Uniswap V4: Prisoners Dilemma?

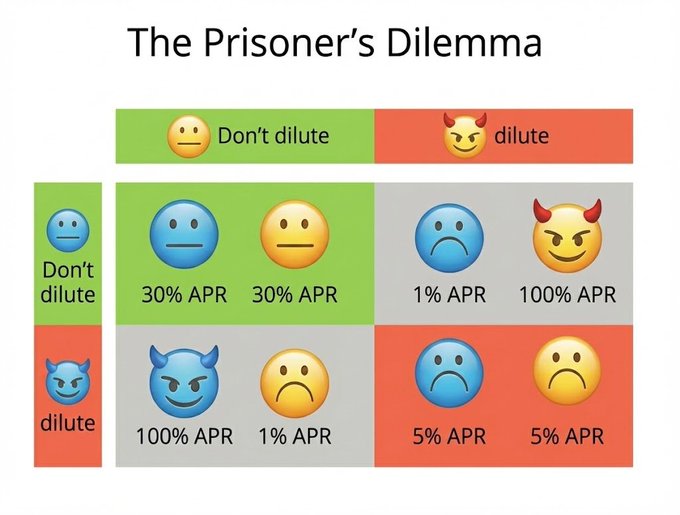

Farmers on @Uniswap V4 are rapidly creating lower fee tier pools to vampire attack the volume from higher fee tiers.

But, if everyone stayed at the same higher fee tier, everyone would have a higher long-term net yield.

Vamping is fairly zero-sum, because if all the TVL migrates to the lower fee tier, and the volume stays relatively consistent, APRs go down across the board.

The end result is the minimum necessary TVL required to service volume at a minimum possible APR necessary to maintain that liquidity.

Which sounds optimal, except we do not have rational agents doing the farming.

Anywho, some lad with 40K was doing 200% APR on AUSD/USDC yesterday, but got diluted from his 0.003% tier by someone in a 0.0009% tier, who is now absorbing 4M in volume on 40K.

So it goes.

h/t "empty" in the dojo for the post inspiration.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content