AAVE is embroiled in an internal conflict over brand ownership. Photo: DL News

AAVE is embroiled in an internal conflict over brand ownership. Photo: DL News

Looking for the answer to who owns AAVE?

AAVE , one of the world's largest decentralized finance protocols, is mired in a deep governance crisis. A long-standing conflict between AAVE Labs and the official DAO community has erupted into a public confrontation over brand ownership, cash flow, and the true nature of control within DeFi.

At the heart of the controversy is a vote on Snapshot, which began on December 23rd and lasted until December 26th, aimed at giving AAVE Token holders direct control over the project's core brand assets – from domain names, social media accounts, naming rights, GitHub organization, NPM namespace to media channels currently managed by AAVE Labs and related entities.

The recent DAO alignment proposal has been moved to Snapshot after extensive discussion. We realize the community is very interested in a path forward and is ready to make a decision.

— Stani. ETH (@StaniKulechov) December 22, 2025

Time for tokenholders to weigh in and vote. https://t.co/QwoPeglhmU

This move, spearheaded by AAVE Labs, instead of closing the debate, was described by many DAO delegates as a hostile takeover attempt, exposing the long- Capital rifts within the AAVE ecosystem.

The direct trigger for the crisis stemmed from the integration of CoW Swap into the AAVE interface in early December. Unlike previous integrations such as ParaSwap, which was believed to bring in around $200,000 per week for the DAO treasury, the fee flow from CoW Swap was found to be going to wallets controlled by AAVE Labs, instead of to the Treasury.

This questionable action quickly sparked accusations of covert privatization. Marc Zeller, the leading delegate of the AAVE Chan Initiative, estimated that the DAO could lose up to $10 million in revenue annually if this model were maintained. AAVE Labs countered, arguing that this was not a “fee switch,” but rather a voluntary frontend revenue stream that the Labs used to pay for infrastructure, security, and engineering staff – costs that the DAO did not directly bear.

The debate quickly moved beyond the scope of a swap contract. “This is no longer about CoW Swap or a wallet,” one delegate remarked. “The core issue is who actually owns AAVE – the code, the interface, or the brand?”

Two proposals, a power struggle.

Tensions escalated in mid-December with two directly confrontational proposals. The first proposal , dubbed a “poison pill” by some holder , called for the DAO to seize all AAVE IP, code, and trademarks, force AAVE Labs to become a subsidiary of the DAO, and even recover all past revenue generated under the AAVE brand.

The second proposal , more moderate but no less sensitive, was initiated by Ernesto Boado, former CTO of AAVE Labs, and focused on transferring ownership of brand assets to the DAO, arguing that if the DAO funded development and marketing, the DAO should own the brand.

It was this second proposal that AAVE Labs unilaterally put to a vote on Snapshot and became the focal point of the crisis.

To be very clear:

— Ernesto (@eboadom)December 22, 2025

- This is not, in ethos, my proposal. AAVE Labs has (for whatever reason) unilaterally submitted my proposal to vote in a rush, with my name on it, and without notifying me at all. If asked, I would not have approved it.

- It was not my intention to submit the… https://t.co/JTWoMMNcQc

Boado publicly opposed the proposal, arguing that it had been put to a vote “hastily, without notification, and with my name attached when I had not agreed.” He called the action shameful and urged the community to abstain or not vote to avoid legitimizing the escalation.

Marc Zeller and many other delegates criticized the timing of the vote, which coincided with a holiday period when participation from large holder and organizations was limited, in the context of a new wave of proxy voting with significant voting power. They argued that this raised suspicions that the process was optimized for results rather than legitimacy.

We acknowledge @ AAVE unilaterally escalated the proposal to Snapshot without resolution discussion, without clear Consensus, and without consent from @eboadom

— Marc ”七十 Billy” Zeller (@Marczeller) December 22, 2025

We've posted our position in response to this unprecedented interference in the DAO governance process.

Worst outcome… https://t.co/80kEpYjikP pic.twitter.com/860GUfavvL

AAVE Labs denies all allegations, asserting that submitting the proposal to Snapshot fully complies with Aave's official governance documentation , which stipulates that an ARFC must be discussed for a minimum of five days before voting takes place.

According to AAVE Labs, there are no rules requiring the consent of the proposal's author before voting, nor is there an obligation to extend discussions beyond the written deadline. The company argues that calls for abstentions are merely political tactics, not governance principles, and emphasizes that DeFi operates 24/7, regardless of holidays.

AAVE Labs warned that the prolonged debate was harming the AAVE brand and accused some critics of trying to rewrite the rules of the game without having enough voting power to win.

The market speaks

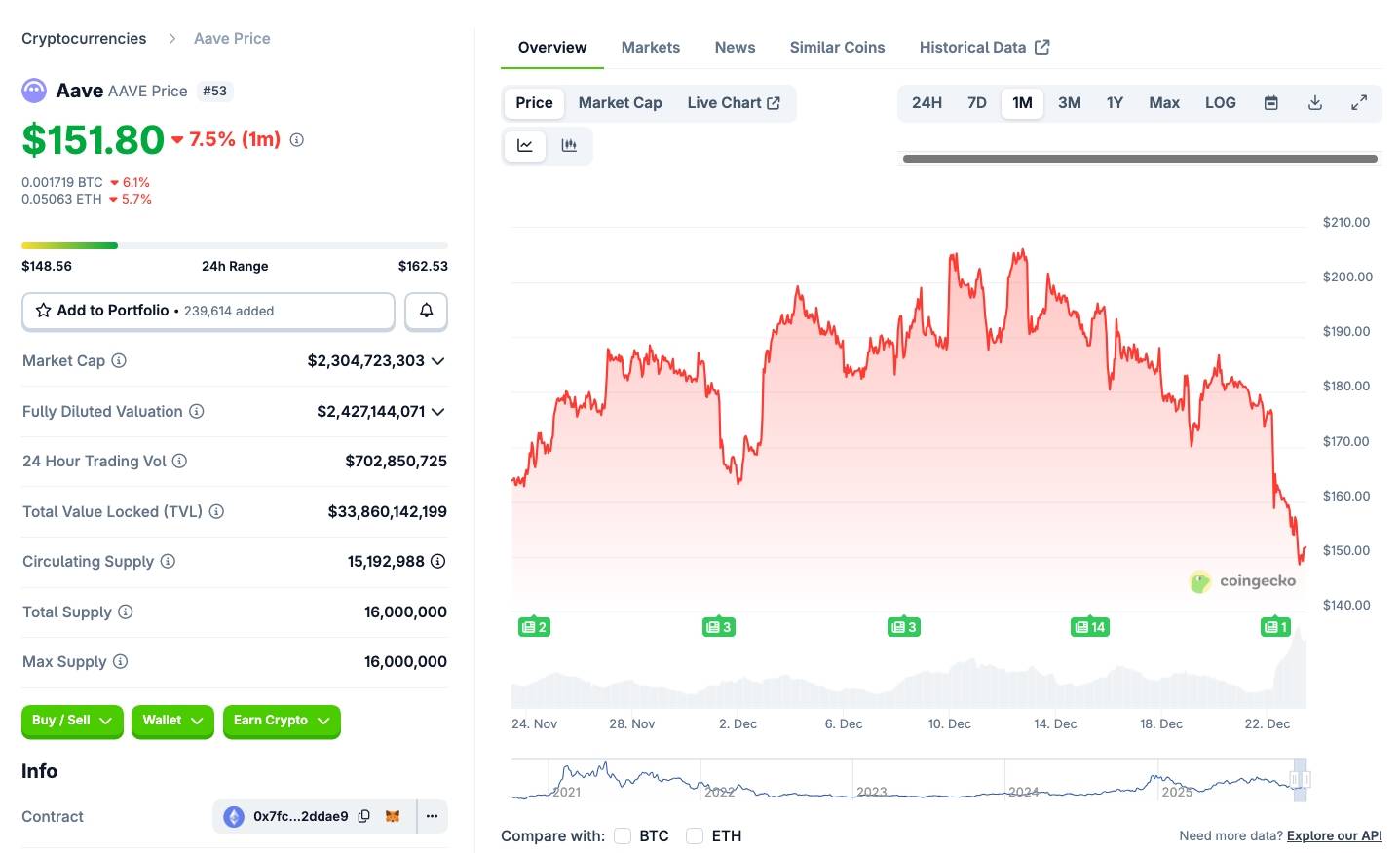

Amid escalating governance battles, the AAVE Token has fallen by as much as 27% since the beginning of the month, retreating to around $152.

AAVE price fluctuations over the last month, screenshot from Coingecko at 10:45 AM on December 23, 2025.

AAVE price fluctuations over the last month, screenshot from Coingecko at 10:45 AM on December 23, 2025.

on-chain data shows that a large "whale" sold off tens of millions of dollars worth of AAVE , accepting a realized loss of approximately $13.75 million, while founder Stani Kulechov took advantage of the situation to buy an additional 32,660 AAVE coins (equivalent to $5.15 million), despite incurring a significant unrealized loss of $2.2 million.

Stani Kulechov( @StaniKulechov ), the founder of @ AAVE , bought 32,660 $ AAVE ($5.15M) at $158 again 7 hours ago.

— Lookonchain (@lookonchain) December 23, 2025

He has bought a total of 84,033 $ AAVE ($12.6M) at an average cost of $176 over the past week, currently sitting on an unrealized loss of $2.2M. https://t.co/HEXO1r7uQK pic.twitter.com/k0pWQCmwGr

Beyond the dispute, the AAVE crisis is posing a difficult question for the entire DeFi industry: Who truly owns a decentralized protocol?

While DAOs can control smart contracts and treasuries, the frontend, branding, domain names, and partnerships are often in the hands of centralized legal entities—faster, but also more powerful, operational units.

AAVE handling of this crisis could set a precedent for a host of other DAOs grappling with the same challenge: balancing the ideal of decentralization with the operational realities of a multi-billion dollar protocol.

In other news, AAVE has just escaped legal action from the SEC after being pursued for four years. Remarkably, AAVE not only survived the four years of scrutiny but also experienced strong growth. The total value of assets locked (TVL) on the protocol now stands at approximately $33 billion, more than double the amount at the beginning of the investigation. Immediately after the SEC announced the end of the investigation, Kulechov released a long-term vision outlining how AAVE could scale into a trillion-dollar ecosystem.

Coin68 compilation