Bitcoin, almost the opposite of its original meaning, is now being accepted by major institutions on Wall Street. Bittensor is like a new "rebellion" against centralized power platforms. This is a very hot topic. As AI develops, many people worry about the centralization and control that this technology can exert.

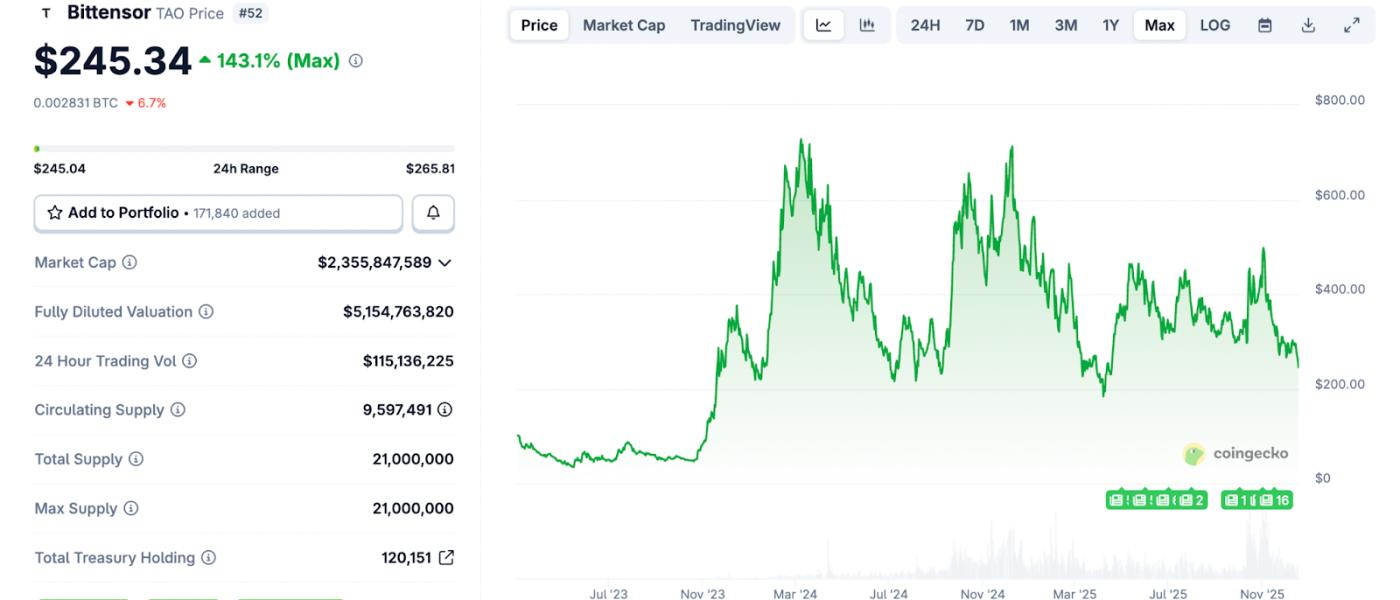

Bittensor and its cryptocurrency, TAO, aim to help make AI services more decentralized, independent of large organizations. Despite losing nearly 53% of its value by 2025, some still believe Bittensor is the “next-generation Bitcoin” for the AI age. But is this expectation realistic?

The potential and promise of Bittensor

This network just completed a reward halving event on December 15, 2025, which reduced the amount of new coins created. The problem is, many people have heard this story before.

Many cryptocurrencies have claimed to be the “next Bitcoin”—because telling that story could yield significant profits.

However, Bittensor's true long-term value could still be very significant – although the project still needs to overcome many challenges, like many other ambitious crypto projects. Bittensor's story is very similar to Bitcoin's: There are "big players" controlling the industry, and a completely new network could challenge, or even change, this order.

For years, KOLs (Key Opinion Leaders) have consistently spread the famous slogan "quit banking, long-term Bitcoin." While Bitcoin is now reappearing in major Wall Street banks and publicly traded companies, this narrative remains effective for the majority of small retail investors.

Bittensor's price history since its listing in 2023. Source: CoinGecko

Bittensor's price history since its listing in 2023. Source: CoinGeckoThe point here is that AI companies like OpenAI, Anthropic, and Deepseek are becoming so large and frightening that many people feel the need to be concerned about their future impact.

Bittensor's core idea is to distribute AI-related workloads, replacing traditional proof-of-work problems with practical, everyday AI applications.

“Bitcoin has demonstrated the economic power of cryptography, demonstrating how it can coordinate a global hardware network to protect data,” Evan Malanga , CEO of Yuma – one of the largest sponsors of the Bittensor platform – Chia BeInCrypto. “Bittensor uses a similar mechanism but directs computing power toward something more practical: training and operating AI and building infrastructure for real-world AI.”

Another Bitcoin? Really?

It's worth noting that Yuma is a subsidiary of Digital Currency Group (DCG), which was one of the earliest investors in cryptocurrencies like Bitcoin, Zcash, and Decentraland.

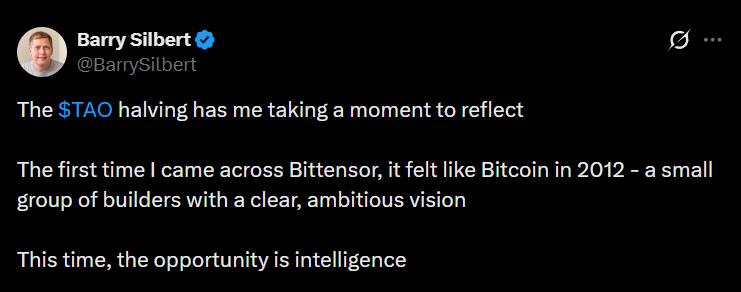

DCG also invested in Coinbase, Circle , and Chainalysis in their early days. DCG's CEO, Barry Silbert , is also backing Bittensor – which many see as a positive sign for the project.

Barry Silbert, who started investing in crypto in 2012, is now also supporting the TAO Token. Source: X

Barry Silbert, who started investing in crypto in 2012, is now also supporting the TAO Token. Source: XBittensor shares some similarities with Bitcoin. There will only be 21 million TAO Token, XEM as a "reminiscence" of Bitcoin. Additionally, TAO undergoes halving events, most recently in December which reduced the reward from 7,200 TAO to 3,600 TAO per day.

Instead of using energy-intensive proof-of-work puzzles like Bitcoin, Bittensor uses a proof-of-intelligence mechanism. This means that nodes in the network must perform AI tasks to demonstrate their capabilities. The better the quality of the output, the greater the node's chance of receiving TAO Token as rewards.

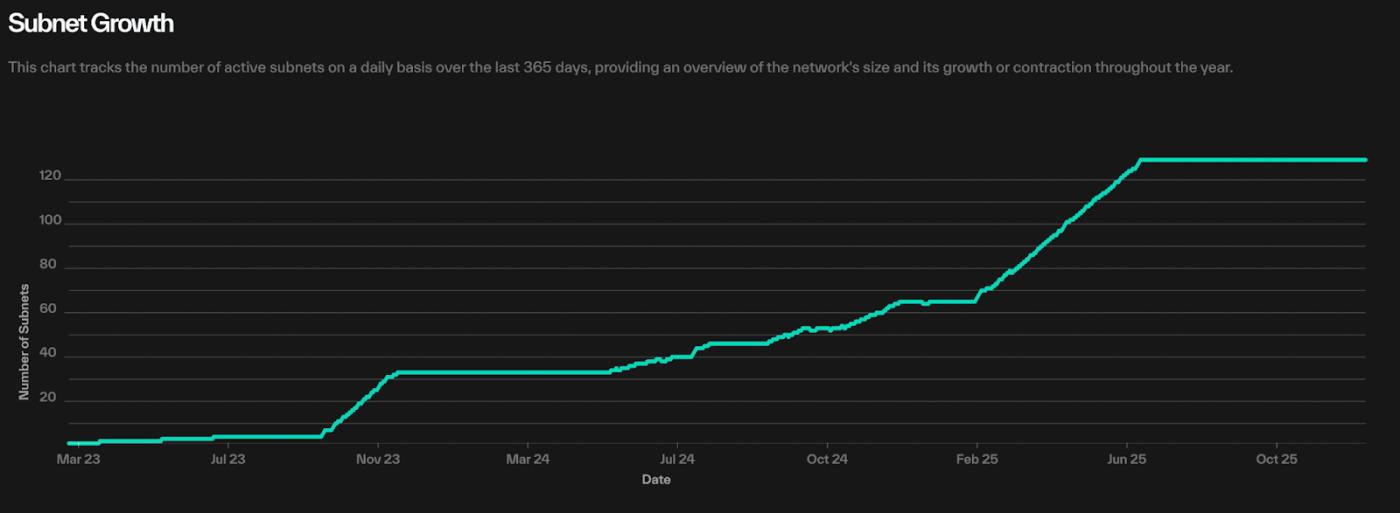

Nodes participating in the Bittensor network are assigned to subnets, with a total of 128 subnets. Each subnet will have a different area of expertise related to AI.

"Each subnet here is like a specialized AI service platform – some subnets specialize in image creation, others in language processing," Chia Arrash Yasavolian , co-founder of Taoshi, a subnet specializing in financial intelligence.

Centralized and decentralized

Concerns about AI often revolve around the idea that a few companies control the entire market. When an industry becomes overly concentrated, customers often end up with poorer service or higher prices – sometimes both.

Bittensor aims to make AI a shared global benefit through its decentralized nature. Independent node operators also help to strengthen Bittensor's network and AI capabilities.

“AI is changing every industry,” commented Ken Jon Miyachi , CEO of BitMind – who developed the deepfake verification subnet on Bittensor. “Bitcoin has changed the perception of store of value, and Bittensor is creating an entirely new economic system, turning intelligence into a shared asset for the whole world.”

But how truly decentralized is this network? On July 10, 2024, the Bittensor system had to shut down after being hacked and losing $8 million . The chain was switched to “secure mode,” creating only new Block without allowing any transactions to occur.

“There are real concerns about the concentration of power right now,” Yasavolian from Taoshi commented. “OpenTensor is the sole entity responsible for validating Block. The top 10 validators across subnets currently hold approximately 67% of the network’s total Stake .”

Some might argue that Bittensor's vulnerability and potential for downtime contradict the spirit of decentralization. However, Bittensor's supporters believe that complete decentralization will be implemented in the future, making the network truly "neutral," much like Bitcoin in terms of asset storage.

"Bittensor's long-term goal is to become a truly neutral AI development tool, and this decentralization process will happen gradually, similar to Ethereum's development path," Yasavolian said.

AI Alarm

One way to increase the decentralization of Bittensor and hear diverse opinions is through subnet operators. These groups have invested time and money into the network, so like Yasavolian, they also have a voice to express their own views.

And the subnet growth rate is also very impressive. From the beginning of 2025 to the present, the number of subnets has increased by 97%, from 65 to 128 subnets.

Sergey Khusnetdinov, AI Director at Gain Ventures , believes this subnet community plays a crucial Vai in Bittensor's success.

"The result is a talent-based, self-developing ecosystem where useful intelligence doesn't originate from a single lab or large corporation, but rather is naturally created by a global community without barriers."

Bittensor subnet growth chart from March 2023. Source: Taostats

Bittensor subnet growth chart from March 2023. Source: TaostatsCurrently, centralized AI companies are valued extremely highly – OpenAI is valued at $500 billion, Anthropic at $350 billion. Deepseek in China is also rumored to be worth around $150 billion. If so, how much would a powerful AI network like Bittensor be worth?

Miyachi, CEO of BitMind – which operates a deepfake detection subnet – is quite confident that the Bittensor network could surpass Bitcoin in the future.

"The value that the Bittensor ecosystem creates could absolutely surpass Bitcoin in the long term," he Chia with BeInCrypto.

This also depends on how people perceive centralized AI systems in the future, or whether the community is genuinely interested in the issue. Meanwhile, Bitcoin has experienced massive surges whenever the world faces economic instability or power concentration crises such as global pandemics, bank runaways, or fiat currency inflation .

Who knows, maybe soon people will start saying, "Keep Bittensors, stay away from centralized AI." But nobody can be sure, because sometimes the future is even more unpredictable than what AI can predict!