Source: Bitwise; Compiled by: Jinse Finance

2025 will be an unforgettable year for the cryptocurrency world – with both highs and lows.

On the positive side: Driven by strong institutional demand and a series of favorable regulatory developments, Bitcoin, Ethereum, Solana, and Ripple (XRP) all hit record highs ($126,080, $4,946, $293, and $3.65 respectively). Stablecoins and tokenization became household terms, major financial institutions such as Morgan Stanley and Merrill Lynch opened up investment channels for cryptocurrency ETFs, and several cryptocurrency companies with valuations of billions of dollars, including Circle, Figure, and Gemini, completed their initial public offerings (IPOs) and went public.

On the negative side: Major cryptocurrencies, including the four assets mentioned above, have all fallen sharply from their highs; as of this writing, their prices have all declined this year. Some smaller Altcoin have fallen by 50% or more. The negative impact of the price decline—concerns stemming from Bitcoin's historical four-year cycle suggesting a "down year," signs of long-term holders selling off, escalating discussions about the risks of quantum computing, and the overall macroeconomic environment—has severely dampened market sentiment.

We believe the bulls will prevail in 2026. From institutional adoption to regulatory progress, the current positive trend is strong and far-reaching, and unlikely to be hindered in the long term.

Against this backdrop, we present the following top ten cryptocurrency predictions for 2026.

1. Bitcoin is poised to break its four-year cycle and reach a new all-time high.

2. Bitcoin's volatility will be lower than that of Nvidia's stock.

3. As institutional demand accelerates, ETFs will purchase more than 100% of the new supply of BTC, ETH, and Solana.

4. Cryptocurrency stocks will outperform technology stocks.

5. Polymarket open interest is set to reach a record high, surpassing levels seen during the 2024 election.

6. Stablecoins will be accused of undermining the stability of emerging market currencies.

7. The assets under management of the blockchain vault (also known as the " 2.0 version of ETF") will double.

8. ETH and Solana will reach new all-time highs (if the CLARITY bill is passed).

9. Half of the Ivy League universities' endowment funds will invest in cryptocurrencies.

10. The United States will launch more than 100 cryptocurrency-linked ETFs.

Additional prediction: The correlation between Bitcoin and stocks will decrease.

Prediction 1: Bitcoin will break its four-year cycle and reach a new all-time high.

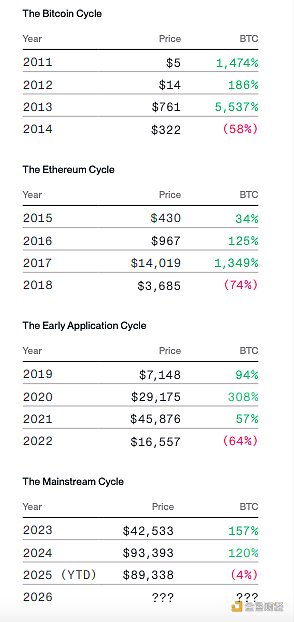

Historically, Bitcoin exhibits a four-year cycle, with three significant "growth years" followed by a year of substantial correction. Based on this cycle, 2026 should have been a correction year.

However, we believe this will not happen.

In our view, the factors that previously drove the four-year cycle—Bitcoin halvings, interest rate cycles, and leveraged booms and busts in the cryptocurrency market—have become significantly less influential than in previous cycles.

Halving events: By definition, each subsequent Bitcoin halving has half the impact of the previous halving.

Interest rate factors: The sharp rise in interest rates in 2018 and 2022 impacted prices; however, we expect interest rates to decline in 2026.

Market crash risk: Following the record liquidation events in October 2025, relatively lower leverage levels, coupled with an improved regulatory environment, have significantly reduced the likelihood of a major market crash.

More importantly, we believe that the wave of institutional inflows that began after the approval of the spot Bitcoin ETF in 2024 will accelerate in 2026, as platforms such as Morgan Stanley, Wells Fargo, and Merrill Lynch begin allocating cryptocurrency assets. Meanwhile, we expect the regulatory shift towards cryptocurrencies following the 2024 election to benefit the cryptocurrency sector, with Wall Street and fintech companies beginning to seriously embrace cryptocurrencies.

We expect these factors to work together to drive Bitcoin to a new all-time high, making the four-year cycle a thing of the past.

Bitcoin's performance: a four-year cycle

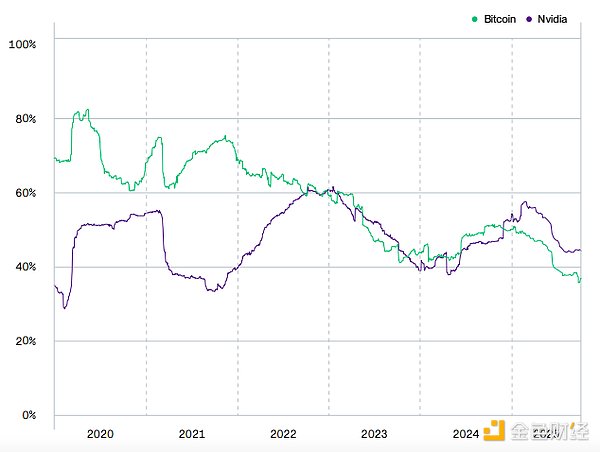

Prediction 2: Bitcoin's volatility will be lower than Nvidia's.

If you've been in the cryptocurrency space long enough, you've probably heard the statement: "I would never invest in an asset as volatile as Bitcoin."

We're already very familiar with this. It's one of the most common criticisms from Bitcoin skeptics.

Does Bitcoin exhibit volatility? Absolutely. We do not deny that.

But is Bitcoin more volatile than other assets that investors are eagerly pursuing? Not recently.

Throughout 2025, Bitcoin's volatility was lower than that of one of the most popular stocks on the market—Nvidia.

Looking at the longer term, Bitcoin's volatility has steadily declined over the past decade. This shift reflects the fact that with the emergence of traditional investment instruments such as exchange-traded funds (ETFs), the fundamental risk of Bitcoin as an investment asset has decreased, and the investor base has become more diversified.

We believe this trend will continue into 2026.

Volatility Comparison: Bitcoin vs. Nvidia

1-year rolling annualized volatility

Source: Bitwise Asset Management, data from Bloomberg. Data period: December 31, 2019 to December 5, 2025. Note: Gold underwent a similar transformation after the US abandoned the gold standard and gold ETFs were launched in 2004. We explored the similarities of these trends in detail in our recent report, "Bitcoin's Long-Term Capital Market Assumptions."

Prediction 3: As institutional demand accelerates, ETFs will purchase more than 100% of the new supply of BTC, ETH, and Solana.

For example, since the launch of Bitcoin ETFs in January 2024, these popular investment vehicles have purchased 710,777 BTC. During the same period, the Bitcoin network produced only 363,047 new BTC. It doesn't take a PhD in economics to conclude that 710,777 is far greater than 363,047. Unsurprisingly, the price of Bitcoin rose by 94% during this period.

Looking ahead to 2026, we have a relatively clear expectation for the new supply in the market. Based on current prices, the estimated new supply is approximately:

166,000 BTC ($15.3 billion)

960,000 ETH ($3 billion)

23,000,000 Solanas ($3.2 billion)

Meanwhile, more large financial institutions are preparing to open up cryptocurrency ETF investment channels to their clients. It's easy to imagine the impact this will have on demand. This doesn't necessarily mean prices will rise; existing holders may still sell their existing cryptocurrency holdings. But this lays a solid foundation for prices in 2026.

Comparison of US spot cryptocurrency ETF purchases (demand) with new issuances since launch (supply)

Prediction 4: Cryptocurrency-related stocks will outperform tech stocks.

Over the past three years, tech stock investors have performed admirably, achieving a return of 140%. They must be quite satisfied.

But investors in cryptocurrency-related stocks are even happier. The Bitwise Crypto Innovators 30 Index—comprising publicly traded companies that provide core infrastructure and services for the trading, security, and maintenance of crypto assets and their underlying platforms—has surged by 585% over the same period.

We expect this trend to accelerate in 2026.

Increased clarity in U.S. government regulations has made it easier for regulated cryptocurrency companies to operate and innovate. This is already beginning to show results, as evidenced by Coinbase relaunching its Initial Coin Offering (ICO) and Circle launching its own Layer-1 blockchain.

We expect a more optimistic regulatory environment to spur new products, new revenue streams, and mergers and acquisitions.

We believe that cryptocurrency-related stocks will perform exceptionally well in 2026—enough to shake up Wall Street.

Return Comparison: Cryptocurrency-Related Stocks vs. Technology Stocks

Source: Bitwise Asset Management, data from Bloomberg. Data period: December 31, 2022 to December 5, 2025. Note: "Cryptocurrency-related stocks" are represented by the Bitwise Crypto Innovators 30 Index; "Technology stocks" are represented by the Nasdaq 100 Index.

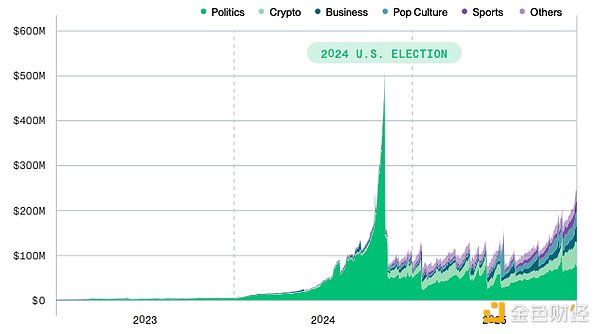

Prediction 5: Polymarket's open interest will reach a record high, surpassing levels seen during the 2024 election.

Polymarket experienced a breakout in 2024. This popular prediction market saw open interest reach $500 million during the 2024 US presidential election, but it plummeted to just $100 million after the election. Many are wondering: will Polymarket need another presidential election to return to its previous highs?

We don't think so. We expect Polymarket to easily break its all-time record in 2026.

There are three reasons:

US Market Open: Although US residents were previously unable to bet on this market, Polymarket has become a household name in the US. This will change in 2026—the platform began opening to US users in early December. We expect betting on a wide range of topics, from politics and economics to sports and popular culture, to drive a significant surge in platform activity.

Institutional Support and Operational Upgrades: Polymarket recently received a $2 billion investment from the Intercontinental Exchange (the parent company of the New York Stock Exchange). The company is using this funding to upgrade its operations, such as signing a licensing agreement with the National Hockey League (NHL) and directly integrating data into Google Finance. They are fully committed to scaling up.

New Market Expansion: Polymarket gained mainstream attention with its political markets, but has also achieved steady growth in other areas such as sports, popular culture, cryptocurrency, and economics. With the US midterm elections approaching and political topics once again in focus, the platform will fully leverage its strengths in 2026.

Polymarket: Open interest categorized by type

Source: Bitwise Asset Management, data from Blockworks Research. Data as of December 5, 2025. Note: Open interest refers to the total USD value of all outstanding bets at any given time.

Prediction 6: Stablecoins will be accused of undermining the stability of emerging market currencies.

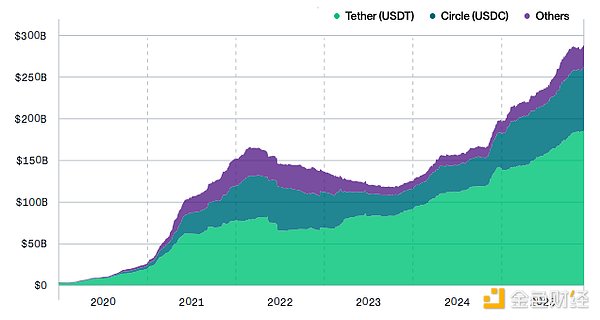

Stablecoins are developing rapidly.

The tokenization of the US dollar, represented by USDT and USDC, and other currencies, had a market size of $205 billion at the beginning of the year. Today, this market size is approaching $300 billion and may reach $500 billion by the end of 2026. In other words, the size of stablecoins is large enough to have a significant impact.

This is good news: stablecoins offer a superior, cheaper, and faster way to transfer funds. Why wouldn't people be optimistic about them?

However, there are many things that central banks in countries facing high inflation need to be wary of.

Multiple studies have shown that stablecoin adoption is primarily concentrated in emerging markets, with a surge in usage in regions with the highest inflation rates. This is because, among other uses, stablecoins allow people in high-inflation countries to easily convert their funds into relatively stable US dollar savings, rather than their local currency. For example, Venezuela's bolivar depreciated by approximately 80% against the US dollar in 2025.

For depositors, converting funds into stablecoins is an excellent option, but it's not good news for central banks—it means the funds are out of their control. The Bank for International Settlements (BIS, an alliance of central banks from around the world) warned its members earlier this year that "the widespread use of stablecoins could undermine monetary sovereignty in the relevant jurisdictions."

As cryptocurrencies gain mainstream acceptance, we anticipate one or two countries will explicitly accuse stablecoins of causing problems with their currencies. Of course, this isn't entirely accurate; if their currencies were sound, people wouldn't switch to stablecoins. But this won't stop these countries from issuing warnings.

Stablecoin market size

Source: Bitwise Asset Management, data from The Block. Data period: January 1, 2020 to December 5, 2025. Note: "Other" includes stablecoins such as BUSD, crvUSD, DAI, FDUSD, FEI, FRAX, GHO, GUSD, HUSD, LUSD, MIM, PYUSD, TUSD, USD1, USDD, USDe, USDP, and USDS.

Prediction 7: The assets under management (AUM) of the on-chain vault (also known as the "2.0 version of ETF") will double.

Most people haven't heard of on-chain vaults yet, but that will change in 2026.

The vault is similar to an on-chain investment fund. Users deposit assets (usually stablecoins such as USDC) into the vault, and a third-party "manager" allocates the funds in various ways to generate returns, mainly focusing on the decentralized finance (DeFi) field.

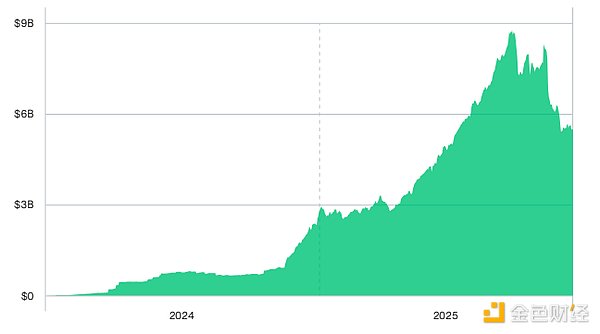

On-chain vaults began to emerge on a large scale in 2024, with assets under management growing from less than $100 million to $2.3 billion. Market attention surged in 2025, with assets under management reaching a peak of $8.8 billion, but a surge in volatility in October 2025 led to losses for poorly managed strategies.

Subsequently, the treasury's assets under management declined, but this situation will not last long.

We believe this is a painful but necessary maturation process. If billions of dollars will be managed through on-chain vaults, institutional-level risk management will become a fundamental requirement.

We believe that by 2026, a number of high-quality managers will enter the market, attracting billions of dollars into the vaults they manage. The pace of development in this sector will be so rapid that it will attract the attention of mainstream financial media. One of the media outlets—Bloomberg, The Wall Street Journal, or the Financial Times—will be referring to these vaults as “ETF 2.0.”

Assets under management (AUM): On-chain vault

Source: Bitwise Asset Management, data from Blockworks Research. Data period: January 1, 2024 to December 5, 2025. Note: Limited aggregated data for on-chain vault assets under management. The chart above includes assets under management for two leading on-chain vault platforms, Morpho and Euler.

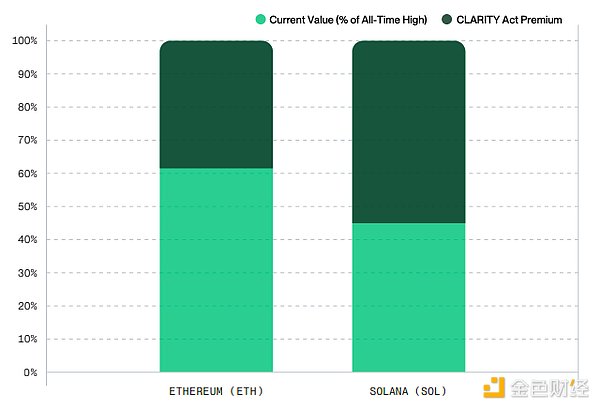

Prediction 8: If the Clarity Act passes, ETH and Solana will reach new all-time highs.

We are optimistic about Ethereum and Solana. Very optimistic. The main reason is that we believe stablecoins and tokenization are huge growth trends, and Ethereum and Solana are likely to be the biggest beneficiaries of this growth.

However, the recent growth of stablecoins and tokenization largely depends on continued progress in US regulation. The passage of the GENIUS Act, focused on stablecoins, in 2025 marked a significant step forward. To achieve the next stage of development, Congress needs to pass "market structure" legislation in the form of the CLARITY Act.

Market structure legislation will provide clear guidance for U.S. cryptocurrency regulation, including whether regulatory responsibility will be led by the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). If the law fails to clarify these divisions of responsibility, the attitude of U.S. regulators towards cryptocurrencies could change following the new election results.

The prospects for market structure legislation in 2026 are mixed. If the CLARITY Act passes, we believe it will trigger a bull market in cryptocurrencies (or, in crypto jargon, a "spectacular" one). ETH and Solana will be the two main beneficiaries, with prices soaring to all-time highs. If the bill fails to pass, a new strategy will be needed.

Potential price increase after market structure legislation is passed

Source: Bitwise Asset Management, data from CoinGecko. Data as of December 5, 2025. Note: Ethereum (ETH) has an all-time high of $4,946.05, and Solana (SOL) has an all-time high of $293.31.

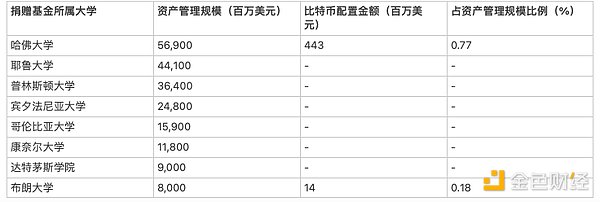

Prediction 9: Half of the Ivy League universities' endowment funds will invest in cryptocurrencies.

Earlier this year, Brown University became the first Ivy League endowment fund to allocate to Bitcoin, initially purchasing approximately $5 million worth of Bitcoin ETFs. We expect more Ivy League schools to join this trend by 2026.

This trend is significant for two reasons:

First and foremost, it's obvious that endowment funds control enormous sums of money—the latest statistics show a total of $871 billion. If they were to follow Harvard University's example and allocate approximately 1% of their portfolios to Bitcoin, the impact would be significant.

Secondly, though less obvious, but more important, endowment funds—especially those of Ivy League universities—often act as trendsetters. For example, many believe that Yale University's acceptance of hedge funds in the early 21st century fueled the industry's dramatic growth over the past two decades. If investments by Harvard and other Ivy League institutions prove successful, it could attract a significant influx of pension funds, insurance companies, and other institutions into cryptocurrency investing.

In other words: "Since Harvard University is investing in Bitcoin, perhaps we should do the same."

Assets under management and Bitcoin allocation: Ivy League endowment funds

Source: Bitwise Asset Management, data from Forbes and Bloomberg. Endowment fund assets under management data as of November 2, 2025; Bitcoin allocation data as of September 30, 2025.

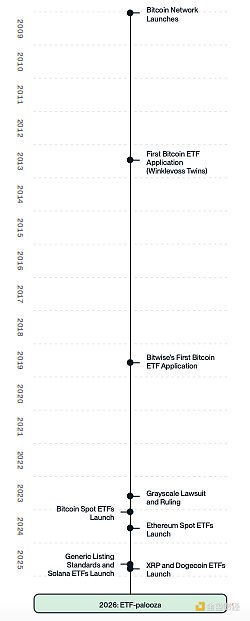

Prediction 10: The US will launch more than 100 cryptocurrency-related ETFs.

For over a decade, the U.S. Securities and Exchange Commission (SEC) repeatedly rejected cryptocurrency ETF applications. Subsequently, under pressure from court rulings, the SEC finally relented and approved the listing of a Bitcoin ETF in January 2024. Six months later, the door opened further, and the Ethereum ETF was officially launched.

The launch of cryptocurrency ETFs is now in full swing.

In October 2025, the SEC released general listing standards, allowing ETF issuers to launch cryptocurrency ETFs under a set of common rules. Subsequently, the Solana ETF (with staking functionality) quickly went public, attracting over $600 million in inflows within months. Ripple (XRP) and Dogecoin-related products followed suit. As of this writing, more cryptocurrency ETFs are expected to enter the market.

Looking ahead to 2026, we believe a clear regulatory roadmap and strong market demand for cryptocurrency ETFs will lay the foundation for an “ETF frenzy.”

We expect to launch more than 100 cryptocurrency-related ETFs, including spot cryptocurrency ETFs, cryptocurrency + staking ETFs, cryptocurrency-related stock ETFs, and cryptocurrency index ETFs.

Here's another prediction: We believe Bitwise will launch the ETF with the highest inflows in 2026.

Cryptocurrency ETF Timeline: 2009 to 2026

Source: Bitwise Asset Management.

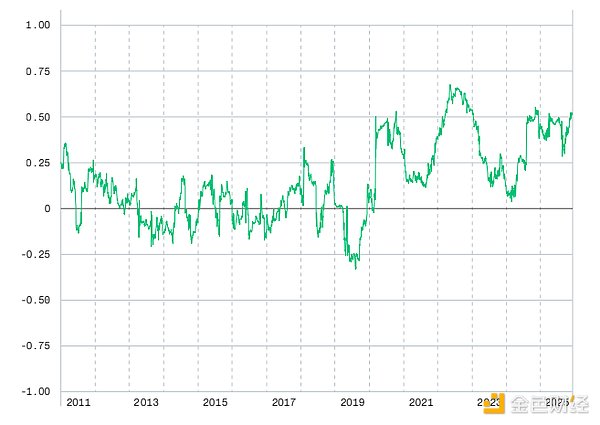

Additional prediction: The correlation between Bitcoin and stocks will decrease.

Many people—especially those in the media—always say that Bitcoin is highly correlated with the stock market.

But the data tells a different story.

Looking at the 90-day rolling correlation, the correlation between Bitcoin and the S&P 500 rarely exceeds 0.50 (which is the statistically standard dividing line between "low correlation" and "moderate correlation").

Regardless, we believe the correlation between Bitcoin and stocks will be lower in 2026 than in 2025. This is because we expect that, even as the stock market is plagued by valuation concerns and short-term economic growth issues, factors unique to the cryptocurrency sector, such as regulatory progress and institutional adoption, will still drive up cryptocurrency prices.

Correlation: Bitcoin vs. S&P 500 (90-day rolling)

Source: Bitwise Asset Management, data from Bloomberg. Data period: December 31, 2010 to December 5, 2025. Note: Traditionally, the range of -0.5 to 0.5 is defined as "lowly correlated" or "uncorrelated".