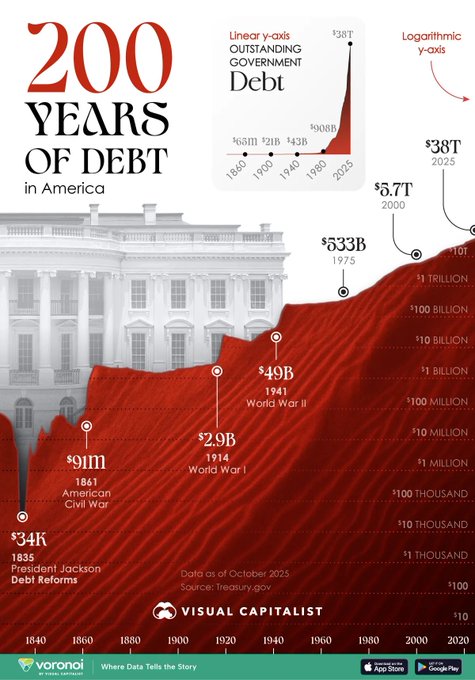

🇺🇸 US DEBT WILL CONTINUE TO RISE DESPITE HIGH TARIFF COLLECTION The US has collected over $200 billion in new tariffs in 2025 from tariffs imposed by President Trump. Of this, approximately $12 billion is intended to support farmers affected by the US-China trade war. President Trump also proposed a $2,000 tariff dividend for eligible Americans, funded from tariff revenue; however, this proposal is currently unsecured and requires congressional approval. Additionally, U.S. Treasury Secretary Scott Bessent said that American workers could receive large tax refunds of $1,000 to $2,000 per household in the first quarter of 2026. This is due to tax cuts under the One Big Beautiful Bill Act, passed in July 2025, which many people haven't had time to adjust for tax deductions, leading to unexpected refunds and potentially boosting short-term spending. The Big Beautiful Bill also entails significant government spending and budget deficits from 2026 onwards. This law includes large-scale tax cuts while increasing spending on defense, border security, and several federal programs. The act is expected to add approximately $3.4 trillion to U.S. public debt over the next 10 years, not including interest. The debt ceiling has also been raised by approximately $5 trillion, allowing the government to borrow more to implement these policies.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content