The crypto market rebounded but then stalled. BTC saw a smaller decline, while ETH, BNB, and SOL experienced deeper pullbacks. ETH and BNB, in particular, rebounded precisely after hitting their second support level. Given the overnight pullback, today's focus is on the strength of the rebound, and crucially, whether it can hold above the levels I've identified.

BTC

Bitcoin's short-term resistance today is around 93,600. If it holds above this level, it may further test the 94,600-94,800 area. If the price reaches this range, consider shorting in batches. There is also resistance around 95,500, but it is expected to be difficult to reach. Currently, focus on the first two resistance levels. If it retraces, the initial target could be around 89,000.

ETH

Ethereum's short-term resistance is at 3210. If this level holds, consider shorting around 3260. The downside target is the 2935-2915 support zone. During this process, pay attention to the support/resistance level around 3030; it's advisable to partially take profit on short positions at this level to manage risk.

SOL

The Sol level is currently at 143, which is the key intraday support/resistance level. If it stabilizes, the next resistance levels are 145.5 and 148. If it falls, the first support level is around 132. If it rebounds and then falls back again, it may further test the support level around 128.

BNB

Today's key level to watch is 901. If the price can hold above 901, the 1-hour chart may see a continuation of the rebound, with resistance levels to watch at 913 (short-term resistance), 928, 939, and around 950. If the price breaks below 901, the current 1-hour rebound may have ended, and support levels to watch are around 888, 874, and 857.

Three key dates in December will dominate market trends over the next three weeks.

The first two are major news events: the Federal Reserve's decision to cut interest rates and the Bank of Japan's decision to raise interest rates. Since market expectations for both have changed, this will bring greater uncertainty.

The third point is options data: Currently, the biggest pain point for Bitcoin options is at 100,000, while the largest open interest for put options is concentrated around 84,000.

This suggests that the price of Bitcoin may struggle to hold above $100,000 in December, while there is institutional support around $84,000. The rapid rebound after Bitcoin broke below that level a few days ago is likely related to this.

If Bitcoin confirms a bottom within the predetermined range, Altcoin will then present better opportunities for participation.

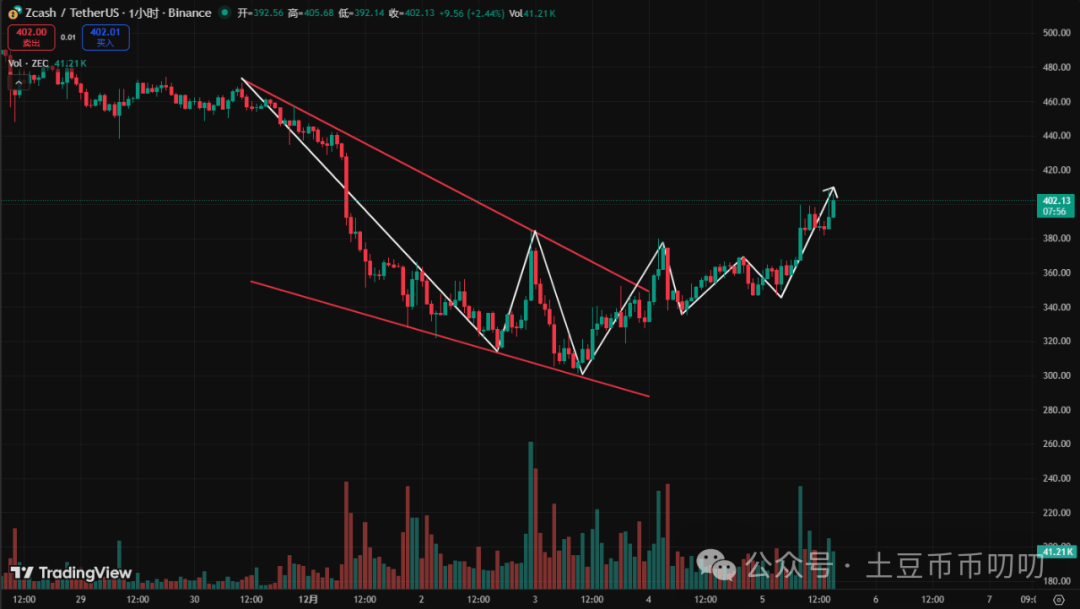

For example, mainstream altcoins such as Ethereum, Solana, and XRP, as well as ZEC and DASH in the privacy sector, have shown signs of a reversal.

In particular, ZEC has formed a multiple bottoming pattern on the 1-hour chart. If it can stabilize in the current range, it is expected to rise to $452. The overall structure of the privacy coin sector has also improved, although its performance is generally weaker than that of ZEC.

$PIEVERSE

PIEVERSE is a recently launched coin that hasn't seen a significant price surge. The project team appears to be accumulating tokens, and since it's not yet listed on spot exchanges, a price increase is highly likely. The key is its performance after listing; if it stabilizes, it will have long-term value, while a quick rise followed by a drop is only suitable for short-term trading. It's recommended to buy in batches around 0.48, or place a small position at the current price, with an initial target of over $1.

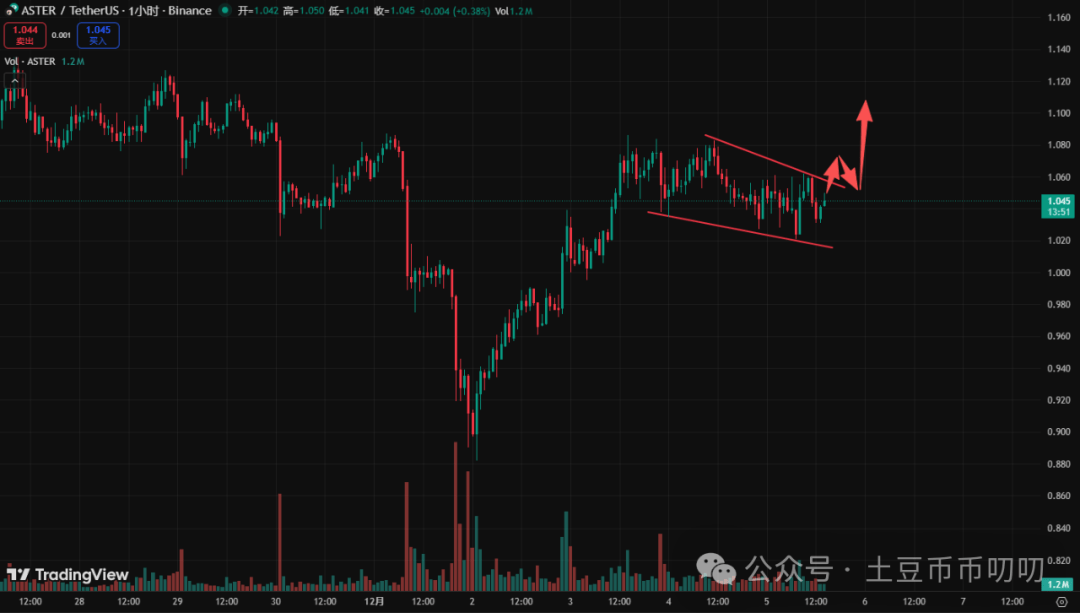

$ASTER

Aster has a short-term rebound potential, currently trading within a descending wedge pattern. This pattern can be seen as a pullback to test the support level after a breakout; the current support is strong, and a break below it is unlikely. A long is recommended near the current price of around 1.04, as a rapid upward move is possible in the short term.

$BAI

$BAI is a mainstream AI-themed meme coin on BSC (Binance AI Intern). Following the Binance Dubai conference, the market has returned to a long-term narrative. With a market capitalization of approximately $180,000, it has consolidated from its million-dollar high, highlighting its value. The project has been recommended before, and there are expectations of CZ (Cai Xing) promoting it again, making it a worthwhile investment in the AI sector.

On-chain

Recently, there have been many memes related to On-Chain meme on BSC, mainly those related to Binance and the TikTok zoo meme. The Binance concept was driven by the Dubai conference, resulting in numerous related tokens, such as the mascot $bibi, $WAGBI, $CEO Xiao He, and last night's $1, all of which were related to the conference. However, the abundance of these hot topics has led to scattered funds, making it difficult to capitalize on them immediately.

The concepts presented at these conferences often lack staying power; the hype fades quickly after the conference ends, and many projects are ignored within two or three days. Even the leading companies don't undergo a thorough shakeout, and participating when the pullback is insufficient is very low-value.

Recently, some projects in the Douyin (TikTok) zoo category have reached millions of views, such as "Little One," but they are likely to be short-lived, like the previous "Eggplant" trend. It's not advisable to simply compare them to established internet cultural symbols like "Hakimi" or "Vulgar Penguin." The two differ significantly in their depth of dissemination and influence; the former relies heavily on a single wave of popularity.

Overall, there are many hot topics surrounding BSC On-Chain Meme at present, but it is not recommended to hold it blindly. It is more suitable for short-term quick in and out and timely profit-taking.

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07

QQ: 1037184923