The cryptocurrency market is making its first significant recovery after the brutal sell-off in November, and some indicators now resemble conditions seen around Thanksgiving in 2022 and 2023.

Bitcoin reclaimed $91,000, ETH broke through $3,000, and the broader market returned to green but cautiously. The recovery came as traders headed into a long holiday in the United States, which often sets the tone for December.

Market indicators turn positive after weeks of concern

The Fear and Greed Index data shows sentiment improved from 11 last week to 22 today, although it remains in “Extreme Fear”.

This change is in line with the steady rise in the cryptocurrency's Medium RSI , which has risen from 38.5 seven days ago to 58.3 today. This figure shows growing strength after being in a deeply oversold state earlier this month.

Cryptocurrency Medium RSI on Thanksgiving 2025. Source: CoinMarketCap

Cryptocurrency Medium RSI on Thanksgiving 2025. Source: CoinMarketCapMomentum has also changed. The normalized MACD on major assets has turned positive for the first time since early November.

About 82% of tracked cryptocurrencies currently show positive momentum trends. Bitcoin, Ethereum, and Solana appear in bullish territory on CoinMarketCap's MACD heatmap.

Price action supports this change. Bitcoin is up 6% for the week. Ethereum is up nearly 8%. Solana is up nearly 8% over the same period.

Market Capital has increased to $3.21 trillion, up 1.1% in the last 24 hours.

Cryptocurrency Medium MACD on Thanksgiving 2025. Source: CoinMarketCap

Cryptocurrency Medium MACD on Thanksgiving 2025. Source: CoinMarketCapA familiar post-Thanksgiving situation has emerged.

The current recovery mirrors a structure seen twice before. In both 2022 and 2023, the market entered Thanksgiving after a sharp decline and then stabilized in December.

In 2022, Bitcoin fell to nearly $16,000 after the FTX collapse . By Thanksgiving, the selling pressure had dried up and the market traded sideways until Christmas.

It was a consolidation phase of a deep bear market, rather than a recovery.

In 2023, Bitcoin entered Thanksgiving at $37,000 after a sharp correction in September-October. Strong ETF expectations and improved liquidation conditions pushed BTC to $43,600 by Christmas. It was a classic early December bull market rally.

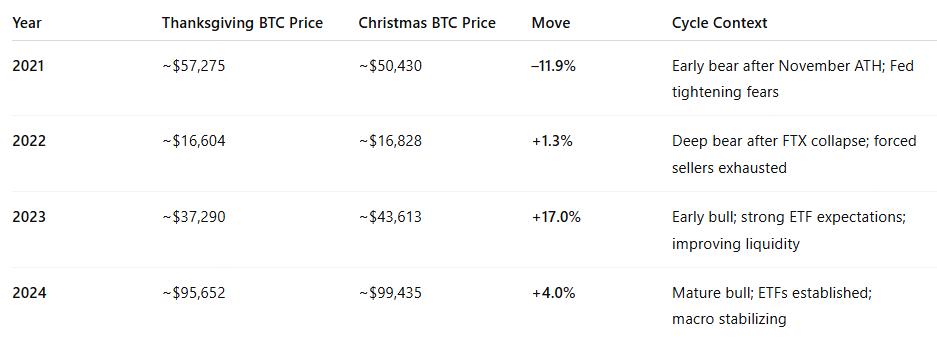

Bitcoin's Performance Between Thanksgiving and Christmas (2021–2024)

Bitcoin's Performance Between Thanksgiving and Christmas (2021–2024)This year, the pattern repeated a familiar element: the November drop came early, and by Thanksgiving, the selling momentum had eased slightly.

Bitcoin's 90-day CVD has flipped from a persistent sell position to neutral, signaling that strong sellers are stepping back. Funding ratio and leverage data also support the same interpretation.

Liquidation damage still shapes the current cycle

BitMine President Tom Lee described the market as “limping” after the October 10 liquidation shock.

Market makers were forced to shrink their balance sheets, weakening market depth on exchanges, a fragility that persisted throughout November , he said.

However, Lee also argued that Bitcoin often makes its biggest moves in short bursts when liquidation recovers. He expects a strong recovery in December if the Federal Reserve signals a softer stance .

On- chain data supports this view. Nexo collateral figures show that users still prefer to borrow against Bitcoin rather than sell it.

BTC accounts for more than 53% of all collateral on the platform. This behavior reduces immediate selling pressure, helping to stabilize spot markets. But it also creates hidden leverage that could increase volatility in the future.

We may be entering a two-year vacation pattern.

Three factors now look similar to post-Thanksgiving conditions in 2022 and 2023:

- Selling Exhaustion: Taker CVD turns neutral signaling the end of forced selling for the time being.

- Momentum Recovery: The MACD and RSI indicators have reversed sharply after Dip in early November.

- Liquidation Stabilization: Market makers are still affected, but volatility has calmed, and ETF outflows have slowed.

If this pattern continues, December could yield one of two outcomes based on the last two years:

- A sideways accumulation phase like 2022 if liquidation remains thin.

- A strong and rapid rebound like in 2023 if macro conditions are favorable.

The deciding factor will likely be the tone of the Federal Reserve in early December and the behavior of Bitcoin ETF flows. Thin liquidation means that even moderate Capital can cause prices to move quickly.

December could bring major volatility in both directions

The market has entered a transitional phase rather than a clear trend. Sentiment remains fearful, but price and momentum indicators show recovery.

Bitcoin's position above $91,000 shows buyers are willing to defend key levels, but Order Book depth remains weak.

With selling pressure easing and technical momentum picking up, the current environment resembles the post-Thanksgiving setup that has marked recent year-end cycles.

If the pattern holds, December will not be flat. It could bring a decisive move as liquidation conditions change.

However, the direction will depend less on crypto narratives and more on macro signals and ETF demand in the coming weeks.