With the interest rate cut on the 10th drawing closer, the market may surge again in the next few days due to expectations. At that time, short positions can be initiated with a small position size at key levels. Short-term trading is still recommended to focus on buying on dips, as the interest rate cut is a tangible positive factor. However, if even the high point of the 4th cannot be broken, it indicates a weak rebound, and short positions can be attempted with a small position size at a minor top. A rally has already occurred overnight; today, it is recommended to wait for a pullback before going long.

Today's hot opportunities:

1. Federal Reserve interest rate decision: to be announced at 3 a.m. this Thursday. The market expects a 25 basis point rate cut, which is the highlight of the week.

2. Stable Mainnet Launch: The mainnet has been launched, and the token $STABLE will be listed tonight at 9 PM. Currently, it is not supported by any major exchanges.

3. BSC Chain Meme Craze: Over the weekend, meme coins such as $DOYR on BSC surged, and a Binance employee's insider coin issuance scandal broke, making the event quite a spectacle.

4. HumidiFi Public Sale: The new tokens will be available for public sale starting tonight at 11 PM.

5. Jensen Huang on Bitcoin: Nvidia CEO says Bitcoin turns idle energy into "portable currency" that can be taken anywhere in the world.

6. Last week, US Bitcoin spot ETFs saw a net outflow of $87.7 million, and Ethereum spot ETFs saw a net outflow of $65.4 million.

7. The exchange's $LUNC, $LUNA, and $USTC suddenly surged, and market rumors suggest that this may be due to the possibility of SBF being granted a special pardon.

BTC

Bitcoin initially fell last Friday before consolidating and rebounding over the weekend. The previous upward move had shown signs of technical weakness, including a MACD bearish divergence and insufficient volume, and the FVG gap remained unfilled. A pullback to the 87,000-89,000 range was highly probable, and this proved true. The precise filling of this range provided an excellent buying opportunity. If the market continues to rise, positions established in this area will form the core basis for future profits.

However, the key short-term level is 90230. If the pullback doesn't break this level, the short-term trend is bullish, with upward resistance levels at 91660 (minor resistance), 92680, 94150, and 96000. If it breaks below 90230, a pullback may begin on the 1-2 hour timeframe, with support levels at 88900 (minor support), 87700, 86230, and 84000.

ETH

Ethereum's daily chart structure is clear, with 3075 as a key support level (stop-loss swap point). A previous break below this level was a false signal, followed by a pullback to fill the FVG gap along with BTC. Currently, it's holding above the EMA filter line and showing continued strength, with the major target pointing towards the 3300-3400 gap and the 30-day moving average confluence zone. (If BTC breaks through this level, ETH's rebound could be even stronger).

We suggest paying attention to the 3075 level. If it retraces but doesn't break through, the short-term trend is bullish, with upward resistance levels at 3150, 3193, and 3240. If it breaks below 3075, a 1-2 hourly pullback may begin, with support levels at 3040 (minor support), 2980, 2915, and 2867.

Copycat

The stocks $SEI and $SUI are still somewhat popular in the market recently, but Alpha has been largely absent, possibly marking the longest period of illiquidity. The project team has also stated that there is absolutely no liquidity. Coupled with the collapse of that local financial institution, it feels like a turbulent time, and there will likely be many chain reactions in the future.

$FIS, $REI, $VOXEL

These three delisted coins have pumped the price. If you're brave enough, buy and sell quickly to make a quick profit! I mentioned before that these kinds of coins are only suitable for short-term trading. When I gave my advice, it was basically at the bottom, and those who followed made money. However, delisted coins are extremely risky. Don't blame me if you get stuck with losses and go to zero. If you make money, monitor the market and exit the trade yourself. If you're not in the group, learn to make your own judgments!

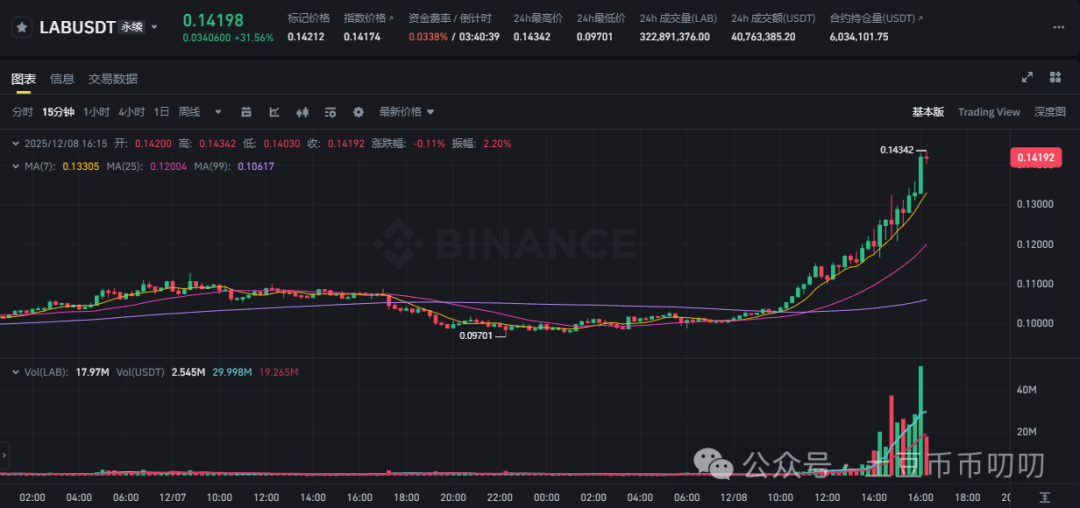

$LAB

This type of LAB is a typical example of a "sand coin" that only lists contracts and doesn't build an ecosystem. Therefore, it experiences a sudden surge upon listing, clearly indicating heavy manipulation by large investors, despite its low market capitalization. The outcome is almost always the same: a pump to attract retail investors, followed by a sharp drop to the bottom – extremely treacherous and untouchable.

$FARTCOIN

You can keep an eye on Fartcoin and consider long when the price falls back to the 0.38-0.36 range, with a stop loss set at 0.342; or wait for a breakout above 0.42 and confirmation on the right side before entering a long position, with an upside target of 0.55.

$ZEC

Instead of continuing to fall, ZEC rebounded again, and it seems likely to retest the resistance level of 420. It may rebound to the target level when the 20-day moving average drops to around 420.

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (a stock trading platform) or contact them via QQ: 1037184923.