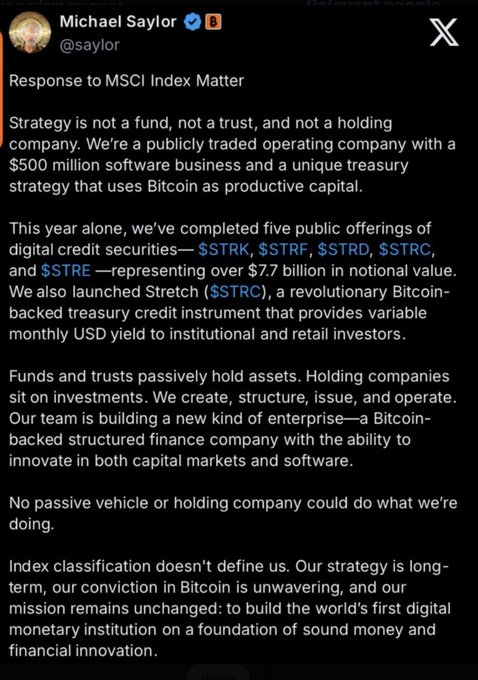

🚨 JPMorgan vs Saylor : Here’s What Actually Went Down The October 10 crash wasn’t some random dip. It started the moment MSCI suggested removing Bitcoin-heavy companies from its indexes. That put MSTR in direct danger… and forced selling is the fastest way to break a market. Then JPMorgan dropped a bearish report right when: • BTC was weak • MSTR was crashing • Liquidity was thin • Sentiment was dead Perfect timing to spark fear. Now the whole space is watching: • People think JPMorgan is building a big short • Brokers are suddenly lending more MSTR shares • Thousands are closing JPM accounts • A huge short squeeze could be coming Saylor stepped in and shut the panic down, reminding everyone MSTR isn’t an ETF but a full operating company. This isn’t just about Saylor anymore. It’s about how big banks shape the story and move markets. And when this flips, the same people spreading fear will be the ones chasing green candles at the top.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share