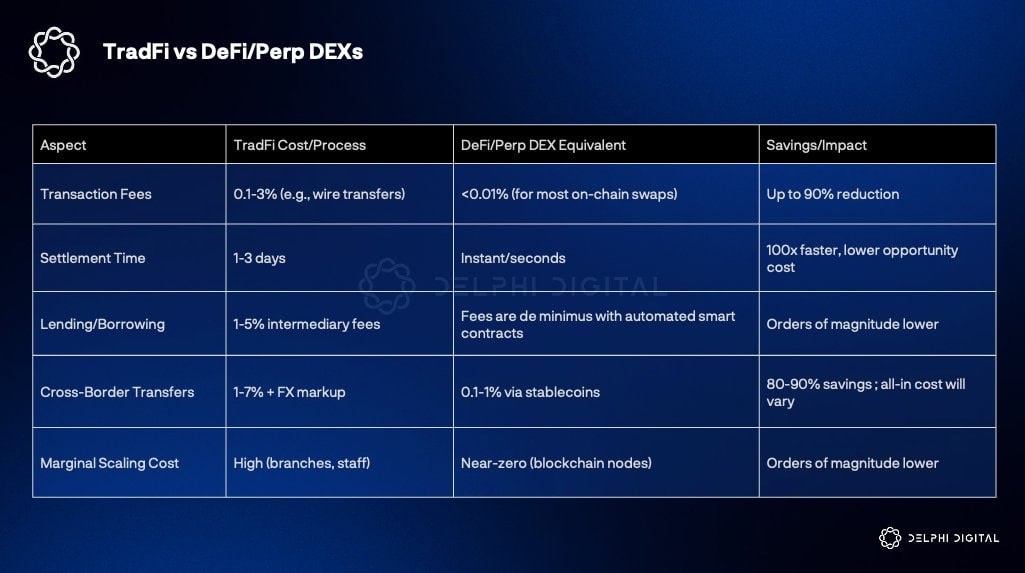

Perp DEXs Disrupting the Traditional Financial Stack ❌ Delphi Digital Perp DEXs are no longer simply derivatives exchanges. Core functions previously handled by Wall Street in traditional finance are being absorbed into a single on-chain venue. 🟢Hyperliquid → Preparing for native borrow/lend 🟢Major Perp DEXs → Developing their own stablecoins 🟢Rapidly expanding to include spot, options, structured products, and vaults This is a battle to become the "Wall Street" of the next digital economy. 🟢There won't be many winners. 🟢Deepest liquidity 🟢Top traders 🟢A platform that attracts builders and capital Only a few Perp DEXs that meet these criteria will widen the gap, creating a self-reinforcing flywheel. In the long term, on-chain companies will rely on this platform to: 🟢Raise funds 🟢Treasury Operations 🟢Borrowing/Lending 🟢Hedging are all handled in one place. Functions that previously required relationships with major banks are now accessible to anyone with a single wallet. Perp DEX is not just an "exchange," it is evolving into an on-chain financial infrastructure in its own right.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content