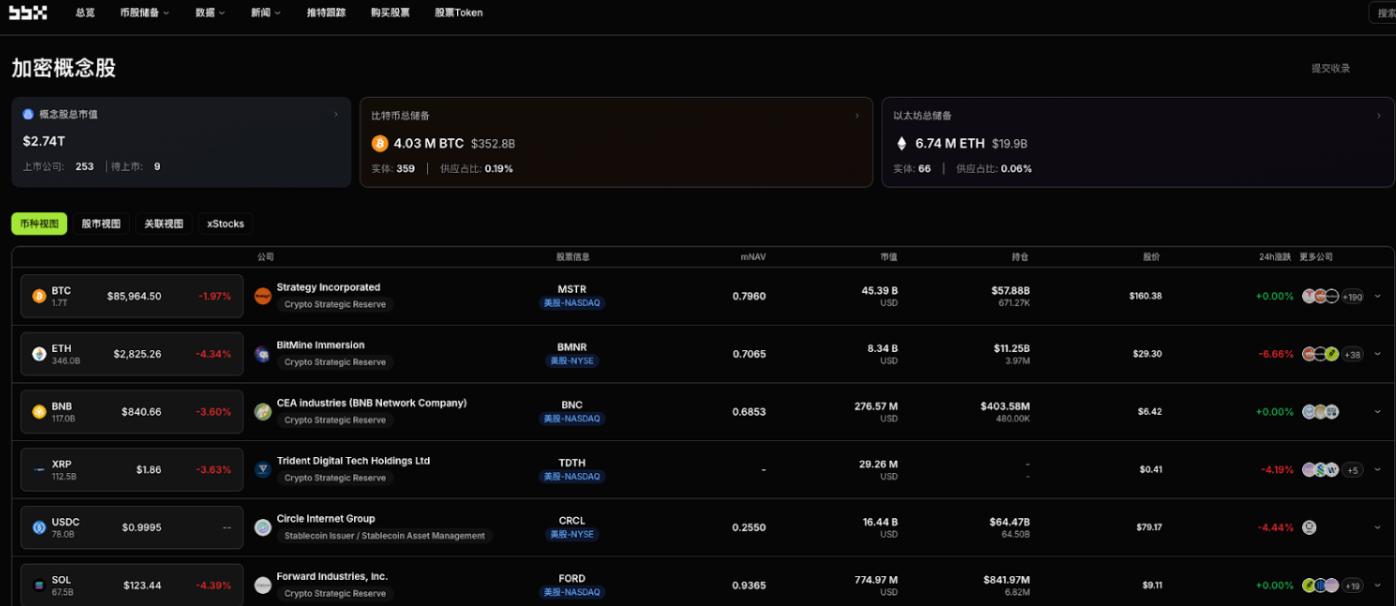

According to ME News, on December 18th (UTC+8), BBX Crypto Concept Stock Information reported that listed companies' strategies in the crypto asset sector continued to diverge and deepen. The disclosed information shows that companies are pursuing differentiated participation paths through direct increases in holdings of mainstream crypto assets, expansion of mining capacity, and the construction of multi-chain treasury systems.

Bitcoin holdings and mining strategy

CIMG (NASDAQ: IMG) announced that it used approximately $24.61 million of internal funds to purchase 230 BTC. Following this purchase, its total Bitcoin holdings have increased to 730 BTC. CIMG stated that the current market correction provided a suitable window for it to execute its long-term Bitcoin reserve strategy.

Delin Holdings (HKEX: 01709) disclosed the acquisition of a total of 4,000 Bitcoin mining machines from three third-party suppliers for a total consideration of approximately HK$39.2 million. Combined with previously completed and ongoing mining machine purchases, Delin Holdings expects the entire equipment to generate an average of approximately 1.71 Bitcoins per day under the current network conditions, further strengthening its upstream mining capabilities.

Ethereum and Multi-Chain Treasury Expansion

BitMine (NYSE: BMNR) purchased approximately 48,049 ETH yesterday, a transaction valued at approximately $141 million. This significant purchase further solidifies its position as a publicly traded Ethereum treasury company and demonstrates its continued optimism about the long-term role of ETH in corporate asset allocation.

MemeStrategy (HKG: 2440) announced that it has increased its holdings of SOL by 2,440 tokens at a cost of approximately HK$14.9 million. Following the transaction, its total SOL holdings have risen to 12,290 tokens, demonstrating the company's active efforts to build a multi-chain digital asset reserve centered on SOL.

Market perspective

Based on yesterday's disclosures, the ways in which listed companies participate in the crypto ecosystem are showing a clear stratification:

On the one hand, CIMG is strengthening its treasury attributes by directly increasing its BTC holdings, while Delin Holdings is choosing to gain long-term hashrate exposure from the mining sector. On the other hand, BitMine and MemeStrategy are continuously expanding their ETH and SOL holdings respectively, driving the evolution of enterprise-level treasuries from "single assets" to "multi-chain combinations." Overall, crypto assets are being more deeply integrated into the balance sheets and business strategies of listed companies. (Source: ME)