Miner "surrender" phenomenon has served as a reversal indicator since 2014, with an average increase of 72%.

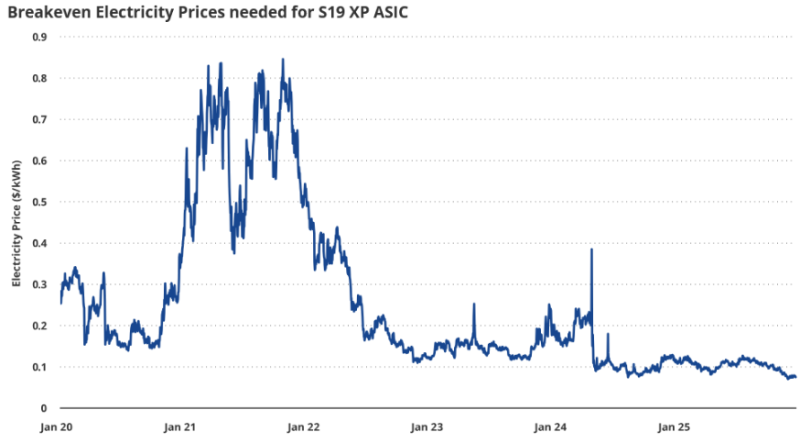

Analysts at asset management firm VanEck have recently released an analysis suggesting that the recent large-scale "capitulation" of Bitcoin miners could actually be a positive sign foreshadowing a market bottom.According to VanEck, as of December 15th, Bitcoin's hash rate (mining difficulty) had fallen 4% over the past month. The decline in hash rate indicates that some miners have shut down their equipment due to declining profitability.

"When hashrate compression persists for a longer period of time, the probability of future positive returns is higher, and the upside is typically larger," VanEck virtual asset research director Matt Sigel and senior investment analyst Patrick Bush wrote in a report released Monday.

Historical data supports this. An analysis of statistics since 2014 found that when the Bitcoin network hash rate declined over the previous 30 days, returns over the next 90 days were positive 65% of the time. Conversely, when the hash rate increased, returns over the same period were positive only 54% of the time.

This pattern persisted even over a longer observation period. When the hash rate growth rate was negative for 90 days, the probability of Bitcoin price appreciation over the following 180 days was 77%, with an average increase of approximately 72%. This figure significantly exceeds the 61% probability of positive returns in situations where the hash rate was rising.

VanEck predicted that this miner capitulation could have a positive impact on Bitcoin's price in the coming months, as it has historically served as an indicator of bull market reversals.

Joohoon Choi joohoon@blockstreet.co.kr