Bitcoin, gold and silver saw a surprise surge in price on Tuesday, ahead of an expected rate cut from the Fed.

Bitcoin – the pioneering cryptocurrency – along with the two safe havens of gold and silver, are likely to experience significant volatility surrounding the Fed's interest rate decision, especially as the price of XAG (silver) has just broken the $60/oz mark for the first time in history, rising +108% in 2025.

Top price targets for BTC, XAU, and XAG before the Fed cuts interest rates.

All eyes are on the Fed's interest rate decision tomorrow and Jerome Powell's subsequent press conference. This is XEM one of the most important macroeconomic events for Bitcoin and safe-haven assets like gold this week.

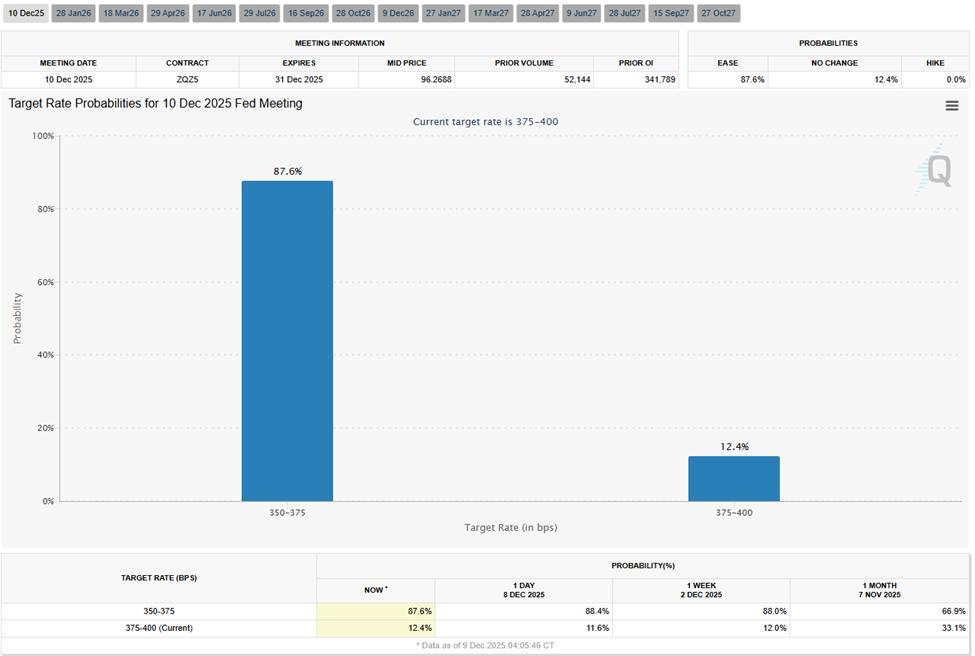

Data from the CME FedWatch Tool shows that investors predict an 87.6% chance that the Fed will cut interest rates.

Forecast of potential interest rate cuts. Source: CME FedWatch Tool

Forecast of potential interest rate cuts. Source: CME FedWatch ToolThe Fed's interest rate cuts typically create a favorable environment for Bitcoin because they inject more liquidation into financial markets. Gold is usually the asset that benefits most clearly and quickly whenever interest rates fall, while silver tends to react more slowly than gold, but if the market rises sharply, silver can then experience a significant surge. That's why silver often experiences strong price increases when the upward momentum has accumulated enough after interest rate cuts.

- Gold always reacts the earliest and most predictably to interest rates.

- Bitcoin benefits from increased market liquidity.

- Silver is often the "final sprint champion" in the later stages of an uptrend.

However, based on current price movements, the market seems to have already reflected this scenario, as traders are quickly “anticipating” the decision to cut interest rates with the possibility of it happening almost certainly.

Bitcoin heads towards $100,000 ahead of Fed rate decision

Bitcoin's price is trending upwards, consolidating within an upward parallel channel since Dip of $80,600 on November 21st. As long as the price remains within this technical pattern, the potential for further gains remains intact.

Based on the Relative Strength Index (RSI) indicator, buying momentum is strengthening and could push BTC higher. The RSI is above 50, indicating overwhelming buying power, but there is still a risk of a reversal as this is also a “tug of war” area between buyers and sellers.

Bitcoin is currently facing the closest resistance at the 50-day Exponential Moving Average (EMA) at $97,015, which is a barrier before the price can approach the most important Fibonacci level of 61.8% at $98,018.

If this area breaks through with overwhelming buying volume, it will be a good time for new bulls to enter the market. Bitcoin could then continue its upward trajectory towards the $103,399 target at the middle of the 50% Fibonacci retracement level.

In case the market is extremely excited, BTC is likely to touch the strong resistance zone – the 38.2% Fibonacci level, indicating a strong bullish trend.

Bitcoin (BTC) price performance. Source: TradingView

Bitcoin (BTC) price performance. Source: TradingViewConversely, if the 61.8% Fibonacci level remains a strong resistance, this could lead to a bearish reversal.

If the sellers are aggressive at this price zone, the 78.6% Fibonacci support zone could be broken, causing BTC to fall out of the ascending parallel channel.

This scenario could pull Bitcoin price back to the $80,600 support zone, a decrease of about 15% compared to the present.

Gold may be in a classic accumulation phase A.

Gold could fall to the $4,199 Dip and even break the rising support line before reversing higher. The RSI indicator shows that the bullish momentum is weakening, so XAU faces the risk of a correction.

However, with RSI still above 50 and strong support from the 50- and 100-day EMAs at $4,202 and $4,203, gold prices could still rise further if they hold these levels.

The key support zone for gold is between $4,178 and $4,192. If the price holds above this zone, the bullish structure will be maintained.

Conversely, a key resistance level lies at $4,241; if this level is breached, the price of gold could rise even more sharply.

If buying pressure prevails, the next targets could be $4,260, or if the market is optimistic, gold prices could easily reach $4,300 before potentially challenging the all-time high of $4,381.

Gold (XAU) price performance. Source: TradingView

Gold (XAU) price performance. Source: TradingViewThus, the current price range can be considered a good buying position for small investors who want to participate late – each correction can be an opportunity for bulls to collect goods.

The price of silver has increased sixfold relative to the S&P 500 YTD.

Silver prices are currently enjoying one of the strongest rallies in stock market history, up six times the YTD gain of the S&P 500. XAG/USD is now on track for its biggest 12-month gain since 1979.

After setting a new historical peak at $60,794, silver prices have entered a phase of finding new levels, with the possibility of further growth.

On the 15-minute timeframe below, the XAG/USD price clearly shows a very strong breakout continuing the uptrend. The price of silver has surpassed the old resistance zone around $58.83 and is accelerating to explore new price levels, confirming the shift from a consolidation phase to an extension of the trend.

All important EMAs (50/100/200) are currently stacked bullish and continue to move up, giving strong signals about the current short-term trend.

Silver price performance (XAG). Source: TradingView

Silver price performance (XAG). Source: TradingViewThe bullish momentum is strengthening, as shown by the RSI above 73, reflecting strong buying pressure. However, the current RSI position also suggests that the market is showing signs of overheating in the short term and there may be a slight correction or consolidation before continuing to rise.

Structurally, the former resistance zone from $58.80 to $59.00 now becomes the first support, while the next psychological and technical target will be around $61.00–$61.50.

As long as the price of silver remains above the rising 50-EMA (red line), the main trend is to favor buying on dips; only a sustained drop below $59.00 will the downside risk truly increase.