Tokenpost conducted its 5th National Survey on Digital Asset Awareness to understand the perceptions and investment behaviors of participants in the South Korean digital asset market. This survey, conducted in partnership with the global exchange Crypto.com, included 1,812 participants, comprising digital asset investors, observers, and non-investors. The aim was to document, through data, what South Korean users are actually experiencing and how they perceive the market amidst a rapidly changing regulatory environment and emerging industry trends such as ETFs, stablecoins, RWA, and AI.

Most people have a "neutral" understanding of taxation... negative reviews outweigh positive reviews.

Regarding awareness of the digital asset tax system, the most common response was "neutral," with 570 respondents. A positive assessment combining "appropriate" (291) and "very appropriate" (105) totaled 396, while a negative assessment combining "somewhat inappropriate" (285) and "very inappropriate" (268) totaled 553, with negative assessments exceeding positive ones. 125 respondents also answered "not quite sure."

Among the respondents who deemed the taxation inappropriate, a recurring sentiment was that taxation was being implemented before the system was fully developed and investor protection was adequate. Other main reasons cited included: insufficient reporting of total profits and losses; questioning the ambiguity regarding acquisition costs, profit and loss calculations, and taxation standards for on-chain, DEX, and airdrop transactions; and concerns about fairness compared to other financial products.

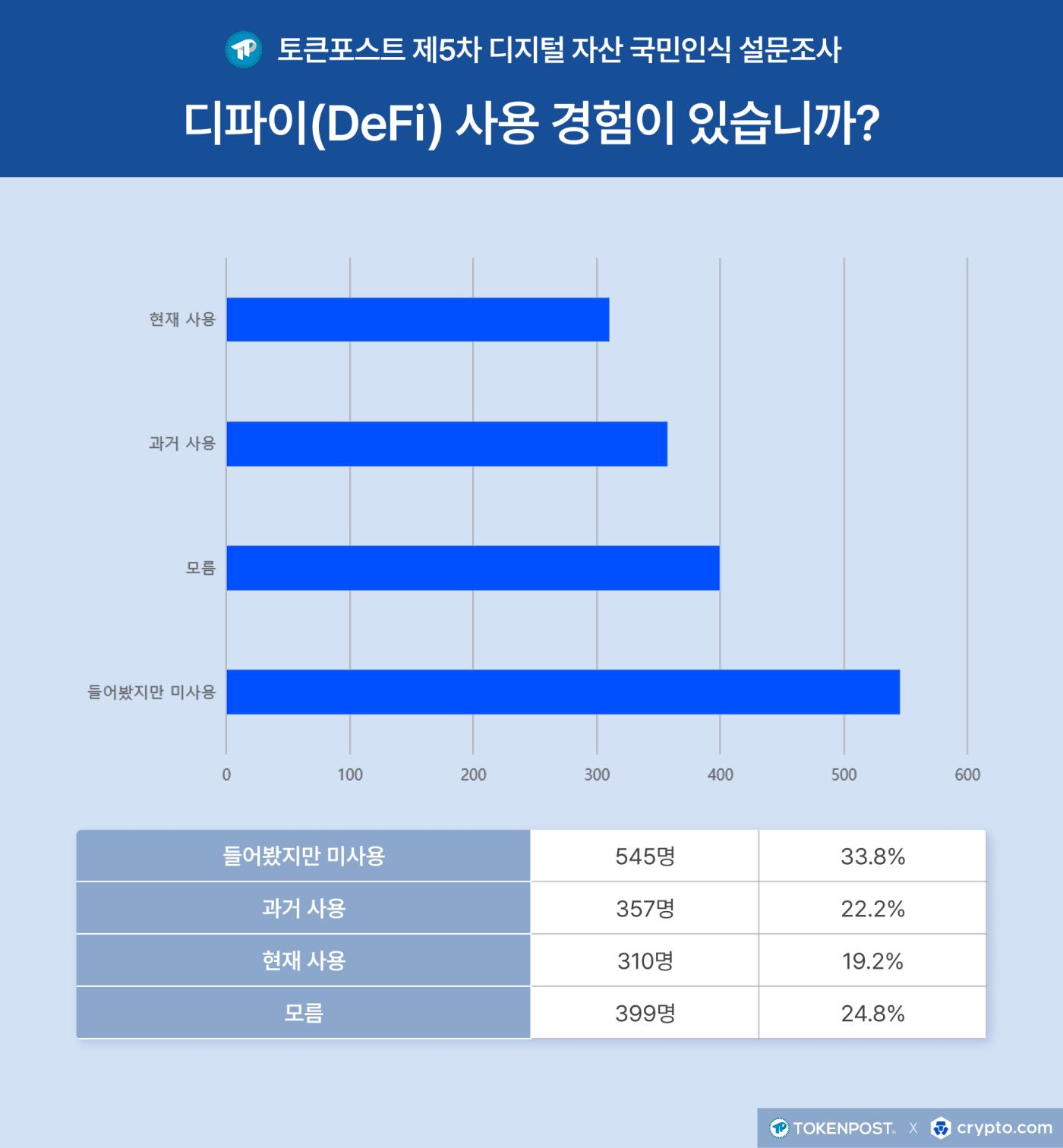

41.4% of users have experience using DeFi.

Regarding DeFi usage experience, the highest percentage (33.8%) said "heard of it but haven't used it"; while the combined percentage of "currently using it" and "past using it" was 41.4%. On the other hand, the answer "don't know" accounted for 24.8%, showing a mixed situation of awareness and actual experience.

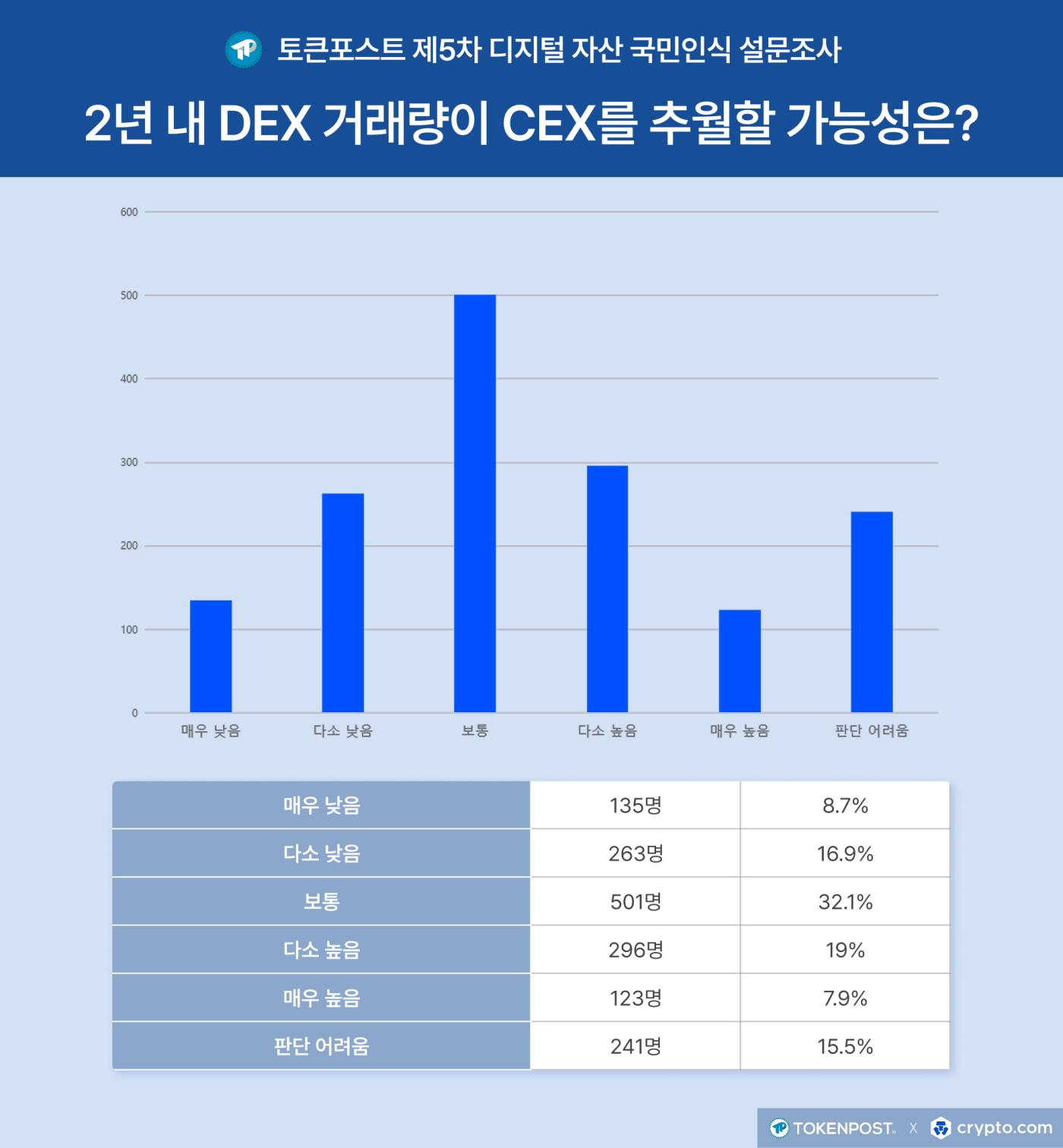

Regarding the possibility that decentralized exchanges (DEXs) will surpass centralized exchanges in trading volume within two years, the highest percentage of respondents (32.1%) answered "neutral," with both positive and negative responses present. The percentage of respondents who answered "difficult to judge" reached 15.5%, indicating that a significant number hold reservations about the prospect of diffusion.

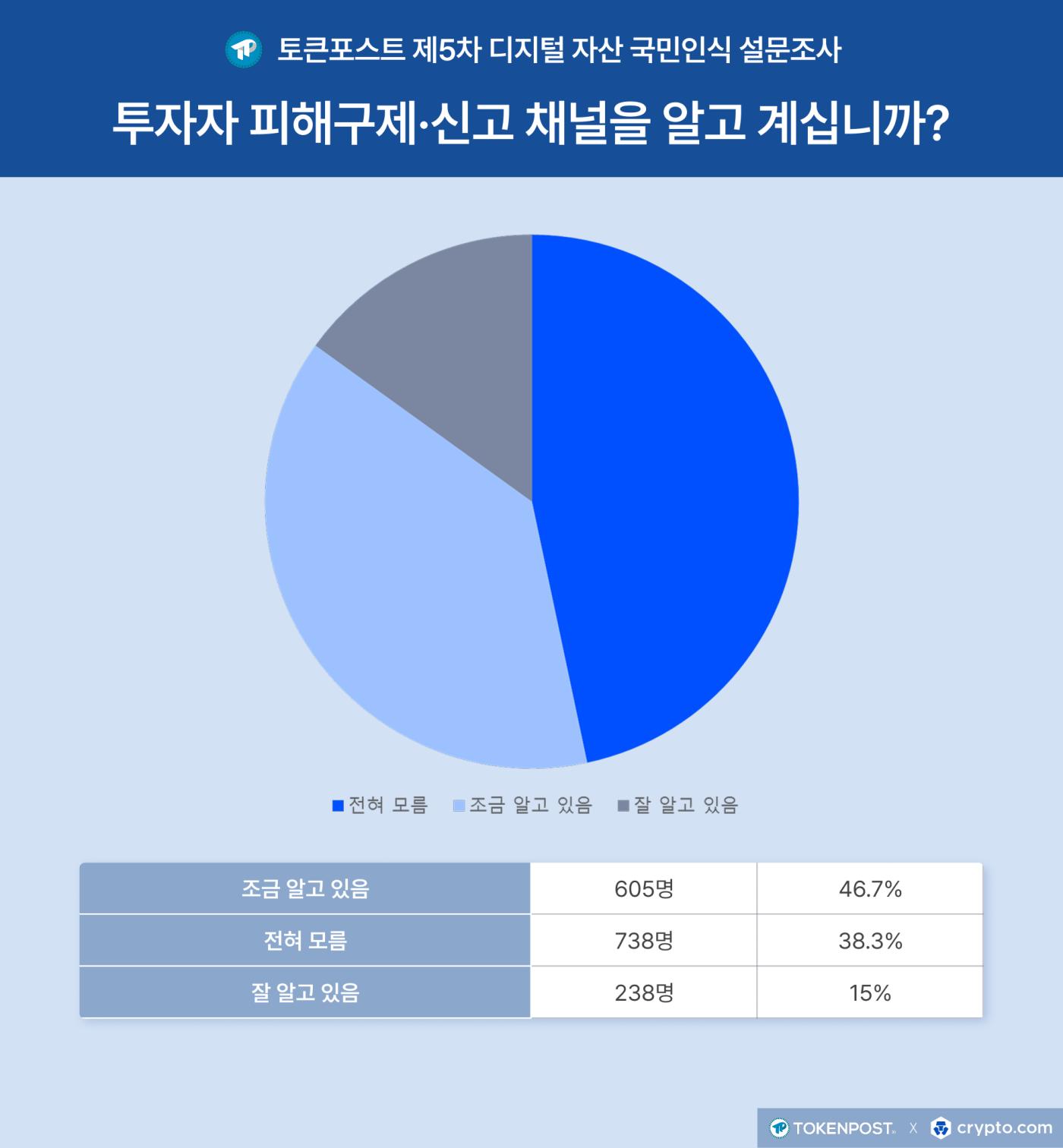

Low awareness of damage redress and reporting channels… Improvement needs focus on “public disclosure and procedures” and “redress system”.

In a survey on investor awareness of remedies and reporting channels for damages, the largest number of respondents (738) said they "had no idea," followed by 605 who "knew a little," and 238 who "knew a lot."

In the subjective responses regarding areas where improvements are desired in policy and regulation, strengthening transparency and public disclosure, and clarifying listing and delisting procedures were the most prominent aspects. Secondly, establishing a system for damage redress and reporting, strengthening the investigation and punishment of illegal activities, enhancing responses to technical and operational risks such as security vulnerabilities and phishing attacks, and improving the consistency and professionalism of regulation were repeatedly mentioned.

For more details, please refer to "The 5th National Survey on Digital Asset Awareness: Understanding the True Investors in the Korean Market at a Turning Point," available in BBR Vol.15 sold on the Tokenpost Smart Store .