There's really not much complicated to analyze about BTC. I said it would fall before, and it's moving exactly as predicted! Not only did it break through the 89,000-90,000 support zone, but it also plunged to around 87,000. The current chart shows a rising wedge pattern, which is a bearish signal in itself. There's a high probability of a small rebound before further declines; the overall trend is very weak. I've been predicting the recent price action almost perfectly; you can check my analyses from the past few days if you don't believe me.

The rebound high is likely between 90,500 and 91,000. Short, I suggest placing a short order at 90,550; if you can get it, it's quite safe. If it falls further, it might hit the low of the last major crash. Once this pattern completes, the price will most likely reach the 80,000 to 75,000 range.

There are no positive factors recently to drive a strong rebound, and the market is expected to continue its downward trend this month. Unless it can firmly establish itself above 93,000, a market reversal is unlikely. Otherwise, every rebound short a good opportunity to short, offering a high return on investment.

ETH is more resilient than BTC. After taking profit on my long position at 3250, I haven't traded ETH since, so I didn't participate in this recent drop. I've given specific entry and exit points for most other cryptocurrencies, except for ETH, mainly because 3250 isn't a good time to short. ETH's current price action is relatively strong, but the overall trend is still downward.

Furthermore, many people believe the current market pattern is a consolidation rectangle, suggesting an upward surge after the consolidation. However, I think it looks more like a bearish flag pattern. If it truly is a bearish flag pattern, there will likely be a small rebound before continuing the decline. Once the pattern is confirmed, simply look for the rebound high to short.

The bearish flag pattern's resistance line is around 3150, forming an upward-sloping line. Short, it's recommended to place orders in the 3150-3200 range. This pattern is particularly prone to creating bull traps; it looks like a breakout to the upside, but it's actually a false breakout, followed by an accelerated decline. Once it falls, the target price is likely around 2930.

My plan is to short short orders for BTC around 90550 and for ETH around 3172U. I've reserved space for averaging down on both coins to prevent being stopped out in case of a false breakout. These two points happen to be their respective resistance levels, making short orders appropriate.

SOL has been testing the support level of 130 repeatedly, which only happens when the market weakens. If it fails to break through this level soon, it might fall back to 100.

The price of BCH has been hovering around 560. There's no need to enter the market until it drops to 520.

With only two weeks left until Q4 settlement, market volatility has been extremely high lately, so it's best to remain on the sidelines and observe. Futures contracts are only suitable for short-term trading; the market is currently experiencing frequent price spikes that trigger stop-loss orders, all in an attempt to extract liquidity.

Popular Cryptocurrency Analysis:

Pippin: This coin is no different from single-player game coins; it keeps pushing the price up, so you really don't dare to short it easily. However, it also drops incredibly fast, crashing to the bottom in a single spike. This is how market manipulators operate: they preemptively place a large number of long orders at low prices, giving them a very high degree of control. As the price rises, there will always be people who can't resist chasing the price higher, so there's basically no selling pressure in the market, and pumping the price doesn't require much capital, which is why the price has remained so strong.

Hype: This coin is moving quite steadily, with virtually no volatility, and it doesn't follow the overall market trend at all. Currently, its chart pattern is a descending wedge, which is a bullish signal. After the consolidation ends, there's a high probability of a breakout. Keep a close eye on it.

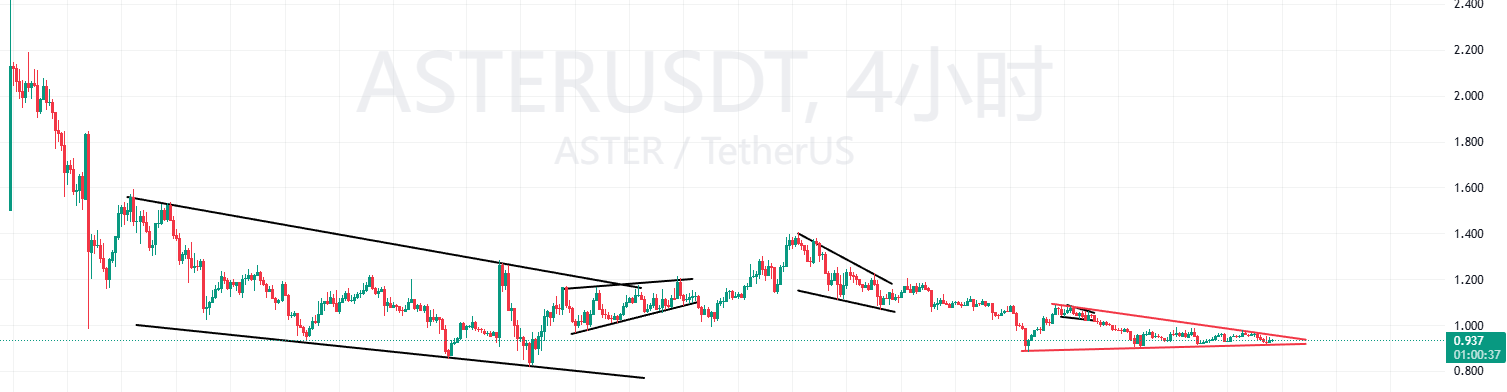

Aster: This coin has been slowly declining in a choppy, downward trend, and it's currently stuck in a triangle pattern. Although CZ is very bullish on it and has bought a significant amount, the market liquidity is extremely poor; any slight rise is immediately followed by a sharp drop back to the original level. Currently, there are no clear signs of a bottoming out, and it will most likely continue its choppy, downward trend. At this point, I really don't recommend going long; we should wait for a clear bottoming signal before considering it. Also, the overall market is still in a downtrend, so we just need to be patient.

Binance Life: The core reason for this surge is the update to UTF-8 programming, which basically means they've been working on resolving compatibility issues for Chinese trading pairs. Now they're just waiting for the right time to launch spot trading, and judging by the progress, it's getting closer and closer. It's estimated that starting next year, the Chinese trading ecosystem will really take off.

The market is constantly changing, and specific entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost! QQ: 2178747366, QQ: 2499660658 ( Add me with a note, and I'll add you to our learning and discussion group).