🚀The cryptocurrency market fell 1.37% in the past 24 hours, bringing the cumulative decline for the week to 7.2%. Key factors contributing to this decline include: market concerns about the macroeconomy ahead of the release of US inflation data, outflows from Bitcoin ETFs, and pressure on the derivatives market.

1. Macroeconomic concerns – The release of the Consumer Price Index (CPI) (December 18) increases the likelihood of the Federal Reserve implementing a tighter monetary policy; the 7-day correlation between Bitcoin and the Nasdaq is +0.89.

2. Institutional capital outflow – This month, spot Bitcoin ETFs saw a net outflow of $2.3 billion.

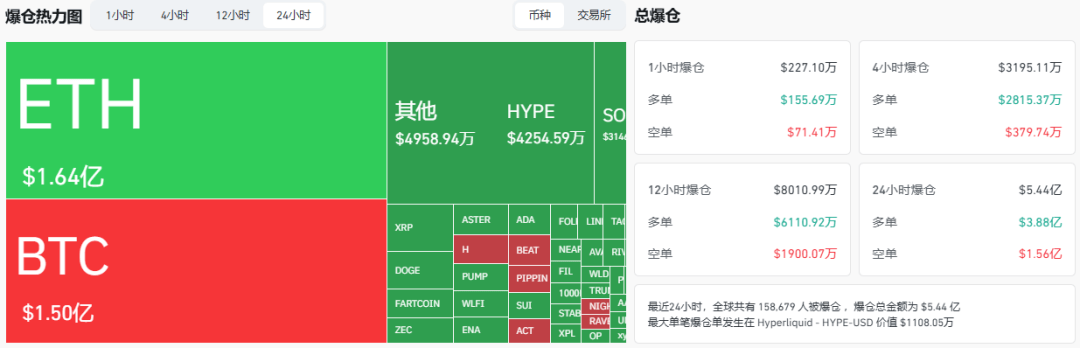

3. Leveraged liquidation – Open interest decreased by 0.89%, while Bitcoin liquidation volume increased by 152% in 24 hours, totaling $142 million.

💥Margin call alert:

In the past 24 hours, a total of 158,687 people across the internet have been liquidated, with a total of $544 million. Among them, long positions suffered a bloodbath ($388 million), and short positions were not spared either ($156 million).

📊 Performance of major cryptocurrencies:

1. Bitcoin (BTC): Price approximately 86,836, down 0.08% in the last 24 hours.

Today, keep an eye on the key level of 87,000. If it can hold above this level, a rebound may occur on the 4-hour chart. The resistance levels to watch are around 88,000, 89,080, and 90,300.

If it fails to hold above this level, the minor rebound will be weak, and it may continue to test support levels. Pay attention to the areas around 85220, 83830, and 82170.

2. Ethereum (ETH): Price around 2838, down 3.65% in the last 24 hours.

Today, we'll focus on 2860 as a key level to watch. If it holds, there's a chance for a rebound on the 1-2 hour chart, with resistance levels around 2900, 2945, and 2980.

If the price fails to hold its ground, the rebound will be weak, and it may test support levels around 2790, 2761, and 2720.

3. BNB: Price around 834, down 4.01% in the last 24 hours.

Today, pay attention to the 847 level. If it holds, there's a chance for a rebound on the 1-2 hour chart, with resistance levels around 859, 876, and 892.

If it fails to hold above this level, it may continue to weaken, with support levels around 833, 815, and 801.

4. SOL: Price around 123, down 3.98% in 24 hours.

Pay attention to the 124 level today. A short-term rebound is possible if it holds above this level, with resistance levels around 126, 130, and 134.

If the price fails to hold its ground, the rebound will be limited. Pay attention to the support levels around 121, 117, and 112.

🌡️Market Sentiment:

Today, the total market capitalization of cryptocurrencies is approximately $3.01 trillion, and the total trading volume in the past 24 hours is approximately $129 billion.

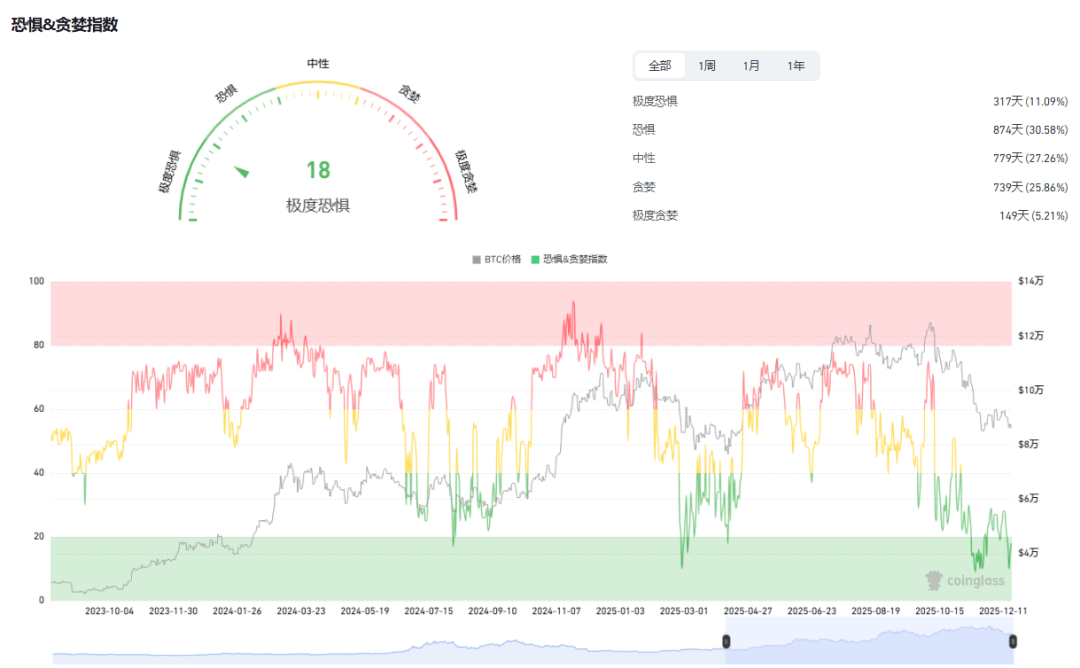

The current market sentiment is 18 (extreme fear), indicating a bearish bias due to panic selling and macroeconomic instability. However, oversold technical indicators for Bitcoin, coupled with its historical 660% surge from 2022 to 2025 driven by RSI signals, suggest a potential rebound. Furthermore, Bitcoin's market capitalization share is currently 59.39%, up 0.6% in the last 24 hours. If this share surpasses 60%, it indicates funds are flowing into the safe-haven BTC; conversely, a decline could present a good opportunity to invest in Altcoin.

Today's Crypto Gainers and Losers List 🔥

📈Top 3 Gainers :

1. ACT: Price $0.0258, up 25% in 24 hours.

2. HMSTR: Price $0.000244, up 23% in 24 hours.

3. BARD: Price $0.8806, up 14% in 24 hours.

📉Top 3 stocks with the largest declines :

1. SOMI: Price $0.2617, down 19% in 24 hours.

2. TOWNS: Price $0.00554, down 17% in 24 hours.

3. FORM: Price $0.3415, down 16% in 24 hours.

✨Performance of other major cryptocurrencies :

Dogecoin (DOGE): Price $0.12490, down 4.74% in the last 24 hours.

Tron (TRX): Price $0.2773, down 1.11% in the last 24 hours.

Cardano (ADA): Price $0.3627, down 4.93% in the last 24 hours.

Hyperliquid (HYPE): Price $24.173, down 10.98% in the last 24 hours.

Avalanche (AVAX): Price $11.78, down 3.76% in the last 24 hours.

Stellar (XLM): Price $0.2091, down 4.26% in the last 24 hours.

Sui (SUI): Price $3956, down 5.94% in the last 24 hours.

Chainlink (LINK): Price $12.19, down 4.62% in the last 24 hours.

Hedera (HBAR): Price $0.10848, down 3.73% in the last 24 hours.

Bitcoin Cash (BCH): Price $530.9, down 2.75% in the last 24 hours.

Shiba Inu (SHIB): Price $0.00000746, down 4.48% in the last 24 hours.

Litecoin (LTC): Price $75.33, down 4.67% in the last 24 hours.

Pepe hiba Inu (PEPE): Price $0.00000388, down 4.90% in the last 24 hours.

Toncoin (TON): Price $1.465, down 4.62% in the last 24 hours.

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07