Deng Tong, Jinse Finance

On December 10, 2025, the U.S. Commodity Futures Trading Commission (CFTC) officially granted Gemini Exchange a Designated Contract Market (DCM) license, allowing it to launch a prediction market platform called Gemini Titan, initially offering binary event contracts (yes/no questions). Gemini also stated that it may expand to derivatives such as crypto futures, options, and perpetual contracts regulated by the CFTC in the future.

I. Gemini Moves Towards Prediction Markets

Gemini first applied for a DCM license on March 10, 2020. After more than five years, Gemini finally obtained the license.

Gemini CEO Tyler Winklevoss stated, “Today’s approval marks the successful completion of a five-year licensing process and opens a new chapter for Gemini. We thank President Trump for ending the Biden administration’s crackdown on cryptocurrencies, and we thank Acting Chair Ms. Pham for her hard work and dedication in helping to realize President Trump’s vision of making the United States the world’s cryptocurrency capital. Ms. Pham’s positioning of the U.S. Commodity Futures Trading Commission (CFTC) as a regulator that supports business and innovation will put the United States at the forefront of these emerging and dynamic markets. It’s refreshing and inspiring to have a president who supports cryptocurrencies, innovation, and the United States, and a financial regulator who supports the United States.”

Winklevoss believes that "the potential of prediction markets may be as large as, or even greater than, traditional capital markets."

Gemini Titan will be entering the prediction market space, offering event contracts presented in the form of simple "yes" or "no" questions. Soon, US Gemini customers will be able to participate in prediction market event contract trading using US dollars in their accounts through the Gemini website. The ability to trade event contracts via the Gemini mobile application will also be available soon.

Looking ahead, Gemini Titan will explore expanding its derivatives offerings to US clients, including cryptocurrency futures, options, and perpetual contracts. Perpetual contracts are the most widely traded derivatives contracts in the cryptocurrency industry, having achieved tremendous success and market acceptance in Asia and other non-US regions over the past decade. Gemini Titan anticipates bringing these innovative and highly liquid contracts to the US market.

Prediction markets leverage collective intelligence and market forces to predict the future more accurately. They reward market participants for providing genuine insights and help them better prepare for the future by aggregating and disseminating more accurate information. Entering this emerging and rapidly growing field is another step by Gemini in building a one-stop financial super app for its customers.

II. What efforts has Gemini made for this license?

1. Reconciliation with the CFTC

In 2022, the CFTC filed a lawsuit against Gemini in Manhattan federal court, accusing Gemini of making "false and misleading statements" to regulators in 2017 regarding its ability to prevent Bitcoin price manipulation in order to launch the first U.S.-regulated Bitcoin futures contract. This incident can be seen as a potential obstacle in Gemini's DCM license application process.

In January of this year, Gemini proactively reached a settlement with the CFTC, paying $5 million in settlement money. Gemini's move demonstrated its willingness to cooperate with CFTC regulations and ended a key dispute related to the CFTC's licensing process, removing a major obstacle to the subsequent approval of a DCM license.

2. Emphasize compliance planning

In December 2024, Gemini obtained European Virtual Asset Service Provider (VASP) registration from the Malta Financial Services Authority (MFSA).

In May of this year, Gemini obtained an investment company license from the Malta Financial Services Authority (MFSA). Once Gemini commences business operations, it will be able to offer regulated derivatives within the EU and the European Economic Area under the Markets in Financial Instruments Directive II (MiFID II), a framework for regulating traditional financial markets. This license brings Gemini one step closer to offering derivatives to retail and institutional users in the EU and the European Economic Area.

In August, Gemini obtained a license from the Crypto Asset Markets Authority (MiCA) in Malta, supporting the company's continued expansion in Europe. Gemini stated, "This approval marks a significant milestone in our regulatory expansion in Europe, as it will enable us to extend our secure and reliable cryptocurrency offerings to clients in over 30 European countries and territories. Clear regulation of the industry is fundamental to the global adoption of cryptocurrencies, and the implementation of the MiCA demonstrates that Europe is one of the most innovative and forward-thinking regions in this regard."

Although Gemini's licenses are not from the United States, they help it establish an image of "compliant operation," which is positive for its eventual acquisition of a DCM license from the U.S. CFTC.

3. Successful IPO

In June 2025, Gemini secretly submitted a draft S-1 form to the SEC. In August, the prospectus was officially released, with "fully compliant operation" as its core selling point. It disclosed its business footprint covering more than 60 countries and regions, trading services for over 70 crypto assets, and core data on 13 million users and $50 billion in custodied assets, demonstrating its robust business scale and resilience. On September 12, Gemini went public.

After Gemini went public, the SEC's stringent regulatory framework provided "third-party endorsement" for its compliance. Specifically, as a publicly traded company, Gemini is required to publish quarterly financial reports, disclosing in detail the composition of its revenue, including transaction fees and custody fees (transaction fees account for approximately two-thirds), as well as core data such as operating costs and user growth.

III. Which other exchanges are expanding their business into prediction markets?

1. Robinhood

Back in 2024, Robinhood and Kalshi partnered to launch a prediction market service. This March, they further collaborated to launch a core entry point for trading event contracts, officially scaling their prediction project. As of November 2025, over 1 million users had traded 9 billion contracts on the project, with 2.3 billion contracts processed in the third quarter of 2025 alone. In terms of revenue, the project has brought considerable returns to Robinhood; by September, the annualized revenue from event contract products had exceeded $200 million, and is expected to reach over $300 million annualized revenue in the future.

On November 26, Reuters reported that Robinhood and Susquehanna International Group plan to acquire a company associated with the bankrupt cryptocurrency exchange FTX in order to enter the prediction market. Robinhood and Susquehanna will acquire a 90% stake in LedgerX, which remained solvent after FTX's bankruptcy in 2022. This acquisition could enable Robinhood to challenge large prediction platforms such as Kalshi and Polymarket.

Robinhood will become the “controlling partner” in this new initiative. Meanwhile, Susquehanna will act as the “first-day liquidity provider,” ensuring clients have a reliable trading partner.

Analysts believe the new agreement will give Robinhood and Susquehanna direct control over the systems needed to create and settle event contracts, and allow them to settle in their own way, especially as Wall Street, sports leagues, and cryptocurrency companies race to shape the future of regulated speculation.

Note: Strictly speaking, Robinhood is not an exchange in the traditional sense, but it is a brokerage firm that connects to multiple exchanges, so Robinhood is mentioned in this section as well.

2. Crypto.com

On December 3, sportswear company Fanatics announced a strategic partnership with Crypto.com to launch Fanatics Markets, a fan-driven prediction market platform. Similar to Polymarket and Kalshi, Fanatics Markets will allow users to trade contracts that predict the outcomes of real-world events.

Fanatics Markets will launch in two phases. Phase one, already live, covers event contracts in the sports, finance, economics, and politics sectors. Phase two will begin early next year, at which time Fanatics Markets will expand to event contracts in areas such as cryptocurrency, stocks/IPOs, climate, popular culture, technology/artificial intelligence, film, and music.

Travis McGhee, Global Head of Predictions at Crypto.com, said, “Crypto.com pioneered the sports prediction marketplace, and we continue to expand our reach through innovative partnerships with top platforms like Fanatics. We are honored to be Fanatics’ preferred partner, and together we will provide fans with a secure and compliant way to access the prediction marketplace.”

3. Coinbase

On November 13, Coinbase and Kalshi announced a partnership, allowing Coinbase to act as the custodian of Kalshi's USDC-based event contracts.

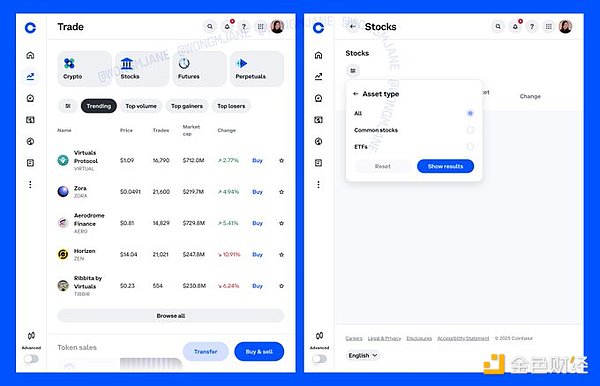

On November 19, technology researcher Jane Manchun Wong claimed to have discovered website data indicating that Coinbase is creating a prediction market platform: Coinbase may be directly integrating with Kalshi.

The leaked images show a standard prediction market interface with the Coinbase branding, seemingly allowing users to participate using USDC or USD. Other options include categories such as economics, sports, science, politics, and technology.

This means that Coinbase's event contract is likely to be: fully regulated in the United States; cash-settled; supported by Kalshi's existing approval system; integrated with Coinbase accounts and custodial wallets; and ultimately settled in USDC, which was co-founded and heavily promoted by Coinbase.

Conclusion

Gemini's acquisition of a DCM license from the CFTC and its official announcement of entering the prediction market are a microcosm of the cryptocurrency field's shift from "wild growth" to "compliant development," and also proof of the continued popularity of the prediction market sector. Gemini's five-year-long pursuit of a license has finally borne fruit, and it's only a matter of time before other crypto giants such as Coinbase enter the prediction market and grab a share of the pie.