MicroStrategy (MSTR), a publicly traded company that actively holds a large amount of Bitcoin, has a stock price that has consistently moved in tandem with the price of Bitcoin (BTC). However, MSTR's stock price has sometimes fallen below the net asset value (NAV) of its Bitcoin holdings, creating a phenomenon known as a "discount" or "negative premium."

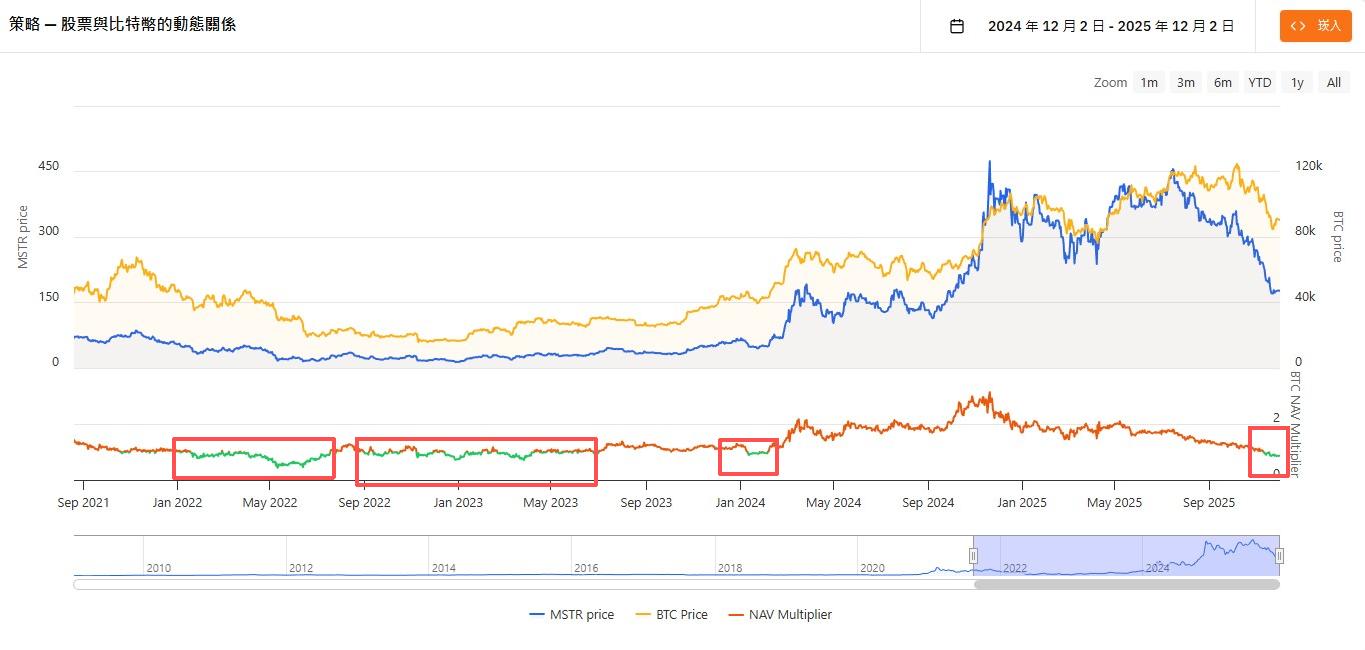

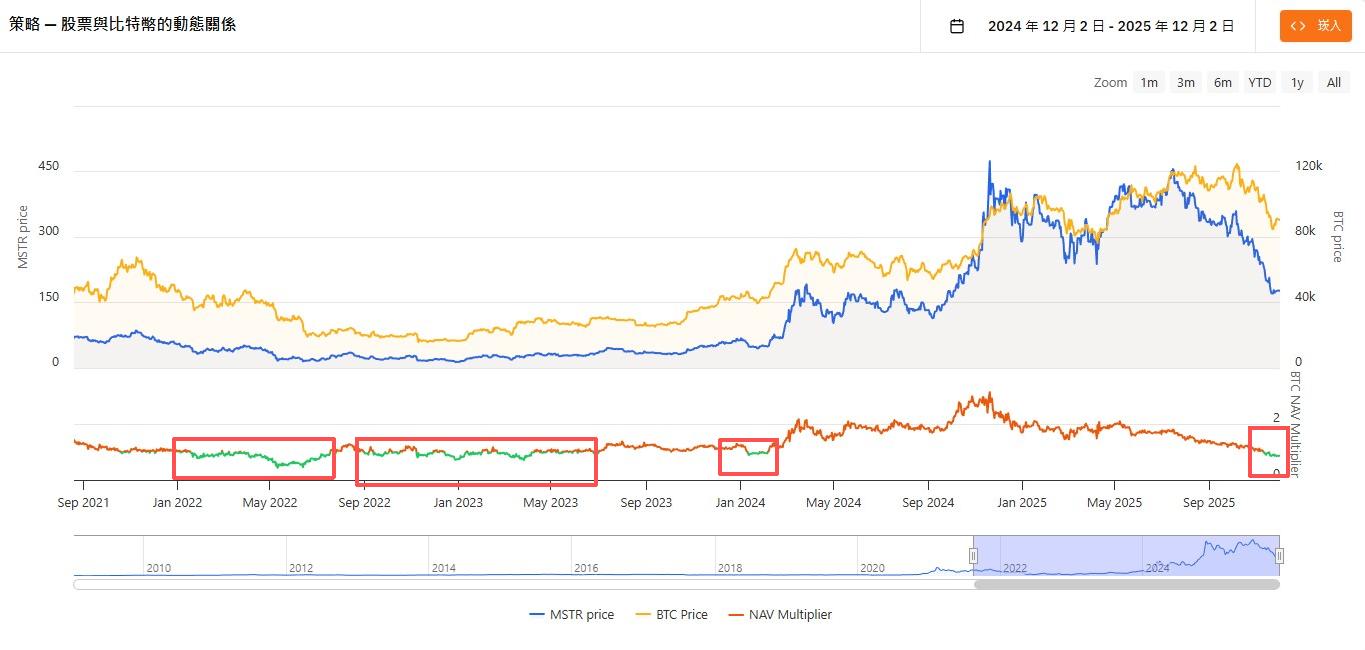

From the historical data in the second chart, we can see the dynamic relationship between MSTR's stock price (blue line), its NAV (yellow line), and the NAV Multiplier (red line) below it. Specifically, when the NAV Multiplier falls below 1.0 and enters the green zone, it indicates that MSTR's stock price is trading at a discount relative to its Bitcoin asset.

Historical Review and Strategy Analysis

The historical area marked by the red box in the chart shows that in the past few years, when MSTR's stock price fell below NAV (i.e., NAV Multiplier $\le 1$), it often foreshadowed a period of extreme market pessimism.

- 2022 to early 2023: During this period, MSTR's stock price was trading at a discount for an extended period, corresponding to the bear market downturn in the cryptocurrency market.

- Early 2024: A brief period of price discounts also occurred.

In hindsight, these historical discount points were all relatively good long-term buying opportunities, as both MSTR's stock price and Bitcoin's price subsequently rebounded significantly.

in conclusion

In summary, based on historical review:

MSTR falling below net asset value = the market believes Bitcoin is dead = a historically excellent buying opportunity.

When the market generates a negative premium for MSTR, it typically reflects investors' extreme uncertainty or pessimism about the future trend of Bitcoin.

This "discount" phenomenon presents a market opportunity for investors who firmly believe in Bitcoin's long-term upward trend. It allows investors to indirectly purchase Bitcoin at a price lower than the asset's actual value.

However, investors must also be aware of an important risk warning: market sentiment and prices may still fluctuate dramatically in the short term. Therefore, they must bear extremely high volatility risk in the short term.

In summary, the MSTR negative premium offers a potential entry point based on historical experience, but it is only suitable for investors with a long-term perspective who can tolerate short-term volatility.