The news of Strategy's exclusion from the MSCI index has sent shockwaves through the entire DAT company. The power of the MSCI index, which can be as simple as numbers, is there no equivalent index in the cryptocurrency market?

Key Takeaways

In traditional finance, indices are a key criterion for determining large-scale fund flows, serving as a benchmark and the basis for various derivative products.

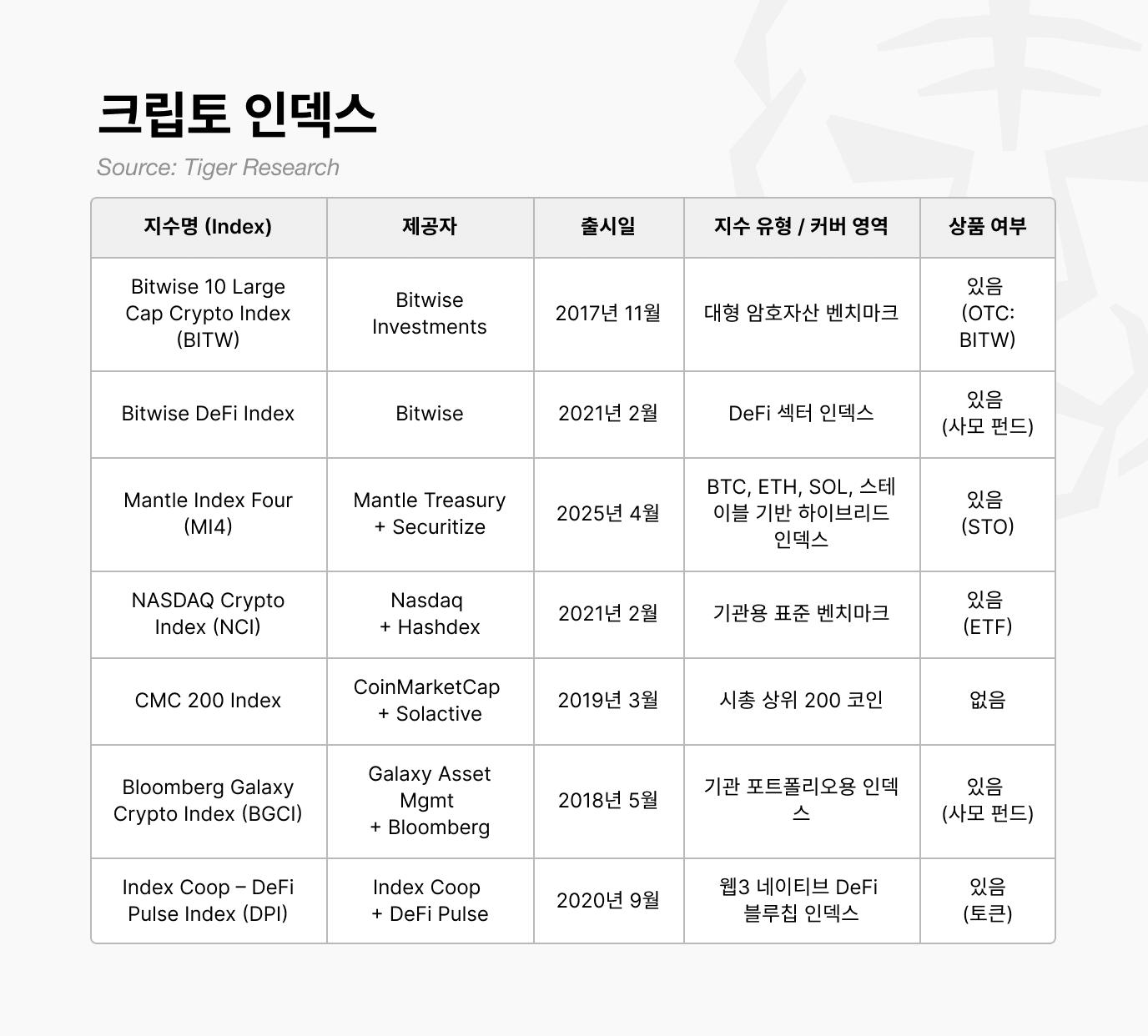

There are players that create indexes within the cryptocurrency market, such as Bitwise, Coinmarketcap, and Mantle.

Derivative products based on the index have also been launched on the market, but their use is limited due to lack of trust and distribution channels.

1. Why a cryptocurrency index now?

In traditional finance, indices like the S&P 500, MSCI, and Nasdaq 100 are more than mere reference numbers. They serve as the foundation for numerous financial products, including ETFs, and are key benchmarks for determining where trillions of dollars in passive funds will move.

The importance of these indices also impacts the cryptocurrency industry. Last October, MSCI proposed excluding companies with digital asset holdings exceeding 50% of their total assets from the MSCI Global Investable Markets Index. Furthermore, JP Morgan's support for this statement fueled widespread market fears about Bitcoin and DAT companies.

If the strategy is actually removed from the MSCI index, the situation becomes more dire. Funds tracking the MSCI index would be required by regulation to sell the stocks. This could lead to massive capital outflows.

Ultimately, this controversy proves that "indexes," which seem like mere numbers, have such a powerful influence that they can even influence the price of cryptocurrency markets.

Be the first to discover insights from the Asian Web3 market, read by over 21,000 Web3 market leaders.

2. Traditional financial indices and products

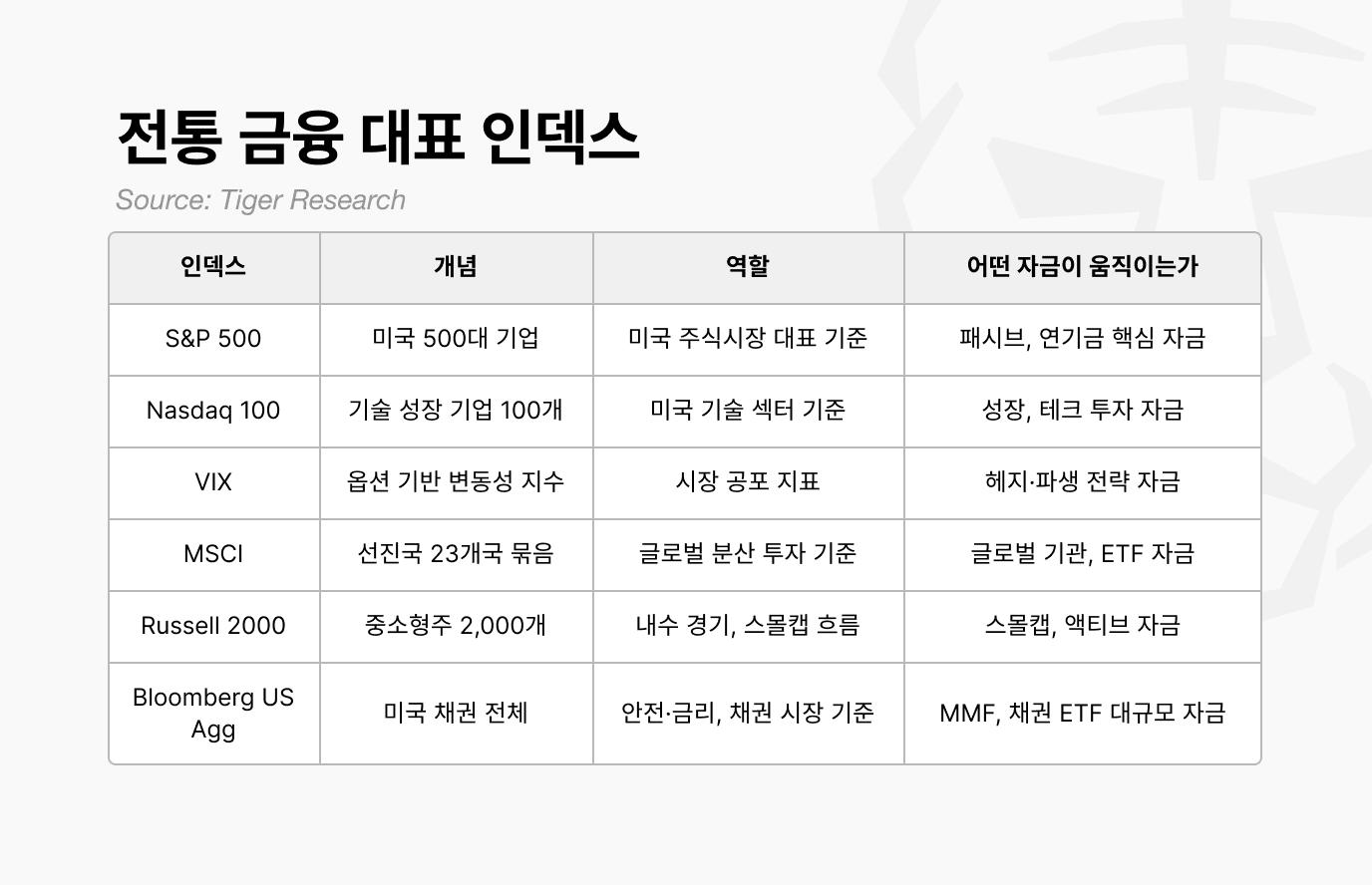

In the financial market, an index is a numerical statistical indicator that provides a snapshot of the movements of the entire market or a specific sector. Traditional finance has already established a standardized set of representative indices. The table below lists the major indices commonly used by institutional investors worldwide.

Investors adjust their fund allocations based on the movements of these indices and determine the direction in which the market is moving. In other words, indices are not simply numbers; they serve as benchmarks for determining how to interpret the overall market during the actual investment process.

For example, a rise in the S&P 500 is interpreted as a general strength in large-cap U.S. stocks, while a decline reflects a risk-averse sentiment across the market. The Nasdaq index can be used to more quickly gauge trends in the technology sector than individual stocks.

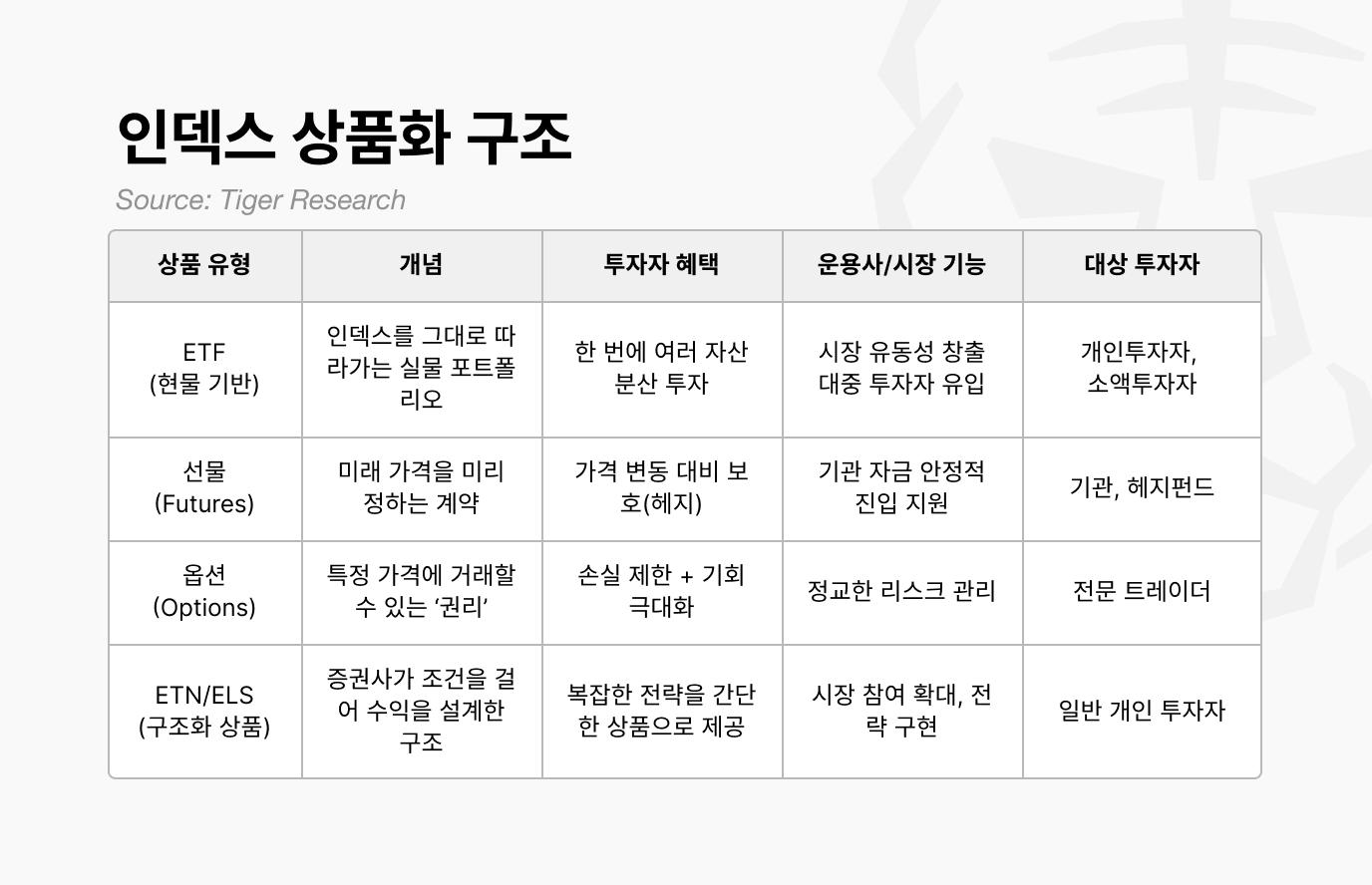

Traditional finance fundamentally transformed the market when it commercialized indexes. While indexes were originally mere data, financial institutions built on them to create structured products like ETFs, futures, and options. Since the advent of these products, indexes have gone beyond simple indicators to become crucial benchmarks, driving massive capital flows.

Moreover, what's important for investors is that index inclusion can actually trigger buying, driving up the stock price. Indeed, Tesla's stock price soared immediately after the S&P 500 inclusion announcement. This was because S&P 500-tracking ETFs and passive funds worldwide were required to include Tesla in their portfolios. This demand, concentrated over a single day, led to a kind of structural buying spree, resulting in a surge in Tesla's stock price. This wasn't due to a sudden improvement in Tesla's fundamentals. Rather, the decision to include Tesla in the index forced a massive inflow of funds.

Cryptocurrency market players are also striving to create indexes with similar power. While currently focused on single stocks, as the market matures, these indices could gain greater traction and play a leading role in driving the market, similar to the aforementioned inclusion in the MSCI and S&P 500 indexes.

The Bitcoin Investment Trust W (BITW) is a large-cap asset index comprised of the ten largest cryptocurrencies by market capitalization worldwide. Recent figures show Bitcoin accounting for approximately 74% of the index, followed by Ethereum at approximately 15%, representing nearly 90% of the total. Following this, other cryptocurrencies, such as XRP, SOL, and ADA, are included based on market capitalization.

This weighting is rebalanced monthly, with coins with significantly increased market capitalization being included, and those with declining market capitalization being automatically excluded. It can be understood as an indicator that only reflects market direction, focusing on large-cap coins. BITW is the closest structure to the S&P 500 large-cap index in the cryptocurrency market.

The Bitwise DeFi Index is a benchmark indicator for institutional investors covering the entire DeFi market. This index doesn't simply mechanically include the top stocks by market capitalization. Instead, it divides the DeFi market into sectors and selects the stocks that best represent each sector.

Of particular note is its thorough risk management. It goes beyond simply looking at numerical data like total value locked (TVL). Potential risks, such as projects with a history of hacking or anonymous developers, are preemptively screened. Furthermore, even verified projects undergo regular "rebalancing." This allows them to flexibly respond to the rapidly changing DeFi market environment, making it the most accurate indicator of overall DeFi market trends.

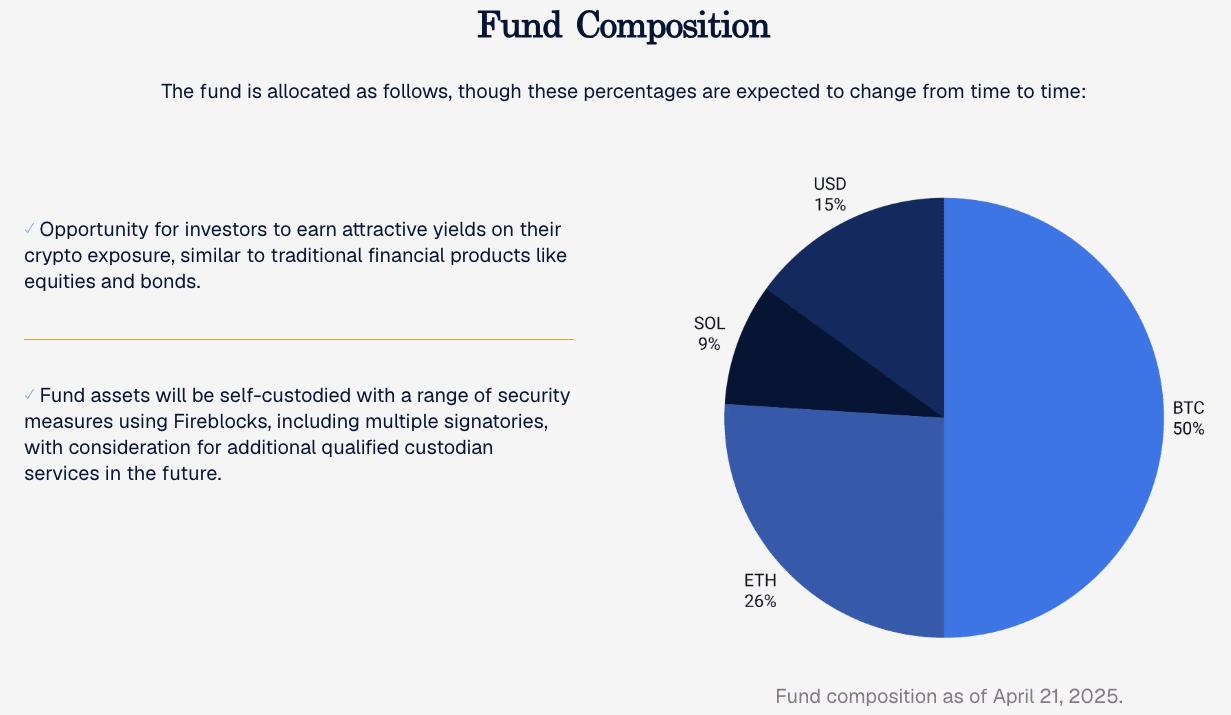

MI4 is an index built on the Mantle ecosystem, comprised of BTC, ETH, SOL, and a stable pool. BTC and ETH serve as core underlying assets, SOL provides exposure to growth sectors, and the stable pool acts as a buffer to reduce volatility.

A key feature of this index is that its weighting is determined not simply by market capitalization, but by considering on-chain returns, liquidity, and volatility. Furthermore, MI4 launched the fund in the form of a security token offering (STO) through Securitize, designed to be accessible to institutional investors within a regulated structure.

MI4 differs from existing products in several ways. While Bitwise exists in the traditional stock market (Fund) and DPI in the digital asset market (Token), MI4 is differentiated by its combination of the two: it is issued as a Security Token Offering (STO) and distributed through the RWA platform (Securitize).

MI4 is a hybrid index that combines the stable index structure of traditional finance with the real-time return structure of on-chain. Unlike other indices, it is a product that reflects the L2 ecosystem and on-chain financial flows.

The CMC200 is a broad-based index that includes the top 200 cryptocurrencies by market capitalization . While the top 10 are nearly identical to the BITW, the sub-index is more comprehensive. It combines large-cap, mid-cap, and small-cap stocks into a single basket. For this reason, it's widely used not just as a simple market representative index, but also to gauge the overall market temperature (risk on/off).

Furthermore, weighting caps are in place to prevent overweighting of Bitcoin and Ethereum. Projects with rapid growth are automatically included after monthly verification by Solactive, a German index provider, while those that decline are automatically excluded. The CMC 200 is an index equivalent to the MSCI ACWI (All World Stocks) in traditional markets.

Unlike Bitwise, DPI is a native cryptocurrency index that selects only core DeFi protocols. Its scope is much narrower, focusing on 10-15 core protocols rather than encompassing the entire DeFi landscape.

The selection criteria follow DeFi Pulse's on-chain evaluation framework. DeFi Pulse evaluates protocols not only by market capitalization but also by integrating TVL (value locked), trading volume (actual usage), and protocol activity (number of transactions and number of users) to determine the actual usage of the protocol. Projects with the highest scores are considered candidates for Decentralized Platform Initiative (DPI).

Afterwards, the Index Coop community and experts will verify on-chain data, further checking token distribution structure, governance risks, and security incident history, and discuss final configuration changes. This is a completely different operating method from Bitwise, which utilizes a traditional financial committee review structure.

DPI is a tokenized index that can be purchased directly on-chain. While Bitwise typically accesses ETFs and funds in traditional finance, DPI can be swapped directly from a wallet or combined with liquidity pools for on-chain strategies. DPI is an index product targeted more at cryptocurrency DeFi users than institutions.

To be frank, the cryptocurrency index market is still in its infancy. In reality, very few investors use these indices as investment benchmarks. Furthermore, financial products based on these indices are difficult for ordinary investors to access.

The biggest reason is the absolute lack of ‘market-proven assets.’

Take the stock market, for example. Few people question whether a company included in the MSCI index is a good company. However, the cryptocurrency market is different. Even among experts, opinions differ on the value of coins ranked in the top 50 or 100 by market capitalization.

Due to this uncertainty, investors continue to rely solely on the movements of these two assets—Bitcoin and Ethereum—as their sole benchmarks. This means they lack confidence in the index itself.

Their appeal as an investment product remains low. Even if you're considering investing in index funds, the approach is challenging. Furthermore, in a market where investors often believe that "coin investing is a jackpot," the returns of index products, which pursue stable returns, can be somewhat disappointing.

Ultimately, all of these limitations can only be resolved as the cryptocurrency market itself matures.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.