Ethereum's long-term trend has once again become the focus after Arthur Hayes provided an overview of the asset's future for large institutions, its price potential, and its competitive position.

These Chia come as Ethereum is trading around the $3,200 mark, fluctuating between $3,060 and $3,440 throughout the past week. Several large institutions, such as Tom Lee's BitMine, have also been aggressively increasing their Ethereum holdings at a record pace.

Ethereum has become the default choice for organizations.

Hayes argues that the market still doesn't fully understand the extent to which traditional financial institutions will integrate Ethereum. According to him, after years of failed attempts at private blockchains, banks have realized the importance of a public payment layer.

"These organizations have finally understood that you can't use a private blockchain; you absolutely must use a public blockchain to ensure security and practical applications," he Chia .

He linked this shift to the stablecoin boom, which forced banks to recognize the value of blockchain-based online payments.

According to Hayes, Ethereum is currently the only platform that possesses all the security, liquidation , and strong application development community that organizations need.

He believes this shift will help Ethereum's price recover strongly in the next cycle, along with strong buying activity from companies like BitMine.

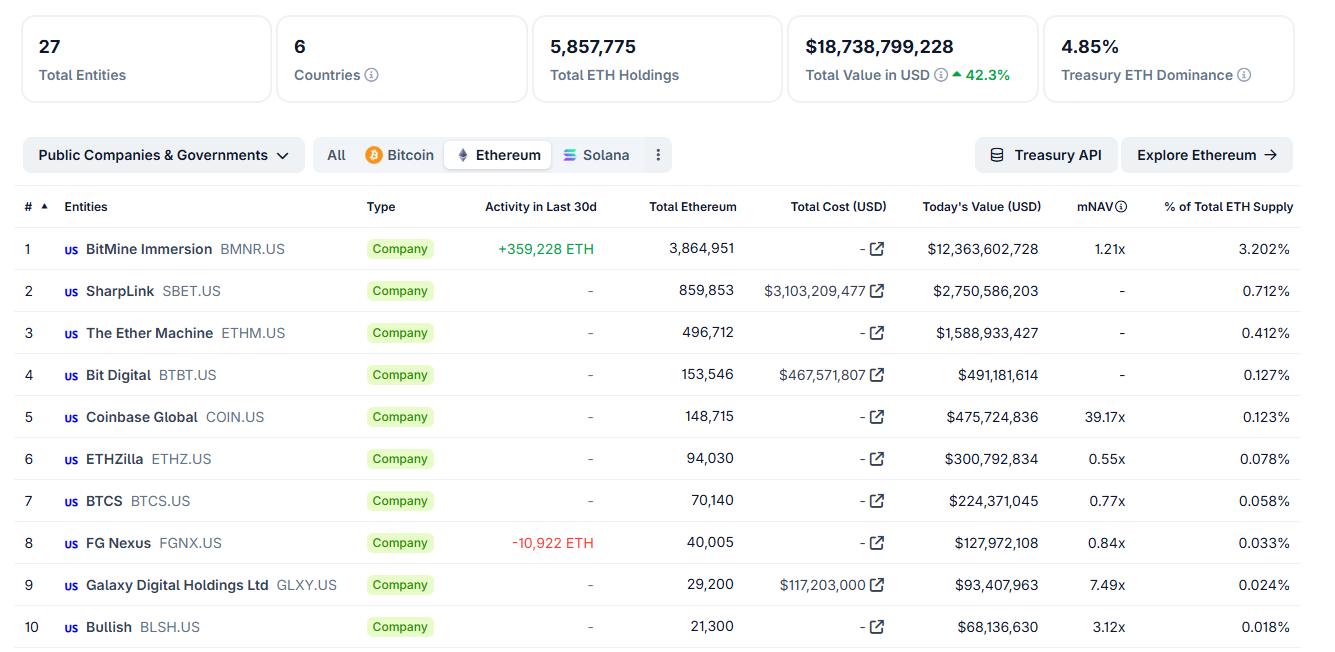

BitMine purchased 33,504 ETH ($112 million) this week and 138,452 ETH ($435 million) earlier in December, bringing their total ETH to approximately 3.86 million ETH. This large-scale institutional accumulation further reinforces the view that funds are preparing for Ethereum's next growth cycle.

Ethereum reserves hold nearly 5% of the total ETH supply. Source: CoinGecko

Ethereum reserves hold nearly 5% of the total ETH supply. Source: CoinGeckoPrivacy remains Ethereum's biggest weakness, but L2s will address this.

Hayes acknowledged that Ethereum still lacks the privacy features that large organizations need. He considered this to be Ethereum's "biggest shortcoming," although Vitalik Buterin and his team are determined to address this issue in their development roadmap.

Despite this shortcoming, he believes the process of organizations adopting ETH will not be delayed. Instead, businesses will build Layer-2 networks with integrated privacy, but still rely on Ethereum for payments and transaction confirmation.

He stated that Ethereum L1 remains a "secure platform" even though most transactions can be executed on L2 platforms like Arbitrum or Optimism.

"There may be further discussion about how fees Chia between L2 and Ethereum L1 networks," he said, but stressed that the reality remains unchanged: organizations will still choose Ethereum to ensure the security of their operations.

This aligns with current market trends. Ethereum reserves on exchanges are at multi-year lows, and whales have accumulated over 900,000 ETH in recent weeks, according to data from Santiment.

The ecosystem serving organizations is still gradually taking shape on the Ethereum platform, even as transaction fees decrease thanks to the strong development of Layer-2 technologies.

A handful of projects won: Ethereum came in first, Solana second.

Hayes predicts the future of public blockchains will revolve around a very small group. He sees Ethereum as the long-term winner, while Solana ranks second but by a considerable margin.

He stated that Solana 's price increase from $7 to $300 was due to the Meme token craze in 2023 and 2024. However, he argued that Solana "needs something new" if it wants to surpass Ethereum again.

Although he predicts Solana will remain in the spotlight, he doesn't believe it can compete with Ethereum in the long term in terms of institutional participation or price strength in the market.

Hayes assessed most other L1 blockchains as weak in their underlying structure. He dismissed high Capital blockchains like Monad, arguing that these were mostly hyped-up projects prone to plummeting after an initial period of rapid growth.

50 ETH to become a millionaire before the next election.

Hayes gave the most specific number prediction when asked how much ETH one needs to own to become a millionaire in the next cycle.

He believes Ethereum could reach $20,000, meaning that just 50 ETH would be enough to own a million-dollar portfolio.

The founder of BitMEX expects this price level to be reached before the next US presidential election. This assessment aligns with current supply trends: the amount of ETH on exchanges is decreasing, institutions are continuously accumulating more, and businesses like BitMine are still regularly buying hundreds of millions of dollars worth of ETH.

If Ethereum fails to meet these expectations, Hayes suggests the cause will be a shift in narrative and market direction.

Furthermore, if the supply of stablecoins drops sharply or institutions gradually withdraw from online trading, Bitcoin could outperform Ethereum for an extended period.

However, according to him, the current market structure still favors Ethereum's long-term dominance – especially as banks are preparing to deploy Web3 strategies on public platforms.