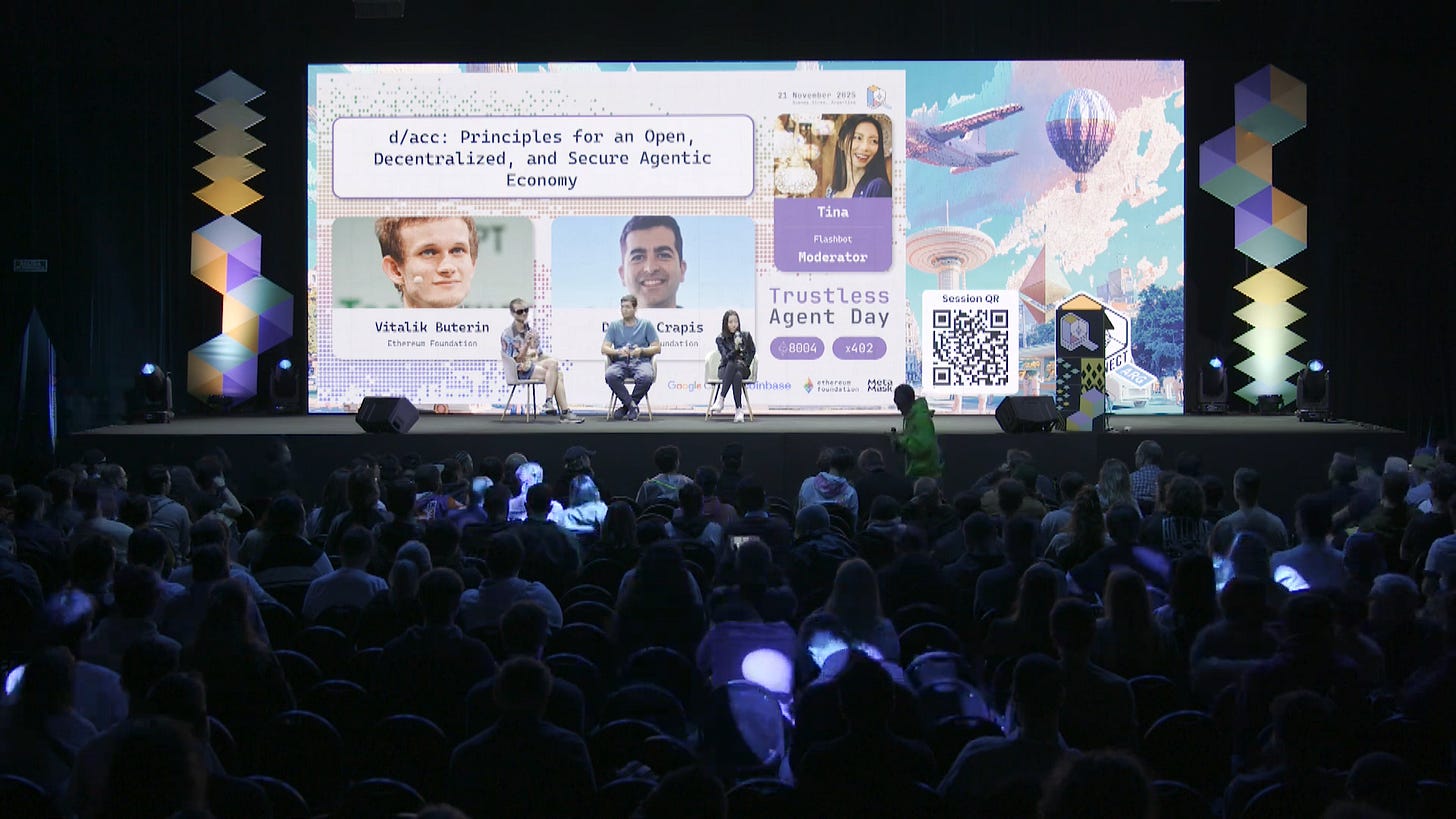

During the recently concluded Devconnect ARG 2025 , an event called Trustless Agent Day became one of the most anticipated highlights of the entire conference. This event, jointly launched by industry giants such as the Ethereum Foundation (EF) , Coinbase , and MetaMask , along with the core developer community, was of high caliber and focused on core topics, marking a significant step forward in the integration of Web3 and AI, moving beyond mere conceptual hype into a new phase of "standardized infrastructure." The event's vision was clear: to end the era of AI agents merely serving as simple API wrappers, and to build a truly permissionless, interoperable, and payment-enabled agentic economy through the ERC-8004 and x402 protocols.

The core consensus of this conference was the establishment of two pillars for the Agent economy: identity and payment . Speakers generally agreed that the biggest obstacle to Agent autonomy lies in cumbersome Web2 authentication (such as API Keys and credit card bindings). The x402 protocol (reviving the HTTP 402 Payment Required status code) is seen as the ultimate solution to "kill API Keys," allowing Agents to access global network resources solely through wallet signatures and micropayments (stablecoins). ERC-8004 , on the other hand, endows Agents with on-chain identity, discovery mechanisms, and verifiable reputation records. As developers from Coinbase and EF have stated, these two standards are like issuing "passports" and "bank accounts" to AI, forming the infrastructure for a trillion-dollar machine economy.

The shift from infrastructure to product-market fit (PMF) was another strong signal throughout the day's presentations. Attendees unanimously agreed that the infrastructure construction phase (Season 1) was largely complete, and it was time to move into the application explosion phase (Season 2). "Stop building shovels, dig for gold!" became a common sentiment among developers. In the search for PMF, "gamification" and "micropayments" were seen as breakthroughs to break the deadlock. Both Babylon's prediction market simulation and Scaffold ETH's slot machine demo demonstrated that allowing agents to engage in low-risk, high-frequency games and transactions is the best path to train their economic decision-making abilities and accumulate data.

However, amidst the optimistic pronouncements of technological development, heated debates and reflections erupted, dubbed "the elephant in the room ." The most pointed criticism came from Eliza's founder, Shaw, who bluntly stated that many current agents are essentially "LARPing" (role-playing/self-deception)—they lack genuine reasoning and decision-making capabilities, merely executing pre-set scripts and lacking training on real-world distributed data. Furthermore, the nature of trust also sparked disagreement: is it the "technological trust" based on privacy protection (ZK/TEE) advocated by the Ethereum Foundation, or "social reputation" relying on on-chain scoring systems? Vitalik Buterin, in his fireside chat, emphasized that privacy should be considered a "basic hygiene," not an add-on feature; how to build a reputation system without compromising user privacy remains an unsolved mathematical problem.

Finally, the discussion on computational sovereignty led to a longer-term perspective. Faced with a closed-source model monopolized by a few tech giants, the Web3 community has shown a strong "local-first" tendency. From Vitalik Buterin to many developers, everyone has expressed a vision of "separation of computation and UI": future agents should not be puppets of cloud-based black boxes, but rather digital twins running locally or on decentralized networks (such as TEE/ZK verification), faithfully serving the user's interests.

In conclusion, Trustless Agent Day was not only a technological showcase but also a brainstorming session on the economic landscape of AI. It heralded a shift in the Agent field from simple LLM calls to building a trusted and interconnected on-chain society with independent economic sovereignty.

To help everyone gain a more thorough understanding of this trend, we have extracted the highlights from the 16 presentations, demos, and panel discussions throughout the day. Below is a detailed recap of the event.

1. Welcome to Babylon: The City of Agents (Simulated and Predictive Markets)

- Speakers : Marco (MetaMask) & Shaw (Eliza/Babylon)

- Project : Babylon / Eliza OS

- Core essence :

- Current limitations of AI : Current AI models are primarily trained on static datasets, lacking training data on "how to collaborate, negotiate, and transact." We lack coordination datasets between agents.

- Babylon Project Vision : Shaw presented Babylon, a "game" or simulation environment based on prediction markets. In this environment, humans and agents can engage in asymmetric information games regarding future events, such as whether SpaceX's launch will be successful.

- Data Flywheel : By having agents play against each other, share information, and place bets in games, a large amount of "synthetic data" can be generated to train agents to become smarter, thus going beyond simple LLM text generation and enabling them to have real economic decision-making capabilities.

- Applications of ERC-8004 and x402 : Babylon is an application registry built on the ERC-8004 standard. Agents register their identities using ERC-8004 and make payments (buying credits, placing bets) using x402. This demonstrates that ERC-8004 is not only an agent registry but also an application registry (like decentralized Yelp or Fiverr).

2. Discover Pay Autonomously: Solving LLM Tools Friction with x402 (x402 Protocol Introduction)

- Speaker : Kevin (Coinbase CDP)

- Project : Coinbase Developer Platform / x402 Protocol

- Core essence :

- Pain point: API Key friction : Currently, when an agent calls external tools (API), it requires a human to manually configure the API Key and bind a credit card, which hinders the agent's autonomy.

- Solution: x402 : Kevin proposed the slogan "Kill the API Key." The x402 protocol revived the HTTP status code 402 (Payment Required). It allows agents to access thousands of API resources with just one wallet.

- How it works : Agent accesses resource -> Server returns 402 status code and price -> Agent wallet signs and sends micropayment (stablecoin) -> Resource is acquired. This process requires no manual intervention.

- Ecosystem Progress : x402 has already supported a large number of tools (such as Firecrawl, Browserbase, Freepik) and processed nearly 50 million transactions in the past 30 days. It has turned stablecoins into a "meter" of internet resources.

3. Bringing x402 to Builders with Scaffold ETH (Developer Tools)

- Speaker : Austin Griffith (Ethereum Foundation / Build Guild)

- Project : Scaffold ETH / Build Guild

- Core essence :

- Lowering the barrier to development : Austin introduced the x402 extension package for Scaffold ETH. This toolkit allows developers to build applications that support crypto payments out of the box, including an automatically adaptable frontend and an interface for debugging contracts.

- Live Demo: Slot Machine : He demonstrated a "slot machine" demo built using x402. Agents or users can pay 0.05 USDC for a single draw based on an on-chain random number (Commit-Reveal).

- Technical details : Although there was network latency during the demonstration, he emphasized how the system handles meta-transactions, allowing the Facilitator to pay the gas bill, thus achieving a seamless user experience.

- The hackathon calls for developers to leverage these off-the-shelf starter kits to quickly build prototypes, automating 80% of the groundwork and allowing them to focus on product logic.

4. Verifiable Credit for the Agentic Economy (On-chain Reputation and Lending)

- Speaker : Med (bond.credit)

- Project : bond.credit

- Core essence :

- The issue of lack of credibility : Currently, a large number of agents handle funds on-chain (such as stablecoin investments), but there is a lack of transparent credibility assessment systems. BIS research shows that 45% of protocols cannot fully verify their TVL (Total Value Limit).

- Bond Credit's solution involves establishing a decentralized rating agency for agents (similar to an on-chain Moody's). It uses ERC-8004 to identify agents and combines on-chain data (performance, fund flows) with off-chain data to calculate a verifiable credit score.

- Applications of TEE : The scoring logic runs within a Trusted Execution Environment (TEE), ensuring the neutrality and immutability of the scoring process. Users can obtain the latest Agent credit report by paying a fee via x402.

- Future Outlook : Moving from simple credit scoring to "Push Credit," which means providing unsecured or low-secured credit lines directly to high-quality agents based on high credit scores, thereby increasing their capital efficiency.

5. Bringing Low Risk to DeFi through Agents (DeFi Automation)

- Speaker : Gauthier (ZyFAI)

- Project : ZyFAI

- Core essence :

- The complexities of DeFi : Ordinary users struggle to manage cross-chain yields, gas fees, and complex rebalancing strategies. Xiphi is a non-custodial smart wallet agent designed to automate low-risk yield strategies.

- Automation and Security : Users deploy Safe wallets and set policies (such as Session Keys) to restrict Agent permissions (allowing interaction with specific protocols but preventing withdrawals). The Agent automatically rebalances funds multiple times daily based on market conditions.

- Trust Proof : To solve the "black box" problem, ZyFAI generates ZK Proof (zero-knowledge proof) to prove that each step of the Agent's operation conforms to the preset logic, and uploads the proof to the ERC-8004 verification registry.

- Accessibility : Currently, this feature is only available within the ZyFAI product, but with the launch of ERC-8004, they will open the SDK, allowing any wallet or exchange to integrate this automated financial management agent.

6. Panel: Why Should We Trust Agents? (Roundtable Discussion: Trust)

- Guests : Cameron (Near), Wei Dai (1KX), Nima (Eigen), Julian (State Capital), Ben

- Core essence :

- Definition of trust : Trust is not only about "doing no evil," but also about "performance compliance." For an agent, trust means verifiable code execution (via TEE or ZK) and performance in specific benchmark tests.

- Human trust vs. machine trust : Human trust is based on emotion and social contracts, while machine trust is based on statistics and cryptographic proofs. Future trust may be built on a combination of "reputation systems + regulatory bottom lines + high-performance metrics (reliability with several nines)."

- Security Risks : The potential risk of the agent spiraling out of control is discussed. If the agent has access to resources and operates at extremely high speeds, post-event accountability alone is insufficient; various forms of pre-emptive verification or hardware constraints are necessary.

- Future Outlook : If the trust issue is resolved, agents will eliminate consumers' "choice paralysis," transforming the "search-filter-buy" process into a direct "intent-result" process.

7. Insider Agent: Trustless Market Maker Intelligence

- Speaker : Alex (Rena labs)

- Project : Rena Labs

- Core essence :

- Market opacity : Market makers (MMs) in the crypto market often operate opaquely, making it difficult for project teams to assess their true performance or whether fraudulent activities exist.

- Solution : Establish a trader reputation agreement based on ERC-8004. Data is processed within the TEE, protecting privacy while generating publicly verifiable performance reports.

- The system features a dual-role system : It includes an "Analyst Agent" (using LLM to analyze data) and a "Rating System" (based on pre-trained models for scoring). Users can create agents to analyze specific market maker behavior.

- On-chain traceability : All ratings and analysis results will generate Attestation and be uploaded to the blockchain, forming a permanent reputation file for the entire market to refer to, thereby driving out bad money.

8. Bringing Visibility to Agents (Agent Registration and Discovery)

- Speaker : Alex Kuperman (Olas)

- Project : Olas (Autonolas)

- Core essence :

- Olas' first-mover advantage : Olas began building its agent registry as early as 2022 and currently has over 2,500 agents, processing millions of transactions. Their motto is "Own your weights, own your brain."

- ERC-8004 Compatibility : Olas is making its existing registry compatible with the ERC-8004 standard. Through the "Identity Registration Bridge," Olas's NFTs and identities are automatically synchronized to the 8004 standard, enabling cross-ecosystem interoperability.

- Discovery Layer : Calls on the community to jointly build "Agent Scan", a cross-standard, cross-chain agent search engine that ensures that no matter what underlying technology an agent uses, it can be discovered by users and other agents.

- Sovereign Agent : This emphasizes the concept of "Sovereign Agents," which are agents that operate locally or on decentralized networks and are not controlled by a single entity.

9. Why UX Matters More Than Infra (User Experience and Developer Incentives)

- Speaker : Andrei Sambra (Warden Protocol)

- Project : Warden Protocol

- Core essence :

- UX is king : For the average user, understanding blockchain, wallets, and gas is a huge hurdle. Warden attempts to hide these complexities through a natural language interface, with the Agent acting as a translator of user intent.

- The cold start problem for developers : Developers only want to write code and don't want to do marketing. Warden provides a platform where developers only need to register an agent to immediately gain access to distribution channels and revenue (Day 1 Revenue).

- The purpose of 8004 : Warden uses the 8004 standard to automatically register the Agent's identity and wallet in the background. When the user interacts with the Agent on the front end, the system automatically processes x402 payments, and the developer receives the funds in real time.

- Incentive Program : A $1 million incentive program was announced, with the first 10 agents in the first month receiving a $10,000 reward to attract developers to join.

10. 8004 Scan and the Agent Stack (Infrastructure and Browser)

- Speaker : YQ (AltLayer)

- Project : AltLayer / 8004 Scan

- Core essence :

- Agent Lifecycle : Describes the complete closed loop of Agent lifecycle from registration (8004), discovery (Scan), payment (x402) to feedback (Reputation).

- 8004 Scan : AltLayer developed a browser similar to Etherscan—8004scan.io. It not only indexes agents but also introduces a feedback system that allows users to rate agents, which is crucial for building trust.

- x402 Extensions (x402x) : Addressing the limitations of x402 v1 (such as the lack of atomic settlement and multi-token support), an extension protocol was proposed. This enables the construction of "digital gateways" that support high-throughput microservice payments.

- Developer Tools : Emphasizes the importance of providing CLI and API, making it easier for developers to interact with 8004 contracts and lowering the barrier to entry for building.

11. Giza Agents: Self-Driving Capital on Ethereum (Financial Agent in Practice)

- Speaker : Renç (Giza)

- Project : Giza

- Core essence :

- Personalized Finance : Giza believes that the future of finance will not be about everyone buying the same token, but rather about each person having an agent that serves their personalized goals.

- Complex yield strategy : This demonstrates an Agent based on the Base Chain that automatically performs yield farming across DeFi protocols based on user-defined risk strategies (e.g., funds must be diversified across at least 3 markets, with no single market accounting for more than 2/3).

- Cost and Profit Forecasting : The agent performs two-way forecasting before execution—profit forecasting and cost (Gas/slippage) forecasting. The trade is only executed if the net profit is positive. This is something humans cannot manually calculate.

- Real-world data : Giza has processed $3 billion in trading volume on Base and has 10,000 active positions, proving the Agent's Product-Market Fit (PMF) in the DeFi field.

12. Building Wall Street in the Agent Economy (No-Code Financial Agent)

- Speaker : Steven Vinyl (Cod3x)

- Project : Cod3x

- Core essence :

- The no-code platform Cod3x allows users to create financial agents using natural language. Users can choose templates (such as RSI mean reversion strategies) and then fine-tune the strategies through dialogue.

- From the Black Market to the Legitimate : Current trading bots operate like a black market, lacking transparency. Through ERC-8004, Cod3x casts NFT identities for each agent, making its strategies and audit logs publicly verifiable.

- x402 Commercialization : Users can not only use the Agent themselves, but also "rent" or sell the data. Other users can copy trade, paying a small fee to the creator for each trade via x402.

- Security : The agent only has transaction permissions, not withdrawal permissions (air-gapped security), and all logic is audited to prevent malicious code injection.

13. When APIs and Agents are Indistinguishable (Decentralized Infrastructure DIN)

- Speaker : EG Galano (DIN, Consensys)

- Project : DIN (Decentralized Infura Network)

- Core essence :

- Agent, or API : From an infrastructure perspective, Agents and APIs are becoming increasingly similar. DIN was originally designed to provide decentralization and SLA (Service Level Agreement) guarantees for Infura's services.

- The scoring challenge : Traditional API scoring (latency, availability) is deterministic. However, AI agents are non-deterministic; the same input may produce different outputs. This necessitates new scoring algorithms.

- Watcher Network : DIN introduces "Watcher" nodes to continuously monitor service quality. These Watchers can generate rating reports and upload them as Reputation data to the 8004 registry.

- Trustworthy Foundation : In the Agent Economy, if the underlying infrastructure (RPC, inference nodes) is unreliable, upper-layer applications will fail. DIN aims to provide this layer of verifiable infrastructure assurance.

14. Unruggable Agents Tech Stack

- Speaker : Nader Dabit (EigenLayer)

- Project : EigenLayer/EigenCloud

- Core essence :

- Unruggable (Unrevocable/Unmalicious) : Smart contracts represent "unmalicious," but their functionality is limited. Agents are powerful but prone to malicious use. The goal is to build "unmalicious agents" that are both flexible and verifiable.

- Full-stack architecture : Nader proposed a complete technology stack:

- Identity/Reputation: ERC-8004.

- Payment: x402.

- Calculation: TEE (Eigen Compute) or ZK.

- Reasoning: Verifiable reasoning (EigenAI).

- EigenAI Breakthrough : Polymarket announced that it is using EigenAI to achieve "autonomous decision-making" in prediction markets. Through verifiable reasoning, it ensures that the AI's judgments on event outcomes are true and tamper-proof.

- Hybrid Applications : Demonstrates how to combine the flexibility of Web2 with the verifiability of Web3 to build an end-to-end trusted agent workflow.

15. Panel: Product Market Fit (PMF)

- Guests : Leonard Tan, Lincoln Murr (Coinbase), Shaw (Eliza), Derek (WalletConnect)

- Core essence :

- Current situation: More tools than applications : It is generally believed that there are more people "making shovels" than "digging for gold." Although the infrastructure (8004/x402) is very complete, there is a lack of truly useful agents.

- Current PMF : The most successful agent currently is the "Coding Agent" because it has the richest data. Other fields (such as DeFi trading) lack high-quality "process data" to train agents.

- The future PMF :

- Short-term : Games and entertainment (such as Babylon). Attract users by being "fun" and generate training data through gameplay.

- Long-term : Extremely abstract. Like Robinhood, users no longer care about specific actions, only the result ("Do I have enough money?").

- The elephant in the room : Most of the agents that claim to be agents are just simple wrappers for APIs, or they are doing things that they are not really trained to do (such as complex transactions), which is a kind of LARP (role-playing/self-deception).

16. Fireside Chat: DAC & The Future

- Guests : Vitalik Buterin, Davide (EF), Tina (Flashbots)

- Core essence :

- The role of blockchain : Vitalik believes that the core role of blockchain in the agent economy is payment (micropayments) and decentralized verification . Especially in micropayments, AI can process transaction decisions involving mere cents more efficiently than humans.

- Privacy as a "hygiene habit" : Privacy should not be an add-on feature, but a "basic hygiene." In high-frequency agent interactions, data leakage must be minimized through ZK or TEE.

- Local-First : Vitalik's vision for future computing architecture is the separation of computing and the user interface. He hopes to see more locally running OS and agents, where users have complete control over hardware and data, rather than relying on the cloud.

- The Challenge of Reputation Systems : This is a mathematical problem. How to build an effective reputation system while protecting privacy (ZK negative reputation proofs) is the focus of future research.

- Community perspective : The community is currently very enthusiastic. The next stage needs to shift from "building standards" (Season 1) to "building applications and privacy layers" (Season 2), and we should be wary of over-reliance on a single large model provider.