Spot Bitcoin ETFs have seen their strongest inflows in over a month, reflecting a return of institutional demand amid changing macroeconomic expectations.

Spot Bitcoin ETFs have seen their strongest inflows in over a month, reflecting a return of institutional demand amid changing macroeconomic expectations.

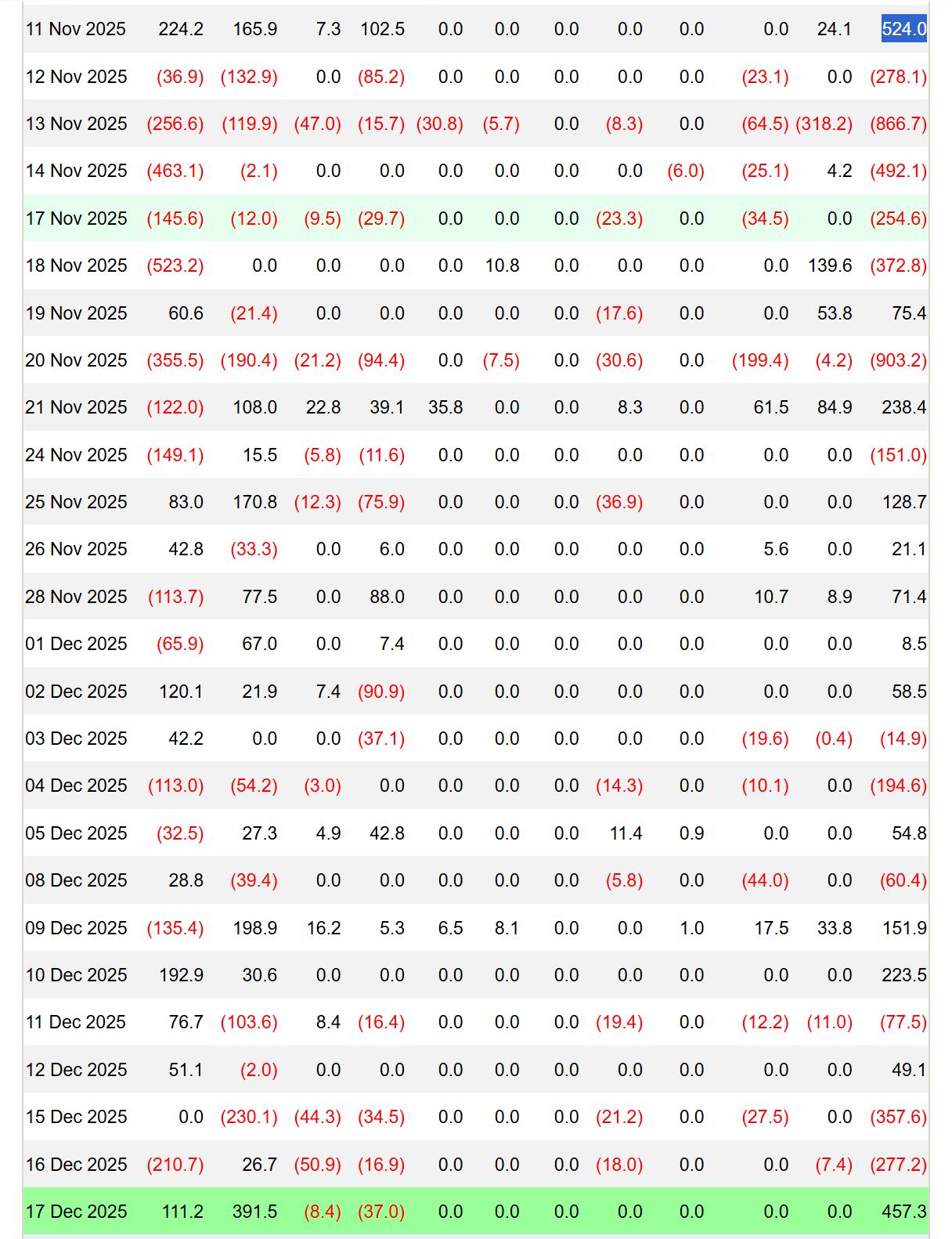

Specifically, on Wednesday, spot Bitcoin ETFs attracted $457 million in net inflows , the highest level in over a month, indicating that demand from institutional investors is showing signs of accelerating again.

Fidelity 's Wise Origin Bitcoin Fund (FBTC) led the way with approximately $391 million in inflows for the day, accounting for the majority of total net inflows. Following closely behind was BlackRock 's iShares Bitcoin Trust (IBIT) with approximately $111 million , according to data from Farside Investors .

This inflow has raised the cumulative net inflow into US spot Bitcoin ETFs to over $57 billion , while total net assets have exceeded $112 billion , equivalent to approximately 6.5% of Bitcoin's market Capital .

This recovery follows a period of significant volatility in November and early December, when money flows repeatedly reversed between periods of light inflows and sharp outflows. The last time Bitcoin ETFs recorded inflows exceeding $450 million was on November 11th, when the funds attracted approximately $524 million in a single day.

Bitcoin ETF inflows reflect early macroeconomic positioning.

Vincent Liu , Chief Investment Officer at Kronos Research , believes this renewed interest is more of an "early positioning" move than a late-cycle euphoria. "The current ETF inflows are like early positioning. As interest rate expectations cool, BTC becomes a purely liquidation transaction. Politics creates sentiment, but Capital flows are driven by macroeconomic factors," he said.

However, Liu also cautioned that the upward trend is unlikely to be smooth. “The momentum may be sustained, but it won’t be consistent. Money flows will follow liquidation and price volatility. As long as BTC remains a clear macroeconomic indicator, ETFs remain the least obstructed path.”

On the same day, US President Donald Trump announced his intention to appoint a new Federal Reserve Chairman who strongly supports interest rate cuts. Speaking at a national address marking the first anniversary of his second term, Trump said he would announce a successor to current Fed Chairman Jerome Powell early next year, adding that all potential candidates support lower interest rates than currently exist. Low interest rates are generally XEM as a positive factor for risky assets like cryptocurrencies.

Approximately 6.7 million BTC are currently at a loss.

Bitcoin has now returned to the price range of nearly a year ago, leaving a dense cluster of supply in the $93,000–$120,000 range, further hindering recovery efforts. This “heavy top” structure has caused the amount of Bitcoin in a losing position to increase to 6.7 million BTC , the highest level of the current cycle, according to Glassnode .

The report indicates that demand remains fragile in both the spot and Derivative markets. Spot buying is selective and short-term, corporate treasury inflows are sporadic, while Futures Contract remain more geared towards risk abatement than confidence rebuilding. Until selling pressure is absorbed above $95,000 or new liquidation emerges, Bitcoin is likely to remain stuck in the structural support zone around $81,000 , according to Glassnode.