Deng Tong, Jinse Finance

As 2025 draws to a close, Jinse Finance presents a series of articles titled "Looking Back at 2025" to mark the passing of the old year and the arrival of the new. This series reviews the progress of the crypto industry throughout the year and expresses the hope that the industry will overcome its winter and shine brightly in the new year.

In 2025, the crypto market experienced a brief period of brilliance, reaching record highs before returning to a period of consolidation and bottoming out. This article reviews the performance of the crypto market this year.

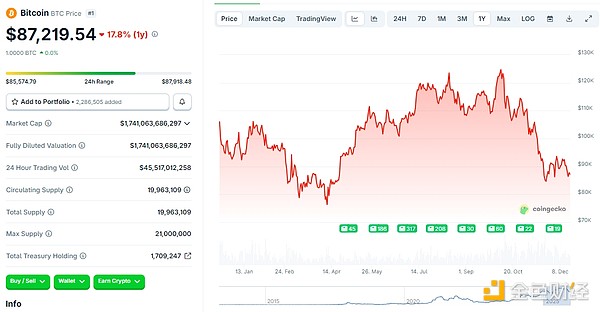

BTC price chart for 2025

ETH Price Chart for 2025

I. January-February: Easing signals + Trump's return to the White House helped BTC surge to $100,000

On January 1, 2025, the price of BTC was $93,507.88. The price then gradually rose, generally hovering above $100,000 until early February. BTC enjoyed a promising start to the year, and the entire industry was in high spirits, with investors generally holding a bullish view on the overall cryptocurrency market outlook for the year.

The Federal Reserve kept interest rates unchanged in its January and February policy meetings, but signaled a "cautious wait-and-see approach with easing expected," prompting the market to anticipate potential liquidity gains. From the end of January to the beginning of February, both meetings kept the target range for the federal funds rate stable between 4.25% and 4.5%. Looking at policy signals, the January meeting statement removed the previous phrase "inflation has made progress toward the 2% target" and added concern about "reflation risks." Fed Chairman Powell explicitly stated that a rate cut would only be considered after "real progress in inflation or weakness in the labor market," but emphasized that "the threshold for a rate hike reversal is extremely high," ruling out the possibility of restarting rate hikes. The February meeting minutes further revealed that officials unanimously agreed that the current restrictive monetary policy was to allow time to assess the economy, while also expressing concern that Trump's tariff policies could push up inflation. However, they generally agreed that "rate cuts in 2025 remain the general direction," leading institutions such as Goldman Sachs and Barclays to predict two 25-basis-point rate cuts this year.

In addition, former US President Trump returned to the White House on January 20, becoming the first "crypto president" in US history. This resonated with the Federal Reserve's easing expectations and together became a catalyst for the rise of the crypto market.

II. March-April: Tariffs and a Slower Pace of Fed Easing Lead to BTC Correction

Since Trump's return to the White House was confirmed, the market has been digesting expectations that he would wield the heavy tariff weapon.

In late February, Trump announced that the tariffs originally scheduled to be imposed on Canada and Mexico would be postponed and take effect as planned the following month—giving the two countries additional time to resolve border security issues, with the tariffs officially taking effect after March 4.

As the anticipated implementation of US tariffs on Canada and Mexico becomes a reality, markets are beginning to reassess the global trade environment. The expected tariffs taking effect on March 4th has sparked concerns about global trade frictions, leading to increased risk aversion and a withdrawal of funds from risky assets, with short-term capital flowing towards the US dollar and cash-like assets.

On March 23, the Federal Reserve's interest rate meeting concluded. The Fed maintained interest rates unchanged but raised its inflation forecast, signaling a potential slowdown in the pace of easing and shattering previous market optimism about rapid rate cuts. Multiple negative factors combined to trigger a short-term sell-off in the cryptocurrency market.

III. May-October: Favorable policies and renewed interest rate cuts helped BTC reach new Double Top highs.

The US's cryptocurrency regulatory policies and interest rate cuts have truly ushered in a "crypto summer" for the crypto market. As a result, the price of BTC has been soaring, reaching an all-time high of $123,561 on August 14, and then surging to another all-time high of $124,774 on October 7.

From July 14 to 18, the US "Crypto Week" kicked off, with three major crypto regulatory bills being passed.

On June 17, the U.S. Senate passed the "Directing and Establishing a National Innovation for Stablecoins Act" (the GENIUS Act) , advancing the U.S. federal government's regulatory efforts on stablecoins and pressuring the House of Representatives to plan the next phase of national digital asset regulation. On July 18, the bill was signed into law by President Trump. The enactment of this act marks the first time the U.S. has formally established a regulatory framework for digital stablecoins.

On July 17, the House of Representatives passed the Anti-CBDC Surveillance Nation Act by a vote of 219 to 210.

On June 23, the House Financial Services Committee and the Agriculture Committee introduced the "Clarity Act on Digital Asset Markets," which defines digital goods as digital assets whose value is "intrinsically linked" to the use of blockchain technology. The bill was passed by the House of Representatives on July 17.

On September 18, the Federal Reserve announced a 25 basis point rate cut, lowering the federal funds rate to 4%-4.25%, and expectations of further easing of liquidity returned. At the same time, central banks in many countries around the world began to include small amounts of BTC in their foreign exchange reserves for diversification, with the Dutch central bank disclosing that it held $1.5 billion worth of BTC assets, boosting market confidence.

On October 1st, the US federal government entered a 43-day shutdown due to running out of funds, and investor concerns about economic uncertainty boosted demand for safe-haven assets. BTC became a favorite among both large institutional and retail investors, thus surging to a new all-time high on October 7th. Although its performance subsequently weakened, the price of BTC generally remained above $110,000 throughout October.

In addition, the Circle IPO on June 5, the Hong Kong Stablecoin Ordinance Bill which came into effect on August 1, the Trump family's WLFI transaction on September 1, and announcements of crypto reserves by various companies have also served as catalysts for the market to rise from time to time.

As prices continued to rise, a crisis was also brewing. After reaching an all-time high of over $120,000 in October, BTC began to decline slowly, sparking widespread discussion in the last two months of the year about whether we were already in a bear market.

IV. November-December: Concerns about the future economy hampered BTC's upward momentum.

On November 1st, the price of BTC was $109,574, after which it began a downward trend. On November 23rd, BTC recorded a low of $84,682, a drop of 22.71% from the beginning of the month. Although it fluctuated above $90,000 for most of the time afterward, the upward trend was weak, sparking various speculations among industry insiders.

The US government shutdown has led to a lack of key economic data, causing market concerns about economic fundamentals and future interest rate trends, which in turn has negatively impacted the performance of risk assets.

Furthermore, although there were prior expectations that the Federal Reserve would continue to cut interest rates, the Fed issued cautious signals before the actual cuts, leading to divergent market expectations regarding future liquidity. On December 10th, the Fed implemented its third rate cut of the year, but the market interpreted it as a "recession-style rate cut" to address a weakening economy, which exacerbated pessimistic expectations. Investors are reassessing macroeconomic variables such as the global interest rate path and fiscal health, favoring more conservative asset allocations amidst uncertainty.

As the crypto market remains sluggish, many DAT companies are struggling to survive. In addition, the increased liquidation caused by drastic market changes will further drive the market down.

Currently, the market is anticipating a "Christmas rally," which may be the "hope of the whole village" this year.

Summarize

The year 2025 began with an almost certain optimism, fueled by Trump's inauguration and high expectations across the industry. After weathering tariffs and a slowdown in the Federal Reserve's easing measures, the market rebounded strongly: favorable policies, renewed interest rate cuts, IPOs of crypto companies like Circle, hype surrounding Trump's family projects, and a surge in DAT companies all contributed to BTC's two breakthroughs of the $120,000 mark. However, influenced by macroeconomic expectations, BTC is likely to experience a period of consolidation and bottoming out towards the end of the year.

Looking at the overall trend of the crypto market, the correlation between BTC and traditional financial markets has significantly increased. The improvement of the regulatory framework and the pace of Federal Reserve policy may continue to be key variables affecting the price trend of BTC in 2026.