Deng Tong, Jinse Finance

On December 9, 2025, Circle announced that it had obtained a financial services license from the Abu Dhabi Global Markets Financial Services Regulatory Authority, authorizing it to operate as a money service provider in the Abu Dhabi International Financial Centre. Besides Circle, other crypto companies such as Binance, Tether, Ripple, and Animoca Brands have also achieved regulatory success in Abu Dhabi.

Where is Abu Dhabi? Which crypto companies have obtained licenses in Abu Dhabi? Why has Abu Dhabi become the crypto capital?

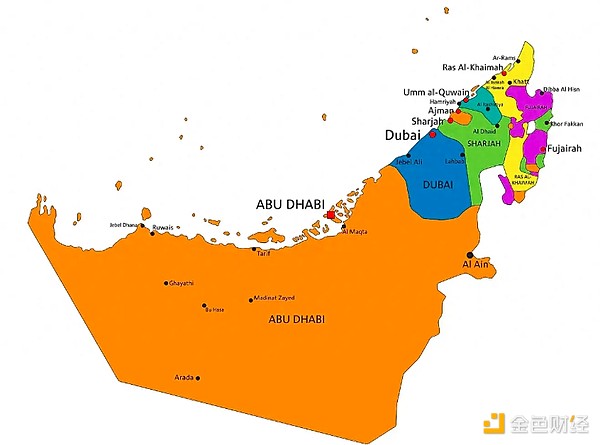

1. Where is Abu Dhabi?

Abu Dhabi is the capital of the United Arab Emirates, the second largest city in the UAE, and the capital of the Emirate of Abu Dhabi. Located on a T-shaped island in the Persian Gulf, on the west-central coast of the UAE, Abu Dhabi is closer to the west coast than most other cities and emirates, which reside on the mainland connected to the rest of the country.

Abu Dhabi means "the place of antelopes" in Arabic. The region has a typical desert climate with little annual rainfall and summer temperatures reaching 50°C. Founded in 1761, the city's early inhabitants relied on pearl harvesting for their livelihood; the current population is predominantly from the Assi Arab tribe (the current UAE president is from this tribe). Oil resource development in the 1960s spurred economic transformation, and Abu Dhabi now boasts the fifth largest oil reserves in the world. Abu Dhabi has transformed from a desert into a modern metropolis and is now the political, industrial, cultural, and commercial center of the UAE.

On May 1, 2013, Sheikh Khalifa bin Zayed Al Nahyan, President of the United Arab Emirates, issued a decree in his capacity as Emir of Abu Dhabi to create a financial free trade zone on Maria Island in the capital, Abu Dhabi. This financial free trade zone, named the "Abu Dhabi Global Market" (ADGM), allows businesses to engage in activities including banking and financial services, commercial investment and investment banking, securities trading and sales, insurance, and banking advisory services.

II. Which crypto companies obtained licenses in Abu Dhabi in 2025?

Circle

On December 9, 2025, stablecoin issuer Circle announced that it had received a Financial Services License (FSP) from the Abu Dhabi Global Markets Financial Services Regulatory Authority, authorizing it to operate as a money service provider in the Abu Dhabi International Financial Centre (IFC). In addition, Circle appointed Dr. Saeeda Jaffar as Managing Director for Circle Middle East and Africa. Jaffar will join Circle from Visa, where she served as Senior Vice President and Group Country Manager for the Gulf Cooperation Council. She will lead Circle's regional strategy, deepen partnerships with financial institutions and enterprises, and drive the accelerated adoption of the company's digital dollar and on-chain payment solutions in the UAE and the wider Middle East and African markets.

Tether

On December 8, 2025, Tether's stablecoin USDT was officially recognized as a "fiat-pegged token" in the Abu Dhabi Global Market, allowing licensed institutions to provide regulated custody and trading services. This marks a significant step forward in the UAE's stablecoin regulation. Tether CEO Paolo Ardoino stated that this recognition "reinforces the status of stablecoins as an important component of today's financial landscape," indicating the growing prevalence of stablecoins in remittances, cross-border settlements, and the digital asset market.

Binance

On December 8, 2025, Binance announced that it had obtained full regulatory approval from the Abu Dhabi Global Markets (ADGM) Financial Services Regulatory Authority (FSRA), and its global platform would officially operate under ADGM's international regulatory framework. In accordance with regulatory requirements, platform operations will migrate to a new three-entity structure to enhance transparency, oversight mechanisms, and risk management. From January 6, 2026, Binance services will be operated by three ADGM-licensed entities: Nest Exchange Services Limited: responsible for platform operations including spot and derivatives trading; Nest Clearing and Custody Limited: responsible for clearing and custody, acting as a central counterparty for derivatives trading; and Nest Trading Limited: providing over-the-counter trading, instant swaps, and some wealth management services.

Ripple

On November 27, 2025, Ripple announced that its US dollar-backed stablecoin Ripple USD (RLUSD) has been recognized by the Abu Dhabi Financial Services Regulatory Authority (FSRA) as an “approved fiat-pegged token” and can be used in the Abu Dhabi Global Market, an international financial center in Abu Dhabi, the capital of the United Arab Emirates (UAE).

Animoca Brands

On November 24, 2025, Animoca Brands announced that it had received in-principle approval from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Markets (ADGM), the international financial center in Abu Dhabi, UAE, to operate as a regulated fund management company. Upon fulfilling relevant conditions and obtaining final regulatory approval, Animoca Brands will be authorized to conduct collective investment fund management activities within or from ADGM.

GFO-X

On September 6, 2025, GFO-X Group, a cryptocurrency derivatives trading platform, received in-principle approval from Abu Dhabi Global Market (ADGM) to launch a digital asset exchange and clearinghouse, with plans to officially commence operations in 2026. This approval allows GFO-X to operate as an accredited investment exchange and clearinghouse.

Bitcoin Suisse

On May 21, 2025, Swiss cryptocurrency financial services provider Bitcoin Suisse announced that its subsidiary, BTCS (Middle East) Ltd., had received In-Principle Approval (IPA) from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Markets (ADGM). The IPA granted by the FSRA lays the foundation for Bitcoin Suisse to obtain a full license, enabling it to offer regulated crypto financial services, including virtual asset, crypto securities and derivatives trading, and local custody, in the vibrant international financial center of Abu Dhabi Global Markets.

III. Why has Abu Dhabi become the crypto capital?

1. Increasingly完善的监管政策

The fundamental reason why Abu Dhabi has become a darling of crypto companies lies in its well-developed crypto regulatory policies.

On June 25, 2018, Abu Dhabi Global Markets (ADGM) launched a new regulatory framework for crypto assets (the "Crypto Asset Activities Regulatory Guidelines"), aimed at strengthening the governance, oversight, and transparency of crypto asset activities. This framework covers crypto asset trading activities conducted by exchanges, custodians, and other intermediaries within ADGM. The framework addresses various risks associated with crypto asset activities, including money laundering and financial crime risks, consumer protection, technology governance, custody, and trading operations.

On May 14, 2019, the Abu Dhabi Global Markets Financial Services Regulatory Authority (FSRA) revised its Regulatory Guidelines for Crypto-Asset Activities. The updated guidelines reinforce the FSRA's focus and commitment as a financial services regulator to supporting innovation and maintaining stringent regulatory practices.

Some details are as follows:

Stablecoins/Fiat Tokens: Stablecoins (fiat tokens) fully backed by fiat currency will be considered a digital representation of money. If used as a payment instrument for remittance activities as defined in the Abu Dhabi Global Markets (ADGM) 2015 Financial Services and Markets Regulations (FSMR), the activity will be licensed and regulated as "providing money services." The guidance also outlines the Financial Services Regulatory Authority's (FSRA) regulatory approach to issuers, custodians, and exchanges using fiat tokens.

Custody: Further clarify the types of crypto asset custody activities that can be carried out, and clarify the FSRA's expectations for custody governance and operations.

Technical Governance: Further improvements and clarifications have been introduced, including improvements and clarifications related to forks resulting from changes to the underlying protocols of crypto assets, as well as expectations regarding governance and control for crypto asset exchanges and licensees.

FSRA Anti-Money Laundering and Sanctions Rules and Guidance (AML): As the Anti-Money Laundering Rulebook is fully applicable to the regulated activities of crypto asset operators/holders, the guidance has been updated to reflect the latest local and global changes and further clarifies the use of new regulatory and monitoring technologies in this area.

In late 2022, the Abu Dhabi Global Markets Financial Services Regulatory Authority (FSRA) launched a new regulatory framework for the issuance of fiat reference tokens (FRTs), which came into effect on December 5, 2022. This framework established FRT issuance as a new, independent regulatory activity, reducing the regulatory burden on FRT issuers while improving financial stability and investor protection. Furthermore, the FSRA initiated a consultation (Consultation Paper No. 11 of 2024) proposing a series of revisions to the FSRA's digital asset regulatory framework, reflecting the region's regulators' growing focus on the digital asset sector.

On November 2, 2023, Abu Dhabi officially launched the world's first regulatory framework for DLT foundations. The ADGM introduced the "Distributed Ledger Technology Foundation Ordinance 2023," providing a path for blockchain projects and decentralized autonomous organizations (DAOs) to register as legitimate entities, supporting these entities in carrying out token issuance and other related activities, while clarifying regulatory requirements for governance and transparency, and helping Web3 entities develop in compliance.

On June 10, 2025, the Abu Dhabi Global Markets Financial Services Authority (ADGM) announced revisions to its digital asset regulatory framework, effective immediately. The revisions focus on modifying the process for Abu Dhabi Global Markets (ADGM) to accept virtual assets (VAs) and use them as recognized virtual assets (AVAs), and setting corresponding capital requirements and fees for authorized persons (virtual asset companies) engaged in regulated activities related to virtual assets. The revisions also introduce specific product intervention rights for virtual assets and establish rules to affirm existing practices prohibiting the use of privacy tokens and algorithmic stablecoins within ADGM. Finally, the revisions expand the investment scope of venture capital funds.

Abu Dhabi, and indeed the UAE as a whole, has become a significant player in the emerging stablecoin and digital asset market thanks to its relatively clear regulatory framework. The region itself is a global business hub. The Abu Dhabi Global Market has become a central venue for exchanges, custodians, and other cryptocurrency-related businesses seeking structured regulation to obtain licenses.

2. A tax haven for cryptocurrencies

Furthermore, Abu Dhabi is a tax haven for individual crypto professionals. Individuals can trade, stake, mine, or sell cryptocurrencies without paying any taxes. Abu Dhabi does not levy personal income tax or capital gains tax on digital assets. For crypto businesses, ADGM has implemented a 50-year tax exemption policy since 2004. Crypto companies within the zone are exempt from profit, capital, and asset-related taxes, employee income is exempt from personal income tax, and 100% foreign ownership is permitted with no restrictions on capital repatriation. In 2023, the UAE introduced a 9% federal corporate tax, which is exempt for crypto companies with annual taxable income ≤ 375,000 AED (USD 100,000), significantly reducing the initial operating costs for small and medium-sized crypto startups.

3. Sovereign wealth funds are venturing into the crypto space.

Abu Dhabi has several sovereign wealth funds, including the Abu Dhabi Investment Authority (ADIA) and Mubadala Investment Company. These funds all have clear official backgrounds and have been deeply involved in the cryptocurrency field in recent years through direct investment and establishing affiliated companies.

As of June 30, 2025, Abu Dhabi's sovereign wealth fund, Mubadala Investments, held 8,726,972 shares of IBIT (BlackRock Bitcoin ETF), with a market value of approximately $534 million.

On April 29th of this year, Abu Dhabi's sovereign wealth fund ADQ, conglomerate IHC (IHC.AD), and First Abu Dhabi Bank (FAB.AD), the UAE's largest bank by assets, announced plans to launch a new stablecoin backed by the UAE dirham (the official currency of the United Arab Emirates). The three companies stated that the stablecoin will be fully regulated by the Central Bank of the UAE.

Conclusion

From desert to modern metropolis, from pearl harvesting to a crypto haven, Abu Dhabi has successfully forged a new path of development based on its oil economy: a crypto innovation capital. With its clear crypto regulatory framework, tax-free or low-tax policies, and sovereign capital participation, Abu Dhabi has attracted the attention of numerous crypto companies from around the world.

In the future, as the global crypto industry continues to develop and improve, Abu Dhabi's "crypto capital" label may become more solidified, and its regulatory experience can provide a reference model for the world.