The Russian exchange Garantex, which was previously sanctioned, is quietly moving funds again, according to an on- chain payment architecture recently discovered by blockchain analytics firm Global Ledger.

Legal evidence shows that individuals in Russia successfully rebuilt the payment system, despite efforts by law enforcement to stop them.

Garantex secretly transferred millions of USD.

A recent investigation by Global Ledger revealed that Garantex, a Russian crypto exchange that was previously sanctioned by the West and had its servers seized, is still quietly transferring large sums of money.

Researchers have discovered several bitcoin and ethereum wallets linked to Garantex, holding a total of over $34 million in cryptocurrencies. At least $25 million of this has been returned to former users. These indications suggest the exchange's operations continued despite international pressure to shut it down.

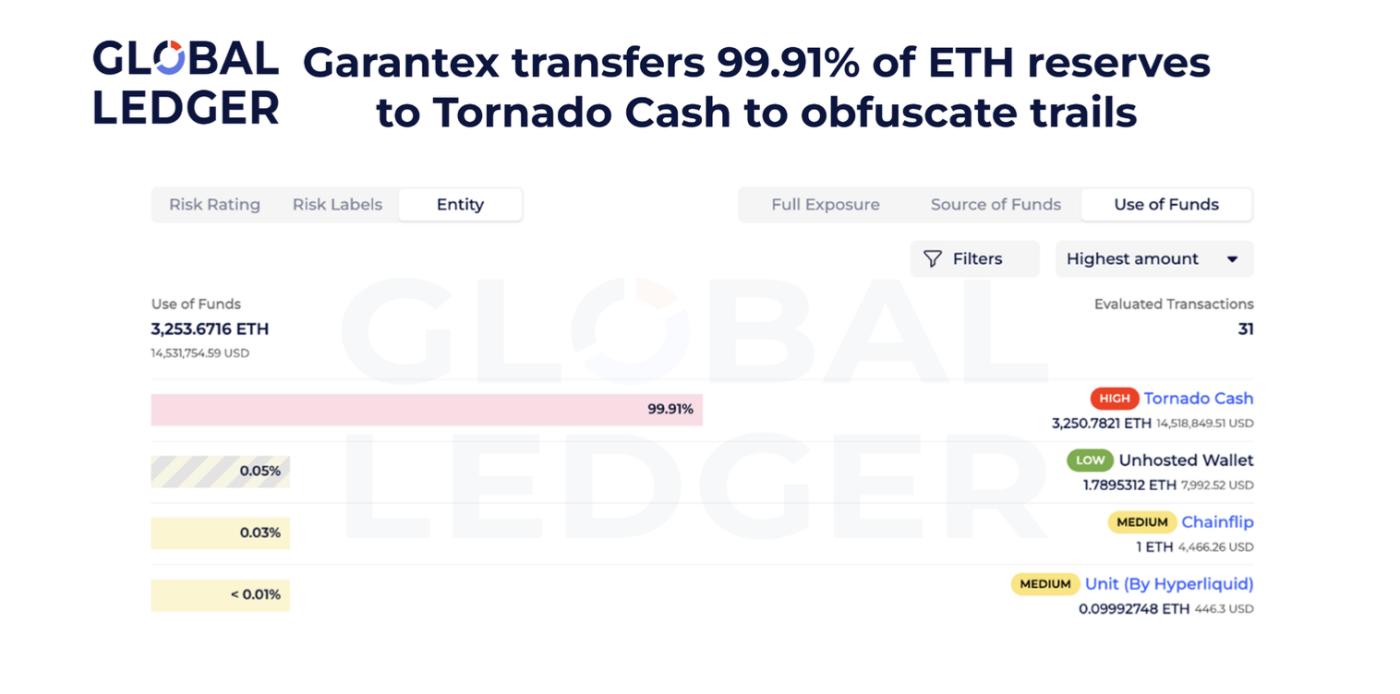

Global Ledger explained that Garantex was operating a payment system designed to conceal the flow of funds. The exchange transferred reserves to coin mixing services like Tornado Cash , obfuscating the source of the funds and making them difficult to trace.

Garantex used Tornado Cash to conceal money transfers. Source: Global Ledger .

Garantex used Tornado Cash to conceal money transfers. Source: Global Ledger .Subsequently, the funds are transferred through cross-chain tools, facilitating the movement of assets between networks such as Ethereum, Optimism , and Arbitrum . Finally, the funds are collected in aggregated wallets, and then further distributed to individual wallets to pay users .

The investigation also revealed that the majority of Ethereum reserves remain unused. Over 88% of the ETH associated with Garantex is still held in reserve wallets, indicating that the exchange has only just begun its initial payment phase.

The Global Ledger report's findings are made against the backdrop of significant changes taking place within the Russian financial system.

How Russia uses the A7A5 to maintain commercial operations.

Russia has undergone a major shift in its approach to digital assets.

In early 2022, the Russian Central Bank proposed a complete ban on crypto , viewing it as a threat to financial stability. However, by 2024, Russia had changed its stance , beginning to use crypto tosupport trade under sanctions .

President Vladimir Putin also supports the new payment system called A7.

In late 2024, A7 launched the A7A5 stablecoin , Peg to the ruble , with plans for its rollout in early 2025. This Token facilitates the easy movement of funds between the traditional financial system and crypto. According to Chainalysis, A7A5 has supported a total volume exceeding $87 billion.

Russian companies use A7A5 to convert rubles to USDT . This allows them to continue making international payments even when banks refuse transfers related to Russia.

While Russia is building a financial system independent of the West, new findings from Global Ledger suggest that Garantex has not disappeared.

Conversely, this exchange has adapted its operations, continuing to circulate funds through systems similar to those of the new state-sponsored platforms.

Overall, evidence suggests a trend toward developing countries adopting crypto-based payment systems to circumvent specific sanctions and mitigate the effectiveness of traditional external pressures.