Coinbase Institutional believes that 2026 will be a pivotal year for crypto assets to deeply integrate into the institutional and financial core. Driven by clearer regulations, continuous technological evolution, and the upgrading of the token economy, stablecoins, derivatives, prediction markets, and asset tokenization are expected to accelerate their development, reshaping the global crypto market structure.

Article by: Coinbase Institutional

Article source: X platform

Article compiled by: Chang

Coinbase Institutional released its "2026 Crypto Market Outlook," a comprehensive analysis of the key forces that will reshape the crypto economy in the coming year. The report covers the market prospects of BTC, ETH, and SOL, as well as regulatory, market structure, asset tokenization, technological upgrades, and long-term cyclical factors. The report also assesses the four-year Bitcoin cycle, the risks of quantum computing, and the potential impact of major platform upgrades such as the Ethereum Fusaka hard fork and Solana Alpenglow.

Highlights

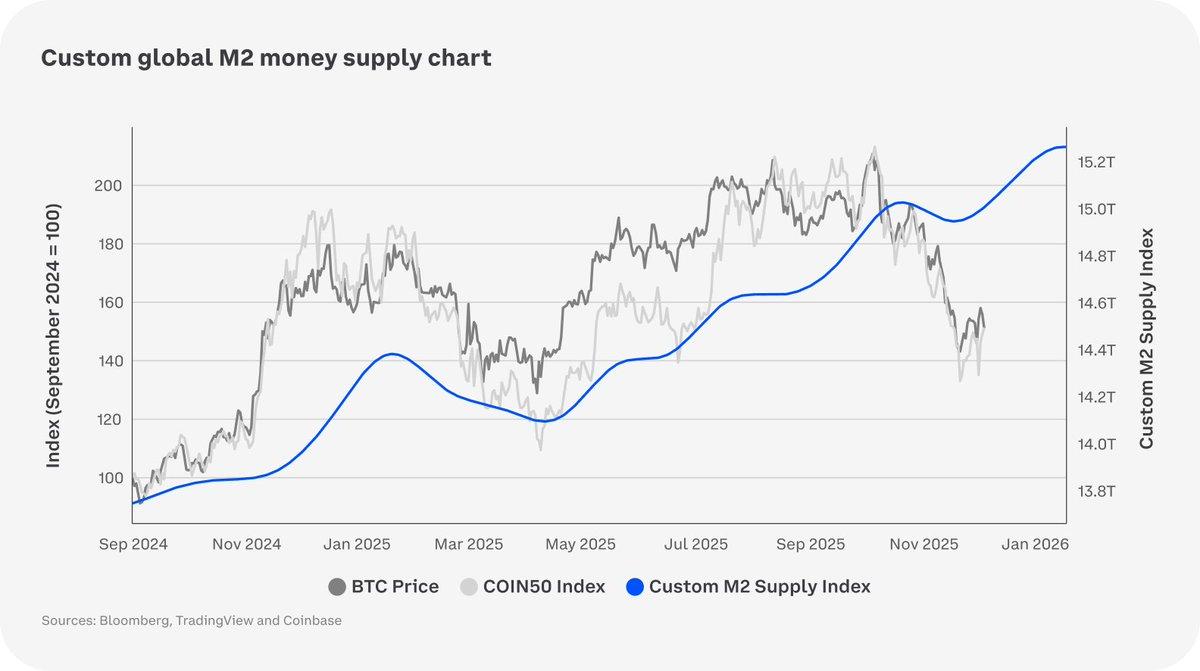

Overall Tone: Cautiously Optimistic: Coinbase believes the US economy remains resilient, with rising labor productivity offsetting some of the risks of a slowdown in macroeconomic data. As for the crypto market, the environment in the first half of 2026 is closer to "1996" than "1999," meaning there is still room for growth, but uncertainty remains high.

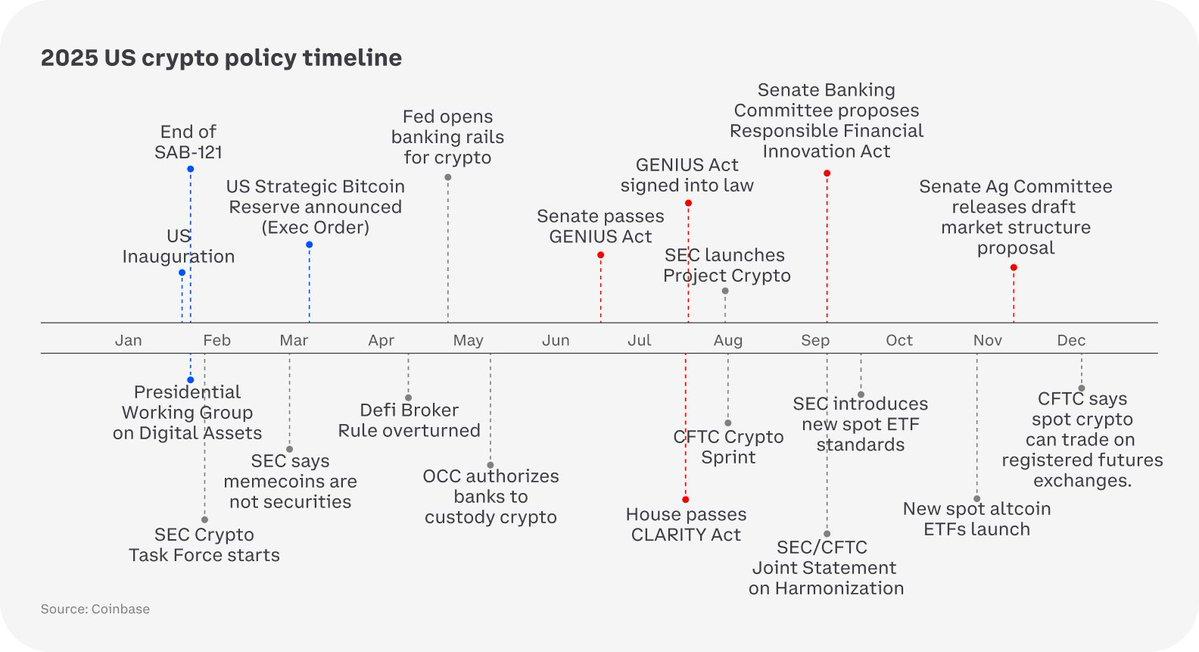

Regulatory progress: A clearer global regulatory framework is expected to significantly change how institutions engage in strategy, risk management, and compliance by 2026.

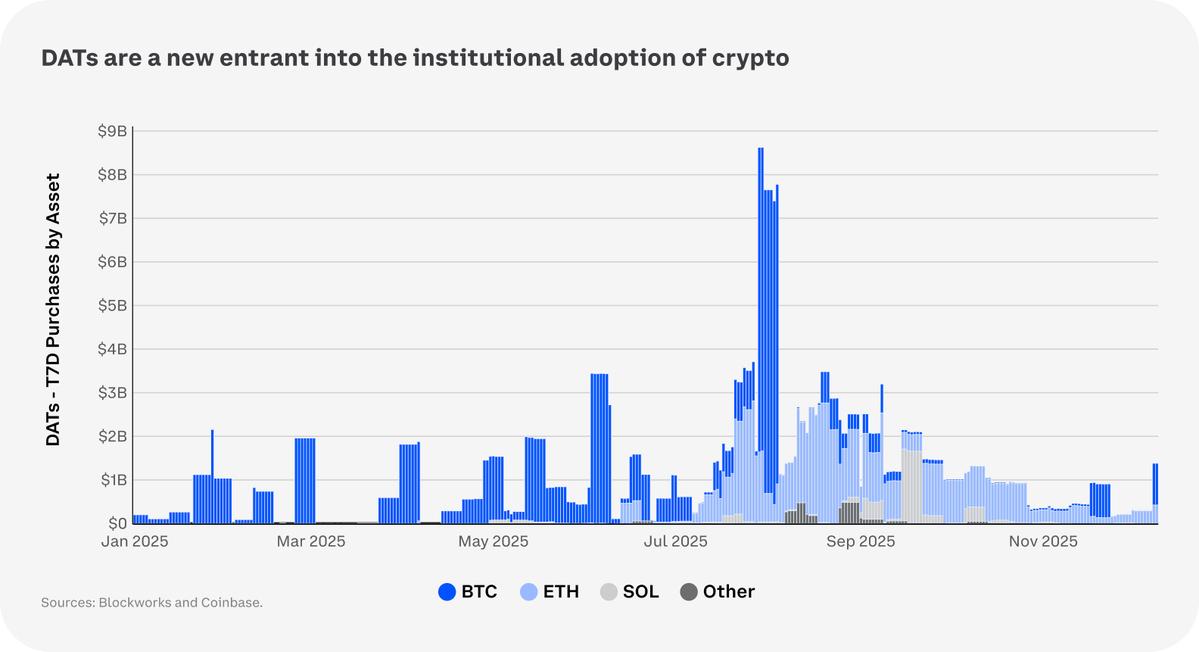

Institutional adoption upgrade: The report predicts that institutions will shift from simple asset accumulation to the "DAT 2.0" model, which revolves around professional trading, custody, and the acquisition and allocation of "sovereign block space," viewing it as a key scarce resource in the digital economy.

Tokenomics 2.0: The protocol layer is shifting towards a more explicit value capture mechanism, and market focus is gradually shifting from narrative-driven beta to a sustainable token economic model linked to real income.

Technological Change Trends

Rising privacy needs: With increased institutional participation and the continued development of technologies such as zero-knowledge proofs (ZKP) and fully homomorphic encryption (FHE), on-chain privacy use cases are expected to grow significantly.

AI × Crypto: Autonomous transactional intelligent agent systems require open, programmable payment infrastructure. Protocols such as x402 support high-frequency micropayment settlements, providing a foundation for the on-chain deployment, governance, and secure operation of intelligent agents.

App-specific chains: Despite the increasing number of dedicated blockchain networks, Coinbase believes that the long-term form will be a network architecture of networks with native interoperability and shared security, rather than isolated on-chain islands.

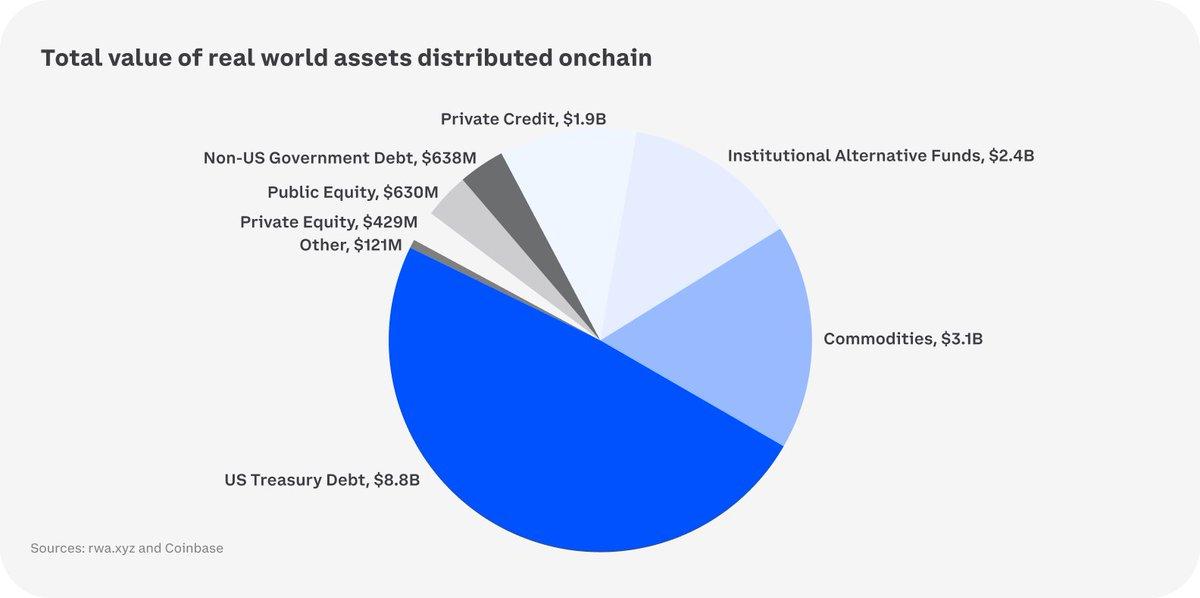

Asset tokenization: Tokenized stocks have the potential for rapid expansion, and atomic composability brings significant advantages; in some scenarios, the loan-to-value (LTV) ratio of DeFi style is already significantly higher than that of traditional margin systems.

The next key growth point

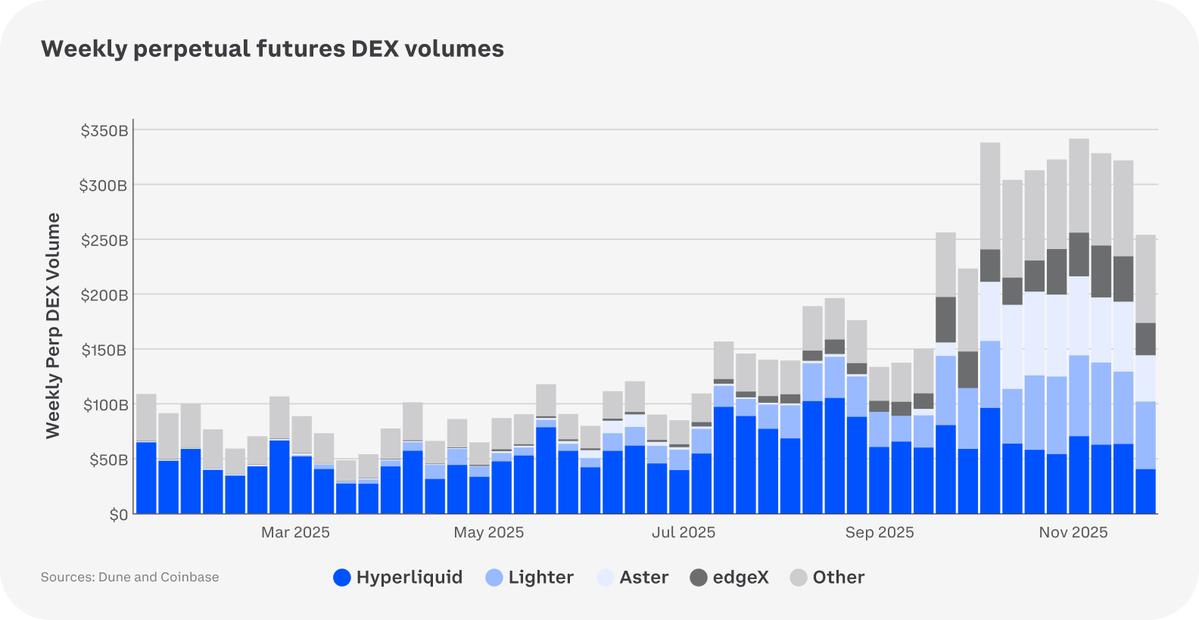

Composability of crypto derivatives: As global retail investor participation in US stocks continues to rise, equity perpetual contracts are poised to become the preferred tool for the next generation of retail investors due to their 24/7 trading and capital efficiency.

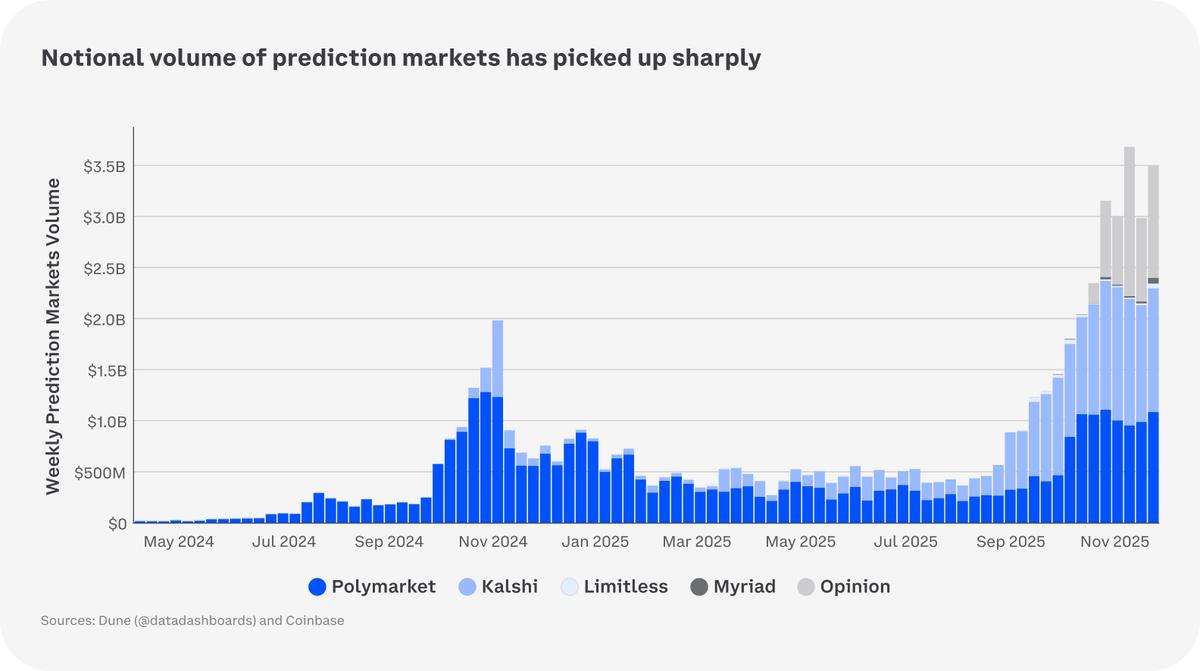

Prediction Markets: Due to changes in the US tax system, prediction market transaction volume is expected to expand significantly in 2026, and prediction market aggregators may become an important front-end entry layer.

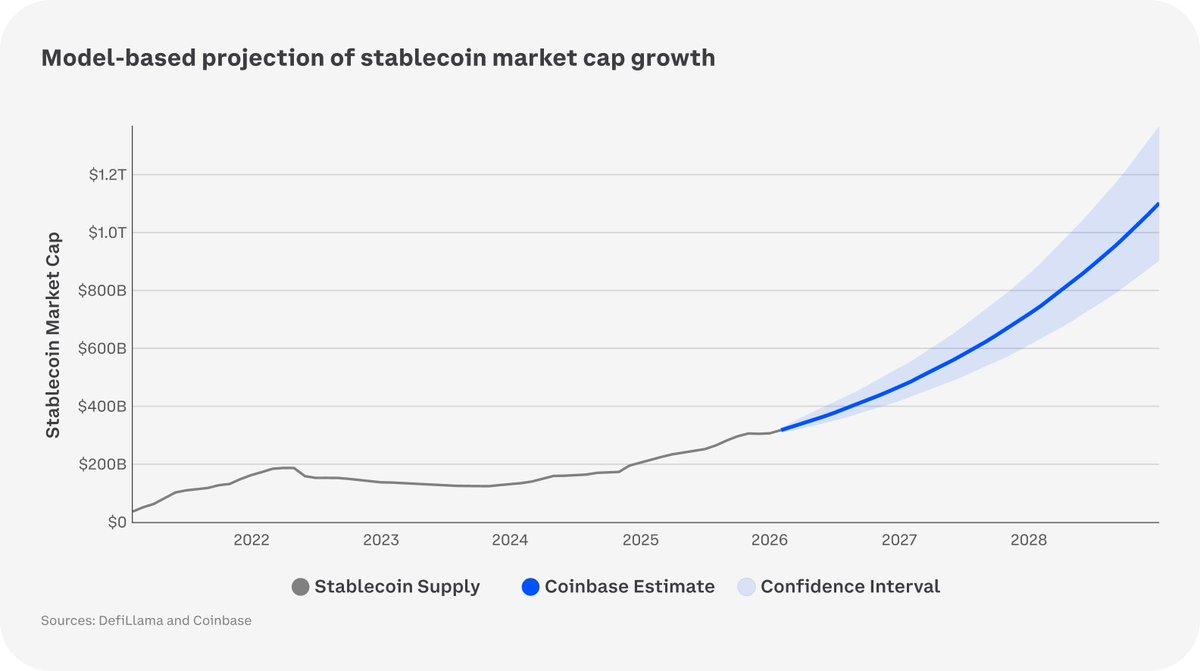

Stablecoins and payments: Stochastic models predict that the total market capitalization of stablecoins is expected to approach $1.2 trillion by the end of 2028. Cross-border settlements, remittances, and payroll payment platforms will become new major application scenarios.

in conclusion

Coinbase believes the crypto industry is at a critical juncture, deeply integrating into the global financial system. The ability to capitalize on this opportunity depends on product quality, regulatory compliance, and user-centric design execution. With these elements working in tandem, crypto innovation has the potential to achieve widespread accessibility "anyone, anywhere, anytime."