This market is so frustrating, constantly swinging up and down like a painted door. The relentless decline shows how well the big players control the market, while the short sellers are having a field day. Next week is the Christmas holiday, so I bet the big players will take an early break and dump their holdings. In this kind of market, rebounds are short-lived, followed by the bears continuing their crushing onslaught. Some smaller exchanges are already struggling to survive; market liquidity is getting worse and worse.

In the past 24 hours, a total of 163,122 people across the internet have had their positions liquidated, with a total liquidation amount of $551 million. Long positions were liquidated for $390 million and short positions for $161 million.

Today's BTC and ETH market analysis

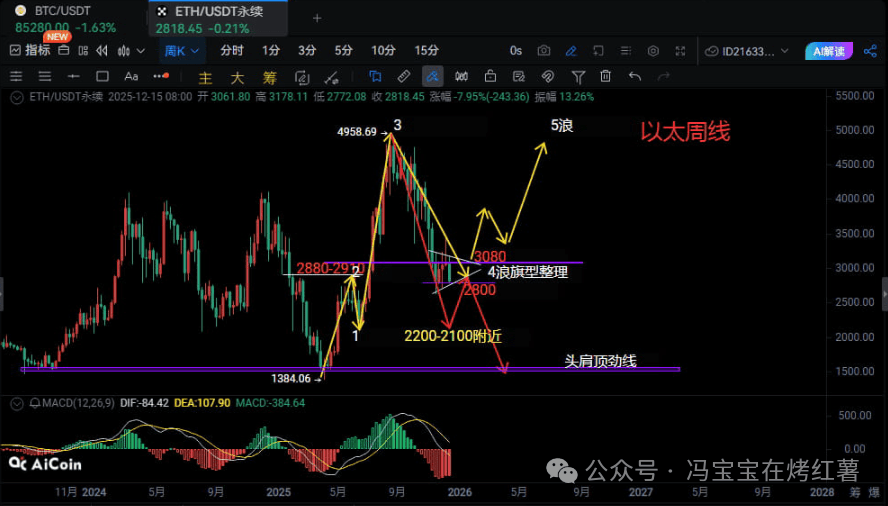

On the weekly chart, Ethereum's downtrend is gradually strengthening. For the past five weeks, the price has mainly oscillated between 2800 and 3080, with many upward breakouts being false breakouts and downward support being tested multiple times. The current price action resembles a four-wave flag pattern. If this pattern holds, the 2800 or even 2700 area would present good opportunities to enter long positions. However, we should be wary of another possibility: if the head and shoulders pattern continues to hold, the price may continue the previous C-wave decline, with the next major target potentially falling in the 2100-2200 range.

Key short-term observation points: Whether Ethereum can effectively break through and hold above 3080-3100 in the remaining trading days of this week and early next week will determine its direction. For Bitcoin, the upside resistance level to watch is 90800-91600, with significant support around 83600.

Bitcoin short-term trading suggestion: Consider short around 86500-87000, with a stop loss above 87500. The first target is 85000-84500, and a break above this level could lead to around 83600. If the price doesn't break through, consider going long.

Ethereum short-term trading suggestion: Consider short when the price rebounds to around 2900-2930, with a stop loss above 2970. The first target is 2810-2836, and if it breaks through, it could reach around 2753; if it doesn't break through, consider going long.

Copycat

Right now, if you randomly click on any of these once-popular Altcoin like $PUMP, $ONDO, and $ORDI, they're all in freefall, constantly hitting new lows! This market is much worse than the 2022 bear market!

This is really a scam, and there are even Altcoin like $PIPPIN and $BEAT!

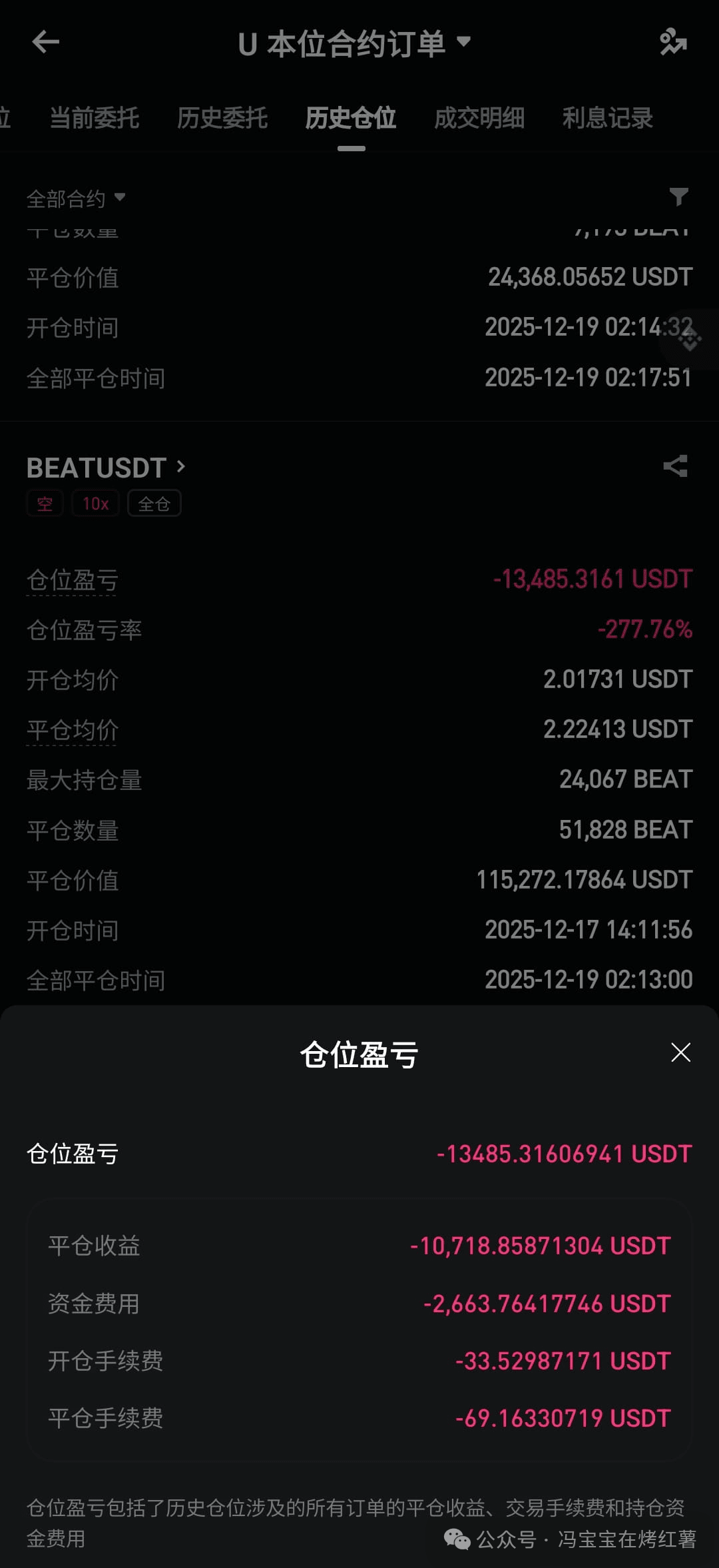

The project team controls over 90% of the tokens, creating price discrepancies between spot and futures prices through wash trading. They secretly build long positions at the bottom, then allow the price to trade sideways for extended periods, forcing short positions to continuously pay funding fees (collected hourly), easily reaping profits. Retail investors don't have the patience to hold on with their capital. Chasing the price higher only leads to a massive sell-off and immediate wipeout.

These two coins have no real value. BEAT's on-chain liquidity pool is less than 1 million USDT, yet it's been artificially inflated to a market capitalization of 3 billion USDT. With such a market, if someone actually dumps their holdings, it simply can't be absorbed, and it goes straight to zero. PIPPIN's main players pumped it 200 times, but when they found no one to buy, they had to dump the price themselves and slowly make back their money through contract funding fees.

I opened a short position of 40,000 USDT on BEAT, and after only one day, the funding fees have already consumed 3,000 USDT, which is equivalent to nearly 8% of my capital being wiped out in a single day. If the market continues to trade sideways, my principal will be completely wiped out, and I will eventually have no choice but to cut my losses and leave the market.

This hourly funding fee mechanism is practically a tailor-made tool for project teams to fleece them; it's no different from outright robbery. Brothers, stay away from these projects. Don't chase the market up or blindly short; let them play by themselves. These coins will ultimately be worthless. Once the funding fee returns to normal (every 4 or 8 hours), a collapse is only a matter of time. Don't let these project teams foot the bill anymore!

Binance Life

I actually profited from yesterday's trade; it was a blast that I kept getting short positions.

$67

When the Chinese community finally reacts collectively and starts discussing, promoting, and praising it wildly, the price will have reached an all-time high, and that's when you can exit the market.

$BNB

Today's key level to watch is 840. If the 4-hour chart can hold above this level, a rebound is likely to begin, with upside targets at resistance levels around 853, 866, and 876. If it fails to hold above 840, it indicates a weak rebound, and the price may continue to decline, with support levels around 829, 818, and 808.

$SOL

Today, the key level to watch is 122. A rebound is only possible if the 4-hour chart shows a firm hold above this level. Resistance levels are around 126, 130, and 134. If the price fails to hold above 122, the rebound momentum will be weak, and support levels to watch are around 117, 112, and 109.

$U

Binance's new stablecoin $U just launched, and it shares the same name as my previous holdings! A lot of meme coins have appeared in the pools, with only one managing to reach a market capitalization of over a million, but its liquidity is truly terrible. In the past, strong institutional investors would have already entered the market to manipulate prices, but this time it looks more like a simple setup, with no real institutional investor involved.

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07