Author: Arthur Hayes

Compiled by: Liam

Editor's Note: The views expressed in this article are solely those of the author and should not be used as the basis for investment decisions, nor do they constitute investment advice or trading recommendations. The article has been slightly abridged.

If I had an online dating profile, it would probably look something like this:

The Language of Love:

The euphemisms and abbreviations coined by politicians and central bank governors for "printing money".

This article will discuss two of the most appropriate examples:

1. QE – Quantitative Easing

2. RMP – Reserve Management Purchase

RMP is a new abbreviation that entered my "love language dictionary" on December 10th, the day of the most recent Federal Reserve meeting. I recognized it instantly, understood its meaning, and cherished it like my long-lost beloved QE. I love QE because QE means printing money; fortunately, I hold financial assets such as gold, gold and silver mining stocks, and Bitcoin, which are appreciating faster than fiat currency is being created.

But this isn't for myself. If all forms of money printing can drive up the price and adoption of Bitcoin and decentralized public blockchains, then hopefully one day we can abandon this dirty fiat currency fractional-reserve system and replace it with a system driven by honest money.

We haven't reached that point yet. But with each unit of fiat currency created, this "redemption" is accelerating.

Unfortunately, for most people today, printing money is destroying their dignity as producers. When a government deliberately devalues its currency, it severs the link between energy input and economic output. Even those hardworking "laborers" who don't understand sophisticated economic theories can intuitively feel like they're running through quicksand—they know that printing money is definitely not a good thing.

In a "one person, one vote" democracy, when inflation soars, the people will vote the ruling party out of power. In an authoritarian regime, the people will take to the streets to overthrow the regime. Therefore, politicians know all too well that governing in an inflationary environment is tantamount to professional suicide. However, the only politically feasible way to repay the massive global debt is to dilute it through inflation. Since inflation can destroy political careers and dynasties, the secret lies in: deceiving the people into believing that what they feel is inflation is not inflation at all.

To this end, central bank governors and finance ministers have thrown out a pot of scalding, abhorrent acronyms to mask the inflation they are imposing on the public, thereby delaying the inevitable systemic deflationary collapse.

If you want to see what severe credit deflation and destruction look like, recall what it felt like from April 2nd to April 9th—when President Trump declared his so-called "Liberation Day" and began imposing massive tariffs. That was unpleasant for the wealthy (the stock market crashed), and for everyone else, because many would lose their jobs if global trade slowed to correct decades of accumulated imbalances. Allowing rapid deflation is a shortcut to triggering revolutions, ending politicians' careers, and even their lives.

As time goes by and knowledge spreads, all these disguises will eventually fail, and the public will associate current abbreviations with printing money. Like any clever drug dealer, once addicts become familiar with the new slang, monetary bureaucrats must change their tactics. This language game excites me because when they change their tricks, it means the situation is critical, and they must press that "Brrrrr" (the sound of the printing press) button hard enough to elevate my investment portfolio to a new level.

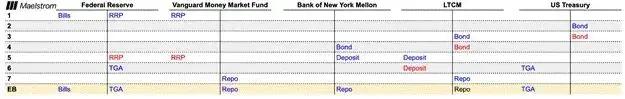

Currently, those in power are trying to convince us that RMP ≠ QE, because QE has been equated with money printing and inflation. To help readers fully understand why RMP = QE, I have created several annotated accounting T-account diagrams.

Why is this important?

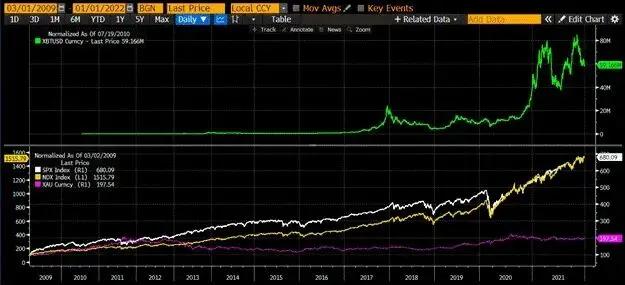

Since the lows of March 2009 following the 2008 financial crisis, risk assets such as the S&P 500, Nasdaq 100, gold, and Bitcoin have broken free from the deflationary trough and recorded astonishing returns.

This is the same chart, but it has been normalized to an initial index value of 100 in March 2009. The appreciation of Satoshi Nakamoto's Bitcoin is so dramatic that it deserves a separate chart for comparison with other traditional inflation hedges such as stocks and gold.

If you want to get rich during the "Pax Americana" era of QE, you must have financial assets. If we've now entered another era of QE or RMP (whatever they call it), hold onto your assets and do everything you can to turn your meager salary into more assets.

Now that you're starting to focus on whether RMP is equivalent to QE, let's do some money market accounting analysis.

Understanding QE and RMP

Now it's time to look at the accounting T-chart. Assets are on the left side of the ledger, and liabilities are on the right. The simplest way to understand the flow of funds is to visualize it. I will explain how and why QE and RMP create money, thus causing financial and goods/service inflation.

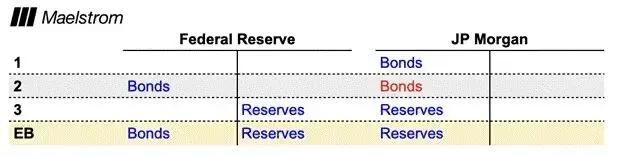

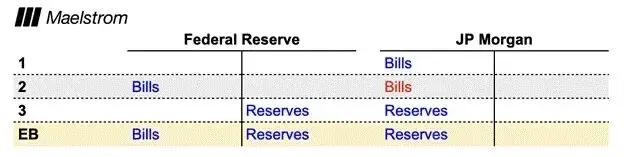

QE first step

1. JPMorgan Chase is a primary dealer with an account with the Federal Reserve and holds Treasury securities.

2: The Federal Reserve conducted a round of quantitative easing by purchasing bonds from JPMorgan Chase.

3: The Federal Reserve creates money out of thin air and pays for bonds by injecting reserves into JPMorgan Chase's accounts.

Ending balance: The Federal Reserve created reserves and purchased bonds from JPMorgan Chase. How will JPMorgan Chase handle these reserves?

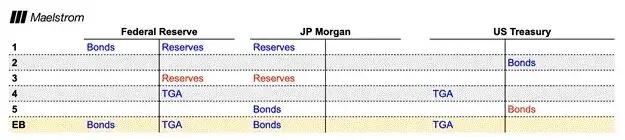

QE Step 2

1. The Federal Reserve creates money out of thin air, namely reserves. Once JPMorgan Chase uses these funds, they have a stimulating effect. JPMorgan Chase will only buy another bond to replace the bonds sold to the Federal Reserve when the new bond is attractive from the perspective of interest rate and credit risk.

2: The U.S. Treasury issues new bonds through auctions, and JPMorgan Chase purchases these bonds. Treasury bonds are risk-free, and in this case, the bond yield is higher than the reserve interest rate, so JPMorgan Chase will buy the newly issued bonds.

3. JPMorgan Chase uses reserves to pay for bonds.

4. The Treasury deposits the reserves into its Treasury General Account (TGA), which is its checking account with the Federal Reserve.

5. JPMorgan Chase received bonds.

EB: The Federal Reserve's money printing activities have funded the increase in the bond supply (the holdings of the Federal Reserve and JPMorgan Chase).

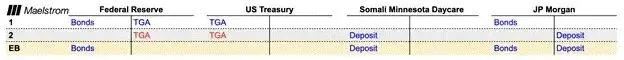

QE Step 3

1. Printing money allows the Treasury to issue more bonds at lower prices. This is purely financial asset inflation. Lower Treasury yields increase the net present value of assets with future cash flows, such as stocks. Inflation of goods and services occurs once the Treasury distributes benefits.

2: The Tim Waltz Somali Children's Daycare Center (which provides services for children with reading difficulties but who want to learn other skills) received a federal grant. The Treasury Department deducted the funds from the TGA account and deposited them into the center's account at JPMorgan Chase.

EB: The TGA account funds government spending, thereby creating demand for goods and services. This is how quantitative easing causes inflation in the real economy.

Short-term Treasury bills and long-term Treasury bonds

Short-term Treasury bills have a maturity of less than one year. The most traded interest-bearing Treasury bond is the 10-year Treasury note, technically known as a 10-year bill. The yield on short-term Treasury bills is slightly higher than the interest rate on reserves held at the Federal Reserve. Let's go back to the first step and replace long-term Treasury bonds with short-term Treasury bills.

EB: The only difference is that the Federal Reserve exchanged reserves for short-term Treasury bills. The quantitative easing flow of funds stopped there because JPMorgan Chase lacked the incentive to buy more short-term Treasury bills, as the reserve rate was higher than the yield on short-term Treasury bills.

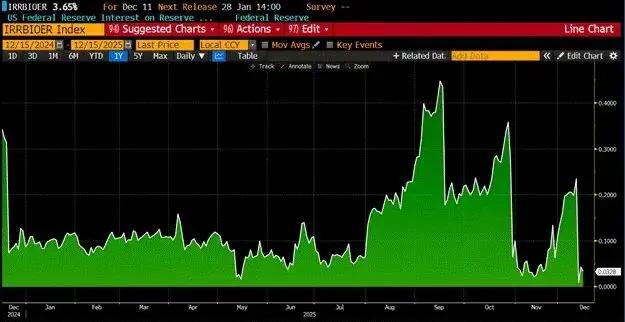

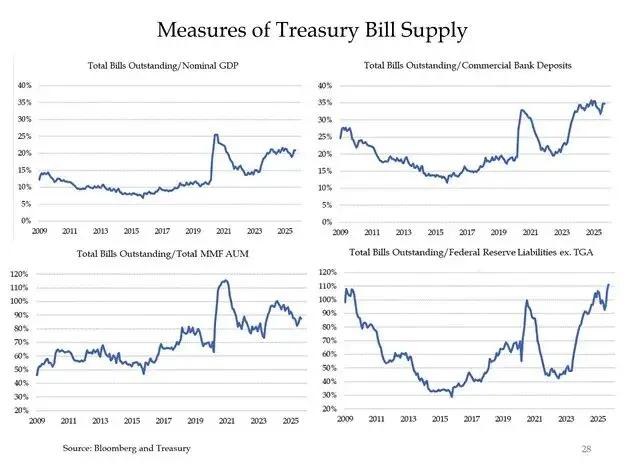

The chart above shows the reserve ratio minus the 3-month Treasury bill yield, resulting in a positive value. Profit-maximizing banks will deposit funds with the Federal Reserve rather than purchase lower-yielding short-term Treasury bills. Therefore, the type of debt securities purchased with reserves is important. If the interest rate risk or maturity is too short, the funds printed by the Federal Reserve will remain on its balance sheet without any effect. Analysts believe that, technically, the stimulus effect of the Federal Reserve purchasing $1 of short-term Treasury bills is far less than the stimulus effect of purchasing $1 of bonds under quantitative easing.

But what if these short-term Treasury bills were held by other financial institutions instead of banks? Currently, money market funds hold 40% of outstanding short-term Treasury bills, while banks hold only 10%. Similarly, if banks could earn higher returns by depositing reserves with the Federal Reserve, why would they buy short-term Treasury bills? To understand the potential impact of the RMP, we must analyze what decisions money market funds would make when the Federal Reserve purchases short-term Treasury bills held by money market funds. I will conduct the same analysis of the RMP as quantitative easing.

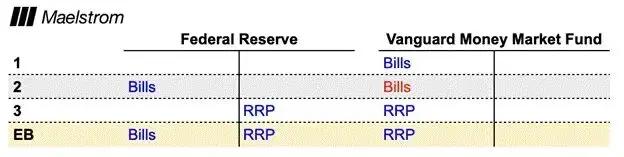

RMP Step 1

1. Vanguard Group is a licensed money market fund that has an account with the Federal Reserve and holds short-term Treasury bills.

2: The Federal Reserve conducted a round of RMP operations by purchasing short-term Treasury bills from Vanguard Group.

3: The Federal Reserve creates money out of thin air and pays bills by crediting funds from reverse repurchase agreements (RRPs) to Vanguard's accounts. RRPs are overnight funding facilities where interest is paid directly by the Federal Reserve daily.

EB: How else can Vanguard Group use its RRP balance?

RMP Step Two (Pioneer Group purchases more notes)

1. The Federal Reserve created money out of thin air, which became RRP balances. Once Vanguard uses these funds, they have a stimulating effect. Vanguard will only purchase other short-term risk-free debt instruments if the yield is higher than the RRP. This means Vanguard will only buy newly issued Treasury bills. As a money market fund (MMF), Vanguard has various restrictions on the types and maturities of debt it can purchase with investor funds. Due to these restrictions, Vanguard typically only buys Treasury bills.

2: The U.S. Treasury issues new notes through auction, which are ultimately purchased by Vanguard Group.

3: Pioneer Group pays its bills using cash in RRP.

4: The Treasury deposits RRP cash into its Treasury General Account (TGA).

5: Pioneer Group received the invoices it purchased.

EB: The money created by the Federal Reserve funds the purchase of newly issued Treasury bills.

Treasury bill yields will never be lower than RRP yields because, as marginal buyers of Treasury bills, money market funds will keep their funds in RRPs if the yields are the same. Technically, because the Federal Reserve can unilaterally print money to pay interest on RRP balances, their credit risk is slightly better than that of the U.S. Treasury, which must obtain congressional approval to issue debt. Therefore, unless Treasury bill yields are higher, money market funds are more inclined to keep cash in RRPs. This is important because Treasury bills lack duration, meaning that a few basis points drop in yields caused by the Fed implementing RMPs will not have a significant impact on financial asset inflation. Inflation only manifests in financial assets and goods and services when the Treasury uses the funds raised to purchase goods and services.

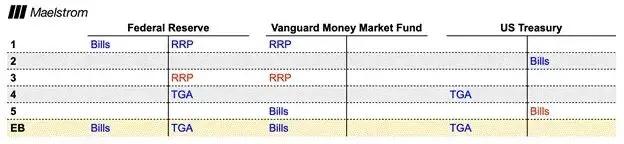

RMP Step 3 (Pioneer Group provides loans to the repurchase market)

If the yield on newly issued Treasury bills is lower than or equal to the RRP yield, or if there is an insufficient supply of newly issued Treasury bills, are there other investment options for money market funds (MMFs) that could lead to inflation in financial assets or goods/services? Yes. Money market funds can borrow cash into the Treasury bill repurchase market.

A repurchase agreement, or repo for short, is a money market fund providing overnight cash loans secured by newly issued Treasury bills. In this example, a repo refers to a money market fund providing overnight cash loans using newly issued Treasury bills as collateral. Under normal market conditions, the repo yield should be equal to or slightly below the upper limit of the federal funds rate. Currently, the RRP yield is equal to the federal funds rate, which is 3.50%. The current yield on three-month Treasury bills is 3.60%. However, the upper limit of the federal funds rate is 3.75%. If a repo transaction is close to the upper limit of the federal funds rate, the money market fund can obtain a yield nearly 0.25% higher in the repo market than it would in the RRP (3.75% minus the RRP yield of 3.50%).

1: The Federal Reserve creates RRP balances by printing money and purchasing Treasury bills from Vanguard Group.

2: The U.S. Treasury issues bonds.

3: LTCM (a dead relative value hedge fund) bought bonds in the auction, but they didn't have enough money to pay for them. They had to borrow in the repurchase market to pay the Treasury.

4: Bank of New York Mellon (BONY) facilitated the three-way repurchase transaction. They received bonds from LTCM as collateral.

5: BONY received cash withdrawn from the Vanguard Group's RRP balance. This cash was deposited into BONY as a deposit and then paid to LTCM.

6: LTCM uses its deposits to pay for bonds. These deposits become part of the TGA balance held by the U.S. Treasury at the Federal Reserve.

7: Vanguard Group draws cash from RRP and lends in the repurchase market. Vanguard Group and LTCM will decide daily whether to extend the repurchase agreement.

EB: The money printed by the Federal Reserve purchased Treasury bills from Vanguard, thereby financing the LTCM's bond purchases. The Treasury can issue long-term or short-term bonds, and the LTCM will buy these bonds at any price because the repurchase rate is predictable and affordable. Vanguard will always lend at an "appropriate" rate because the Federal Reserve prints money and buys the notes it issues. The RMP is a disguised way for the Federal Reserve to cash checks for the government. This is highly inflationary from both a financial and physical goods/services perspective.

RMP Politics

I have some questions, and the answers may surprise you.

Why wasn't the RMP announcement included in the formal Federal Open Market Committee statement, as it has been in all previous quantitative easing programs?

The Federal Reserve unilaterally decided that quantitative easing (QE) is a monetary policy tool that stimulates the economy by removing interest-rate-sensitive long-term bonds from the market. The Fed considers RMP a technical implementation tool that will not stimulate the economy because it removes short-term Treasury bills, which are similar to cash, from the market.

Does the RMP require a formal vote by the FOMC?

Yes and no. The FOMC instructed the Federal Reserve Bank of New York to implement the Reserve Requirement Plan (RMP) to keep reserves "ample." The New York Fed can unilaterally decide to increase or decrease the size of its RMP Treasury bill purchases until the Federal Open Market Committee (FOMC) votes to terminate the program.

What constitutes "sufficient reserves"?

This is a vague concept with no fixed definition. The New York Fed decides when reserves are sufficient and when they are insufficient. I will explain in the next section why Bill Bessant of Buffalo controls the level of sufficient reserves. In effect, the Fed has transferred control of the short end of the yield curve to the Treasury.

Who is the president of the Federal Reserve Bank of New York? What are his views on quantitative easing and the RMP?

John Williams is the president of the Federal Reserve Bank of New York. His next five-year term begins in March 2026. He will not leave. He has been a strong advocate for the theory that the Fed must expand its balance sheet to ensure "ample reserves." He has a strong voting record for quantitative easing and has publicly stated his full support for printing money. He believes the RMP is not quantitative easing and therefore has no economic stimulus effect. This is good because when inflation inevitably rises, he can declare "it's not my fault" and continue to use the RMP to print money.

Unlimited and unrestrained money printing frenzy

The various sophistry surrounding the definition of quantitative easing (QE) and the "ample" level of reserves has allowed the Federal Reserve to fulfill politicians' promises. This is not quantitative easing (QE) at all; it's the printing press running at full speed! Every previous QE program had a set end date and a monthly cap on bond purchases. Extending the program required a public vote. In theory, the RMP could expand indefinitely as long as John Williams (Federal Reserve Chairman) wanted to. However, John Williams didn't actually have real control because his economic dogma prevented him from considering that his bank was directly contributing to inflation.

Ample reserves and RMP

The RMP exists because the free market cannot cope with the enormous, "Alabama Black Snake" risk posed by a surge in Treasury bill issuance. Reserves must grow. This must be synchronized with Treasury issuance, or the market will collapse. I discussed this in my article titled "Hallelujah."

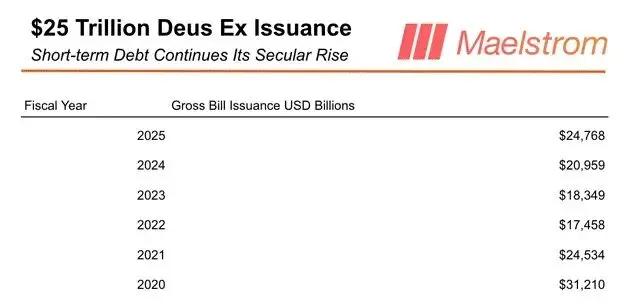

The following is a table showing the total issuance of tradable Treasury bonds from fiscal years 2020 to 2025:

In short, despite Bessant's assertion that Yellen's refusal to extend the debt maturity was an epic policy mistake, the U.S. Treasury's reliance on cheap, short-term financing continues to grow. Currently, the market must absorb approximately $500 billion in Treasury bonds weekly, up from about $400 billion weekly in 2024. Trump's inauguration, despite his campaign promises to reduce the deficit, has not altered the trend of ever-increasing total Treasury issuance. Moreover, who is in power is irrelevant, as the issuance schedule will not change even if Kamala Harris is elected.

What drives the growth in total government bond issuance? The massive and continuous increase in issuance is because politicians will not stop distributing welfare.

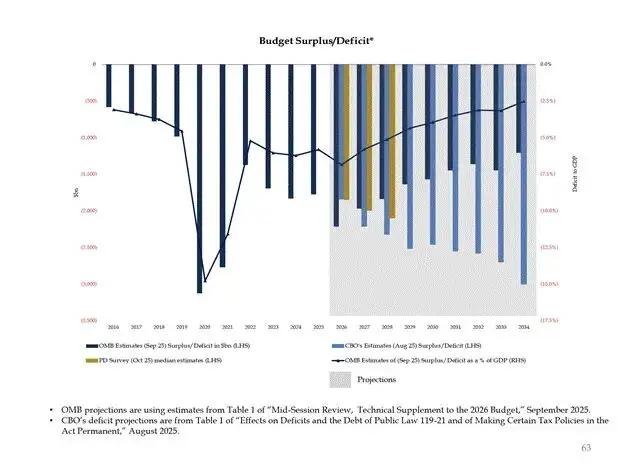

Both the Congressional Budget Office (CBO) and primary dealers agree that the deficit will exceed $2 trillion over the next three years. This extravagant spending pattern appears to show no signs of abating.

Before discussing the argument that RMP ≠ QE, I'd like to predict how Bessant will use RMP to stimulate the real estate market.

RMP-funded buyback

I know this is painful for some of you investors, but recall what happened in early April. Right after Trump made his "TACO" (likely referring to antitrust laws) regarding tariffs, Bessant claimed in a Bloomberg interview that he could use repurchase agreements to stabilize the Treasury market. Since then, the notional total amount of Treasury repurchase agreements has steadily increased. Through repurchase programs, the Treasury uses proceeds from issuing Treasury bonds to buy back older, less active bonds. If the Federal Reserve prints money to buy these bonds, then short-term Treasury bills effectively finance the Treasury directly, allowing the Treasury to increase the total issuance of short-term Treasury bills and use some of the proceeds to buy back longer-term Treasury bonds. Specifically, I believe Bessant will use repurchase agreements to buy 10-year Treasury bonds, thereby lowering yields. In this way, Bessant can magically eliminate interest rate risk in the market using interest rate market policy (RMP). In effect, this is exactly how quantitative easing works!

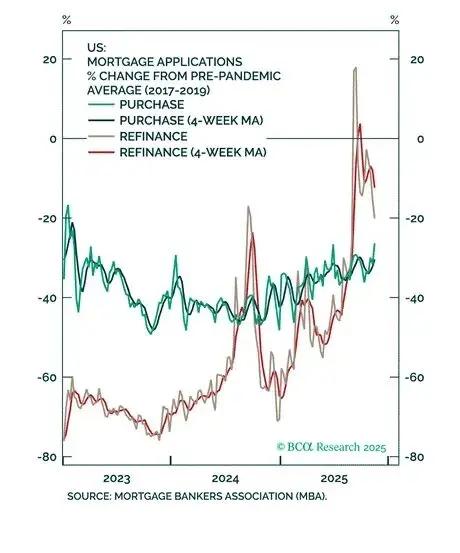

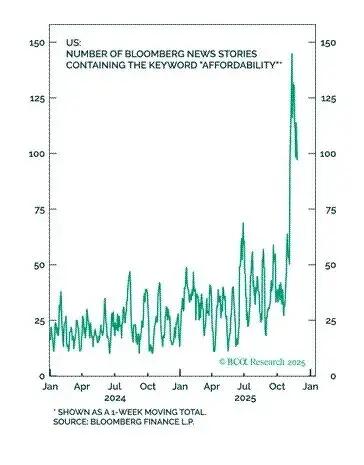

The 10-year Treasury yield is crucial for homeowners, who make up 65% of all American households, as well as for low-income first-time homebuyers. Lower 10-year Treasury yields help American households access home equity loans, thereby increasing consumption. Furthermore, mortgage rates will fall, which will help improve housing affordability. Trump has consistently stated publicly that he believes mortgage rates are too high, and if he can achieve this, it will help the Republican Party remain in power. Therefore, Bessant will utilize interest rate market policies and repurchase agreements to purchase 10-year Treasury bonds, thereby lowering mortgage rates.

Let's take a quick look at some charts of the US housing market.

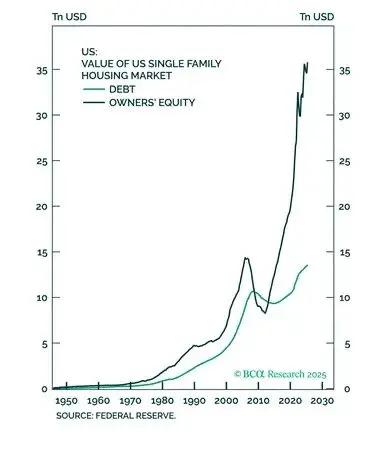

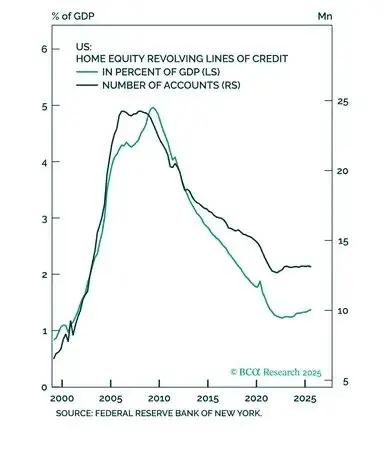

There is a significant amount of home equity available for leveraged financing.

The wave of refinancing has only just begun.

The current level of refinancing is far below the peak of the 2008 real estate bubble.

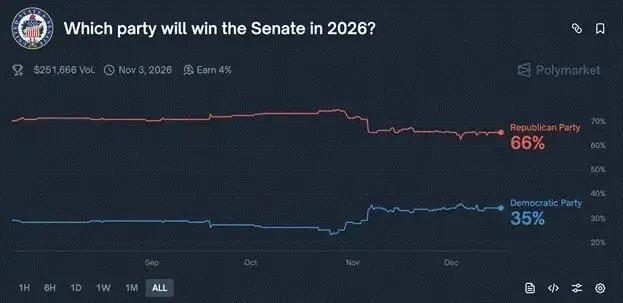

If Trump can address housing affordability by lowering financing costs, Republicans might be able to reverse the current situation and maintain their majority in both houses of the legislature.

Bessant has not publicly stated that he will use buybacks to stimulate the housing market, but if I were him, I would use this new money-printing tool in the manner described above. Now let's hear the arguments for why RMP ≠ QE.

Opponents will always oppose

The following are criticisms of the RMP plan from opponents, questioning its ability to create financial and goods/services inflation:

The Federal Reserve purchases short-term Treasury bills through the Reserve Investor Policy (RMP) and long-term bonds through quantitative easing (QE). Without long-term bonds, purchasing short-term Treasury bills has little impact on financial markets.

- The RMP will end in April, as that is the tax deadline, after which the repurchase market will return to normal due to reduced TGA volatility.

My accounting T-chart clearly shows how the RMP's short-term Treasury bill purchases directly fund new Treasury issuance. The debt will be used for spending, thus triggering inflation and potentially lowering long-term debt yields through repurchase agreements. Although the Interest Rate Management Program (RMP) delivers easing through Treasury bills rather than bonds, it still works. Nitpicking will only lead to underperforming the market.

The increase in total Treasury bill issuance refutes claims that the interest rate control program failed in April. Out of necessity, the U.S. government's financing structure is shifting, relying more heavily on Treasury bills.

This article refutes both criticisms, convincing me that the four-year cycle is over. Bitcoin clearly disagrees with my view, gold thinks it's "so-so," but silver is poised to make a fortune. To that, I can only say: be patient, man, be patient. In late November 2008, after former Federal Reserve Chairman Ben Bernanke announced the first round of quantitative easing (QE1), the market experienced a continuous plunge. It wasn't until March 2009 that the market bottomed out and rebounded. But if you remained on the sidelines, you missed an excellent buying opportunity.

Since the introduction of RMP (Random Monetary Policy), Bitcoin (white) has fallen by 6%, while gold has risen by 2%.

Another liquidity factor that the RMP will alter is the fact that many of the world's major central banks, such as the European Central Bank and the Bank of Japan, are shrinking their balance sheets. This balance sheet reduction is inconsistent with the strategy of cryptocurrencies only rising and never falling. Over time, the RMP will create billions of dollars in new liquidity, causing the dollar to plummet against other fiat currencies. While a weaker dollar benefits Trump's "America First" reindustrialization plan, it is disastrous for global exporters, who not only face tariffs but also suffer from the pressure of their currencies appreciating against the dollar. Germany and Japan will respectively utilize the ECB and the Bank of Japan to create more domestic credit to curb the appreciation of the euro and yen against the dollar. By 2026, the Federal Reserve, the ECB, and the Bank of Japan will work together to accelerate the demise of fiat currencies. Hooray!

Trading Outlook

While $40 billion per month is substantial, it represents a far lower percentage of total outstanding debt than in 2009. Therefore, we cannot expect its credit stimulus effect at current financial asset price levels to be as significant as it was in 2009. For this reason, the current misconception that the RMP is superior to QE in credit creation, and the uncertainty surrounding the RMP's continued existence after April 2026, will cause Bitcoin's price to fluctuate between $80,000 and $100,000 until the beginning of the new year. As the market equates the RMP with quantitative easing (QE), Bitcoin will quickly return to $124,000 and rapidly move towards $200,000. March will be the peak of expectations for the RMP to drive up asset prices, at which point Bitcoin will fall and form a local bottom well above $124,000, as John Williams remains firmly holding the "Brrrr" button.

Altcoin are terminally ill. The crash on October 10th caused significant losses for many individual and hedge fund liquidity traders. I believe many liquidity providers, after seeing their October net asset value reports, said, "Enough is enough!" Redemption requests flooded in, leading to a continued price plunge. The Altcoin market will need time to recover, but for those who value their money and carefully read exchange rules, now is the time to rummage through the junkyard.

When it comes to Altcoin, my favorite is Ethena. The rise in Bitcoin prices, driven by the Fed's interest rate cuts leading to lower currency prices and the RMP policy increasing the money supply, fueled demand for synthetic dollar leverage in the crypto capital markets. This drove up cash hedging or basis yields, prompting the creation of USDe for lending at higher interest rates. More importantly, the spread between Treasury bill and cryptocurrency basis yields widened, resulting in higher yields for cryptocurrencies.

The increase in interest income from the Ethena protocol will flow back into the ENA treasury, ultimately driving the buyback of ENA tokens. I expect the circulating supply of USDe to increase, which will be a leading indicator of a significant rise in the price of ENA. This is purely the result of the interplay between traditional finance and cryptocurrency dollar interest rates, a situation similar to what happened when the Federal Reserve launched its easing cycle in September 2024.