Author: JAE, PANews

With its unique Delta-neutral hedging strategy, USDe has become a censorship-resistant, scalable synthetic dollar that can capture perpetual contract funding rate gains, driving the rapid rise of its issuer, Ethena. Its TVL (Total Value Locked) once approached the $15 billion mark, and it is considered by the industry to be a key force challenging the duopoly of the two traditional centralized stablecoins, USDT and USDC.

However, by October 2025, Ethena's situation had taken a sharp turn for the worse, facing severe structural challenges. Within just two months, the protocol suffered a series of blows, including the halving of USDe TVL and the unexpected termination of incubated ecosystem projects. These events prompted the market to reflect: Is Ethena's core mechanism vulnerable to external influences? Is the protocol's early high-growth model sustainable? Where is its second growth curve?

The decline of leveraged arbitrage and the shelving of ecosystem projects led to a sharp drop in USDe TVL.

The major challenges Ethena has recently faced are no accident; they expose the protocol's over-reliance on external liquidity during its rapid expansion and a misjudgment in its strategic positioning.

According to the latest data from DeFiLlama, as of December 2, 2025, USDe TVL has fallen to approximately $7 billion, a drop of more than 50% compared to its peak of over $14.8 billion in October.

The sharp decline in USDe TVL was not due to the failure of the protocol's hedging mechanism, but mainly due to the panic triggered by the "1011" USDe de-pegging incident on Binance, which led to a systemic exit from high-leverage arbitrage strategies in DeFi. During Ethena's rapid growth phase, many users used USDe as collateral to borrow USDC on platforms like Aave, obtaining leverage of up to 10 times or more through revolving lending operations to amplify potential returns.

The lifeline of this model lies in the window of opportunity presented by interest rate spreads. As market lending rates fluctuate, the APY (annualized yield) of USDe drops to around 5.1%, while the cost of borrowing USDC on Aave remains at 5.4%. Once the yield on USDe falls below the borrowing cost, arbitrage trading relying on the positive spread becomes unprofitable. Leveraged positions that previously drove up TVL (total liquidity leverage) then begin to be liquidated and redeemed in large numbers, causing a massive outflow of liquidity and a significant contraction in TVL.

This phenomenon also reveals the reflexivity of the USDe yield model, where the agreement yield and TVL growth form a self-reinforcing cycle, while also introducing structural vulnerabilities. When deposit rates are high, high yields attract a large influx of leveraged funds, driving up TVL. However, once deposit rates fall or borrowing costs rise, causing yields to drop below a critical point, a large number of leveraged positions will collectively withdraw from the market, accelerating the contraction of the agreement.

USDe's growth depends not only on the Delta-neutral hedging mechanism but is also profoundly affected by market panic. Although Ethena maintains a collateralization ratio of over 100%, the spread of risk-averse sentiment in the market and the crisis of USDe's brief de-pegging to $0.65 on Binance have further exacerbated the withdrawal of liquidity.

While TVL plummeted, Terminal Finance, a DEX (decentralized exchange) incubated by Ethena, announced the termination of its listing plans, casting a shadow over the protocol's strategic direction. Previously, Terminal had attracted over $280 million in deposits during its pre-launch phase, drawing significant market attention.

The fundamental reason for Terminal's termination was the failure of the planned public blockchain, Converge, to launch as scheduled. In March of this year, Ethena Labs and Securitize announced a collaboration to build Converge, an institutional-grade public blockchain compatible with Ethereum. Terminal was positioned as the liquidity hub on the Converge chain.

However, due to Converge's failure to launch mainnet as promised and the lack of a definite launch plan in the near future, Terminal lost its essential infrastructure. Terminal's official account posted on X, frankly stating that the team explored various transformation options, but believed these paths all faced "limited ecosystem support, a lack of asset integration potential, and a bleak long-term development prospect," ultimately deciding to terminate the project.

Terminal's failure marks a significant setback for Ethena's attempt to build its own public blockchain ecosystem. In the highly competitive public blockchain arena, the dispersion of resources and effort is often costly. This event suggests that Ethena must shift its focus to a more efficient and scalable horizontal scaling model, namely, concentrating on becoming a stablecoin infrastructure provider for public blockchains.

Developing a white-label platform as a second growth engine to expand the functionality and utility of USDe

Despite experiencing growing pains with liquidity and ecosystem projects, Ethena is shifting its growth focus to infrastructure services and product diversification through a series of major strategic moves, and its profitability has demonstrated strong resilience.

Currently, the WhiteLabel platform is Ethena's most important second growth driver. This is a SaaS (Stablecoin as a Service) product that shifts the protocol's role from asset issuer to infrastructure provider. The WhiteLabel platform allows market participants such as high-performance public chains, consumer applications, and wallets to efficiently issue their own customized USD assets using Ethena's underlying infrastructure. It has already partnered with DeFi, exchanges, and public chains.

For example, on October 2nd, Ethena announced a significant white-label partnership with Sui and its Nasdaq-listed DAT company, SUI Group Holdings (NASDAQ: SUIG), under which the Sui ecosystem will launch two types of native USD assets:

suiUSDe: A yield-generating stablecoin based on the Ethena synthetic dollar model;

USDi: A stablecoin backed by the BlackRock BUIDL tokenization fund.

This collaboration with Sui marks the first time a white-label platform has been adopted by a non-EVM public chain, signifying that Ethena's infrastructure possesses cross-chain scalability. Furthermore, SUI Group will use the net proceeds generated by suiUSDe and USDi to purchase more SUI tokens on the open market, directly linking stablecoin issuance to ecosystem growth.

On October 8, Ethena announced a partnership with Jupiter, a leading DEX aggregator in the Solana ecosystem, to launch JupUSD, securing another key foothold in the non-EVM public chain ecosystem.

Jupiter plans to gradually replace $750 million of USDC in its core liquidity pool with JupUSD. Initially, JupUSD will be backed by USDtb, supported by BlackRock's BUIDL fund, and will later integrate USDe. This large-scale asset conversion will allow Ethena's assets to be introduced into mainstream DeFi applications within the Solana ecosystem, such as Jupiter Perps and Jupiter Lend, further solidifying the white-label platform's application scenarios in non-EVM public chain ecosystems.

The implementation of the white-label strategy is not only about expanding Ethena's market share, but also about mitigating the structural risks of protocols. Through the white-label platform, Ethena can assist various market participants in integrating and issuing RWA-supported stablecoins (such as USDtb/USDi). This also means that Ethena's revenue streams can be diversified, no longer relying heavily on the highly volatile funding rates of perpetual contracts.

During periods of low or negative funding rates, the institutional-grade stable returns offered by RWA can balance the overall returns of the protocol and may alleviate the reflexivity exhibited in USDe's early growth model.

It's worth noting that Ethena is also deepening the utility of USDe as a DeFi utility asset, thereby reducing its reliance on leveraged arbitrageurs. Ethena Labs has established a strategic partnership with Nunchi, the deployer of Hyperliquid HIP-3.

Nunchi is building yield perpetual contracts, a type of financial product that allows users to trade or hedge various yields, such as RWA rates, dividends, or ETH staking returns.

In this collaboration, USDe has been designated as the underlying collateral and settlement asset for yield perpetual contracts. More importantly, users will benefit from a "margin yield" mechanism when using USDe as margin, allowing them to offset transaction fees and funding costs with the passive income earned from holding USDe. This will not only enhance market liquidity but also reduce users' actual transaction costs.

This mechanism also helps USDe evolve from a savings instrument into a functional asset in the DeFi derivatives market. A portion of the revenue generated on Nunchi will also flow back to Ethena, creating a new revenue flywheel and further diversifying the protocol's revenue streams.

It has captured over $600 million in protocol revenue and received approval and investment from Multicoin.

In fact, prior to the turmoil Ethena experienced, the protocol's underlying profitability had already been proven, and its fundamentals remained robust. Token Terminal data shows that Ethena captured $151 million in fees in the third quarter of this year, setting a new record for the platform, and the protocol's total cumulative revenue has exceeded $600 million.

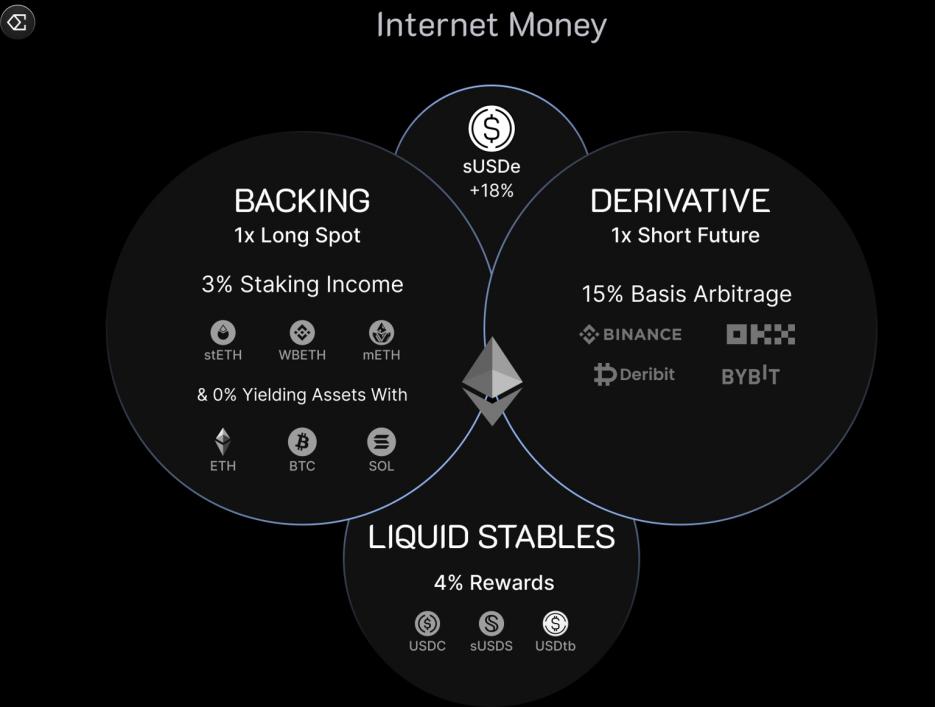

This revenue data also demonstrates Ethena's efficient profitability when market conditions are favorable. Ethena's revenue primarily consists of three parts: 1) funding rates and basis gains earned from perpetual contract hedging positions; 2) ETH staking incentives; and 3) fixed rewards from liquidity stablecoins.

This diversified revenue structure, along with the decentralized hedging of protocol positions across BTC and ETH and a reserve fund of up to $62 million, provides strong support for Ethena's fundamental robustness.

Amidst market volatility, endorsements from leading institutions have instilled confidence in Ethena's long-term prospects. On November 15th, Multicoin Capital announced that it had invested in the protocol's governance token, ENA, through its liquidity fund.

Multicoin Capital's investment logic focuses on the enormous potential of the stablecoin sector, predicting that the stablecoin market will grow to trillions of dollars and believing that "yield is the ultimate competitive advantage." They believe that Ethena's synthetic dollar model can effectively transform global market demand for leveraged crypto assets into substantial returns, a capability that distinguishes Ethena from traditional centralized stablecoins.

From a capital perspective, Multicoin Capital's investment focus is primarily on the platform potential of protocols as issuers of yield-generating stablecoins. Ethena's scale, brand, and revenue-generating capabilities enable it to expand into new product lines, which will provide strategic and financial support for the protocol's later expansion of its infrastructure business.

Despite facing a 50% drop in TVL and the termination of ecosystem projects, Ethena still achieved record revenue and received counter-cyclical investment from top-tier capital. It is attempting to mitigate the impact of the liquidity retreat and seek new business growth by adopting a "stablecoin as a service" white-label strategy and further expanding the application scenarios of USDe.

For Ethena, the key to whether it can successfully transform from a high-yield savings bank for consumers (2C) to a stablecoin infrastructure for businesses (2B) will be the protocol's ability to reach new heights in the next cycle.