Written by Glendon, Techub News

The market for forecasting is developing rapidly and is accelerating its move towards becoming a mainstream financial market, making it a hot "huge opportunity" right now.

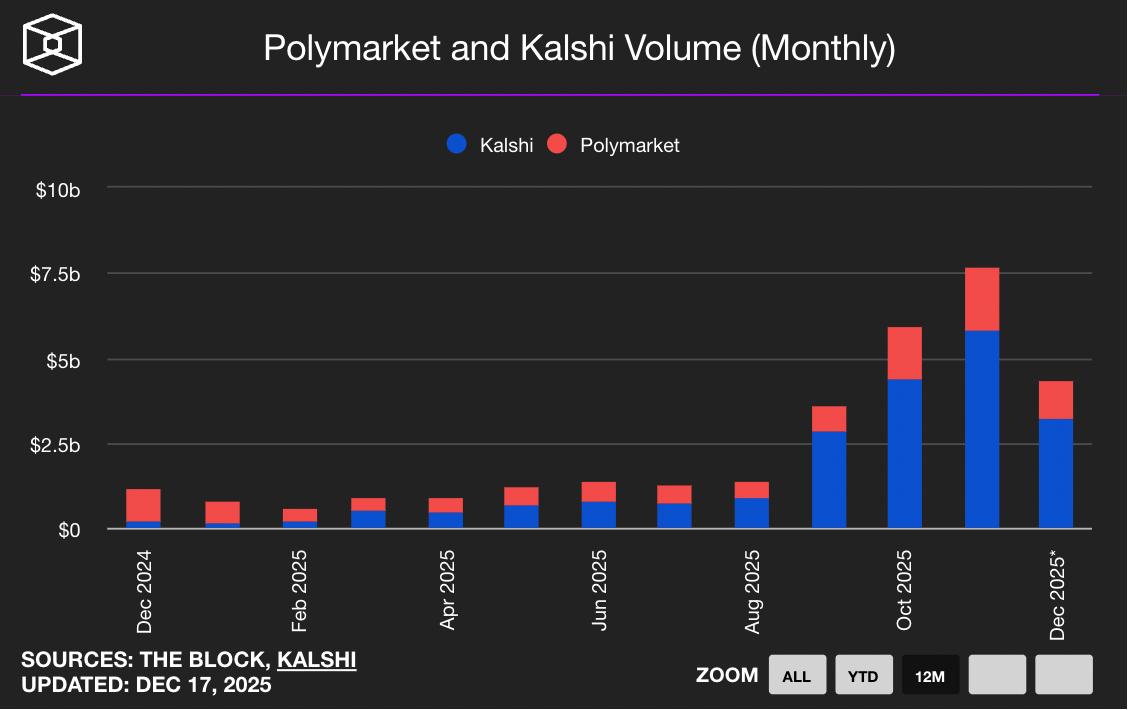

According to data from The Block, Kalshi's trading volume reached $5.8 billion in November, a 32% increase from October, setting a new record high; Polymarket's trading volume also climbed to $3.74 billion in November, a record high, representing a 23.8% increase month-over-month.

Today, Probable, a prediction market, officially launched on BNB Chain. Incubated by PancakeSwap and YZi Labs, the platform allows users to predict cryptocurrencies, global events, sporting events, and more, all without any transaction fees. Meanwhile, Coinbase is also actively expanding its platform, announcing at its System Update press conference that it will significantly expand the range of assets traded on its platform, primarily including stock trading, prediction markets, and other new services, to solidify its market positioning as an "all-in-one exchange."

As we can see, the prediction market "two giants," Kalshi and Polymarket, have led the industry's explosive growth, while crypto-native prediction markets like Probable and trading platforms such as Coinbase are catching up. Even with the current sluggish market conditions, the field still presents a thriving picture. But behind this excitement, what is the current state of development in the prediction market sector?

Kalshi: Firmly seated on the "throne," aiming for the on-chain prediction market.

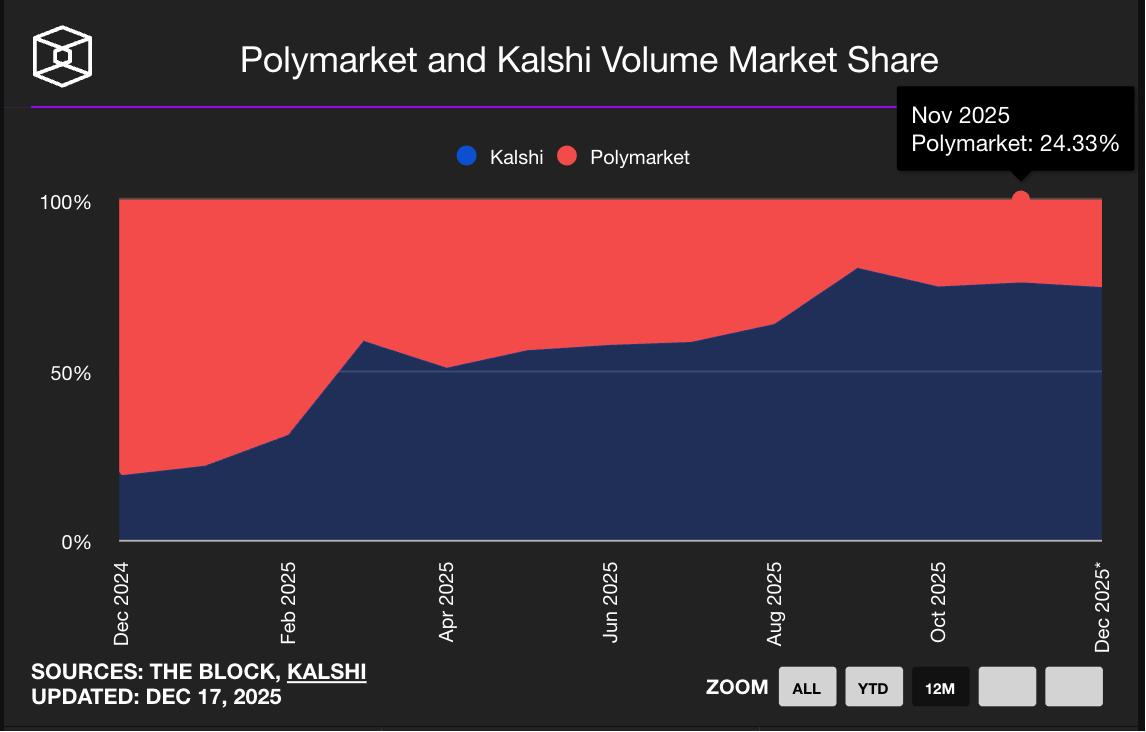

Currently, Kalshi firmly holds the dominant position in the prediction market and is working hard to consolidate its market position.

As the first prediction market platform in the US regulated and licensed by the Commodity Futures Trading Commission (CFTC), Kalshi is not a native crypto application. However, Kalshi is actively seeking change, having already onboarded thousands of prediction markets through Solana to promote the open monetization of its global liquidity pools. Simultaneously, Kalshi has launched a developer grant program totaling over $2 million to encourage emerging applications to integrate on-chain functionality. This move targets the $3 trillion crypto asset market, with a clear objective: to attract high-frequency trading crypto users and further expand its user base. This seems to indicate that Kalshi is preparing to directly compete with Polymarket in the on-chain finance arena.

In terms of funding, Kalshi completed a $1 billion Series E funding round earlier this month, led by Paradigm, with participation from a16z, Sequoia Capital, ARK Invest, and others, bringing its latest valuation to $11 billion. To gain a more advantageous position in the market, on December 12th, Kalshi, along with Crypto.com, Robinhood, Coinbase, and Underdog, formed the Coalition for Prediction Markets (CPM) to strengthen its compliance moat. This alliance aims to maintain a safe, transparent, and federally regulated environment for prediction markets. Notably, this alliance excluded its competitor, Polymarket, the intention behind which is self-evident.

In addition to financial platforms such as Robinhood and Coinbase, Kalshi has partnered with news channels such as CNN and CNBC, integrating its real-time probability data into their programs for media use.

As of this writing, data from The Block shows that Kalshi's trading volume this month has reached $3.22 billion, with weekly trading volume exceeding $1 billion. Currently, the platform has established over 3,500 trading markets and will continue to expand its product offerings, seek more media partnerships, and integrate more brokerages.

Polymarket: Returning to the US Market, Aiming to Seize Market Share

Polymarket received approval last month from the U.S. Commodity Futures Trading Commission (CFTC) for an amended designation, allowing it to access the U.S. market through intermediaries. Currently, Polymarket's focus remains on launching trading in the U.S. market. Earlier this month, Polymarket began rolling out its new mobile application to users on the waiting list in batches, initially focusing on sports prediction features, with plans to expand functionality to various markets in the future.

During this period, Polymarket also actively expanded its partnership channels. On December 5th, Polymarket officially launched on the MetaMask mobile app, introducing the MetaMask prediction market powered by Polymarket. On December 9th, Polymarket CEO Shayne Coplan revealed an important piece of information in an interview with AXIOS: Polymarket is currently operating at a loss. Under these circumstances, capturing as much market share as possible has become Polymarket's top priority.

Market data shows that Polymarket currently faces considerable competitive pressure. As of this writing, Polymarket's market share is only 24.33% compared to Kalshi, while these two platforms account for nearly 95% of the entire prediction market. Specifically, Polymarket's trading volume this month is approximately $1.11 billion, and its monthly active users are currently around 334,700. However, with the official opening of the US market, Polymarket will usher in new development opportunities, and its competition with Kalshi is about to begin.

Opinion is rapidly rising, and BNB Chain has become an important innovation hub.

From an industry ecosystem perspective, BNB Chain has become an important innovation hub. Currently, several prediction markets are operating on BNB Chain. Among them, Opinion, the prediction market within the BNB Chain ecosystem, has stood out and become a shining new star.

Opinion officially launched on October 23rd and immediately demonstrated phenomenal growth, becoming one of the fastest-growing prediction markets. Within a month of its public launch, its trading volume surpassed $5 billion, and within 50 days, its cumulative nominal trading volume exceeded $6.4 billion, with daily trading volume repeatedly exceeding $200 million. Its advantage lies in standardizing macroeconomic indicators such as inflation, interest rates, and employment into tradable assets, making it a representative case of a macro-oriented prediction market.

Earlier this month, the Opinion team revealed important news at an event: it had recently secured tens of millions of dollars in funding, which will be used to advance the development of its prediction market ecosystem based on the BNB Chain, user growth plans, and infrastructure. To further promote ecosystem development, Opinion announced on December 10th the establishment of a $1 million incentive program, the Builders Program, open to developers worldwide.

Opinion currently supports mobile trading, and users can log in and trade through Binance Wallet and other methods.

Opinion's performance in terms of holdings is also noteworthy. According to DefiLlama data, Opinion's total holdings in the prediction market once exceeded $72 million, setting a new historical high and ranking second in on-chain prediction markets, second only to Polymarket (approximately $286 million). As of now, the platform's total holdings have declined to approximately $64.93 million.

It's worth noting that Binance has shown considerable optimism about the prediction market sector and is heavily investing in it. Besides Probable, a prediction market co-incubated by PancakeSwap and YZi Labs, which was mentioned earlier and launched on BNB Chain, BNB Chain recently launched another highly anticipated prediction market platform, Predict. Founded by former Binance employees and incubated and invested in by YZi Labs, this platform is unique in that it supports interest-bearing funds. Users' funds don't remain idle while participating in predictions; they generate returns simultaneously.

Furthermore, Trust Wallet, the self-custodied cryptocurrency wallet under Binance founder CZ, has also launched a prediction market. It initially integrated with the Web3 prediction market protocol Myriad and plans to soon expand to major platforms such as Kalshi and Polymarket. These actions clearly demonstrate Binance's high level of attention to prediction markets and its determination to comprehensively develop this sector.

Other prediction markets: A multi-pronged approach, with progress in various areas.

Besides the leading prediction market platforms mentioned above, there are also some noteworthy new developments in other prediction markets:

- The Base ecosystem prediction market Limitless has completed its third $50,000 LMTS token buyback this month, bringing its total buyback from the secondary market to $150,000 over the past three weeks, with a total holding of approximately $670,000.

- Myriad has integrated with the crypto wallet Trust Wallet, and its total holdings have risen to $960,000.

- Solana's ecosystem prediction marketplace worm.wtf, launched in mid-October, has recently completed a $4.5 million Pre-Seed funding round.

- Space, a leveraged prediction market, has completed a $3 million seed round and strategic financing. It plans to build the first 10x leveraged prediction market on the Solana blockchain and launched the public sale of SPACE tokens early this morning.

While crypto prediction market projects are developing on their own, more and more crypto trading platforms have also discovered the potential of prediction markets and have successively launched related prediction market products or functions, further enriching the market ecosystem.

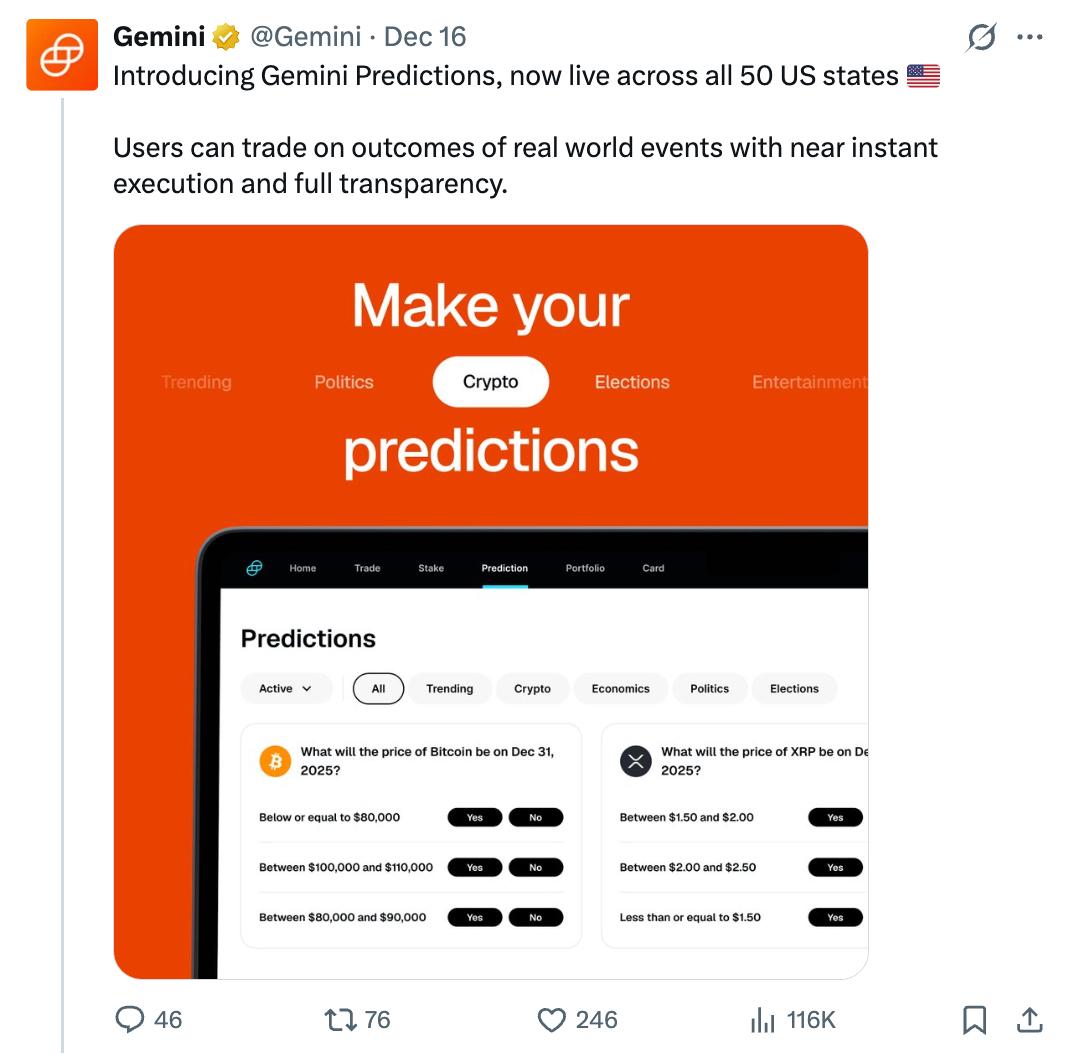

Crypto exchage Gemini (ticker symbol GEMI) received approval from the U.S. Commodity Futures Trading Commission (CFTC) this month to enter the prediction market arena. It subsequently launched its prediction market product, Gemini Predictions, which is now available in all 50 U.S. states. This product allows users to trade based on the outcomes of real-world events, offering near-instant execution and complete transparency.

Crypto wallet Phantom has partnered with Kalshi to launch a prediction market feature, allowing users to trade binary event contracts using Solana tokens within the wallet, covering popular events in sports, politics, crypto, and culture. Its prediction market is now open to eligible users.

In addition, Coinbase is also making intensive preparations to launch an internal prediction market powered by Kalshi, expected to be released next week. It's important to note that this is not an exclusive partnership, but once the product launches, Kalshi will be Coinbase's only operator partnered with a prediction market.

It's worth noting that the entry of traditional fintech institutions has intensified competition in this field. Following in the footsteps of Robinhood, Google, and the CME Group, sportswear giant Fanatics launched its prediction market platform, Fanatics Markets, this month, initially available in 10 US states. Fanatics partners with Crypto.com to provide compliant trading infrastructure, and leveraging its strong resources and capabilities, plans to expand its business to categories such as crypto prices, IPOs, technological advancements, and movie results by 2026. Fanatics has explicitly stated its goal is to compete with Polymarket and Kalshi to seize market share.

Summarize

From the current competitive landscape, the US market has become a duopoly dominated by Kalshi and Polymarket. New entrants face extremely high compliance and liquidity barriers, making it difficult to gain a foothold in this market. However, from a broader perspective, the prediction market industry is actually still in its early stages of development, possessing enormous potential. Currently, more users are focusing on traditional areas such as sports events, neglecting broader economic scenarios. Analysts at Citizens Financial Group Inc. point out that the industry's current annual revenue is approximately $2 billion, but by 2030, prediction market companies' revenue could grow fivefold, exceeding $10 billion. This means the industry may be on the verge of explosive growth, with unlimited potential for the future.

Over the next five years, prediction markets are poised for a remarkable transformation from niche speculative tools to mainstream decision-making infrastructure. Deep involvement from institutional investors will drive continuous improvements in market efficiency, while AI-driven dynamic pricing models may fundamentally alter traditional prediction mechanisms, bringing about a radical shift in the market. For industry participants, seizing the dual opportunities of "compliance" and "scenario-based applications" may become a core strategy for securing a foothold in this emerging market worth hundreds of billions of dollars.