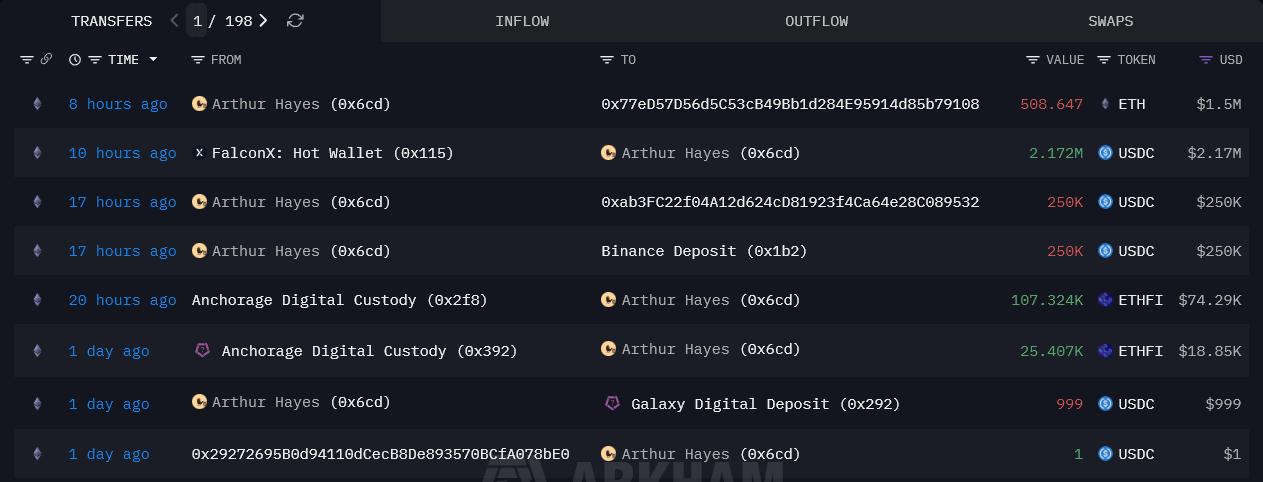

Arthur Hayes has transferred 508,647 ETH, worth approximately $1.5 million, to Galaxy Digital, sparking speculation that the "whale" might be reducing his investment risk. This is surprising given Hayes' recent optimistic outlook on Ethereum.

Arthur Hayes and his prediction to sell Ethereum.

on-chain data shows that this transaction originated from a wallet linked to Hayes and was sent to a Galaxy Digital deposit address.

Transferring coins to large institutions doesn't necessarily mean selling them immediately. Instead, these transactions often occur to provide liquidation or facilitate direct buying and selling off-exchange transactions.

Arthur Hayes sent 508 ETH to Galaxy Digital. Source: Arkham

Arthur Hayes sent 508 ETH to Galaxy Digital. Source: ArkhamThe transaction took place as Ethereum was trading just below the key $3,000 level , following a volatile December marked by ETF Capital and Derivative adjustments.

However, Hayes still holds over 4,500 ETH.

Therefore, any selling would only be to rebalance the portfolio, not to completely withdraw from the market.

This timing is quite noteworthy. Just a few days earlier, Hayes had published a detailed analysis of Ethereum's future with large institutions , concluding that financial giants had accepted the limitations of Private Blockchain.

"You can't build a Private Blockchain . You have to use a public blockchain to ensure security and real applicability."

Hayes argues that stablecoins are the catalyst that will make Ethereum more accessible to traditional finance. He predicts that banks will build Web3 infrastructure on Ethereum, rather than separate ledger systems.

"In the near future, major banks will experiment with crypto and Web3 using public blockchains. And I believe that public blockchain will be Ethereum."

He also acknowledged that privacy remains a major issue for organizations, but Hayes believes this will be addressed at the application or Layer-2 level, and Ethereum will continue to ensure overall security.

"They might create L2 with some privacy features… but the underlying platform, the primary security layer, will still be Ethereum."

However, the market remains quite volatile. Ethereum has not been able to steadily rise above $3,000 due to significant Capital from spot ETH ETFs in mid-December, and volatility in the Derivative market has also slightly decreased. This indicates a cautious rather than pessimistic sentiment.

At the protocol level, transaction activity continues to shift towards rollups, keeping transaction fees on Ethereum low but limiting the main chain 's fee revenue.

Hayes also took a more realistic approach when discussing price expectations, setting long-term targets rather than specific short-term predictions.

"If ETH reaches $20,000, you could become a millionaire with just about 50 Ethereum… I think this will happen towards the end of the cycle, near the next presidential election."

Currently, Hayes' on-chain activities suggest this is a tactical adjustment, not a change in market confidence. His argument remains clear: Ethereum will win if stablecoins and on-chain institutional finance continue to scale.

As for the market, it's probably still waiting for this story to actually come true.