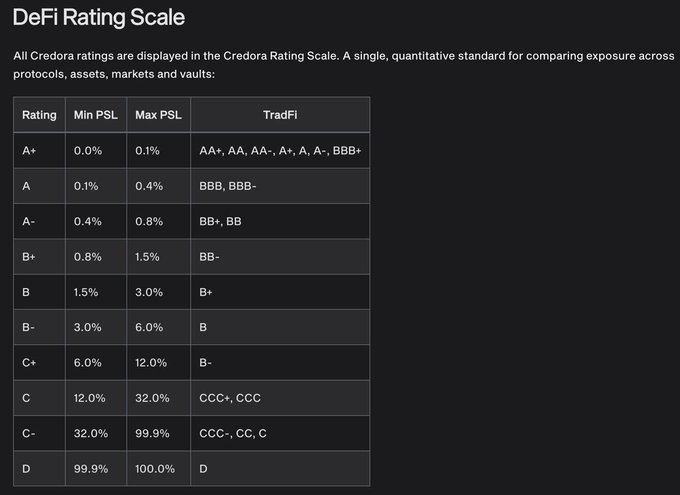

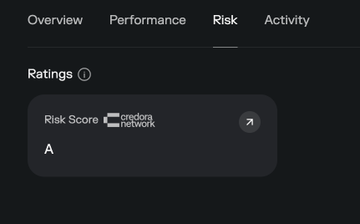

These @CredoraNetwork risk ratings have been a huge missing component for lender risk management in @Morpho-style vaults, and other risk curator-led yield platforms. If I am depositing into a vault, I tend to figure out: + What collateral pairs is my money exposed to? + How utilized are markets, in case I need to withdraw? + What's the underlying APYs? Is it all real or subsidized? But when it comes to a more holistic assessment of risk I can compare across these yields, it's embarrasing how little information I have to work with. "Oh I recognize this team, and they have a good reputation, I think? I mean wait, or is it just because i see their name on every vault?" Sometimes, my thoughts are not too far off from this. I noticed @SteakhouseFi for example was one of a few to be first in line to get a risk rating for their flagship Steakhouse USDC vault and Steakhouse USDT vaults on Ethereum. We as onchain investors need this kind of standardized scoring to be better informed about the vaults we are lending to.

Credora by RedStone

@CredoraNetwork

12-10

Credora risk ratings are now live in the @Morpho app!

According to our research, vaults with transparent risk ratings achieve significantly higher TVL retention and capital stickiness.

Intuition-based strategies are a thing of the past.

The future of DeFi is risk-aware 🧵

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share