(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

If I had an online dating profile, it would sound something like this:

Love Language:

Euphemistic terms and acronyms created by politicians and central bankers describing money printing.

The two most apropos examples that this essay shall discuss:

QE — Quantitative Easing

RMP — Reserve Management Purchases

RMP is a new acronym that entered my Love Language dictionary on December 10th, the day of the most recent Fed meeting.[1] Immediately, I recognized it, understood its meaning, and treasured it like my long-lost love, QE. I love QE because it means money printing, and thankfully I own financial assets like gold, gold/silver mining stocks, and Bitcoin that rise faster than the pace of fiat money creation. But it’s not all about me. If money printing in all its forms drives the price and adoption of Bitcoin and decentralized public blockchains higher, then hopefully one day we can discard this filthy fiat fractional reserve system and replace it with one powered by honest money.

We aren’t there yet. But the rapture quickens with every unit of fiat created.

Unfortunately, in the here and now for most of humanity, money printing destroys their dignity as productive humans. When the government intentionally debases the currency, it destroys the link between energy inputs and economic outputs. Knowing no fancy economic theories that explain why they feel like they are running in quicksand, those wage cucking plebes understand that money printing is no bueno. In democratic systems of one human, one vote, the plebes vote out the incumbent party when inflation surges. In autocratic systems, the plebes enter the streets and topple the regime. Therefore, politicians know that ruling in an inflationary environment is a death sentence for their careers. However, the only politically palatable way to pay for the massive amount of global debt is to inflate it away. Given that inflation destroys political careers and dynasties, the skill is hoodwinking plebes into believing that the inflation they feel isn’t inflation at all. Therefore, central bankers and finance ministers roll out a cauldron of bubbling ghoulish acronyms to obfuscate the inflation they hoist upon the public in order to forestall the inevitable systemic deflationary collapse.

If you want to understand what aggressive credit deflation and destruction looks like, remember how you felt from US President Trump’s self-proclaimed “Liberation Day” April 2nd to April 9th when he TACO’d on tariffs.[2] It wasn’t pleasant for the rich, because stonks dumped, or for everyone else because if global trade slowed to rectify a multi-decade buildup of economic, trade, and political imbalances, many would lose their jobs. Allowing rapid deflation is a sure way to spark a revolution and end your career or your life as a politician.

All this subterfuge, given time, because of the expansion of knowledge, always results in the plebes associating the acronym de-jour with money printing. Like any good drug dealer, the monetary mandarins must change up when the plebes get hip to the new slang. This linguistic dance excites me because when they change up, it means the situation is dire and the Brrrrr button shall be slammed with a force necessary to levitate my portfolio to new dimensions.

Currently, the establishment wishes to convince us that RMP ≠ QE, because QE is associated with money printing and inflation. In order for readers to fully understand why RMP = QE, I created several annotated accounting T-charts.

Why does this all matter?

Since the post-2008 Global Financial Crisis March 2009 lows, risky assets like stonks (S&P 500 and the Nasdaq 100 indices), gold, and Bitcoin flew out of the deflationary river Styx and notched up insane returns.

This is the same chart but normalized to a starting index value of 100 in March 2009. Lord Satoshi’s Bitcoin’s percentage appreciation is so magnificent that it deserves its own panel for readability against other traditional inflation hedges, i.e. stocks and gold.

If you wanted to be rich in the age of Pax Americana QE, you needed to own financial assets. If there is another age of QE or RMP or whatever the fuck they call it, hold the assets you have, and do whatever it takes to convert your shitty salary into more.

Now that you care whether RMP = QE, let’s do some money markets accounting.

Understanding QE and RMP

It’s time for accounting T-chart porn. Assets are on the left side of the ledger and liabilities on the right. The easiest way to understand how money moves is to depict it. I will illustrate the answer to the question of how and why QE and RMP create money that causes financial and goods/services inflation.

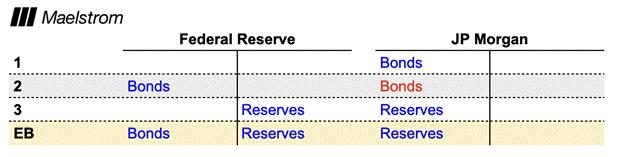

QE Step 1

[1]: JP Morgan is a primary dealer with an account at the Fed, and it holds treasury bonds.

[2]: The Fed conducts a round of QE by purchasing bonds from JP Morgan.

[3]: The Fed creates money out of thin air and pays for the bonds by crediting JP Morgan with reserves.

[EB — Ending Balance]: The Fed created reserves and purchased bonds from JP Morgan. What does JP Morgan do with those reserves?

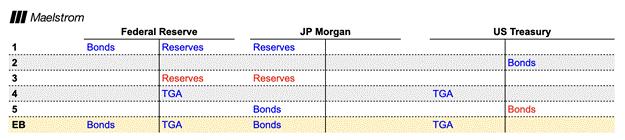

QE Step 2

[1]: The Fed created money out of thin air, which are reserves. This money becomes stimulative once JP Morgan does something with it. JP Morgan will purchase another bond to replace the one sold to the Fed only if the new bond is attractive from an interest rate and credit risk perspective.

[2]: The US Treasury issues new bonds at auction, which JP Morgan buys. Treasuries are risk-free, and because in this example bonds yield more than reserves, JP Morgan will purchase the newly issued bonds.

[3]: JP Morgan pays for the bonds with reserves.

[4]: The Treasury receives the reserves into its Treasury General Account (TGA) which is its checking account with the Fed.

[5]: JP Morgan receives its bonds.

[EB]: The Fed’s money printer financed the increase in the supply of bonds (Fed + JP Morgan’s holdings).

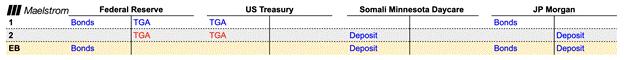

QE Step 3

[1]: Money printing allowed the Treasury to issue more bonds at a cheaper price. This is purely financial asset inflation. Lower treasury bond yields will increase the net present value of assets with streams of future cash flows like stocks. Goods/services inflation occurs once the Treasury hands out goodies.

[2]: The Tim Walz Somali Daycare Center for Kids Who Can’t Read Good and Who Wanna Learn to Do Other Stuff Good Too receives a federal grant. The Treasury debts the TGA and credits the center’s JP Morgan account.

[EB]: The TGA funds government handouts, which creates demand for goods and services. This is how QE creates inflation in the real economy.

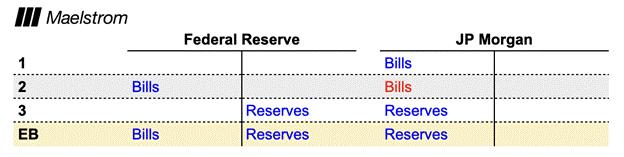

Bills vs. Bonds

A bill has a maturity of less than one year. The most traded treasury with a coupon is a 10-year bond, which is technically called a 10-year note. Bills yield slightly more than cash deposited at the Fed as reserves. Let’s go back to Step 1 and replace bonds with bills.

[EB]: The only difference is that the Fed exchanged reserves for bills. The QE money flow stops here because JP Morgan is less incentivized to purchase additional bills because the interest on reserves is greater than the bills yield.

The above chart is the IORB minus the 3-month T-bill yield, which is positive. A profit maximizing bank will keep money at the Fed rather than buying a T-bill with a lower yield. [3] Therefore, the type of debt security purchased with reserves matters. If the interest rate risk or duration is too small, the Fed’s printed money remains on its balance sheet, accomplishing nothing. Analysts argue that technically speaking, $1 of RMP purchases of bills is way less stimulative than $1 of QE purchases of bonds.

But what if the banks aren’t the ones holding the bills, but it’s another financial player? Money market funds (MMF) currently own 40% of T-bills outstanding, while banks only own 10%. Again, why would a bank purchase bills when it earns more money lending to the Fed at IORB? To understand the potential impact of RMP, we must analyze the decisions an MMF will make when the Fed purchases its holdings of bills. I will conduct the same analysis for RMP as I did with QE.

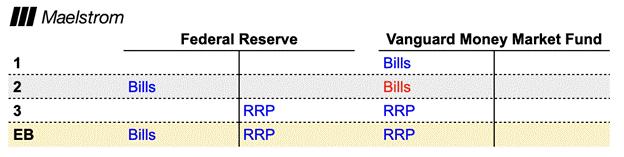

RMP Step 1

[1]: Vanguard is a licensed money market fund with an account at the Fed, and it holds treasury bills.

[2]: The Fed conducts a round of RMP by purchasing bills from Vanguard.

[3]: The Fed creates money out of thin air and pays for the bills by crediting Vanguard with funds held in the Reverse Repo Program (RRP). The RRP is an overnight facility with interest paid daily directly by the Fed.

[EB]: What else can Vanguard do with RRP balances?

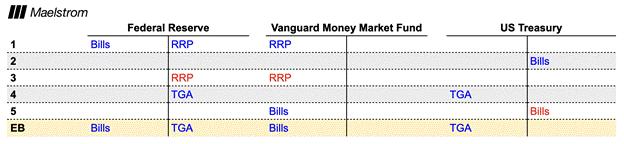

RMP Step 2 (Vanguard buys more bills)

[1]: The Fed created money out of thin air, which became RRP balances. This money becomes stimulative once Vanguard does something with it. Vanguard will only buy another short-dated risk-free debt instrument if it yields higher than the RRP. That means Vanguard will only purchase another newly issued T-bill. As an MMF, Vanguard has various restrictions on the type and tenor of debt it may purchase with its investors’ money. Because of these restrictions, Vanguard typically will only purchase T-bills.

[2]: The US Treasury issues a new bill at auction, which Vanguard will ultimately purchase.

[3]: Vanguard pays for the bills by spending cash in the RRP.

[4]: The Treasury receives the RRP cash into its TGA.

[5]: Vanguard receives its bills.

[EB]: The Fed’s creation of money financed the purchase of newly issued Treasury bills.

The T-bill yield will never go below that of RRP because MMFs, as the marginal buyer of T-bills, will leave money in RRP if the yield is equal to that of a T-bill. Technically speaking, because the Fed can print money unilaterally to pay interest on RRP balances, it is a slightly better credit risk than the US Treasury, which must have congressional approval to issue debt. Therefore, MMFs prefer to keep cash in the RRP unless there are greater yields on T-bills. The reason this is important is that the T-bills’ lack of duration means that lowering the yield a few basis points because the Fed conducts RMP will not have much effect on financial asset inflation. Only if the Treasury spends the money it raised on goods and services will inflation show up in financial assets and goods and services.

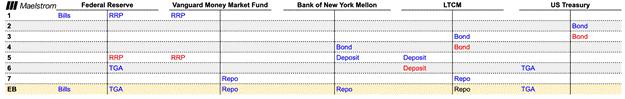

RMP Step 2 (Vanguard lends to the repo market)

If newly issued T-bill ≦ RRP yields or the supply of newly issued T-bills is insufficient, are there any other investments MMFs can make that potentially cause financial asset or goods/services inflation? Yes. MMFs can lend cash into the treasury repo market.

A repo is short for repurchase agreement. In this example, a bond repo is when a MMF provides an overnight cash loan collateralized by a newly issued treasury bond. When the markets behave, the repo yield should be at or slightly below the upper bound of Fed Funds. Currently, the RRP yield equals Fed Funds or 3.50%. The current three-month T-bill yields 3.60%. But the upper bound of Fed Funds is 3.75%. If repo trades close to the upper bound of Fed Funds, a MMF is getting almost a 0.25% yield pickup (3.75% minus RRP yield of 3.50%) by lending in the repo market vs. in the RRP.

[1]: The Fed created RRP balances by printing money and purchasing bills from Vanguard.

[2]: The US Treasury issues bonds.

[3]: LTCM, an RV hedge fund back from the dead, purchases the bonds at auction, but they don’t have the money to pay for them. They must borrow money in the repo market to pay the Treasury.

[4]: Bank of New York Mellon (BONY) facilitates tri-party repo transactions. They receive the bonds as collateral from LTCM.

[5]: BONY receives cash drawn from Vanguard’s RRP balance. That cash shows up as a deposit at BONY which is then given to LTCM.

[6]: LTCM uses its deposit to pay for the bonds. The deposit becomes a TGA balance that the US Treasury holds at the Fed.

[7]: Vanguard withdrew cash from the RRP and lent it in the repo market. Vanguard and LTCM will decide each day whether they would like to roll the repo.

[EB]: The Fed’s printed money bought bills from Vanguard, which facilitated LTCM’s financing of its bond purchases. The Treasury can issue debt of long or short duration, and LTCM will purchase it at any price because repo rates are predictable and affordable. Vanguard will always lend at “appropriate” rates because the Fed printed money and purchased its bills. The RMP is a thinly disguised way for the Fed to cash the government’s checks. This is highly inflationary from both a financial and real goods/services perspective.

RMP Politics

I gots some questions, and the answers will surprise you.

Why wasn’t the announcement of the RMP included in the formal FOMC statement like all previous QE programs were?

The Fed unilaterally decided that QE is a monetary policy tool that stimulates the economy by removing interest rate sensitive long-term bonds from the market. The Fed considers RMP a technical implementation tool that does not stimulate the economy because it removes T-bills from the market that are cash-like instruments.

Is the RMP subject to a formal FOMC vote?

Yes, and no. The FOMC instructed the New York Fed to implement RMP such that reserves remain “ample”. The New York Fed can unilaterally decide to increase or decrease the size of RMP T-bill purchases until the FOMC votes to end the program.

What is the level of “ample reserves”?

It is a nebulous concept with no fixed definition. The New York Fed decides when reserves are ample and when they are deficient. I will explain in the next section why Buffalo Bill Bessent controls the level of ample reserves. In effect, the Fed handed over control of the short-end of the yield curve to the Treasury Department.

Who is the New York Fed president and what are his views on QE versus RMP?

John Williams is the president of the New York Fed. His next five-year term begins in March 2026. He ain’t going nowhere. He has been a vocal proponent of the theory that the Fed’s balance sheet must expand to ensure there are “ample reserves”. His voting record on QE is very supportive, and publicly he is all for money printing. He believes RMP is not QE, and therefore not economically stimulative. This is great because when inflation inevitably rears its ugly head, he will proclaim, “It ain’t my fault,” and continue printing money using the RMP.

Unlimited Unchecked Money Printing

The sophistry surrounding what is QE and not QE and what level of reserves are “ample”, allows the Fed to cash the checks of the politicians. This ain’t QE, this is Money Printer Go Fucking Brrrrr! Every past QE program featured an end date and a maximum amount of bonds to be purchased each month. Extension of the program required a public vote. RMP can theoretically expand infinitely as long as John Williams wishes it so. And John Williams is not really in charge because his economic dogma doesn’t allow him to consider that his bank is directly fueling inflation.

Ample Reserves and RMP

The RMP exists because the free market cannot handle the too beaucoup Alabama black snake that is a surge in T-bill issuance. Reserves must grow in lockstep with T-bill issuance or else the market seizes up. I discussed this in my essay “Hallelujah”.

Here is a table of the total amount of marketable Treasury debt securities issued from fiscal year 2020 to 2025:

In short, the US Treasury’s addiction to cheap short-term funding continues to grow despite Buffalo Bill Bessent’s assertion that Bad Gurl Yellen refusal to term out the debt was a policy error of epic proportions. As it stands now, the market must absorb ~$500 billion per week of T-bills, which is up from ~$400 billion per week in 2024. The ascension of Trump, who campaigned on deficit reduction, did nothing to change the trajectory of increased gross T-bill issuance. And it doesn’t matter who is in charge because if Kamala Harris had won, the issuance schedule would be the same.

The driving force behind why gross T-bill issuance is large and growing is that the politicians will not stop handing out goodies.

The CBO and primary dealers both agree that deficits will be >$2 trillion for the next three years. Nothing stops this train of profligacy.[4]

Before I discuss arguments put forward why RMP ≠ QE, I want to offer a prediction on how Buffalo Bill Bessent will use the RMP to juice the housing market.

RMP Funded Buy Backs

I know this is painful for some of you punters, but think back on the events in early April this year. Right after Trump TACO’d on tariffs, Buffalo Bill Bessent in a Bloomberg interview proclaimed he could use buy backs to calm the Treasury market. Since then, the gross notional of Treasury buy backs increased. Through the buyback program, the Treasury uses proceeds from T-bill issuance to buy back older off-the-run debt. If the Fed prints money to purchase T-bills, in effect directly financing the Treasury, then the Treasury can increase the gross issuance of T-bills and use part of those proceeds to buy back longer-dated Treasury notes and bonds. Specifically, I believe Bessent will use buy backs to purchase 10-year treasuries, thus reducing the yield. In this way, Bessent can magically remove interest rate risk from the market using the RMP. Actually, that is exactly what QE does!!!!!

The 10-year yield is very important for the 65% of US households that are homeowners and those poor first-time home buyers. Lower 10-year yields help US households take out home equity loans to fund greater consumption. In addition, the mortgage rate will decline, which helps housing affordability. Trump is very vocal about his belief that mortgage rates are too high, and if he can deliver on this, it will help the Team Red Republicans stay in power. Therefore, Bessent will use the RMP and buy backs to purchase 10-year treasuries and reduce mortgage rates.

Let’s quickly step through some US housing market chart porn.

There is plenty of home equity available to lever up.

The refinancing wave is just beginning.

The current levels of refinancing are nowhere near the 2008 housing bubble peak.

If Trump can deliver on housing affordability by reducing financing costs, the Team Red Republicans could defy the current odds and maintain their majority in both houses of the legislature.

Bessent hasn’t gone on record saying he would use buy backs to pump the housing market, but if I were him, I would use this new money-printing tool in the ways described above. Now let’s hear the arguments why RMP ≠ QE.

Haters Gonna Hate

Here are the barbs the haters throw at the RMP program regarding its ability to create financial and goods/services inflation:

- The Fed buys T-bills via RMP and longer-duration bonds via QE. Without the duration, T-bill purchases will have little to no effect on financial markets.[5]

- RMP will end in April because that is when tax payments are due, after which the repo markets will normalize because of a less volatile TGA.

My accounting T-charts clearly show how the RMP’s T-bill purchases directly fund new Treasury debt issuance. The debt will fund spending, which causes inflation, and it might lower yields on longer-term debt via buy backs. Even though the RMP transmits easing via T-bills rather than bonds, it still gets the job done. Splitting hairs is a surefire way to underperform the market.

The growth in gross issuance of T-bills invalidates the notion that the RMP’s usefulness ends in April. There is a structural shift towards funding the US government with T-bills driven by necessity.

This essay knocks down those two criticisms and gives me the confidence that the four-year cycle is dead. Bitcoin clearly doesn’t agree with my arguments, gold thinks they are “meh”, but silver is going rock ’em sock ’em robots. All I can say to that is patience, degen, patience. The market continued puking after former Fed chairperson Ben Bernanke announced QE1 in late November 2008. The markets didn’t bottom until March 2009, but if you stayed on the sidelines, you missed a great buying opportunity.

Bitcoin (white) is down 6% since the launch of RMP, while gold is up 2%.

Another piece of liquidity that the RMP will change is the correct observation that many of the world’s major central banks (e.g. ECB and BOJ) are reducing the size of their balance sheets. Balance sheet reduction is not compatible with crypto Up Only. As time passes and the RMP creates billions of dollars of new liquidity, the dollar’s exchange rate versus other fiat currencies will plummet. While a falling dollar is great for Trump’s America-first re-industrialization plans, it is terrible for global exporters who face not only tariffs but a rising domestic currency versus the dollar. China, Germany, and Japan will use the PBOC, ECB, and BOJ respectively to create more domestic credit to arrest the rise of the yuan, euro, and yen against the dollar. With their powers combined, in 2026 the Fed, PBOC, ECB, and BOJ will accelerate the destruction of fiat money. Hallelujah!

Trading Outlook

$40 billion per month is great, but as a percentage of dollars outstanding, it’s much less in 2025 than in 2009. Therefore, we cannot expect its credit impulse at current financial asset prices to be as impactful. For this reason, the current misguided belief that RMP < QE in terms of credit creation, and the uncertainty of RMP’s existence post-April 2026, will cause Bitcoin to chop between $80,000 and $100,000 until the new year begins. As the market equates RMP to QE, Bitcoin will quickly retake $124,000 and punch quickly towards $200,000. March will mark peak expectations for the power of the RMP to ramp asset prices, and Bitcoin will decline and form a local bottom well above $124,000 as John Williams keeps his grubby fingers firmly planted on the Brrrr button.

Shitcoins are sickly. The October 10th wipeout materially harmed many individuals and hedge fund liquid traders. I believe that many LPs of liquid funds saw their October NAV statements and said, “No Mas!”. The redemption requests flooded in, causing the persistent bid smacking. It will take time for the altcoin complex to heal, but for those who husbanded their precious capital and read the fucking documents about how exchanges operate, it’s time to dumpster dive.

In terms of shitcoins, my favorite is Ethena (token: $ENA). As the price of money falls because of Fed rate cuts, and the quantity grows because of RMP, Bitcoin rises and creates a demand for leverage supplied by synthetic dollars within the crypto capital markets. This boosts the cash and carry or basis yield, which causes folks to create USDe to lend at much higher rates. Most importantly, the spread between the T-bill and crypto perp basis yield widens in favor of crypto. The increase in the Ethena protocol interest income flows back to the ENA treasury, which ultimately will fuel buybacks of the ENA tokens. I expect the USDe circulating supply to rise, and this will be the leading indicator of a sharp rise in ENA. This is purely a TradFi vs. crypto USD rates play, and a similar setup presented itself when the Fed began its easing cycle in September 2024.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] The Fed is short for the US Federal Reserve.

[2] TACO — Trump Always Chicken’s Out

[3] IORB — Interest on Reserve Balances

[4] CBO — Congressional Budget Office

[5] Duration and interest rate risk are synonymous.